80g Limit On Deduction Web 28 Juni 2018 nbsp 0183 32 1 Deduction U s 80G is Allowable to all kind of Assessee 2 Deduction U s 80G on Donation to Foreign Trust 3 Deduction U s 80G on Donation to Political Parties 4 Only donation made to prescribed funds and institutions qualify for section 80G deduction 5 Maximum allowable deduction under section 80G 6

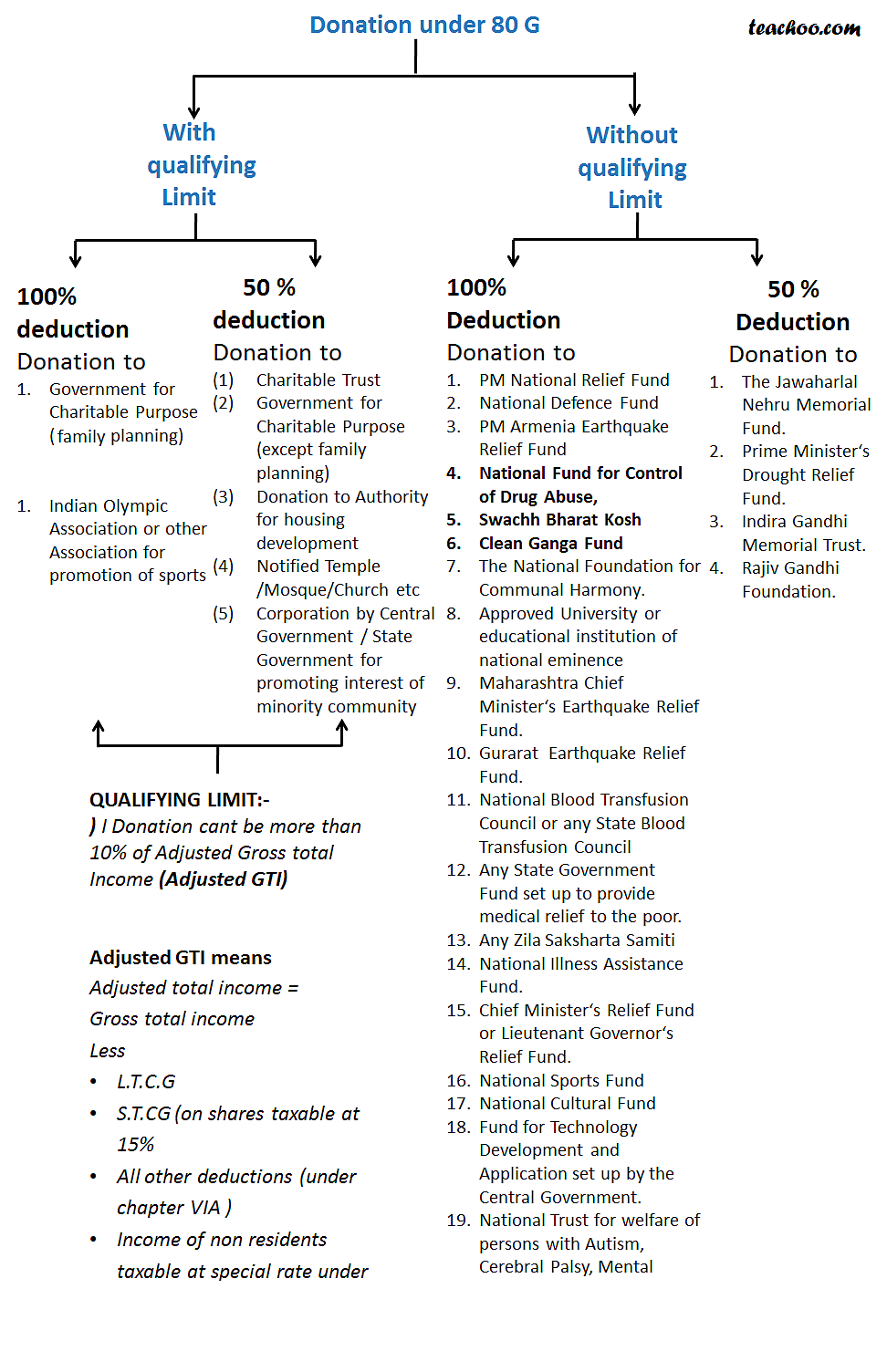

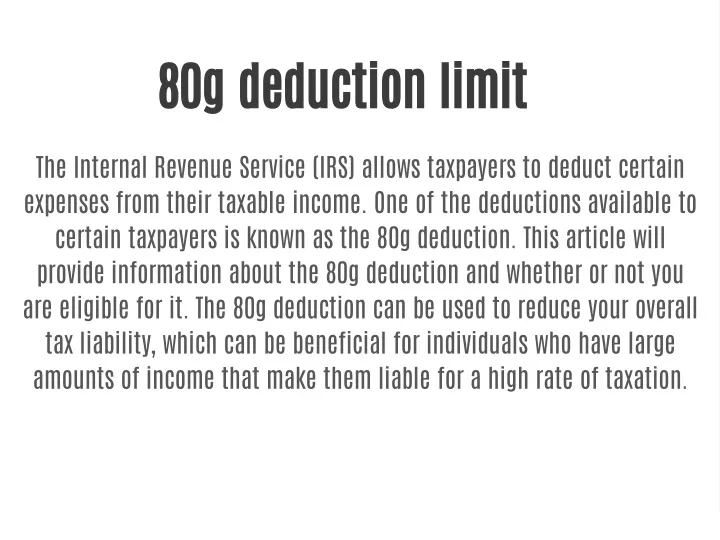

Web 12 Apr 2023 nbsp 0183 32 In this case the lower amount is the qualifying limit of Rs 75 000 Therefore the maximum deduction allowable under Section 80G is 50 of Rs 75 000 which comes out to be Rs 37 500 Hence you can claim a deduction of Rs 37 500 under Section 80G for the donations made to eligible NGOs Web 30 Dez 2023 nbsp 0183 32 Section 80G Deduction Eligible List of Funds Charitable Institutions for Donations 100 deduction subject to qualifying limit and 50 deduction subject to qualifying limit

80g Limit On Deduction

80g Limit On Deduction

https://www.eagtax.co.uk/wp-content/uploads/2023/02/Super-Deduction.jpg

Donations Under Section 80G Deductions In Income Tax Teachoo

https://d77da31580fbc8944c00-52b01ccbcfe56047120eec75d9cb2cbd.ssl.cf6.rackcdn.com/75f8ccf9-5626-4c24-bf62-37a2b4aa9032/80g-new.png

What Is Section 80G Tax Deductions On Your Donations Deduction U s

https://i.ytimg.com/vi/qbX0I6TKH9g/maxresdefault.jpg

Web 9 Feb 2023 nbsp 0183 32 What is 80G Deduction Limit List of Funds Eligible for Deduction Under Section 80G Donations with 100 Income Tax Deduction without any qualifying limit Donations with 50 Income Tax Deduction without any qualifying limit Donations with 100 Income Tax Deduction subject to qualifying limit of 10 of adjusted gross total Web 14 Juli 2020 nbsp 0183 32 1 Deduction without any qualifying limit 100 2 Deduction without any qualifying limit 50 3 Deduction subject to qualifying limit 100 4 Deduction subject to qualifying limit 50 Here are the complete 80G deduction list

Web Deduction under Section 80G Donations paid to eligible trusts charities which qualify for tax deductions are subject to certain conditions Donations under Section 80G can be broadly classified into four categories as mentioned below Web Maximum Limit for Deduction under Section 80G In some cases there is no maximum limitfor the deduction which can be claimed for donations made under section 80G However in some cases deduction on donations under Section 80G is limited to 10 of the Adjusted Gross Total Incomeof the taxpayer

