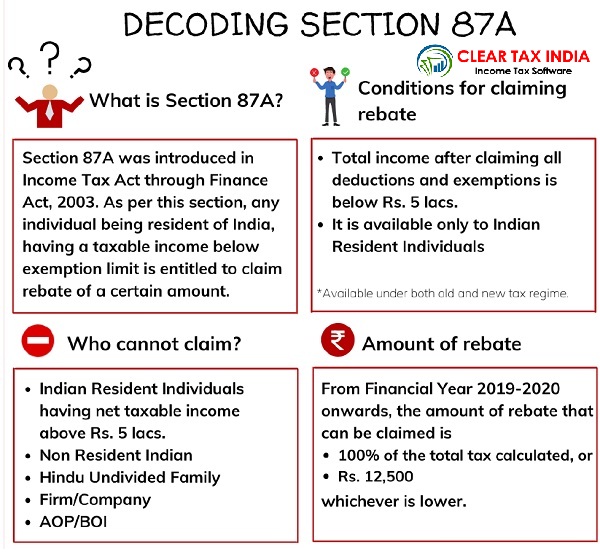

Allowance Rebate In Income Tax Tax Rebate Under Section 87A Find out Who can claim Income Tax Rebate u s 87A for FY 2023 24 AY 2024 25 and FY 2022 23 AY 2023 24 Know how to claim

No education allowance is an exemption upto 100 per child maximum of two children under section 10 However tuition fee deduction can be claimed upto 1 5 Tax rates and bands Tax is paid on the amount of taxable income remaining after the Personal Allowance has been deducted The following rates are for

Allowance Rebate In Income Tax

Allowance Rebate In Income Tax

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhjaMWWuh9Yw1oHqfkfrIaYbLGaB376RebKDTPXR4-jMTYYQRhPBXomiwY9EVzEmXIgQ2oXuDWoror_llXVa0a4CVcBPyG3JecnKbrFpU1YAcL3BqdldNxiSh81eUspfAXJiNGbHbVcluzwXjoIUmqkZimUhTYHrQKq1Zu6xuaat2LRf6h-UCOGnP3s/w640-h596/87a.jpg

Medical Expenses Rebate In Income Tax Return

https://i.ytimg.com/vi/UlG2OZkak_k/maxresdefault.jpg

How Can Taxpayers Obtain Income Tax Rebate In India

https://navi.com/blog/wp-content/uploads/2022/03/income-tax-rebate-1.jpg

How much Income Tax you pay in each tax year depends on how much of your income is above your Personal Allowance how much of your income falls within each tax band You may be able to claim tax relief if you use cars vans motorcycles or bicycles for work This does not include travelling to and from your work unless it s a temporary place of

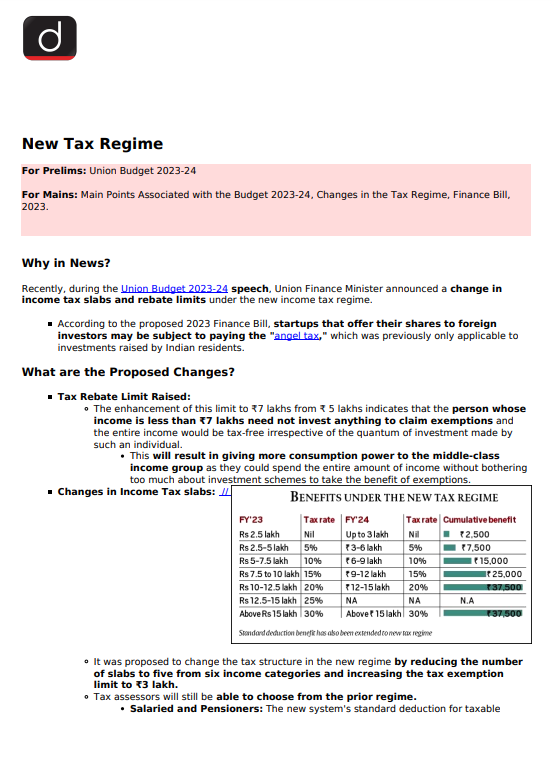

An allowance is an amount of otherwise taxable income that you can earn each year without paying tax on it What shall I pay If you earn above the threshold your Rebate u s 87A Resident Individuals are also eligible for a Rebate of up to 100 of income tax subject to a maximum limit depending on tax regimes as under Total Income Old

Download Allowance Rebate In Income Tax

More picture related to Allowance Rebate In Income Tax

How To Calculate Standard Deduction In Income Tax Act Scripbox

https://cdn-scripbox-wordpress.scripbox.com/wp-content/uploads/2021/05/standard-deduction-income-tax.jpg

