80g 5 Ix Deduction Limit For companies the deduction under Section 80G can be claimed on the amount donated to eligible institutions or funds up to a maximum of

Explanation 1 An institution or fund established for the benefit of Scheduled Castes backward classes Scheduled Tribes or of women and children shall not be deemed to be an institution Section 80G allows taxpayers to claim deductions on donations made to specific organizations promoting philanthropy and social responsibility These deductions are available to individuals

80g 5 Ix Deduction Limit

80g 5 Ix Deduction Limit

https://i.ytimg.com/vi/cPm3JIxRiM0/maxresdefault.jpg

Deduction U s 80C Full List Of Investment Available For Deduction

https://i.ytimg.com/vi/MKQFD36bOYM/maxresdefault.jpg

The So Wealth Management Group RRSP Contribution VS Deduction Limit

https://ca.rbcwealthmanagement.com/documents/868682/868696/NOA+example+RSP.jpg/e75bce35-f7cf-41c3-b275-168b7d515f10?t=1647291707920

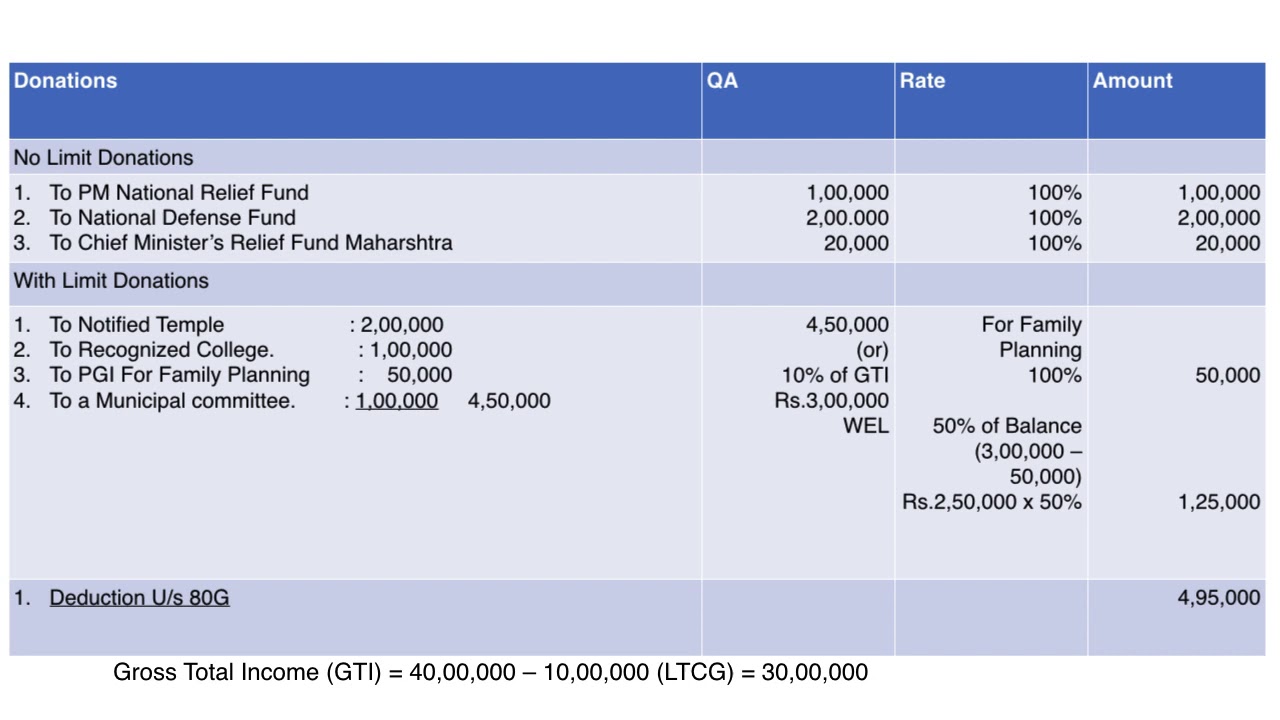

Section 80G of the Income Tax Act provides deductions for donations made to certain charitable institutions and funds The amount of deduction varies depending on the 80G deduction applies to taxpayers making donations to charitable trusts organisations and institutions registered under the Income Tax Department As a taxpayer you can be eligible

