Agriculture Fuel Rebate From 1 July 2023 to 30 June 2024 Check the fuel tax credit rates for businesses from 1 July 2023 to 30 June 2024 Last updated 26 June 2024 Print or Download Fuel tax credit rates You need to use the rate that applies on the date you acquired the fuel

With the ever increasing fuel prices farms are looking to reduce expenses and improve cash flow The Province of Nova Scotia has a fuel tax exemption program that allows qualifying businesses to apply for a refund Businesses can claim credits for the fuel tax excise or customs duty included in the price of fuel used in their business activities You can claim for taxable fuel that you purchase manufacture or import Just make sure it s used in your business

Agriculture Fuel Rebate

Agriculture Fuel Rebate

https://asset-cdn.learnyst.com/assets/schools/103740/schoolLogo/Agriculture_tnrfxb.png

Fuel Management System Fuel Card Management IntelliShift

https://intellishift.com/wp-content/uploads/2022/03/[email protected]

Rising Fuel Fertiliser Prices Fuelling Farm Spending

https://today.thefinancialexpress.com.bd/uploads/1642960205.jpg

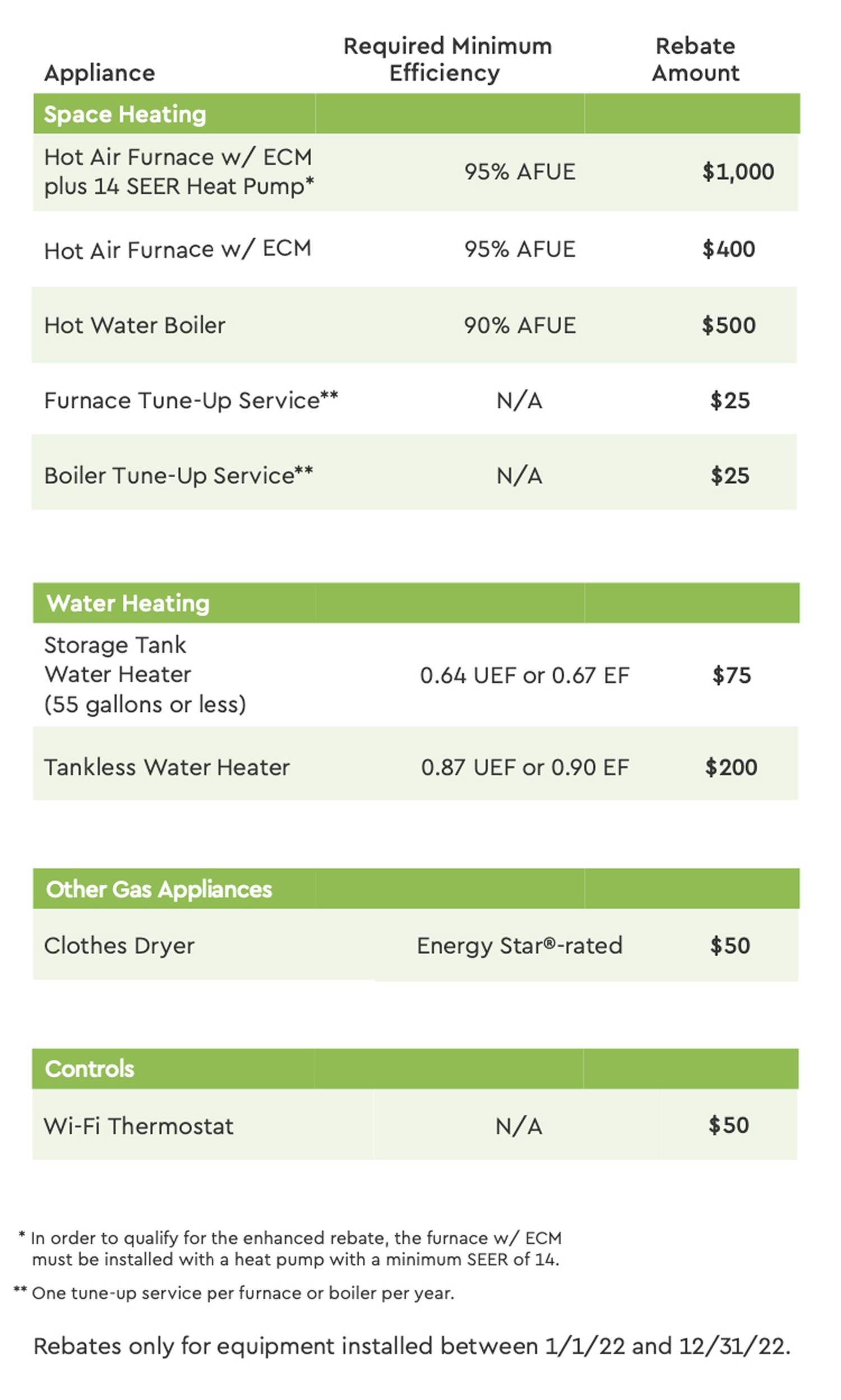

Fuel tax credit rates are indexed twice a year in February and August in line with the consumer price index CPI The CPI indexation factor for rates from 5 August 2024 is 1 020 Fuel excise duty was temporarily reduced The payment rate is set at 1 47 for 2021 and 1 73 for 2022 per 1 000 in eligible farming expenses for the fuel charge year Any credit claimed would be required to be included in taxable income Eligible farming expenses The total farming expenses must be at least 25 000 to be eligible

Recognizing that many farmers use natural gas and propane in their operations the federal government provides a refundable tax credit to return fuel charge proceeds to farming businesses that operate in provinces where Check the fuel tax credit rates for non businesses from 1 July 2023 to 30 June 2024

Download Agriculture Fuel Rebate

More picture related to Agriculture Fuel Rebate

National Fuel Rebate Form 2023 Printable Forms Free Online

https://fuelingtomorrowtoday.com/wp-content/uploads/2021/12/Residential-appliance-chart-1.jpg

National Fuel Rebate Form 2022 PrintableRebateForm

https://printablerebateform.net/wp-content/uploads/2022/11/National-Fuel-Rebate-Form.png

Snafu Pivotal Seatpost Jet Fuel Review Review A Bike

http://media.chainreactioncycles.com/is/image/ChainReactionCycles/prod142901_Jet Fuel_NE_01?$productfeedlarge$