Rebate Allowable Under Section 87A Of Income Tax Act

https://taxguru.in/wp-content/uploads/2020/08/Tax-Rebate.jpg

What Is A Rebate In Income Tax

https://www.mudranidhi.com/wp-content/uploads/2023/12/What-is-a-Rebate-in-Income-Tax-1024x576.jpg

When you claim a deduction in your tax return your tax is calculated on the basis of a lower income amount This means that you will pay less tax The amount you will be due to Form 1099 K 1099 MISC W 2 or other income statement for workers in the gig economy Form 1099 INT for interest received Other income documents and

Find out the allowances available for different categories of taxpayers in India This webpage provides a list of exemptions and deductions that can reduce your taxable Tax rebate Canadians with low to modest incomes to receive payment Canadian 20 and 50 bills are shown in a display case at the Bank of Canada Museum

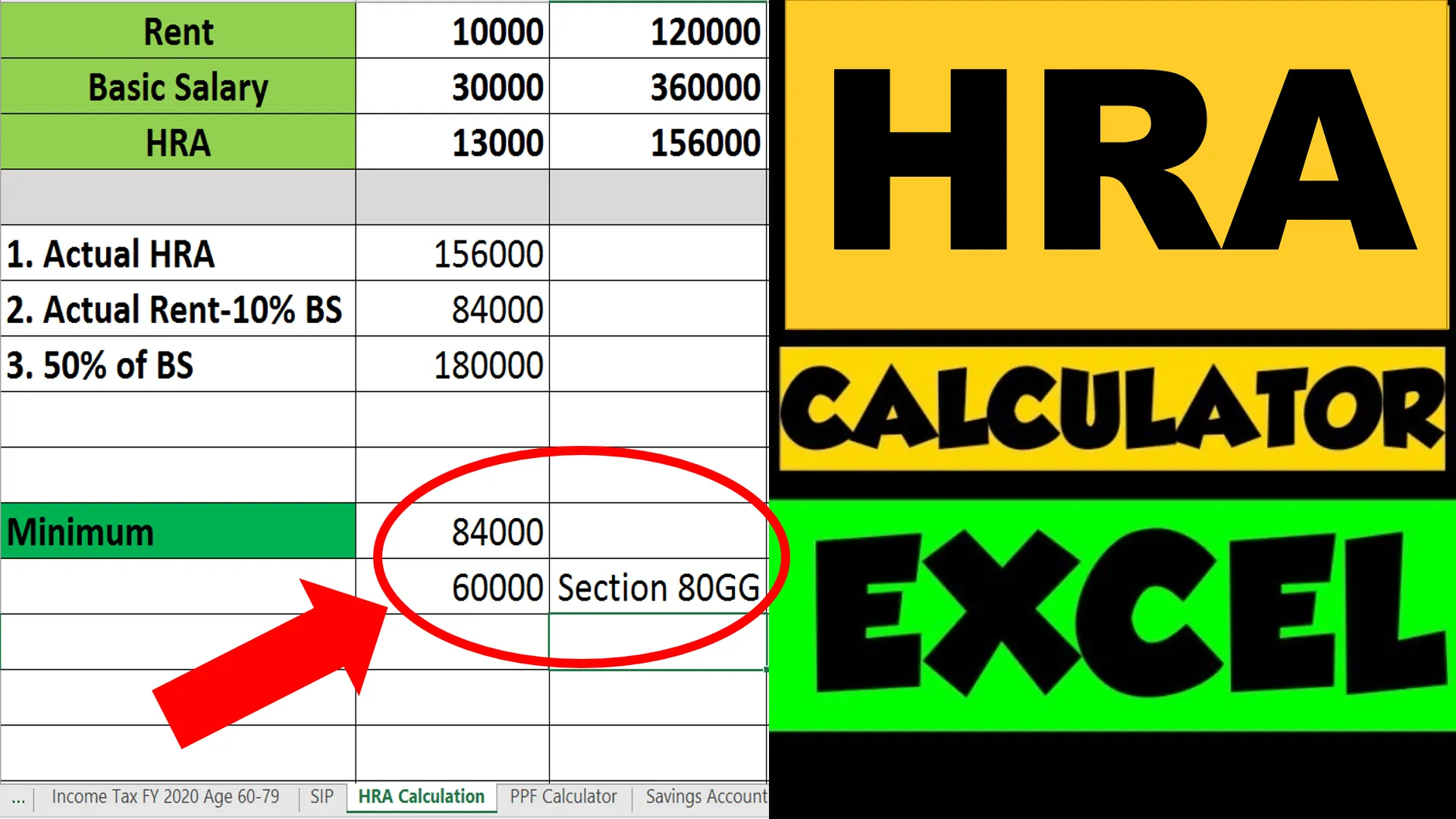

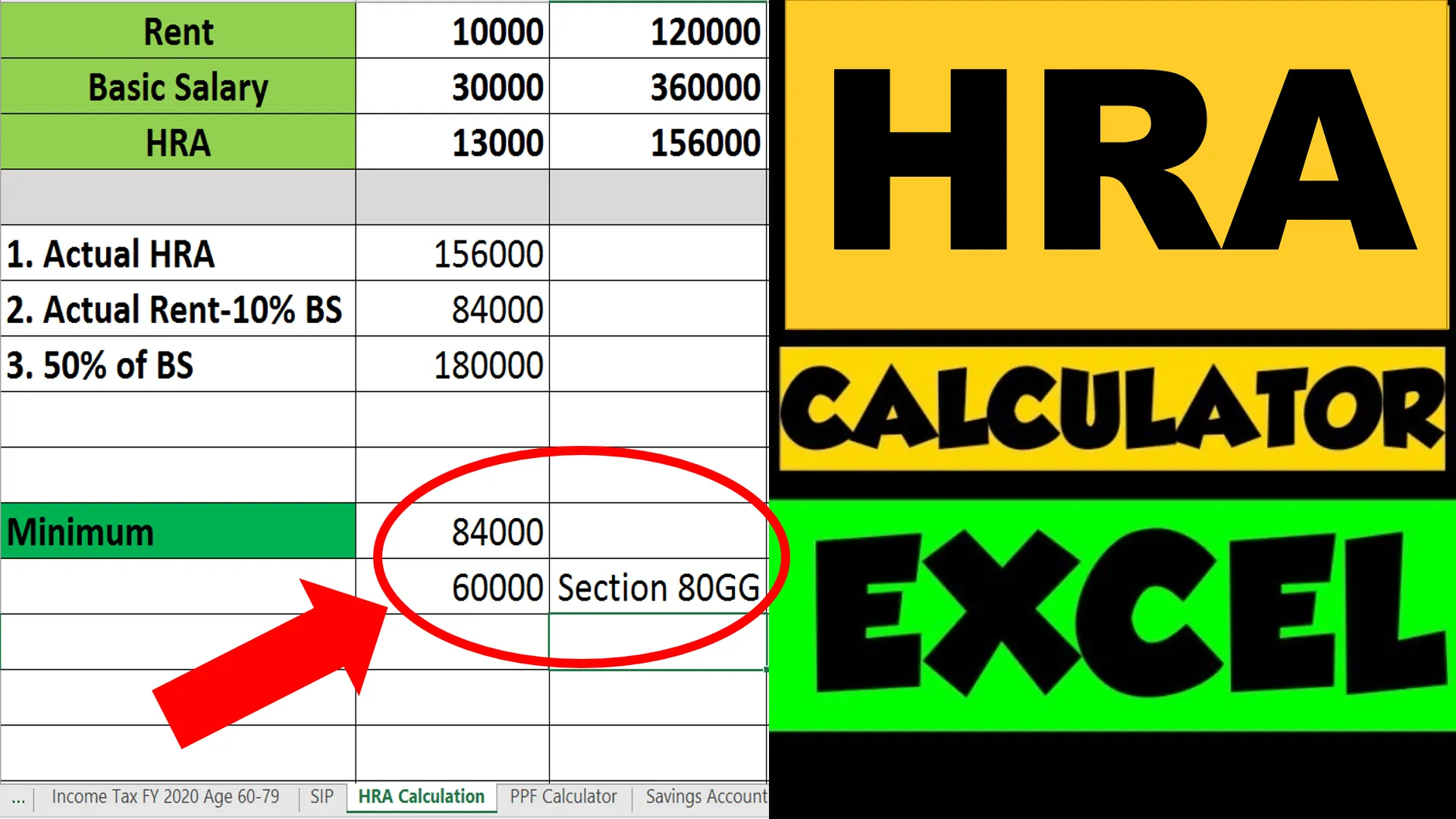

HRA Exemption Calculator In Excel House Rent Allowance Calculation

https://fincalc-blog.in/wp-content/uploads/2021/09/hra-exemption-calculator-house-rent-allowance-to-save-income-tax-salaried-employees-video.webp

