80g Deduction Limit For Fy 2023 24 Web 7 Aug 2023 nbsp 0183 32 Income Tax Benefits available under Old Tax Regime for FY 2023 24 AY 2024 25 Below are the income tax deductions that are available under the old tax regime only Section 80c The maximum tax exemption limit under Section 80C is Rs 1 5 Lakh for FY 2023 24 The various best tax saving and investment options that can be claimed as

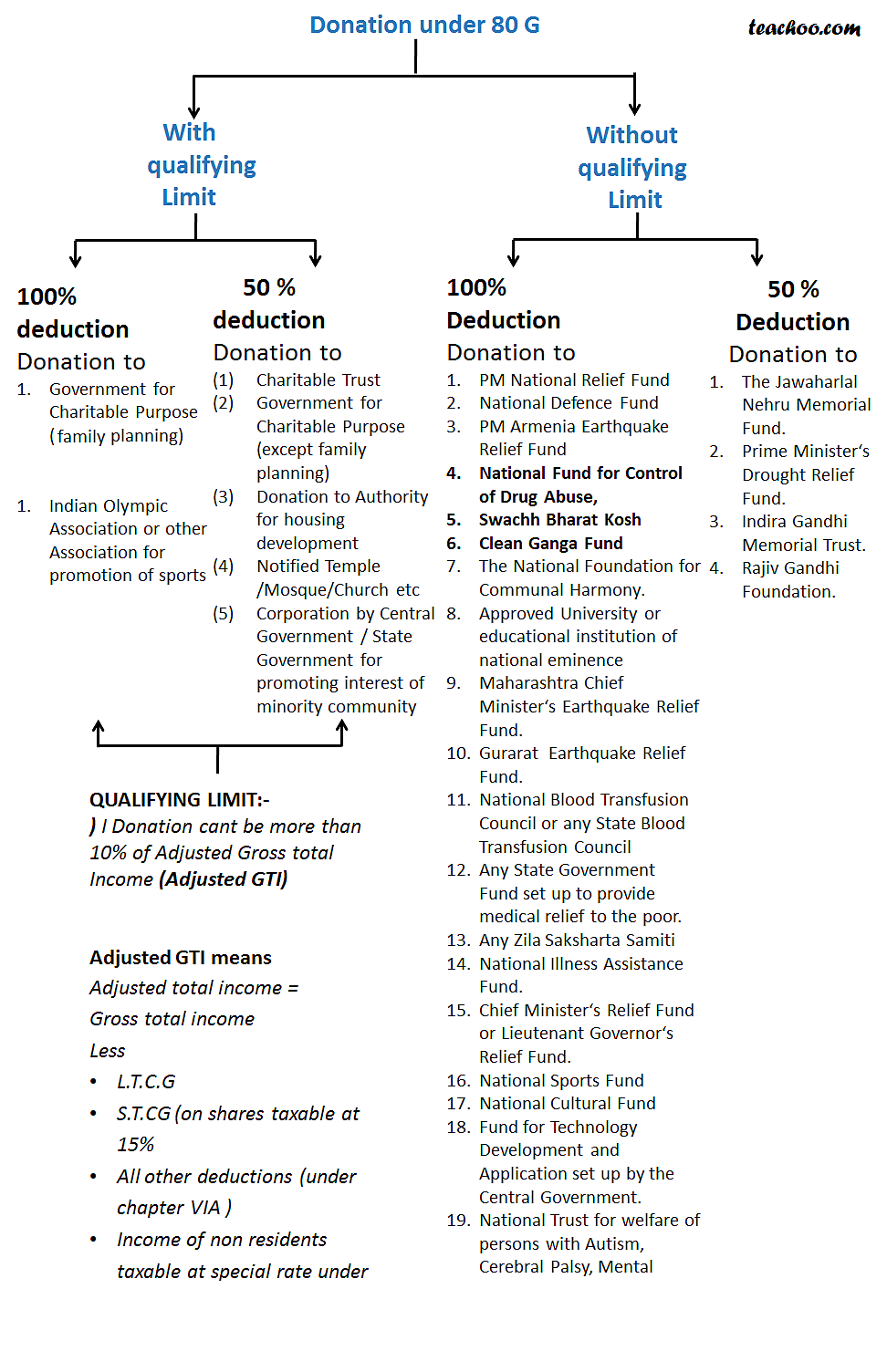

Web Vor 6 Tagen nbsp 0183 32 Budget 2023 Update for Deductions Under Section 80G As per the latest announcement in budget 2023 the donations made to the following funds will not be eligible for deductions under Section 80G National Defense Fund Prime Minister s National Relief Fund The National Foundation for Communal Harmony National State Blood Transfusion Web Section 80G of Income Tax Act Deduction Under 80g for FY 2023 24 amp AY 2024 25 Goodreturns Home 187 Calculators 187 Income Tax 187 Section 80G Section 80G of Income Tax Act Under this

