Are 529 Plans Tax Deductible In California While contributions to California s plan are not deductible at the state or federal level all investment growth is free from state and federal taxes and the earnings portion of withdrawals used for qualified education expenses are federal and California state income tax free Note that contributions to some states plans can be state tax

No Tax Deduction While California s 529 plan is a good one California is one of seven states with an income tax system that does not allow tax deductions for contributions Contributions to the California 529 plan are not tax deductible on state income tax returns California is one of eight states that have a state income tax but which do not offer a tax deduction or tax credit based on contributions to the state s 529 plan Seven states have no state income tax Was this article helpful

Are 529 Plans Tax Deductible In California

Are 529 Plans Tax Deductible In California

https://static.twentyoverten.com/5dd43b58fe95cc60688ef1e8/ZSL2kRyDUT/Financial-Planning-1.jpg

Can 529 Be Used For Rent A Student s Guide ApartmentGuide

https://www.apartmentguide.com/blog/wp-content/uploads/2021/10/what-is-a-529.jpg

529 Plans Tax Time

https://cdn.zephyrcms.com/e112549c-a559-40fd-93fb-638041043470/-/progressive/yes/-/format/jpeg/-/stretch/off/-/resize/1200x/529-plans-tax-time-gennext-sm.jpg

While federal tax rules do not allow families to deduct 529 contributions states have their own policies Remember that each 529 plan is owned and operated by a state government Therefore many states allow families to deduct 529 contributions on their state taxes State by State Tax Deduction Rules for 529 Plans Those states are Alaska Florida New Hampshire Nevada South Dakota Tennessee Texas Washington and Wyoming California Hawaii and Kentucky do not offer any type of 529 tax deduction but do assess income tax This table breaks down the 529 tax deduction by state

Unique Tax Benefits As a 529 Plan ScholarShare 529 provides California families compelling income tax benefits Although contributions are not deductible on your federal tax return any investment earnings can grow tax deferred Tax deferred growth Any earnings can grow 100 tax deferred Tax free withdrawals California conforms with modifications to Section 529 Plans as of the specified date of January 1 2015 as they relate to tax exempt qualified tuition programs California modifies the additional 10 percent tax on excess distributions to instead be an additional tax of 2 5 percent for state purposes

Download Are 529 Plans Tax Deductible In California

More picture related to Are 529 Plans Tax Deductible In California

Is The NC 529 Plan Tax Deductible CFNC

https://www.cfnc.org/media/sjshnqm0/fafsa-tax-forms.jpg

Tax Benefits Of A 529 Plan

https://wiserinvestor.com/wp-content/uploads/2023/04/Copy-of-Website-Image-Blog.jpg

529 Plan Tax Deductible College Savings Plans

https://4.bp.blogspot.com/-KACGJkhs4-I/Wz2ceBdA20I/AAAAAAABwN4/7eif-mTS9dwYg5L7qJgdT3Xb3h-q15BqACK4BGAYYCw/s1600/529%2BPlan%2B-%2BTax%2BDeductible%2BCollege%2BSavings%2BPlans-707056.png

Contributions to California 529 plans are not deductible on federal or California state income tax returns California is one of the few states with a state income tax that does not allow state income tax deductions or tax credits on contributions to the state s 529 plans 1 Withdrawals for registered apprenticeship programs and student loans can be withdrawn free from federal and California income tax If you are not a California taxpayer these withdrawals may include recapture of tax deduction state income tax as well as penalties

