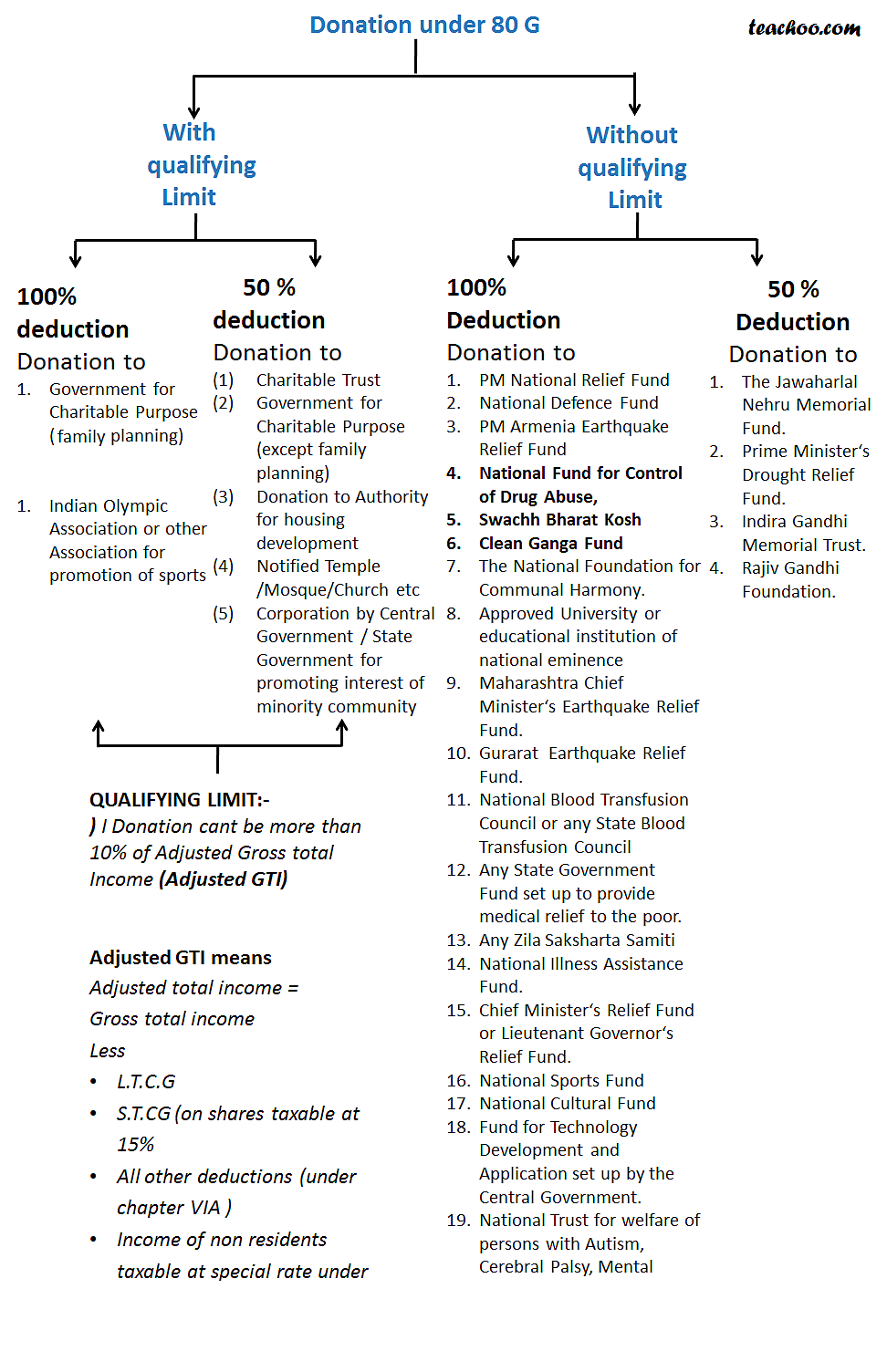

80g 5 Deduction Limit Web 28 Juni 2018 nbsp 0183 32 1 Deduction U s 80G is Allowable to all kind of Assessee 2 Deduction U s 80G on Donation to Foreign Trust 3 Deduction U s 80G on Donation to Political Parties 4 Only donation made to prescribed funds and institutions qualify for section 80G deduction 5 Maximum allowable deduction under section 80G 6