Download 80g Limit On Deduction

More picture related to 80g Limit On Deduction

Chapter VI A 80G Deduction For Donation To Charitable Institution

https://blog.tax2win.in/wp-content/uploads/2018/07/DEDUCTION-us-80G-Infographic-2.jpg

Section 80g Deduction 80g Section 80g Of Income Tax Act 2020 21

https://i.ytimg.com/vi/gJwepgBOgKE/maxresdefault.jpg

Deductions U S 80C Under Schedule VI Of Income Tax IFCCL

https://www.caindelhiindia.com/blog/wp-content/uploads/2021/07/80c.jpg

Web 10 Mai 2023 nbsp 0183 32 Section 80G of the Income Tax Act allows a deduction on the monetary donation made to the specified charitable institutions The rules of claiming Section 80G deduction while filing income tax return have been made stricter in recent years Here is all you need to know about claiming Section 80G deduction while filing ITR this year Web 18 Juni 2021 nbsp 0183 32 A recent amendment to Section 80G of the Income Tax Act introduces new compliance measures that could hinder future fundraising for nonprofits by Ravi Bagaria Ritu Jain 3 min read You may have heard of the recent amendments to the Income Tax Act 1961 for charitable organisations that was notified on March 26th 2021

Web 24 Okt 2023 nbsp 0183 32 The deduction can be 100 or 50 with or without restriction as per the provisions of section 80G What is the Qualifying Amount u s 80G for Donations As per the provisions of section 80G not every donation qualifies for a 100 deduction It depends on the eligibility of the organization to which donation is made Web 19 Dez 2020 nbsp 0183 32 Benefits of Deduction Under Section 80G The section 80G of Income Tax Act 1961 serves dual benefits for society Primarily it reduces the tax liability of the taxpayers and provides them with a chance to invest that money in charitable and social development cases READ Pan Aadhaar Linking Final Extension Granted by CBDT up to 31st

Itemized Deduction Vs Standard Deduction Explained YouTube

https://i.ytimg.com/vi/2LmBSfomk2Q/maxresdefault.jpg

PPT Donation Under 80g PowerPoint Presentation Free Download ID

https://image6.slideserve.com/11987059/80g-deduction-limit-n.jpg

https://taxguru.in/income-tax/all-about-deduction-under-section-80g-of...

Web 28 Juni 2018 nbsp 0183 32 1 Deduction U s 80G is Allowable to all kind of Assessee 2 Deduction U s 80G on Donation to Foreign Trust 3 Deduction U s 80G on Donation to Political Parties 4 Only donation made to prescribed funds and institutions qualify for section 80G deduction 5 Maximum allowable deduction under section 80G 6

https://economictimes.indiatimes.com/wealth/tax/what-is-section-80g...

Web 12 Apr 2023 nbsp 0183 32 In this case the lower amount is the qualifying limit of Rs 75 000 Therefore the maximum deduction allowable under Section 80G is 50 of Rs 75 000 which comes out to be Rs 37 500 Hence you can claim a deduction of Rs 37 500 under Section 80G for the donations made to eligible NGOs

Deduction YouTube

Itemized Deduction Vs Standard Deduction Explained YouTube

Deductions Under Section 80C Benefits Works Myfinopedia

Deduction YouTube

What Is Section 80G Tax Deductions On Your Donations Deduction U s

80G Deduction

80G Deduction

EXCEL Of Tax Deduction Form xlsx WPS Free Templates

Deduction Under Section 80C To 80U Chapter VI Income Tax Deduction

Qbi Deduction Explained Inflation Protection

80g Limit On Deduction - Web 20 Jan 2022 nbsp 0183 32 Section 80G Deduction Limit Section 80G of the Indian Tax Act categories donations under two categories based on the maximum limit that can be claimed for tax deductions All eligible donations are available for deduction either up to 100 or 50 along with the restrictions if any prescribed under Section 80G Let us learn more