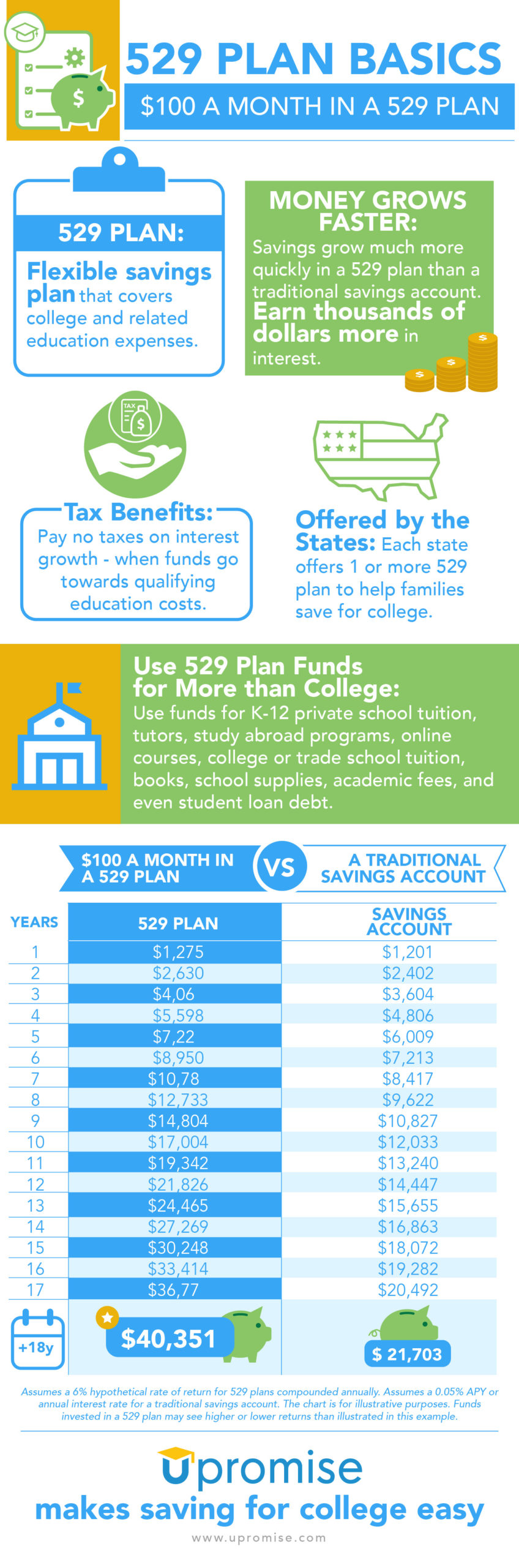

At a glance 529 contributions are tax deductible on the state level in some states They are not tax deductible on the federal level But if you re saving for college you ll want to know that 529 savings plans offer other tax benefits such as tax free earnings growth and tax free withdrawals for qualified expenses Contributions to the California 529 arrangement are not tax deductible on state income tax returns California is one of eight that have a state income tax however which don t offer a tax reasoning or tax credit dependent on contributions to

