Are Contributions To 529 Plans Tax Deductible In California Using a 529 plan can help you save tax free dollars for college expenses Here are the tax benefits you could get if you live in California

While contributions to California s plan are not deductible at the state or federal level all investment growth is free from state and federal taxes and the earnings portion of withdrawals Contributions to California 529 plans are made with after tax dollars similar to a Roth IRA Contributions to California 529 plans are not deductible on federal or California state

Are Contributions To 529 Plans Tax Deductible In California

Are Contributions To 529 Plans Tax Deductible In California

https://static.twentyoverten.com/5dd43b58fe95cc60688ef1e8/ZSL2kRyDUT/Financial-Planning-1.jpg

Are Contributions To A 529 Plan Tax Deductible Sootchy

https://global-uploads.webflow.com/5e7af514190cb858e85adbbe/5f9c2480d8e12e5446ae4d45_shutterstock_1109910923-min.jpg

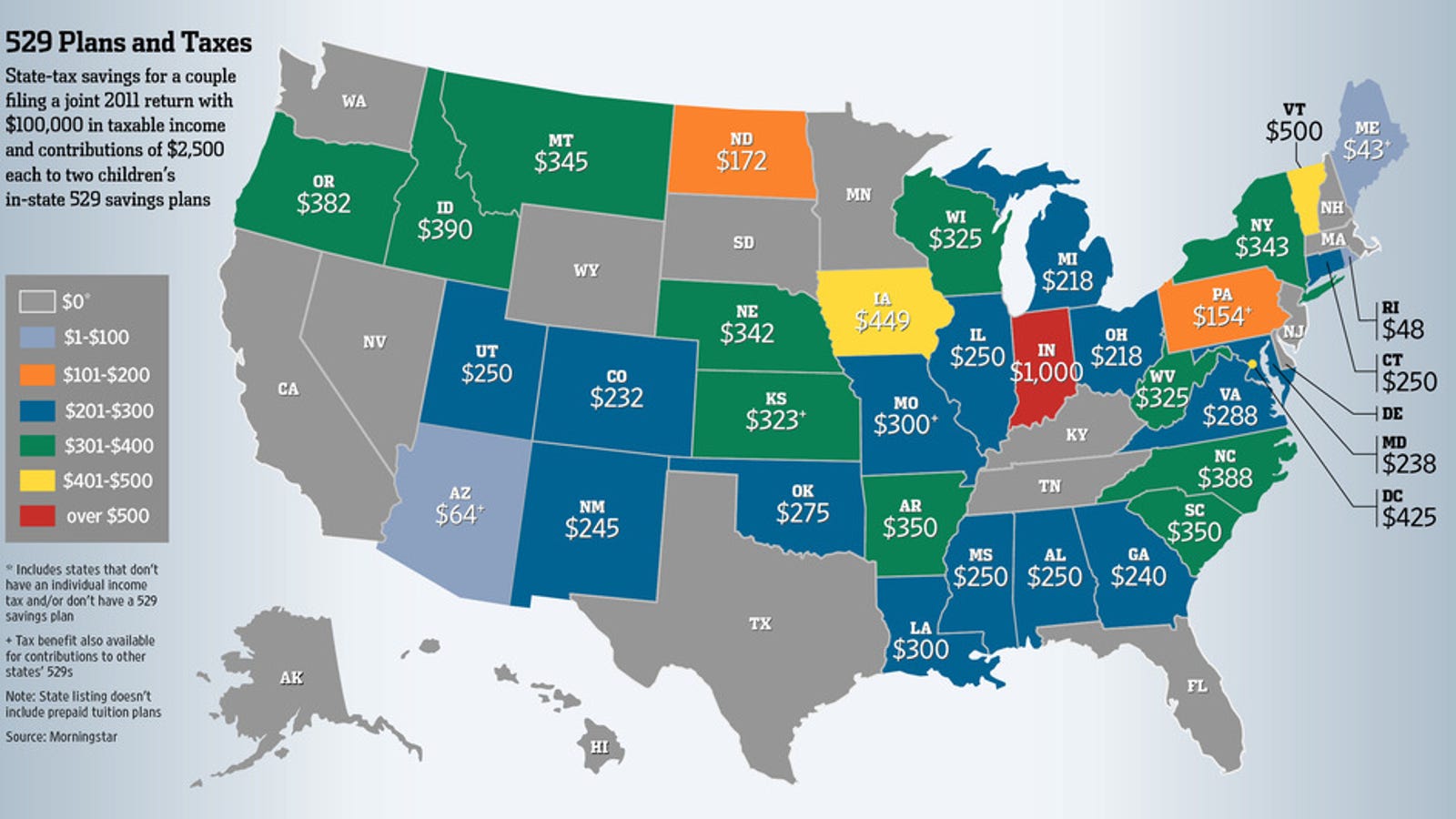

The Tax Benefits Of College 529 Savings Plans Compared By State

https://i.kinja-img.com/gawker-media/image/upload/s--1ZmmFPnG--/c_fill,fl_progressive,g_center,h_900,q_80,w_1600/1005722794300725574.jpg

