80g Donation Rules To claim a deduction under Section 80G the donation must be in the form of money and not goods or services The deduction

Only donations in cash cheque are eligible for the tax deduction under section 80G Donations in kind do not entitle for Last updated on January 18th 2024 Section 80G of income tax act allows tax deductions on donations made to certain organizations and relief

80g Donation Rules

80g Donation Rules

https://apps.hematology.org/images/acn/2019/06/Blood-donation-transfusion-donor-square.jpg

Give A Donation Craigieburn Trails

https://www.craigieburntrails.org.nz/wp-content/uploads/2015/04/donations-giving-donate-charity-FinanceFox.jpg

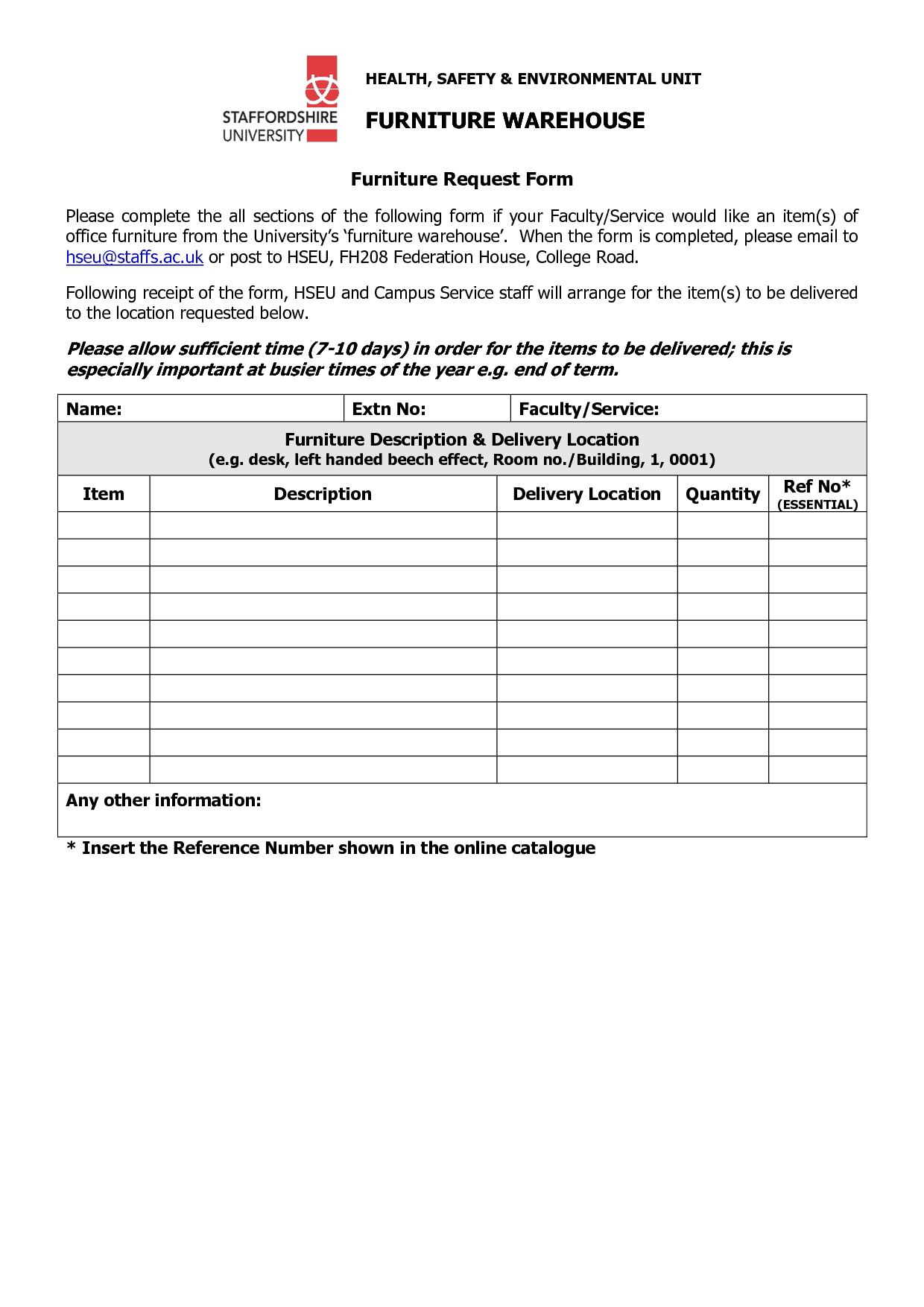

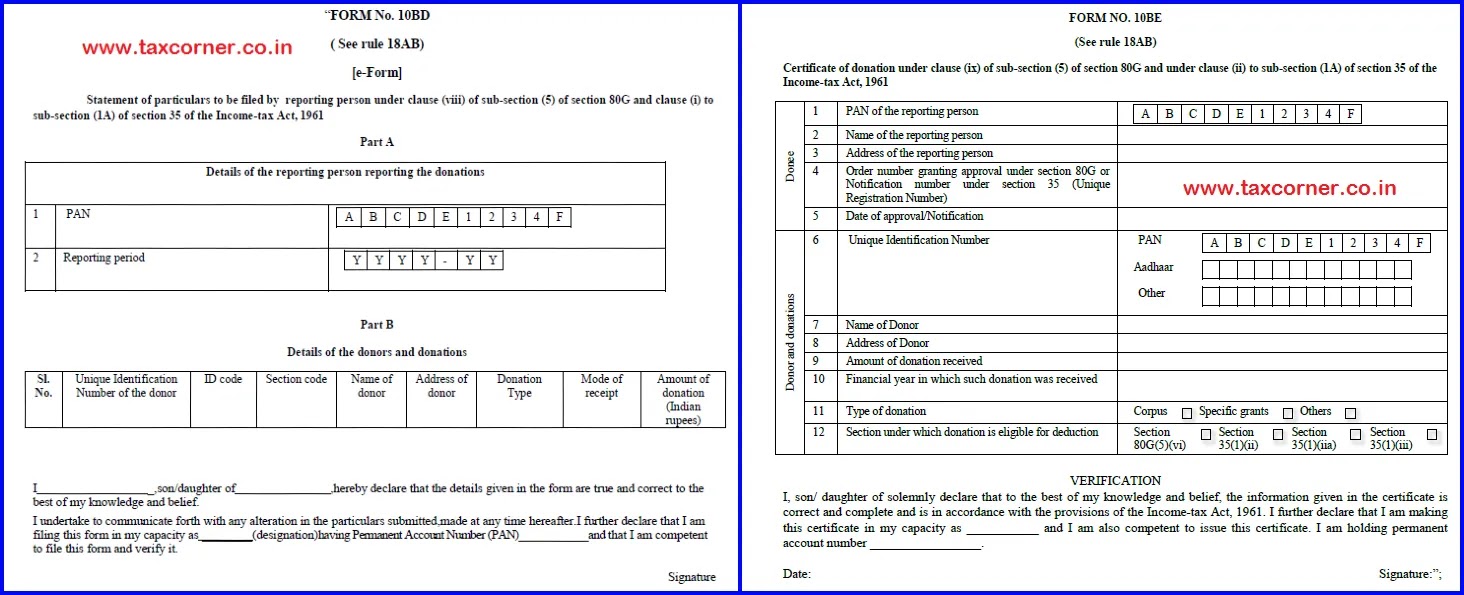

FAQs On Reporting Of Donations In Form 10BD For Statement Of Donation

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEg1WPwXKPEn26wdTOb7Nw3jCOIPj5Co6m4e_iEoq9xhWykJguVrLAZUXM-g2hDROj5NmwZpmtX85VmbCarIWzB3gNHqfmH_ltT89FFjK0DqtpW9sCJAVD7dHz5fBr0cMUJpmpRXzjrRPSk1EyVRMD_cYpf2WkT80Zj1k_rBJj0UKkJo9km9_x_XYvr-uQ/w1200-h630-p-k-no-nu/faqs-reporting-of-donations-form-10bd-statement-of-donation.webp

Section 80G of the Income Tax Act 1961 allows taxpayers to save tax by donating money to eligible charitable institutions By donating to eligible institutions and If you want to claim a deduction under Section 80G for donations made to specified institutions during the financial year 2021 22 you can do so if Form 10BE is

For donations made in kind such as clothes books food etc no tax benefit is available under Section 80G Here is everything you need to know about Section 80G and Section The government introduced an amendment to Section 80G in financial year 2017 18 under which donations made in cash above Rs 2 000 are no longer allowed as

Download 80g Donation Rules

More picture related to 80g Donation Rules

Donation Apps An Easy Way To Collect Donations

https://cdn.jotfor.ms/p/products/donation-apps/assets/img-min/how-to/slide1.png

Add A Donation The Sebaus Foundation

https://sebaus.org/wp-content/uploads/2021/10/logo-1-highres.png

Donation Receipt Format Free Download

http://mybillbook.in/s/wp-content/uploads/2023/02/donation-receipt-format.jpg

Draft Donations in kind such as clothing food medicines etc do not qualify as an eligible donation under 80G for income tax deductions The important thing Section 80G and 80GGA Your guide to tax efficiency Learn about eligible donations recent budget updates and a step by step guide to claim deductions

To claim a deduction under Section 80G the donation must be in the form of money Donations made in kind such as goods or services are not eligible for the Section 80G of Income Tax Act 1961 provides for the deduction in respect of donation to certain funds charitable institutions etc Find out more This document covers Persons