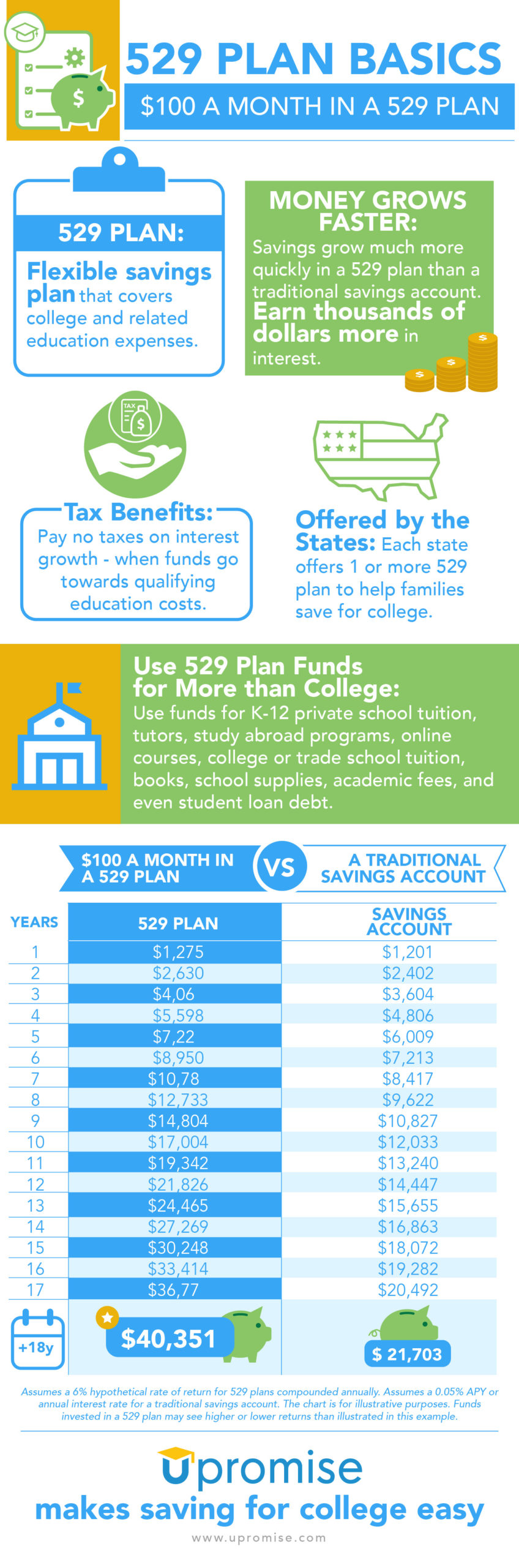

529 Plan Infographic

https://www.upromise.com/articles/wp-content/uploads/sites/3/2021/06/529-Plan-Infographic-How-529-Plan-Works-Infographic-Upromise-Rewards-Upromise-makes-saving-for-college-easy-2-scaled.jpg

If 529 Plans Get Taxed Here s Another Tax free Option

https://image.cnbcfm.com/api/v1/image/48803411-182175346.jpg?v=1532564740

https://www.merrilledge.com/article/tax-advantages...

While contributions to California s plan are not deductible at the state or federal level all investment growth is free from state and federal taxes and the earnings portion of withdrawals used for qualified education expenses are federal and California state income tax free Note that contributions to some states plans can be state tax

https://finance.zacks.com/california-allow-deduct...

No Tax Deduction While California s 529 plan is a good one California is one of seven states with an income tax system that does not allow tax deductions for contributions