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template

https://www.signnow.com/preview/585/571/585571881/large.png

https://cleartax.in/s/income-tax-rebate-us-87a

Tax Rebate Under Section 87A Find out Who can claim Income Tax Rebate u s 87A for FY 2023 24 AY 2024 25 and FY 2022 23 AY 2023 24 Know how to claim

https://cleartax.in/s/tuition-fees-deduction-under-section-80c

No education allowance is an exemption upto 100 per child maximum of two children under section 10 However tuition fee deduction can be claimed upto 1 5

How To Get Tax Rebate In Income Tax

HRA Exemption Calculator In Excel House Rent Allowance Calculation

Income Tax Computation Format PDF A Comprehensive Guide

Income Tax Appellate Tribunal Recruitment Https www itat gov in

Latest Income Tax Slab Rates For FY 2022 23 AY 2023 24 Budget 2022

Where To Invest For Tax Rebate In Income Tax Of Bangladesh Calculate

Where To Invest For Tax Rebate In Income Tax Of Bangladesh Calculate

Rebate Under New Tax Regime PrintableRebateForm

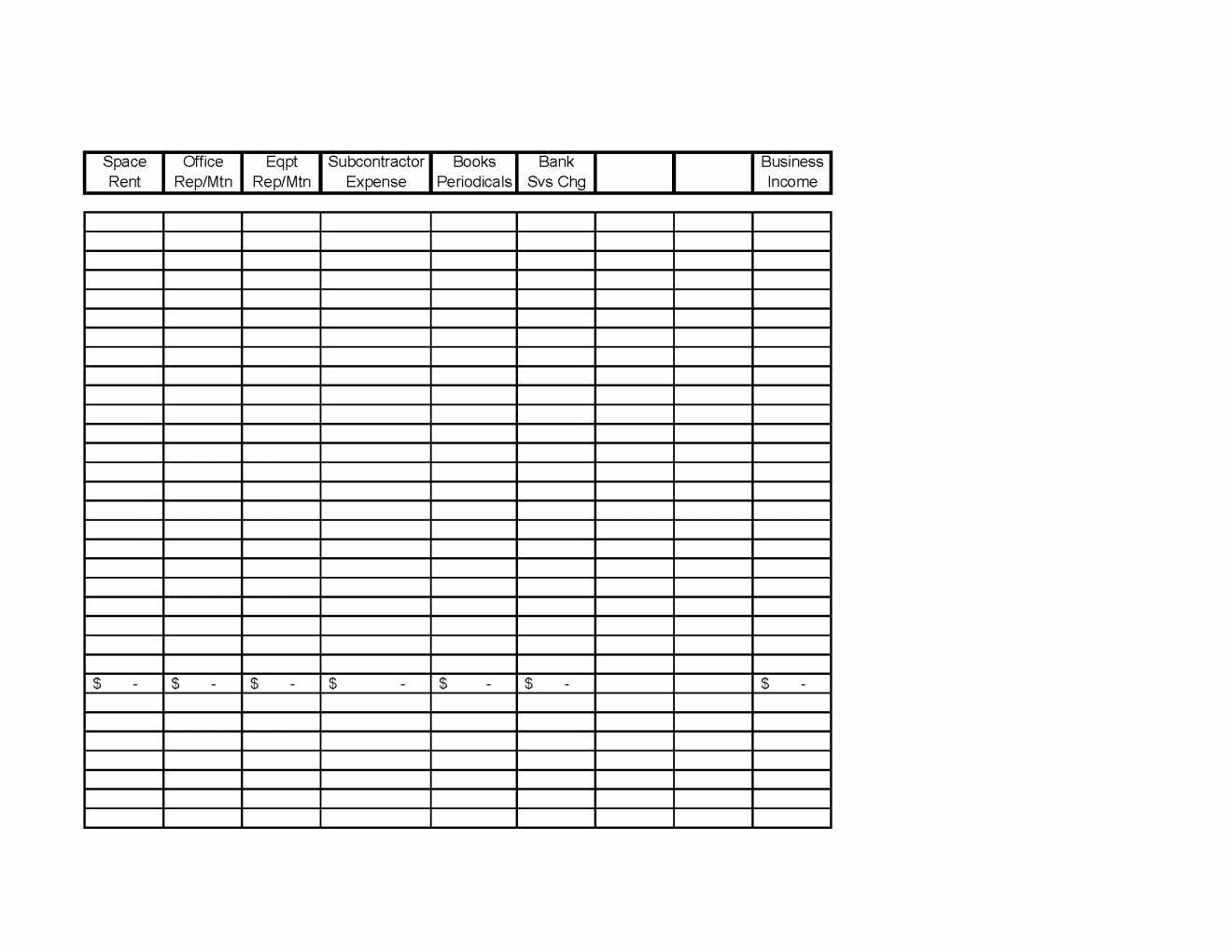

Income Tax Spreadsheet Tax Organizer Worksheet Download New In Income

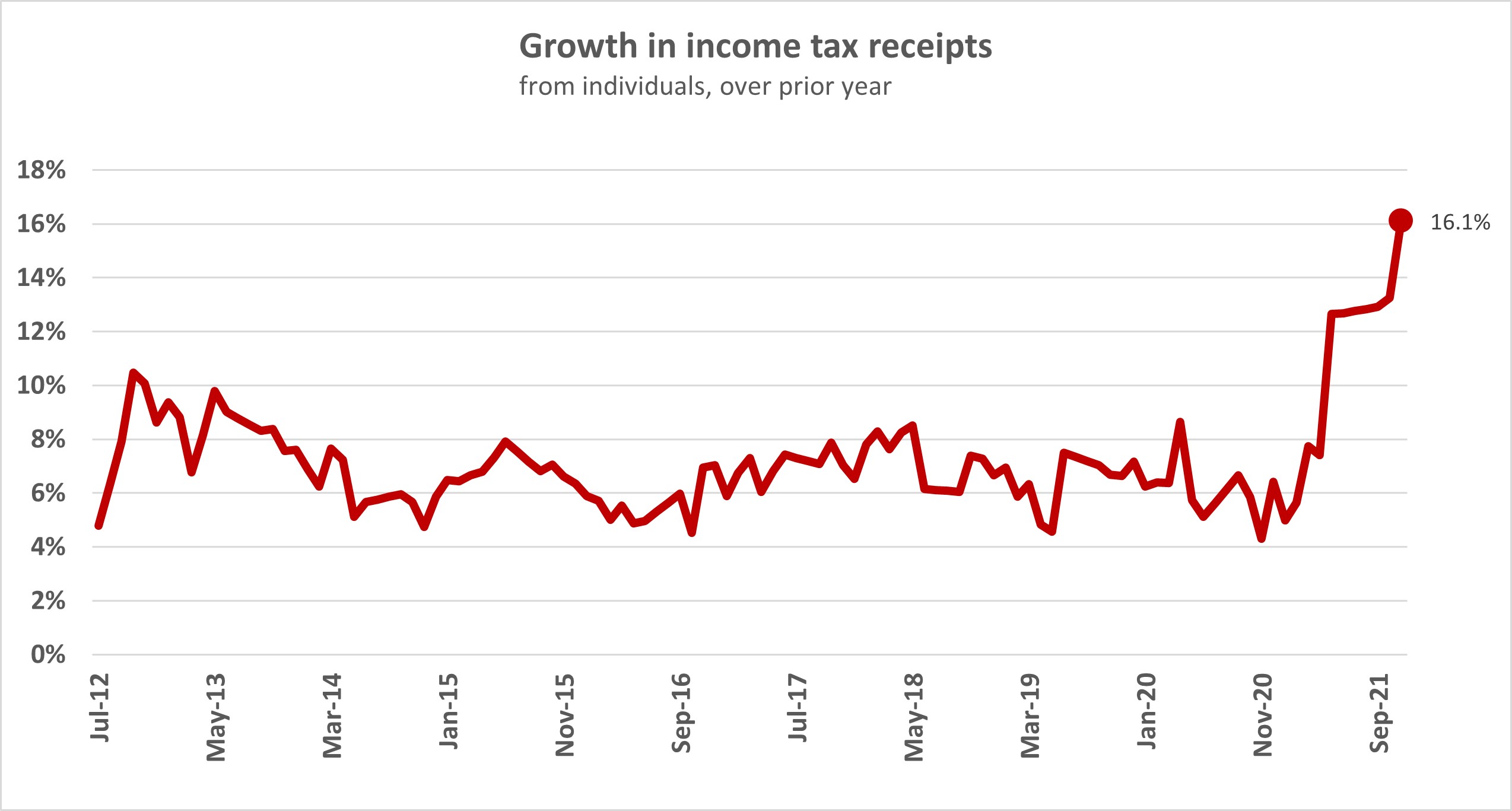

Income Taxes Paid By Individuals Eclipse Previous High Interest co nz

Allowance Rebate In Income Tax - Fri October 4 2024 6 19 PM PDT 8 min read Oct 4 WILKES BARRE Gov Josh Shapiro this week announced that his Administration has processed more