Are Company Reimbursed Moving Expenses Taxable Employee moving expenses paid by your company even if you have an accountable plan are subject to withholding for federal income taxes FICA taxes Social

A1 Yes if the employee moved in 2017 and would have been able to deduct the expenses for the move if paid by the employee in 2017 the payment of those expenses by the You can report moving expenses paid by your employer as taxable income when you file your taxes for the previous year If you had relocation expenses that exceeded the amount you received or were

Are Company Reimbursed Moving Expenses Taxable

Are Company Reimbursed Moving Expenses Taxable

https://www.inspiredbirthpro.com/wp-content/uploads/2010/03/Business-Expenses.jpg

EmpoweringStewardship Accountable Reimbursement Plan

https://empoweringstewardship.com/-/media/CLSE/BlogImages/receipts-banner.jpg

Can I Claim Apartment Expenses On My Taxes Leia Aqui Can You Claim

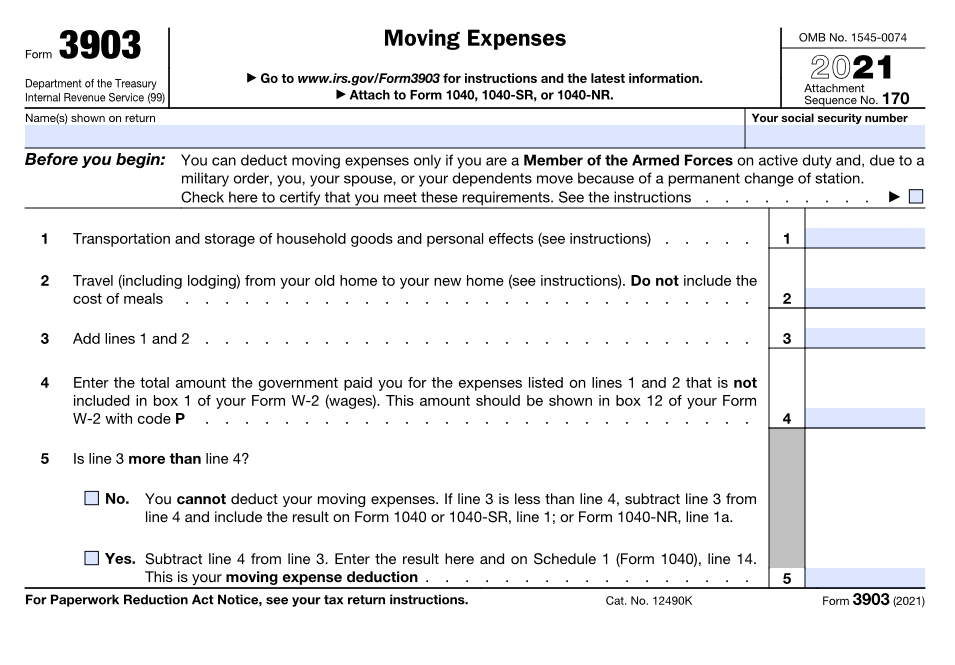

https://www.cpapracticeadvisor.com/wp-content/uploads/sites/2/2022/05/Form_3903_IRS.627935caded63.png

Generally commuting expenses between your home and your business location within the area of your tax home are not deductible You can deduct actual car expenses which Yes relocation reimbursements are considered a fringe benefit by the IRS and are subject to income taxes Employers also need to pay standard payroll taxes on

Moving expense reimbursements paid under a nonaccountable plan must be reported as wages and are subject to FICA and FUTA taxes Withholding is at the same rate as for the employee s For tax years 2018 through 2025 reimbursements for certain moving expenses are no longer excluded from the gross income of nonmilitary taxpayers No Additional Cost

Download Are Company Reimbursed Moving Expenses Taxable

More picture related to Are Company Reimbursed Moving Expenses Taxable

Out of Network Insurance Benefits A Guide To Getting Reimbursed For

https://mindsplain.com/wp-content/uploads/2019/10/insurance_reimbursement_Blog.png

What Employers Need To Know About Expense Reimbursement Sentric

https://sentrichr.com/wp-content/uploads/2021/03/Common-Business-Expenses-Reimbursed.png

Reimbursed Moving Expenses Taxable All Around Moving NYC

https://www.allaroundmoving.com/wp-content/uploads/2023/06/Moving-Expenses-Taxable.jpg

If you pay or reimburse moving costs that the CRA does not list under Moving expenses paid by employer that are not a taxable benefit the amounts are generally Through 2025 employer paid relocation expenses are taxable and unreimbursed moving expenses are no longer deductible These rules expire in 2025 but in the meantime here s why you may