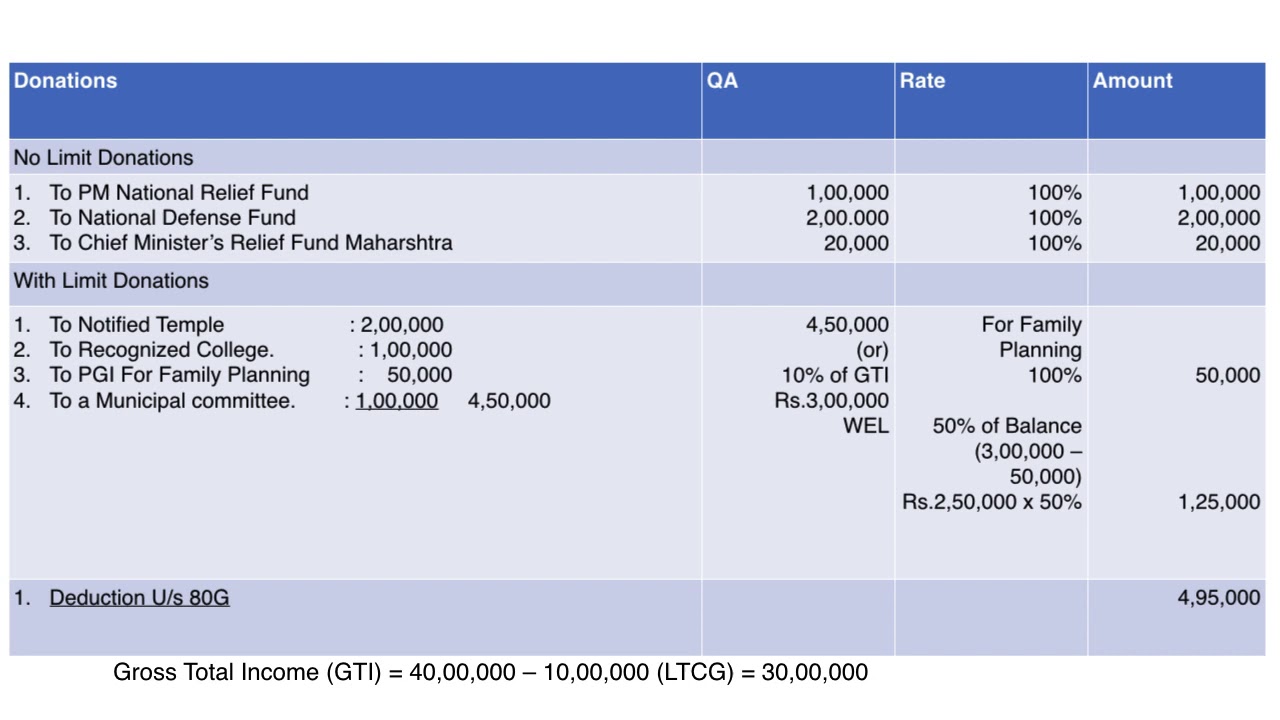

Web 12 Apr 2023 nbsp 0183 32 In this case the lower amount is the qualifying limit of Rs 75 000 Therefore the maximum deduction allowable under Section 80G is 50 of Rs 75 000 which comes out to be Rs 37 500 Hence you can claim a deduction of Rs 37 500 under Section 80G for the donations made to eligible NGOs Web 9 Feb 2023 nbsp 0183 32 What is 80G Deduction Limit List of Funds Eligible for Deduction Under Section 80G Donations with 100 Income Tax Deduction without any qualifying limit Donations with 50 Income Tax Deduction without any qualifying limit Donations with 100 Income Tax Deduction subject to qualifying limit of 10 of adjusted gross total

80g 5 Deduction Limit

80g 5 Deduction Limit

https://www.eagtax.co.uk/wp-content/uploads/2023/02/Super-Deduction.jpg

Where Can I Donate Clothes For Tax Deduction

https://blog.tax2win.in/wp-content/uploads/2018/07/DEDUCTION-us-80G-Infographic-2.jpg

Donations Under Section 80G Deductions In Income Tax Teachoo

https://d77da31580fbc8944c00-52b01ccbcfe56047120eec75d9cb2cbd.ssl.cf6.rackcdn.com/75f8ccf9-5626-4c24-bf62-37a2b4aa9032/80g-new.png