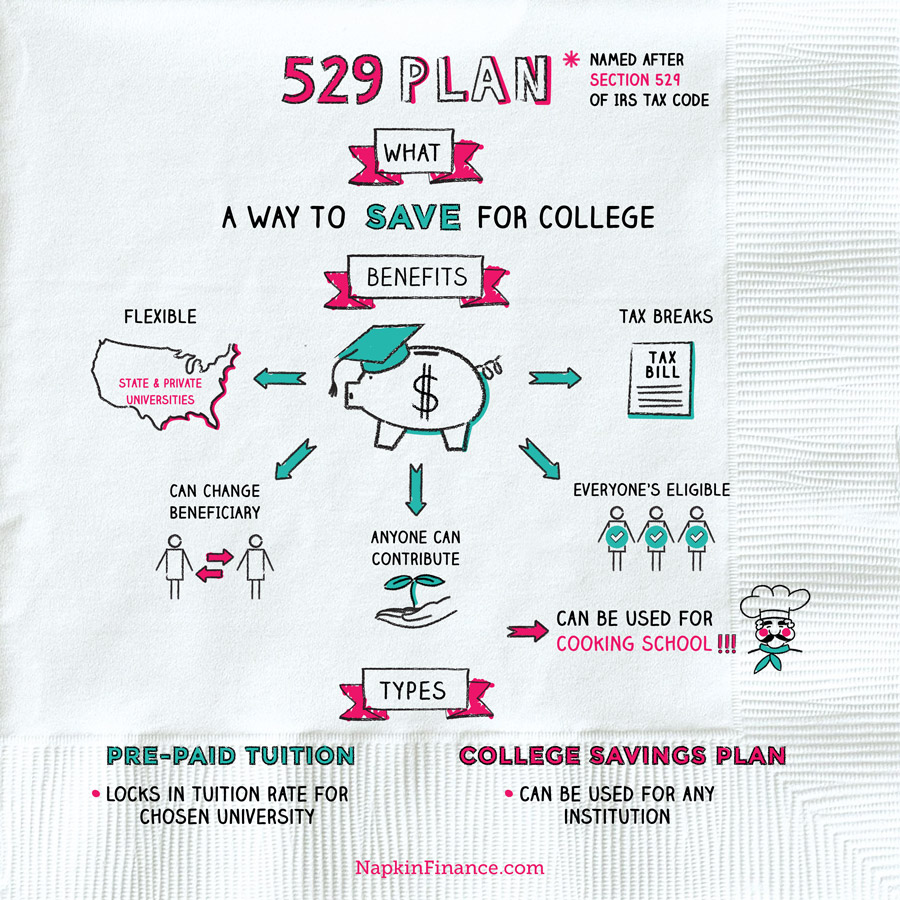

529 Plan Napkin Finance

529 Plan Infographic

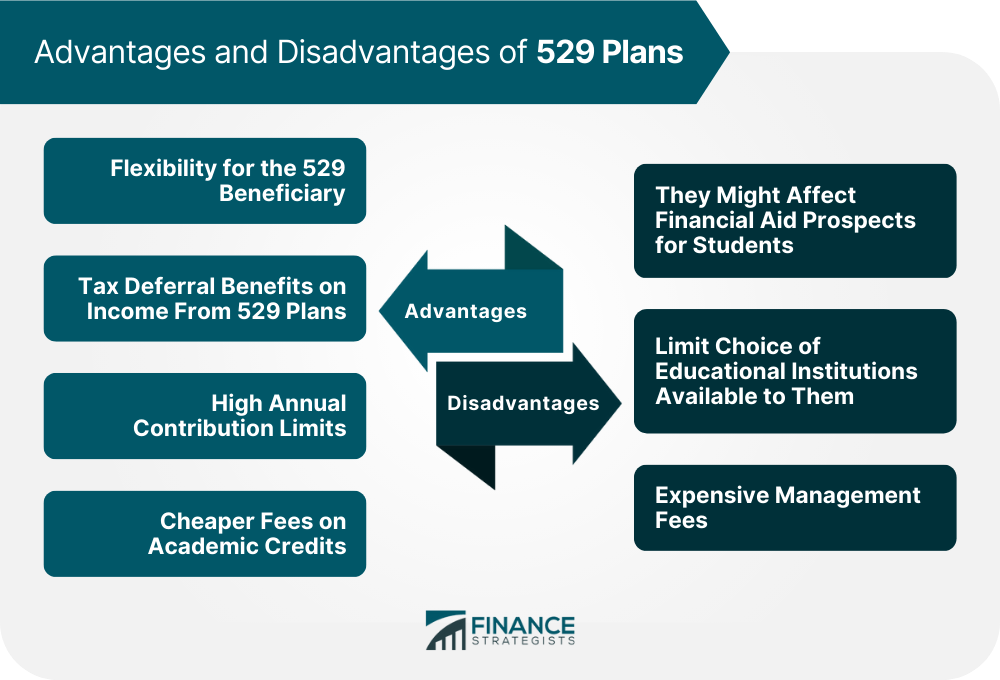

529 Plans Definition Types How It Works Pros And Cons

What Are 529 Plans FAQs Answered Successful Student

The Complete Guide To Virginia 529 Plans For 2024

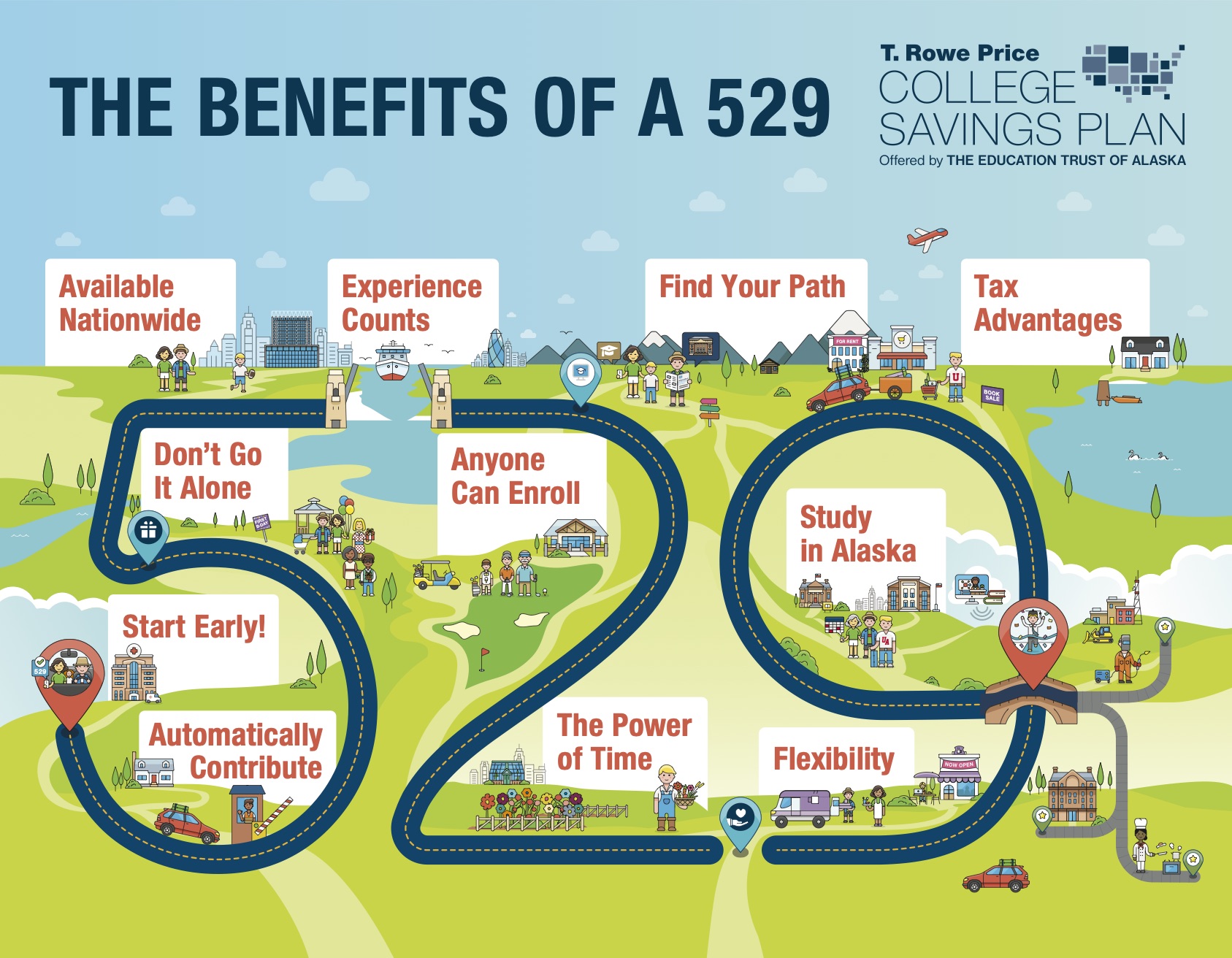

The Benefits Of and How To Open 529 Plans For College Savings

The Benefits Of and How To Open 529 Plans For College Savings

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KXA3BHVQV757F3XZ3L5JPXJOGQ.png)

How Much Are 529 Plans Tax Benefits Worth Morningstar

The Benefits Of A 529 Plan INFOGRAPHIC

What Can I Do With Unspent Money In A 529 Plan Law Offices Of Robert

Are 529 Plans Tax Deductible In California - California conforms with modifications to Section 529 Plans as of the specified date of January 1 2015 as they relate to tax exempt qualified tuition programs California modifies the additional 10 percent tax on excess distributions to instead be an additional tax of 2 5 percent for state purposes