80g Deduction Limit For Fy 2023 24

80g Deduction Limit For Fy 2023 24

https://blog.tax2win.in/wp-content/uploads/2018/07/DEDUCTION-us-80G-Infographic-2.jpg

Tax Deduction At Source TDS Rate FY 2023 24 AY 2024 25 Academy

https://www.tax4wealth.com/storage/uploads/1682753120-tax-deduction-at-source-tds-tds-rate-fy-2023-24.jpg

TDS Rate Chart AY 2023 2024 FY 2022 2023 Sensys Blog

https://www.sensystechnologies.com/blog/wp-content/uploads/2022/04/20220429_120210-768x524.jpg

Web This return is applicable for an Individual or Hindu Undivided Family HUF who is Resident other than Not Ordinarily Resident or a Firm other than LLP which is a Resident having Total Income up to 50 lakh and having income from Business or Profession which is computed on a presumptive basis u s 44AD 44ADA 44AE and income from any of Web 25 Juli 2023 nbsp 0183 32 Deduction is limited to whole of the amount paid or deposited subject to a maximum of Rs 1 50 000 12 This maximum limit of Rs 1 50 000 12 is the aggregate of the deduction that may be claimed under sections 80C 80CCC and 80CCD 2 The sums paid or deposited need not be out of income chargeable to tax of the previous year

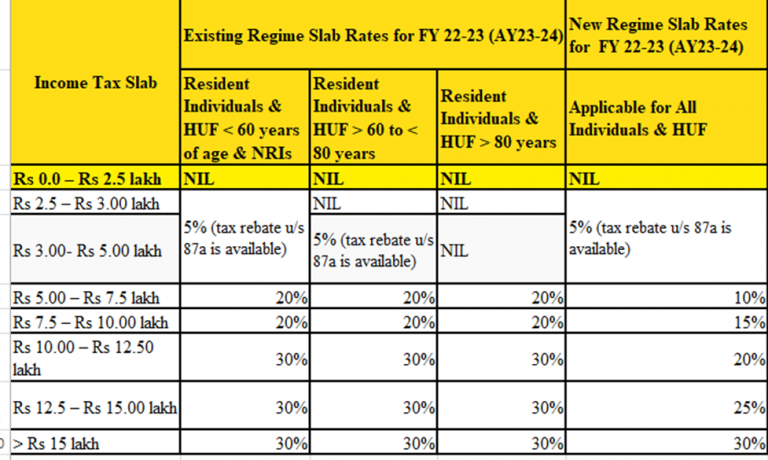

Web 28 Dez 2023 nbsp 0183 32 Such taxpayers can opt for the reduced income tax slab for the FY 2022 23 AY 2023 2024 under the new tax regime Explore the comprehensive list of Income Tax Deductions for FY 2022 23 AY 2023 24 under Sections 80C 80CCC 80CCD and 80D Maximize your tax savings with this detailed guide Web 9 Nov 2023 nbsp 0183 32 For the financial year 2022 23 the maximum limit for deductions under Section 80D of the Income Tax Act in India is set at 1 5 lakh What is the limit for 80C and 80D The deduction limit under Section 80C is 1 5 Lakh while under Section 80D it is 2 Lakh for senior citizens and 1 5 Lakh for individual taxpayers and

Download 80g Deduction Limit For Fy 2023 24

More picture related to 80g Deduction Limit For Fy 2023 24

80G Deduction

https://www.cabkgoyal.com/wp-content/uploads/2023/05/80g-deduction.png

PPT Donation Under 80g PowerPoint Presentation Free Download ID

https://image6.slideserve.com/11987059/80g-deduction-limit-n.jpg

TDS RATE CHART FY 2023 24 AY 2024 25

https://lh3.googleusercontent.com/-U1B6M_piwJU/ZCCHC6XQhVI/AAAAAAAASYY/gJLpV_Y68PYE_yA5uyRyQuGNVGayIemIgCNcBGAsYHQ/w1200-h630-p-k-no-nu/1679853320461382-0.png