The short answer is yes Relocation expenses for employees paid by an employer aside from BVO GBO homesale programs are all considered taxable income to the employee by the IRS and state authorities and by Is an Employer Paid Move Taxable Employer paid moves are now taxable The Tax Cuts and Jobs Act of 2017 suspended moving expense deductions and the

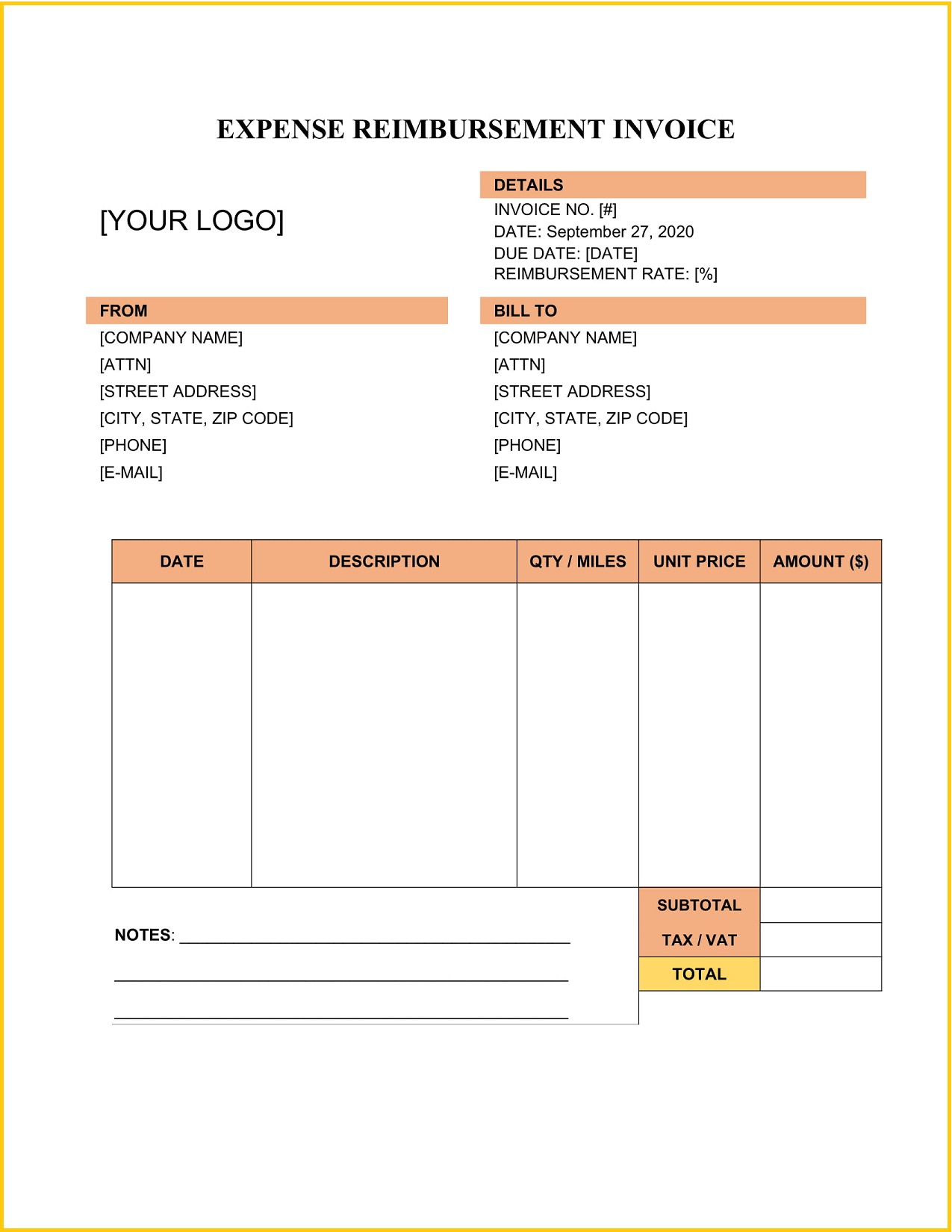

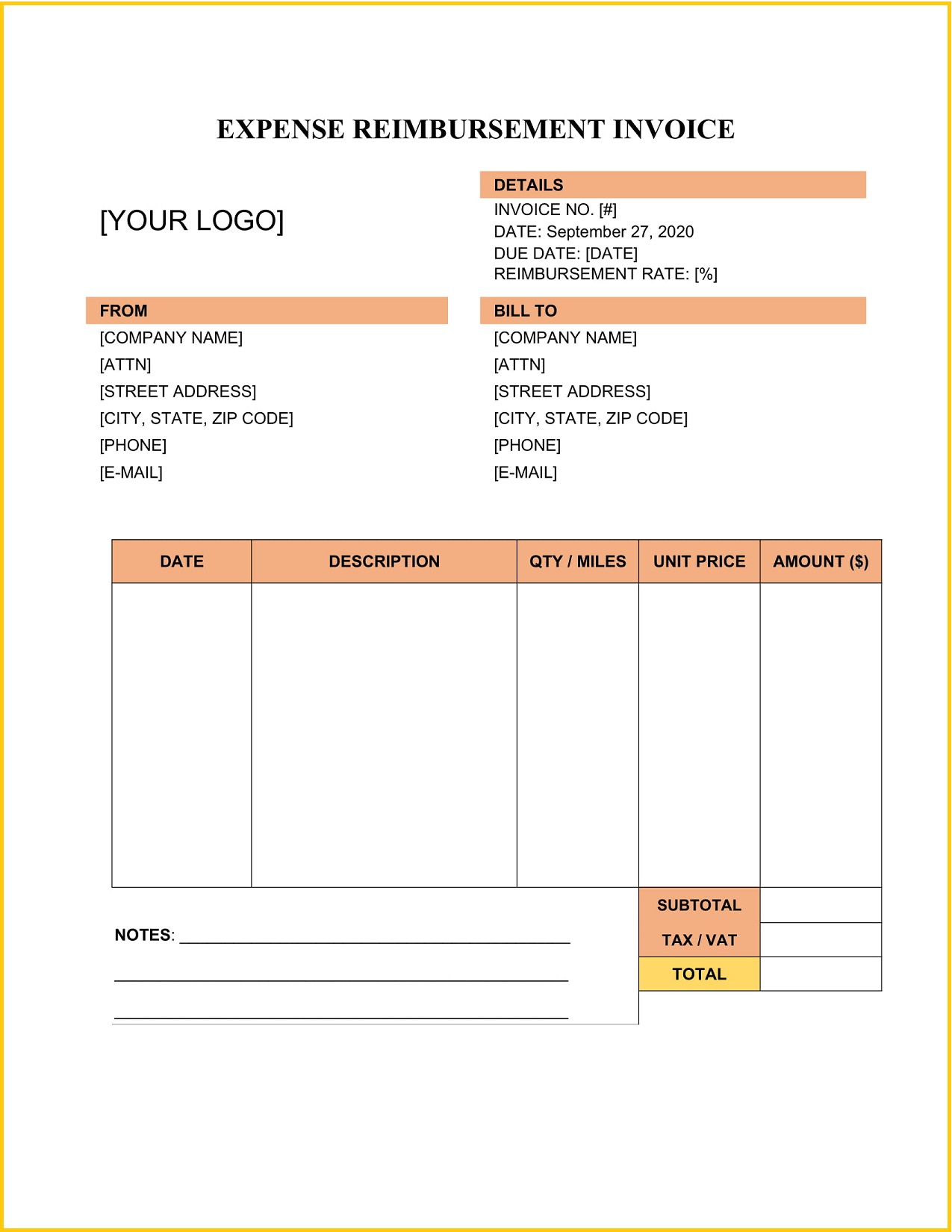

Expense Reimbursement Invoice Template Sample

https://www.geneevarojr.com/wp-content/uploads/2020/09/Expense-Reimbursement-Invoice-Form.jpg?fit=1275%2C1650&ssl=1

Types Of Employee Reimbursements

https://www.peoplekeep.com/hubfs/All Images/Featured Images/Types of employee reimbursements_fb.jpg#keepProtocol

https://www.thebalancemoney.com/employer-guide...

Employee moving expenses paid by your company even if you have an accountable plan are subject to withholding for federal income taxes FICA taxes Social

https://www.irs.gov/newsroom/frequently-asked...