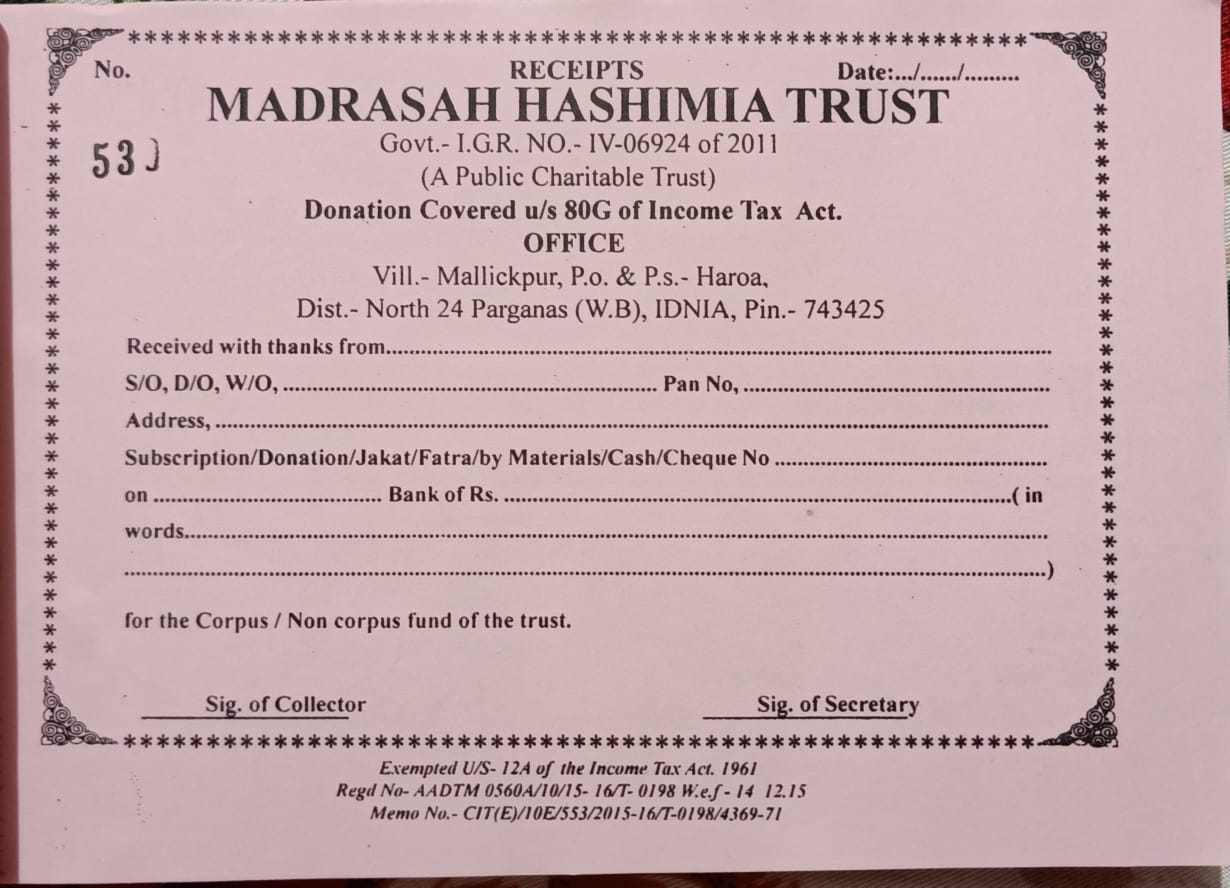

Donation Receipt Madrasah Hashimia Trust

https://madrasahhashimiatrust.org/upload/donation.jpg

Fundraiser Clipart Donation Picture 1176321 Fundraiser Clipart Donation

https://webstockreview.net/images/donation-clipart-fundraiser-12.png

https://tax2win.in/guide/80g-deduction-d…

To claim a deduction under Section 80G the donation must be in the form of money and not goods or services The deduction

https://taxguru.in/income-tax/all-about-d…

Only donations in cash cheque are eligible for the tax deduction under section 80G Donations in kind do not entitle for

Section 80G Deduction For Donations To Charitable Institutions Tax2win

Donation Receipt Madrasah Hashimia Trust

Charity Donation Template

Printable 501c3 Donation Receipt Template Printable Templates

Donation Box Vector Illustration Donut Donation Charity PNG And

Needed File Online Form No 10BD For Donations Eligible 80G

Needed File Online Form No 10BD For Donations Eligible 80G

NGO Donation Receipt Format Free Download

Donation Free Of Charge Creative Commons Handwriting Image

8 Best Images Of Donation List Template Printable Free Printable

80g Donation Rules - Apart from the re validation of 12A and 80G read more about it here a charitable organisation having an 80G approval needs to file a statement of