Agricultural Rebate Calculation A complete tax rebate is possible if The total agricultural income is Rs 5 000 The income from agricultural land is your only source of income no other income You have both

There is a complete tax rebate on agriculture income in these cases If your total agricultural income is less than Rs 5 000 p a If the income from agricultural land is the Agricultural income up to Rs 5000 is tax exempt Know about agricultural activities land exemption tax calculation with Scripbox

Agricultural Rebate Calculation

Agricultural Rebate Calculation

https://i.ytimg.com/vi/Gm-LyXhsTao/maxresdefault.jpg

Prestige Campaigns Rebate Campaign

https://www.prestigeinvest.finance/assets/campaigns/rebate_campaign-6e71d07bdfe4e53ff9660d7974eee03eecb1c992f32c563c5b4dda098806ec52.jpg

Volume Incentive Rebate Management And Examples Enable

https://assets-global.website-files.com/61eee558e613794aa8a7f70c/625f1a5b24cb3f200b74efe5_incentive-example-2.png

Step 2 Calculation of tax on net agricultural income maximum exemption limit as per slab rates i e Rs 5 50 000 Rs 3 00 000 Rs 2 50 000 Tax on the first Rs 2 50 000 Nil Tax Excel Calculator for Calculating Net Income Tax Payable on Agricultural Income in India How to Calculate Income Tax Payable and Rebate on Agricultural Income in India with Excel Auto

The rebate amount under Section 87A allows a tax rebate of up to Rs 12 500 for individuals with taxable income up to Rs 5 00 000 FY 2022 23 under the old regime Under Overview This briefing note illustrates the role and logic of Cost Benefit Analysis CBA in the evaluation of climate change adaptation policies and projects in the agriculture sectors and

Download Agricultural Rebate Calculation

More picture related to Agricultural Rebate Calculation

Agricultural Income Eligibility Calculation And Rebate

https://i2.wp.com/saral.pro/wp-content/uploads/2023/01/Agricultural-Income-Applicability-Calculation-Rebate.png?resize=1024%2C583&ssl=1

How To Calulate Rebate FY 2019 20 AY 2020 21 Chapter 4 Income Tax

https://d77da31580fbc8944c00-52b01ccbcfe56047120eec75d9cb2cbd.ssl.cf6.rackcdn.com/4f3e8d40-1fcf-4c08-b717-2df0bca83a73/rebate-1.png

2022 Menards Rebate Forms RebateForMenards

https://i0.wp.com/www.rebateformenards.com/wp-content/uploads/2022/10/2022-menards-rebate-forms.jpg?fit=1024%2C963&ssl=1

Agricultural income Non agricultural income A Net agricultural income basic exemption limit B Total amount of tax due B A Example If you earn Rs Less Rebate on Agricultural Income Tax on Rs 4 00 000 Rs 2 50 000 being basic exemption 42500 Net Tax Payable 10 000 Add Health Education Cess 4 400

17 August 2022 Income Tax India is an agricultural economy meaning most citizens earn their living from producing crops and maintaining farms As a result the Government of India GOI Updated On 16 Mar 2024 Agricultural income is not taxable under Section 10 1 of the Income Tax Act as it is not counted as a part of an individual s total income

Income Tax Rebate Calculation And

https://i.ytimg.com/vi/3YmLv86Uf_8/maxresdefault.jpg

Greek Rebate Free Stock Photo Public Domain Pictures

https://www.publicdomainpictures.net/pictures/270000/velka/greek-rebate.jpg

https://saral.pro/blogs/agricultural-income

A complete tax rebate is possible if The total agricultural income is Rs 5 000 The income from agricultural land is your only source of income no other income You have both

https://tax2win.in/guide/income-tax-agricultural-income

There is a complete tax rebate on agriculture income in these cases If your total agricultural income is less than Rs 5 000 p a If the income from agricultural land is the