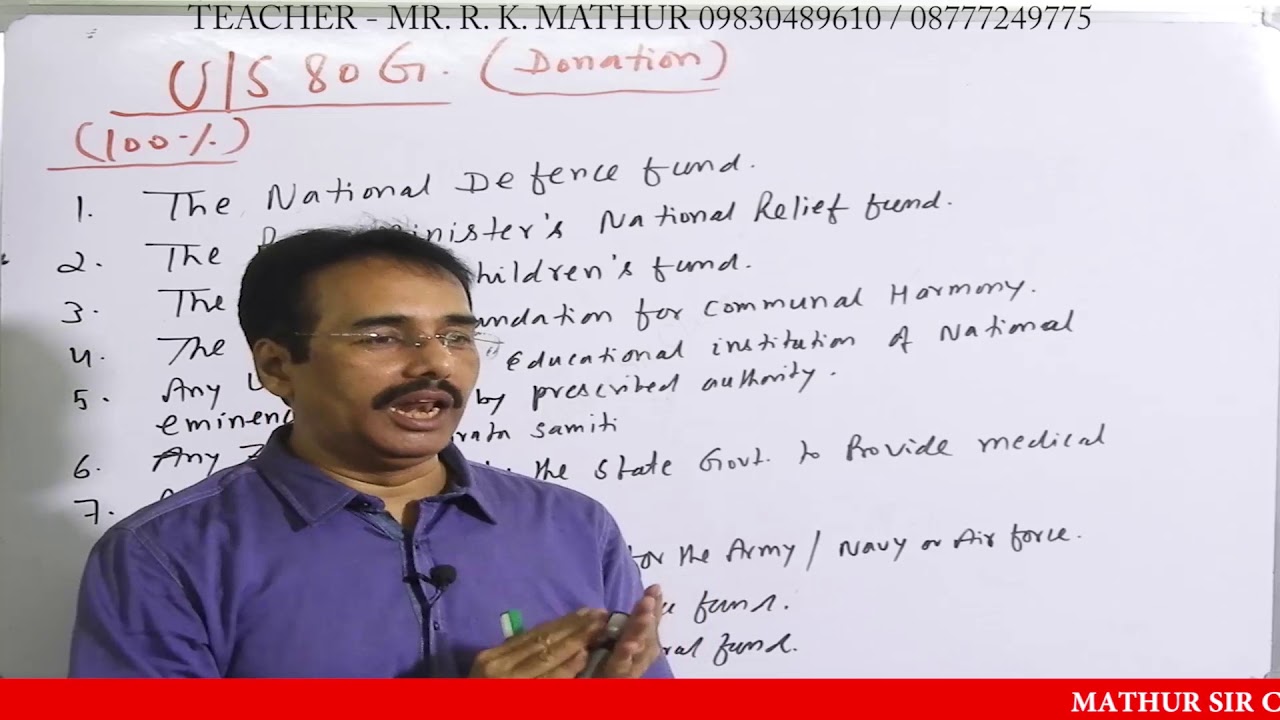

It is essential to be aware of the eligible entities and the specific deduction limits while making donations By following the necessary procedures and keeping proper documentation The various donations specified in section 80G are eligible for deduction up to either 100 or 50 with or without restriction as provided in section 80G Donations with 100

Download 80g 5 Ix Deduction Limit

More picture related to 80g 5 Ix Deduction Limit

Chapter VI A 80G Deduction For Donation To Charitable Institution

https://blog.tax2win.in/wp-content/uploads/2018/07/DEDUCTION-us-80G-Infographic-2.jpg

PPT Donation Under 80g PowerPoint Presentation Free Download ID

https://image6.slideserve.com/11987059/80g-deduction-limit-n.jpg

Deduction Under Section 80G Section 80G Of Income Tax Act Deduction

https://i.ytimg.com/vi/e8nkR9ItXYc/maxresdefault.jpg

What is Section 80G Contributions to relief funds and humanitarian organizations can be deducted under Section 80G of the Internal Revenue Code Any taxpayer whether a person a To claim a deduction under Section 80G of the Income Tax Act for donations made to specified funds or charitable institutions follow these steps Make Eligible Donations Ensure that you make donations to organisations

Section 80G Deduction is a facility available in the Income Tax Act which allows taxpayers to claim deductions for various contributions made as donations The deduction The donation made to a fund or institution shall be allowed as deduction only if such fund or institution is either specified in the provision itself or notified by the tax authorities

The Process To Claim Tax Deduction Under Section 80G Has Changed Here

https://i.ytimg.com/vi/AbWpJdqLcy0/maxresdefault.jpg

Donate And Avail Deduction Under Section 80G Of Income Tax Act

https://www.cry.org/wp-content/uploads/donate-and-avail-deduction-under-section-80g-of-income-tax-act.jpg

https://tax2win.in › guide

For companies the deduction under Section 80G can be claimed on the amount donated to eligible institutions or funds up to a maximum of

https://indiankanoon.org › doc

Explanation 1 An institution or fund established for the benefit of Scheduled Castes backward classes Scheduled Tribes or of women and children shall not be deemed to be an institution

SALT Deduction Limit 2024 BBB Act

The Process To Claim Tax Deduction Under Section 80G Has Changed Here

Chapter VI A 80G Deduction For Donation To Charitable Institution

.png)

What Is The RRSP Deduction Limit

Deduction Under Section 80G Part 2 YouTube

What Is Section 80G Tax Deductions On Your Donations Deduction U s

What Is Section 80G Tax Deductions On Your Donations Deduction U s

TAX DEDUCTION UNDER SECTION 80TTA DEDUCTION ON SAVINGS INTEREST

Deduction Under Section 80G Of Income Tax Act Chandan Agarwal

The SALT Deduction Limit Go Curry Cracker

80g 5 Ix Deduction Limit - Learn how to claim donation deduction in income tax under Section 80G Understand the 80G donation limit process of donation under 80G while contributing to an NGO