Web 12 Apr 2023 nbsp 0183 32 Chartered accountant Section 80G of the Income Tax Act 1961 allows taxpayers to save tax by donating money to eligible charitable institutions By donating to eligible institutions and organisations taxpayers can claim deductions ranging from 50 to 100 of the amount donated Web 12 Aug 2023 nbsp 0183 32 Can I claim Health Insurance Premium Section 80D Income Tax Benefit under the New Tax Regime for FY 2023 24 As per the Finance Bill 2023 24 you can now opt for a lower new income tax slabs rates for FY 2023 24 AY 2024 25 Latest Income Tax Slabs amp Rates FY 2023 24 under New Tax Regime

Web 15 Dez 2023 nbsp 0183 32 Who is eligible to claim the Section 80C deduction Individuals and HUFs are eligible to claim the Section 80C deduction The maximum annual deduction from the taxpayer s total income that is permitted under section 80C is Rs 1 5 lakh The deduction is not available to companies partnership firms or limited liability companies Web Vor 3 Tagen nbsp 0183 32 FY 2023 24 AY 2024 25 Up to Rs 3 00 000 Nil Rs 3 00 000 to Rs 6 00 000 5 on income which exceeds Rs 3 00 000 Rs 6 00 000 to Rs 900 000 Rs 15 000 10 on income more than Rs 6 00 000 Rs 9 00 000 to Rs 12 00 000 Rs 45 000 15 on income more than Rs 9 00 000 Rs 12 00 000 to Rs 1500 000 Rs 90 000 20 on

Latest Income Tax Slab Rates For FY 2021 22 AY 2022 23 Budget 2021

https://www.basunivesh.com/wp-content/uploads/2021/02/Latest-Income-Tax-Slab-Rates-for-FY-2021-22-AY-2022-23.jpg

Donations Under Section 80G Deductions In Income Tax Teachoo

https://d77da31580fbc8944c00-52b01ccbcfe56047120eec75d9cb2cbd.ssl.cf6.rackcdn.com/75f8ccf9-5626-4c24-bf62-37a2b4aa9032/80g-new.png

https://www.relakhs.com/income-tax-deductions-list-fy-2023-24-under...

Web 7 Aug 2023 nbsp 0183 32 Income Tax Benefits available under Old Tax Regime for FY 2023 24 AY 2024 25 Below are the income tax deductions that are available under the old tax regime only Section 80c The maximum tax exemption limit under Section 80C is Rs 1 5 Lakh for FY 2023 24 The various best tax saving and investment options that can be claimed as

https://tax2win.in/guide/80g-deduction-donations-to-charitable-institutions

Web Vor 6 Tagen nbsp 0183 32 Budget 2023 Update for Deductions Under Section 80G As per the latest announcement in budget 2023 the donations made to the following funds will not be eligible for deductions under Section 80G National Defense Fund Prime Minister s National Relief Fund The National Foundation for Communal Harmony National State Blood Transfusion

Information On Section 80G Of Income Tax Act Ebizfiling

Latest Income Tax Slab Rates For FY 2021 22 AY 2022 23 Budget 2021

Calculate TDS On Salary And Check Deductions And Exemptions

EXCEL Of Tax Deduction Form xlsx WPS Free Templates

-compressed.jpg)

Tds Rate Chart For The Fy 2023 24 Ay 2024 25 Ebizfiling Porn Sex Picture

What Is Section 80G Tax Deductions On Your Donations Deduction U s

What Is Section 80G Tax Deductions On Your Donations Deduction U s

TDS Chart For FY 2021 22

Tax Exemption For Donation Under Section 80G Cash Donation Limit Of

Income Tax Slabs New Old Tax Rates FY 2022 23 AY 2023 24 Janani

80g Deduction Limit For Fy 2023 24 - Web 28 Dez 2023 nbsp 0183 32 Such taxpayers can opt for the reduced income tax slab for the FY 2022 23 AY 2023 2024 under the new tax regime Explore the comprehensive list of Income Tax Deductions for FY 2022 23 AY 2023 24 under Sections 80C 80CCC 80CCD and 80D Maximize your tax savings with this detailed guide