Line 47556 Return of fuel charge proceeds to farmers tax credit If you are a self employed farmer or an individual who is a member of a partnership operating a farming business with one or more permanent establishments in Alberta Manitoba New Brunswick Newfoundland and Labrador Nova Scotia Ontario Prince Edward Island or Farmers and regional Australians are anxious about the future of the fuel tax credit mechanism should a minority Government result following Saturday s election Farmers angst is fuelled by rhetoric from some independent candidates incorrectly labelling the FTC a subsidy NFF president Fiona Simson said

You ll need to manage how you control the type of fuel your customers use If you allow customers to use rebated fuel for qualifying purposes in your vehicles machines or appliances you The income threshold to qualify for the heating rebate program is 29 000 for single income households and 44 000 for family income households On average the program provides more than

Free Images Advertising Environment Industry Stadium Public

https://c.pxhere.com/photos/b5/de/railway_fuel_tanks_hospet_india_industry_tanks_tank_petroleum_chemical-985123.jpg!d

Premium RV Gas Additive Gasoline Injector Cleaner Stabilizer

https://www.hotshotsecret.com/wp-content/uploads/2020/05/rv-pga_16ozsq_200406.jpg

https://www.ato.gov.au/businesses-and...

From 1 July 2023 to 30 June 2024 Check the fuel tax credit rates for businesses from 1 July 2023 to 30 June 2024 Last updated 26 June 2024 Print or Download Fuel tax credit rates You need to use the rate that applies on the date you acquired the fuel

https://nsfa-fane.ca/fuel-tax-program

With the ever increasing fuel prices farms are looking to reduce expenses and improve cash flow The Province of Nova Scotia has a fuel tax exemption program that allows qualifying businesses to apply for a refund

Mizoram Agriculture About Us

Free Images Advertising Environment Industry Stadium Public

CNH Industrial Solutions For A More Tech And Sustainable Agriculture

National Fuel Rebate Form 2022 Government Printable Rebate Form

Agriculture Fuel Diesel Gasoline Rahn s Oil Propane

National Fuel Furnace Rebate 2023 Rebate2022

National Fuel Furnace Rebate 2023 Rebate2022

Fuel EPayCard

Doolan Fuel Company

Nationals Commit To Water Rebate Scheme Farm Weekly WA

Agriculture Fuel Rebate - The Carbon Tax Rebate Program is a proposed program to return fuel charge proceeds directly to farming businesses in Ontario Manitoba Saskatchewan and Alberta through a refundable tax