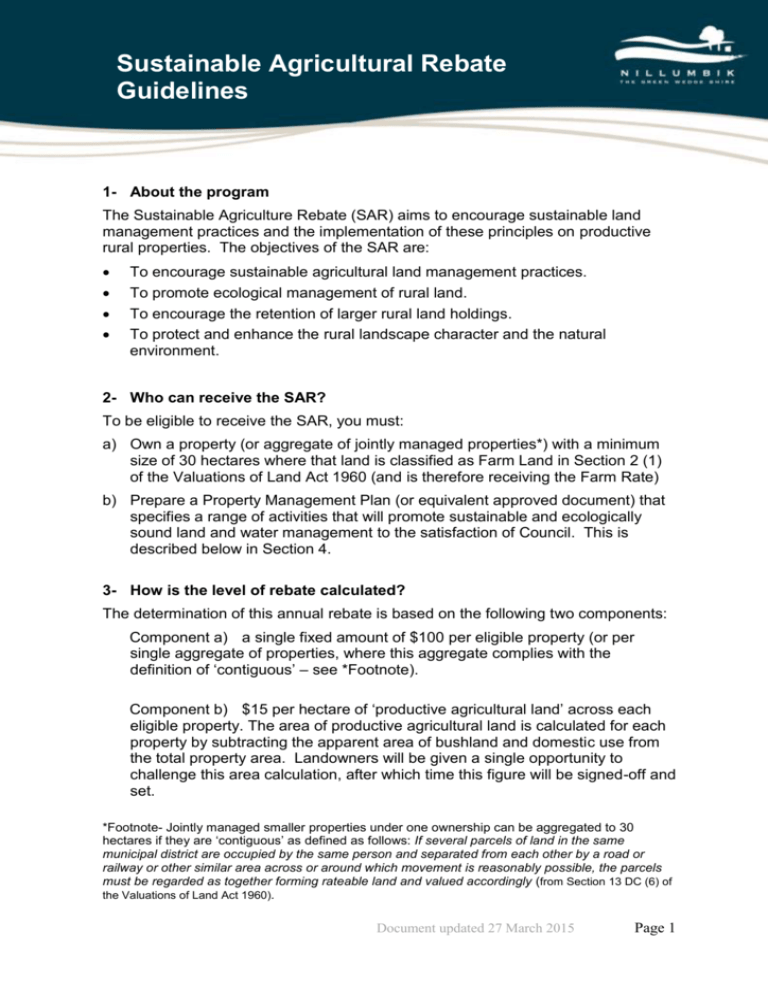

Sustainable Agricultural Rebate Guidelines

Income Tax Rebate Calculation And

Traderider Rebate Program Verify Trade ID

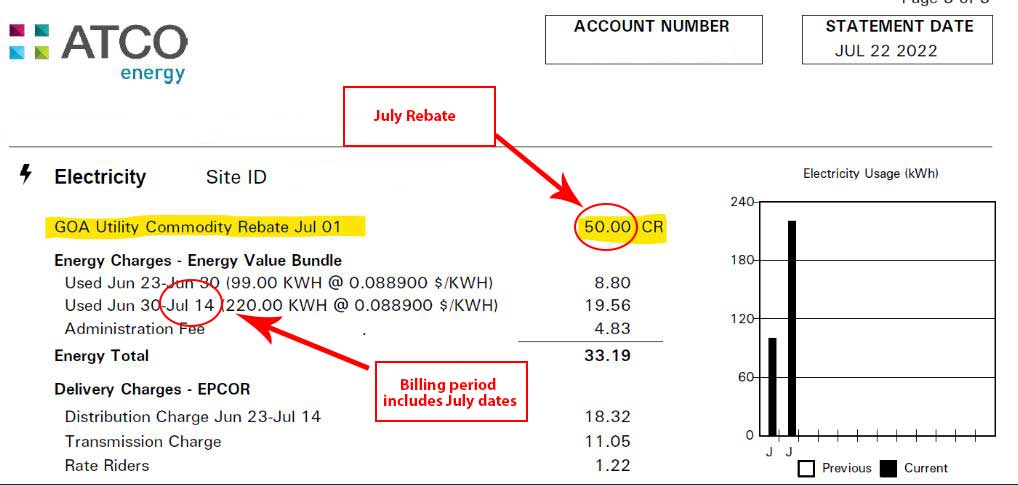

Utilities Consumer Advocate Electricity Rebate Program

Fillable Online 2020 MLR Rebate Template Fax Email Print PdfFiller

Rebate Calculations 101 How Are Rebates Calculated Enable

Rebate Calculations 101 How Are Rebates Calculated Enable

Rebate Management Software QuyaSoft

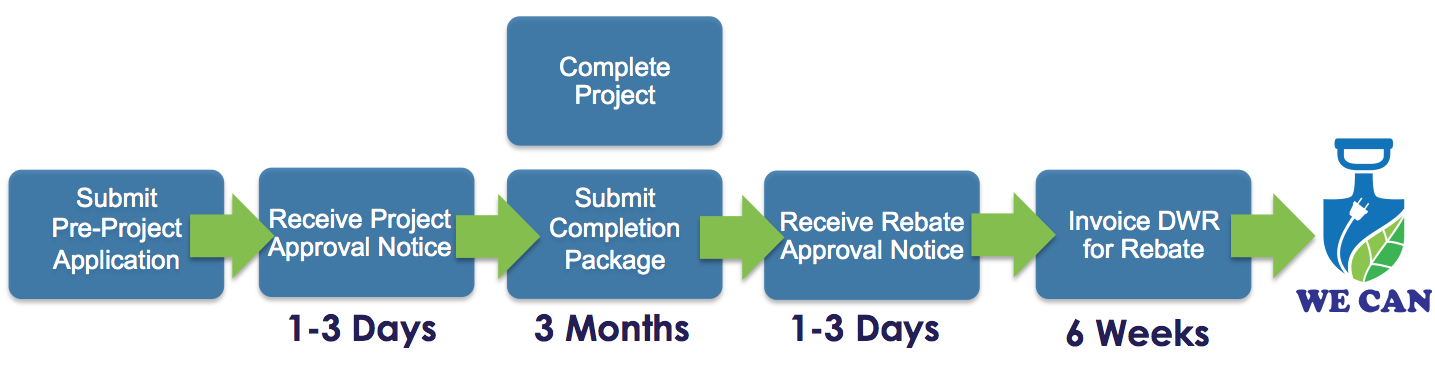

Our Rebate Process WE CAN SJV

Expired 15 Rebate From P G Freebies 4 Mom

Agricultural Rebate Calculation - The calculation of tax shall be as follows Sale of Agricultural Land Section 54B of Income Tax Act Tax Exemption from capital gain resulting in the sale of agricultural land