Web Maximum Limit for Deduction under Section 80G In some cases there is no maximum limit for the deduction which can be claimed for donations made under section 80G However in some cases deduction on donations under Section 80G is limited to 10 of the Adjusted Gross Total Income of the taxpayer Web Under section 80G there is no defined maximum deduction limit It all depends on the type of fund or institute you donate and sometimes also to your adjusted gross total income For determining exemption limit under section 80G you should classify donation in below 2 categories Eligible donation Without any Limit

Web The amount of deduction is prescribed in section 80G 2 iv The conditions which must be satisfied contains in before the donation to the trust or institution becomes tax deductible in the hands of a donor Section 80G 5 of Income Tax Act These conditions are as under i Income of the Trust would not be includible in Total Income The income of the trust etc Web 18 Juni 2021 nbsp 0183 32 Figure 1 Process for a donor to avail 80G deduction pre amendment for donations made up to 31st March 2021 In Figure 1 you can see that pre amendment the process to avail the 80G deduction for a donor was quite simple All that XYZ Foundation had to do was ensure a donation receipt was issued to Donor A with a valid 80G certificate

Download 80g 5 Deduction Limit

More picture related to 80g 5 Deduction Limit

Calculation Of Deduction U s 80G YouTube

https://i.ytimg.com/vi/cPm3JIxRiM0/maxresdefault.jpg

80G Deduction

https://www.cabkgoyal.com/wp-content/uploads/2023/05/80g-deduction.png

PPT Donation Under 80g PowerPoint Presentation Free Download ID

https://image6.slideserve.com/11987059/80g-deduction-limit-n.jpg

Web 20 Aug 2018 nbsp 0183 32 Main article Approval of a fund or institution under Section 80G Where the donation is made by a person to any other fund or institution the donor is entitled for deduction under this provision only when the donee fund or institution complies with the conditions as specified under section 80G 5 Web Vor 12 Stunden nbsp 0183 32 It has been almost 5 years since standard deduction was revised the previous instance was in 2019 There are many compelling reasons to raise the limit of the standard deduction from Rs 50 000 Standard deduction needs to be periodically adjusted to account for inflation says Akhil Chandna Partner Grant Thornton Bharat Though

Web 11 Dez 2023 nbsp 0183 32 In this instance the lower amount is the qualifying limit of Rs 90 000 Therefore the maximum deduction allowable under Section 80G is 50 of Rs 100 000 equaling Rs 50 000 Therefore you can claim a deduction of Rs 50 000 under Section 80G for the donations made to eligible NGOs Web 6 Feb 2020 nbsp 0183 32 Under Section 80G the amount donated is allowed to be claimed as a deduction at the time of filing the assessee s income tax return Deduction under Section 80G can be claimed by individuals partnership firms HUF company and other types of taxpayers irrespective of the type of income earned