A1 Yes if the employee moved in 2017 and would have been able to deduct the expenses for the move if paid by the employee in 2017 the payment of those expenses by the

Expense Reimbursement Invoice Template Invoice Maker HIV Prevention

Expense Reimbursement Invoice Template Sample

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

How To Calculate Gross Net Profit Margin Haiper

Employer Paid Moving Expenses Are They Taxable

Reimbursed Expenses Accounting Accuracy CompanyMileage

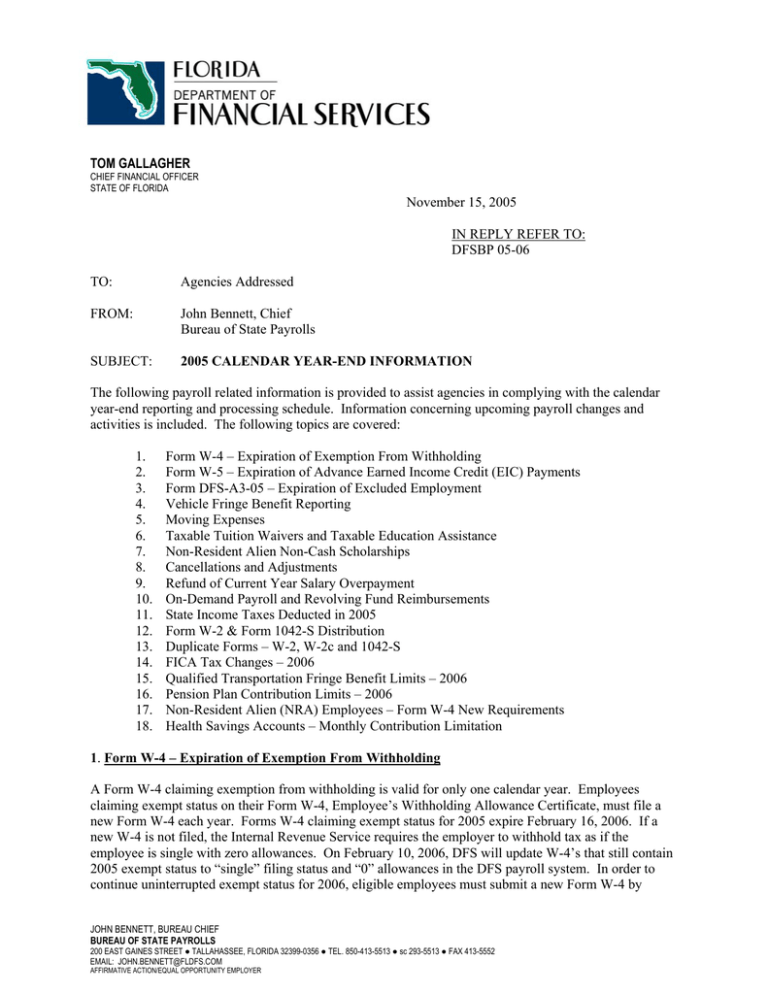

TOM GALLAGHER November 15 2005 IN REPLY REFER TO