Contributions to the California 529 plan are not tax deductible on state income tax returns California is one of eight states that have a state income tax but which do not offer a Contributions to a 529 plan however are not deductible Q Can I make withdrawals from my 529 plan for tuition at elementary or secondary schools A Yes

Four states currently have a state income tax but do not offer a contribution deduction California Hawaii Kentucky and North Carolina Estimated tax savings for a couple filing jointly with 100 000 in taxable Unlike other tax advantaged accounts 529 plans have relatively high contribution limits Contributions up to 529 000 are allowed per beneficiary in California making it a

Download Are Contributions To 529 Plans Tax Deductible In California

More picture related to Are Contributions To 529 Plans Tax Deductible In California

529 Plans Tax Time

https://cdn.zephyrcms.com/e112549c-a559-40fd-93fb-638041043470/-/progressive/yes/-/format/jpeg/-/stretch/off/-/resize/1200x/529-plans-tax-time-gennext-sm.jpg

Is The NC 529 Plan Tax Deductible CFNC

https://www.cfnc.org/media/sjshnqm0/fafsa-tax-forms.jpg

Saving For Education 529 Plans Wheeler Accountants

https://wheelercpa.com/wp-content/uploads/529-plans-2120x1060.jpeg

California does not offer any tax deductions for contributing to a 529 plan Minimum There is no minimum contribution Maximum Accepts contributions until all account balances for the same beneficiary reach 529 000 Although contributions to a California 529 plan are not directly tax deductible there are other tax benefits to consider The earnings in these accounts grow tax deferred and withdrawals for

Contributions to the California 529 arrangement are not tax deductible on state income tax returns California is one of eight that have a state income tax however which don t Contributions to a California 529 plan are not tax deductible on the California state income tax return California is one of eight states that have a state income tax but which do

If 529 Plans Get Taxed Here s Another Tax free Option

https://image.cnbcfm.com/api/v1/image/48803411-182175346.jpg?v=1532564740

529 Maximum Contribution Limits In 2023 The Education Plan

http://theeducationplan.com/sites/default/files/styles/extra_large_landscape_1680x1120_/public/2022-12/Header Image - Max Contributions.png?itok=rIC2zKiH

https://smartasset.com › personal-finance

Using a 529 plan can help you save tax free dollars for college expenses Here are the tax benefits you could get if you live in California

https://www.merrilledge.com › article

While contributions to California s plan are not deductible at the state or federal level all investment growth is free from state and federal taxes and the earnings portion of withdrawals

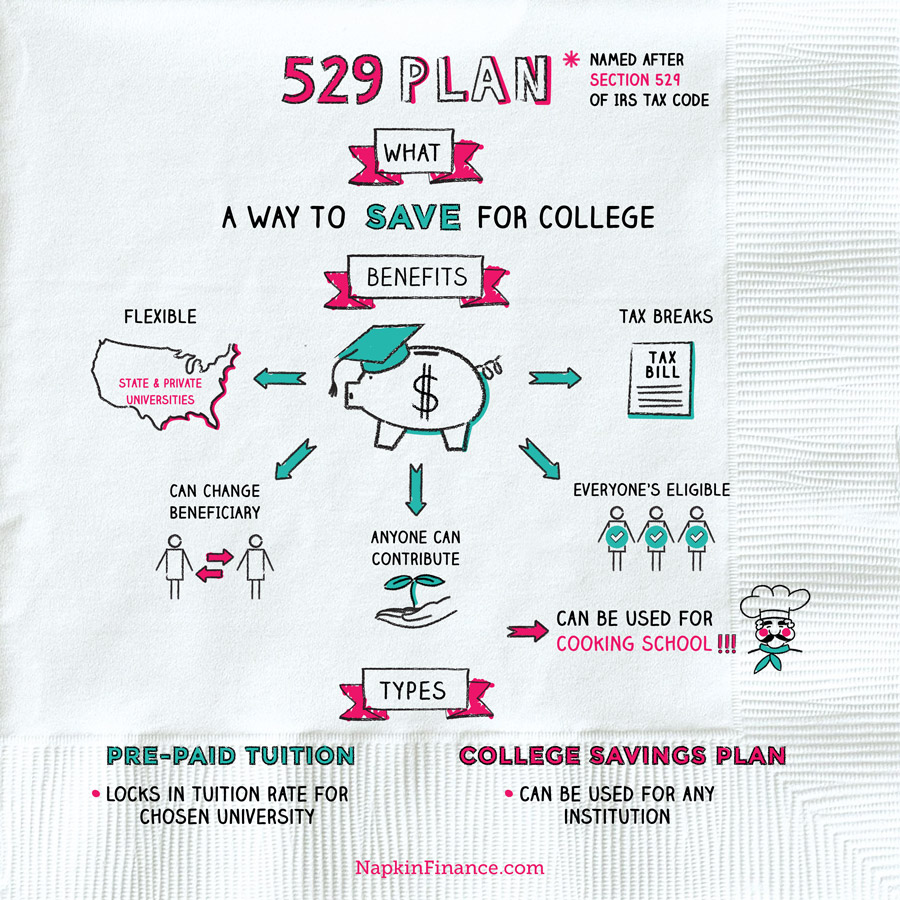

529 Plan Napkin Finance

If 529 Plans Get Taxed Here s Another Tax free Option

The Complete Guide To Virginia 529 Plans For 2024

529 Plan Tax Deductible College Savings Plans

Nj 529 Plan Tax Benefits Tiffaney Bernal

/close-up-of-diploma-and-banknotes--studio-shot-150973797-b97794ab5e8f4535b64517d016b1220e.jpg)