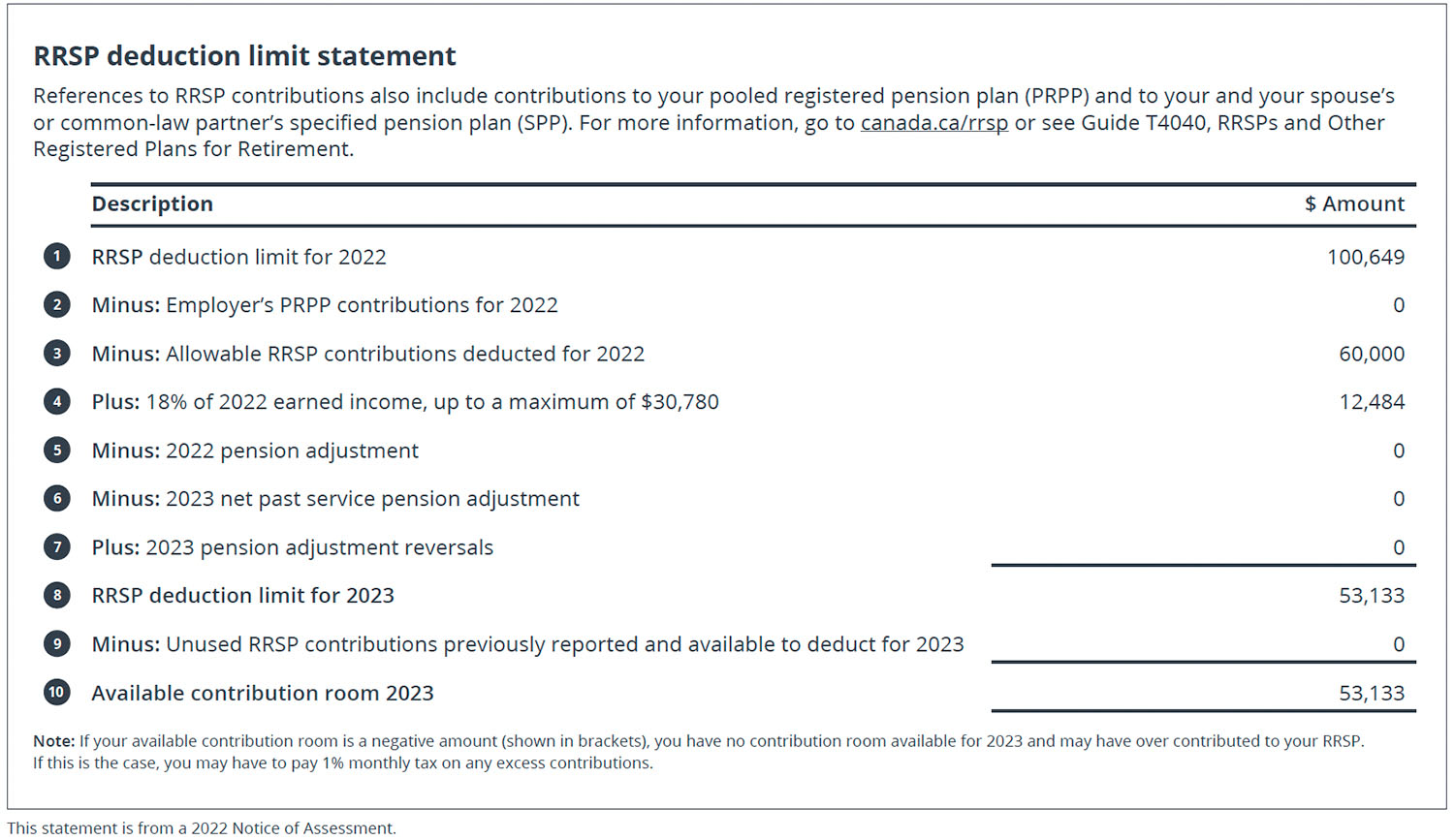

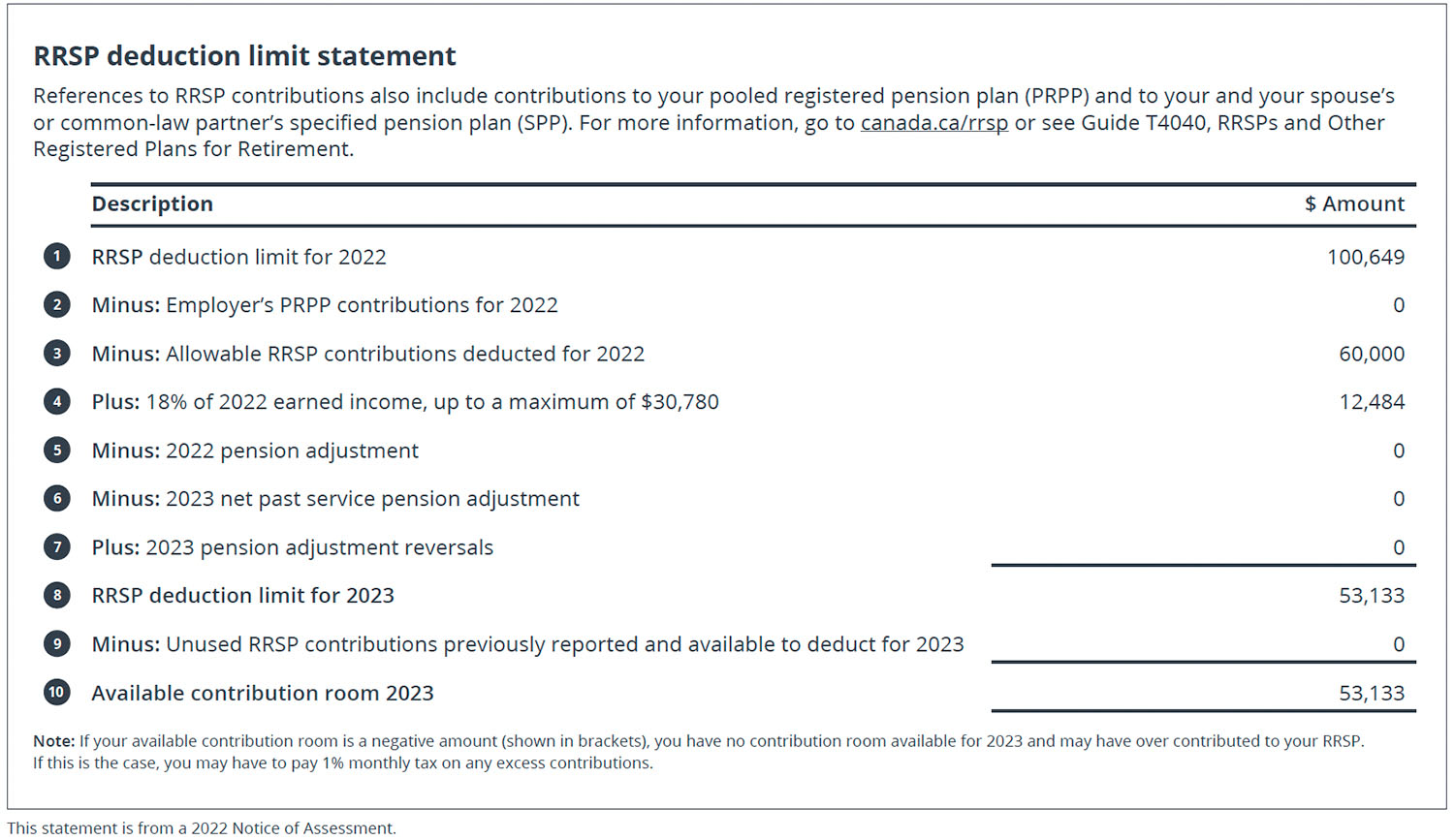

Understanding The RRSP Deduction Limit Statement Wellington Altus

https://wellington-altus.ca/wp-content/uploads/2023/02/RRSP-Deduction-Limit-Statement-2024.jpg

Deduction Under Section 80G Part 2 YouTube

https://i.ytimg.com/vi/0WiwQ7gkHR4/maxresdefault.jpg

https://taxguru.in/income-tax/all-about-deduction-under-section-80g-of...

Web 28 Juni 2018 nbsp 0183 32 1 Deduction U s 80G is Allowable to all kind of Assessee 2 Deduction U s 80G on Donation to Foreign Trust 3 Deduction U s 80G on Donation to Political Parties 4 Only donation made to prescribed funds and institutions qualify for section 80G deduction 5 Maximum allowable deduction under section 80G 6

https://economictimes.indiatimes.com/wealth/tax/what-is-section-80g...

Web 12 Apr 2023 nbsp 0183 32 In this case the lower amount is the qualifying limit of Rs 75 000 Therefore the maximum deduction allowable under Section 80G is 50 of Rs 75 000 which comes out to be Rs 37 500 Hence you can claim a deduction of Rs 37 500 under Section 80G for the donations made to eligible NGOs

Information On Section 80G Of Income Tax Act Ebizfiling

Understanding The RRSP Deduction Limit Statement Wellington Altus

Section 80C Deductions List To Save Income Tax FinCalC Blog

Explanation Of Section 80G Tax ExemptionLimit Yadnya Investment Academy

Setting Up Deductions In QuickBooks Online Advanced Payroll

Qbi Deduction Explained Inflation Protection

Qbi Deduction Explained Inflation Protection

Loi3dtN1iqvoAQrML OAYXTqCW

Limit Volume 5

5 Year End Medical Plan Tax Deduction Strategies

80g 5 Deduction Limit - Web 18 Juni 2021 nbsp 0183 32 Figure 1 Process for a donor to avail 80G deduction pre amendment for donations made up to 31st March 2021 In Figure 1 you can see that pre amendment the process to avail the 80G deduction for a donor was quite simple All that XYZ Foundation had to do was ensure a donation receipt was issued to Donor A with a valid 80G certificate