TOM GALLAGHER November 15 2005 IN REPLY REFER TO

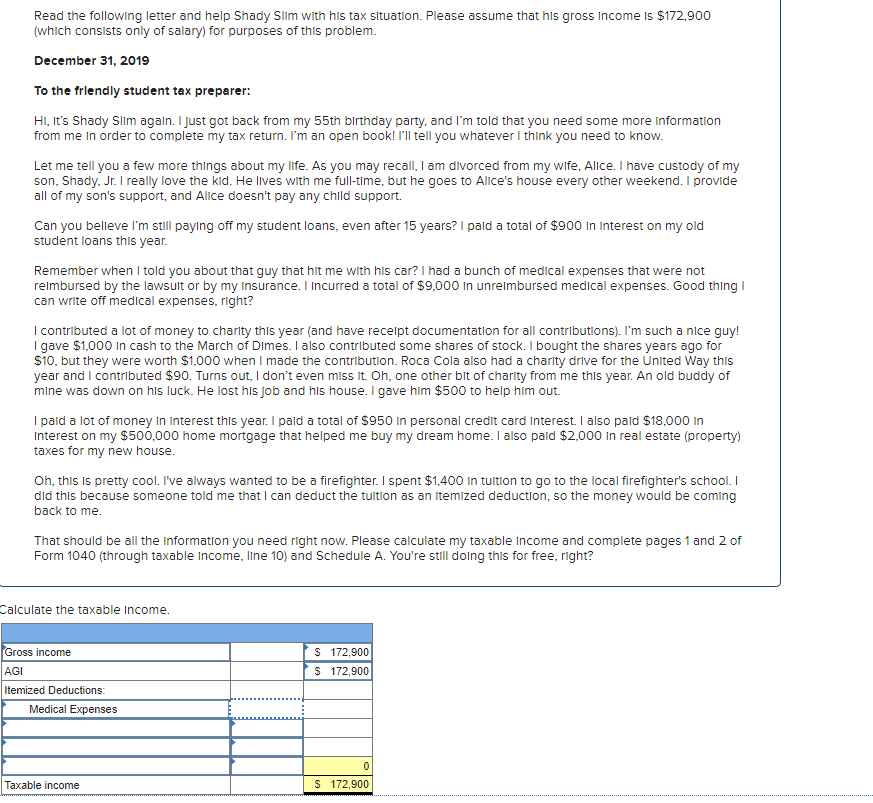

Solved Read The Following Letter And Help Shady Slim With Chegg

Businesses Should Now Use Accountable Plan To Reimburse Employees

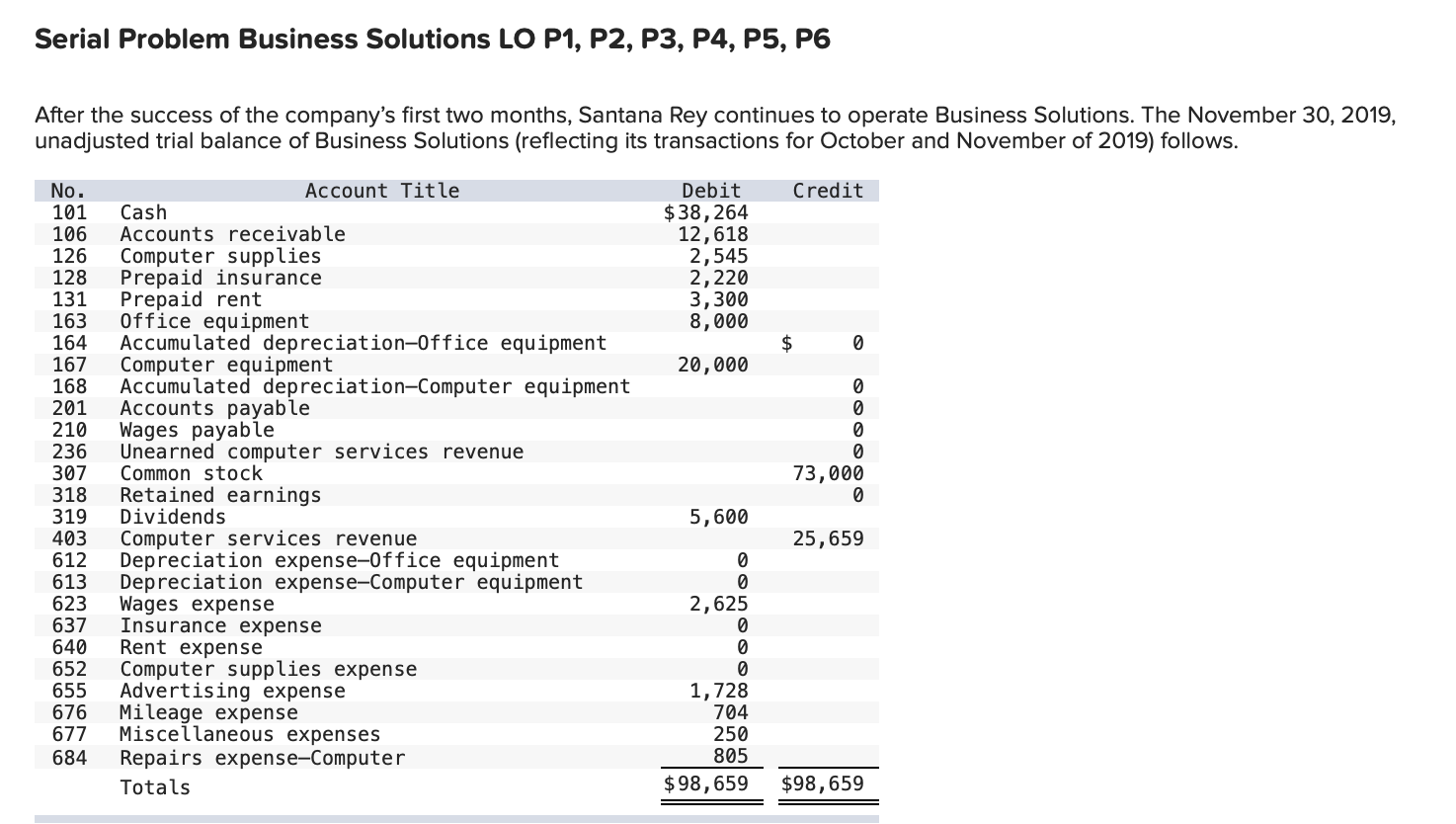

Solved Business Solutions Had The Following Transactions And Chegg

Are Company Reimbursed Moving Expenses Taxable - Generally commuting expenses between your home and your business location within the area of your tax home are not deductible You can deduct actual car expenses which