Are Contributions To 529 Plans Tax Deductible In Virginia Tax Walls

/close-up-of-diploma-and-banknotes--studio-shot-150973797-b97794ab5e8f4535b64517d016b1220e.jpg)

Are Contributions To 529 Plans Tax Deductible In Virginia Tax Walls

What Can I Do With Unspent Money In A 529 Plan Law Offices Of Robert

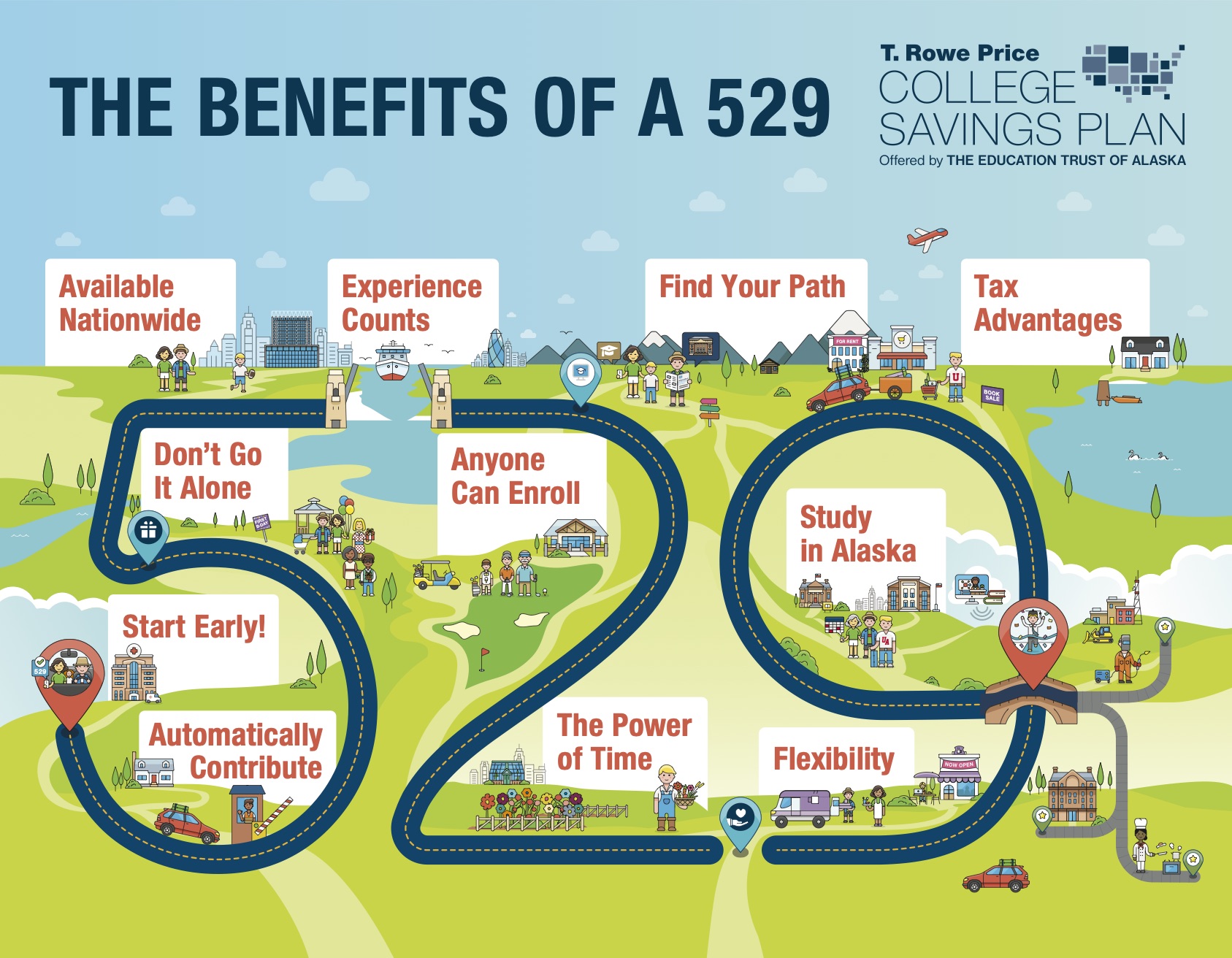

The Benefits Of A 529 Plan INFOGRAPHIC

529 Versus ESA The Best For College Savings Mark J Kohler

Are Contributions To 529 Plans Tax Deductible In California - Contributions to a 529 plan are not subject to federal income tax and the earnings on the investments grow tax free Withdrawals are tax free if used for qualified education