Are Contributions To 529 Plans Tax Deductible In Ny Yes residents in the state of New York can deduct contributions to 529 plans from their New York state taxable income Currently one can deduct up to 5 000 per year for single New York filers and 10 000 per year for New York taxpayers who are married filing jointly

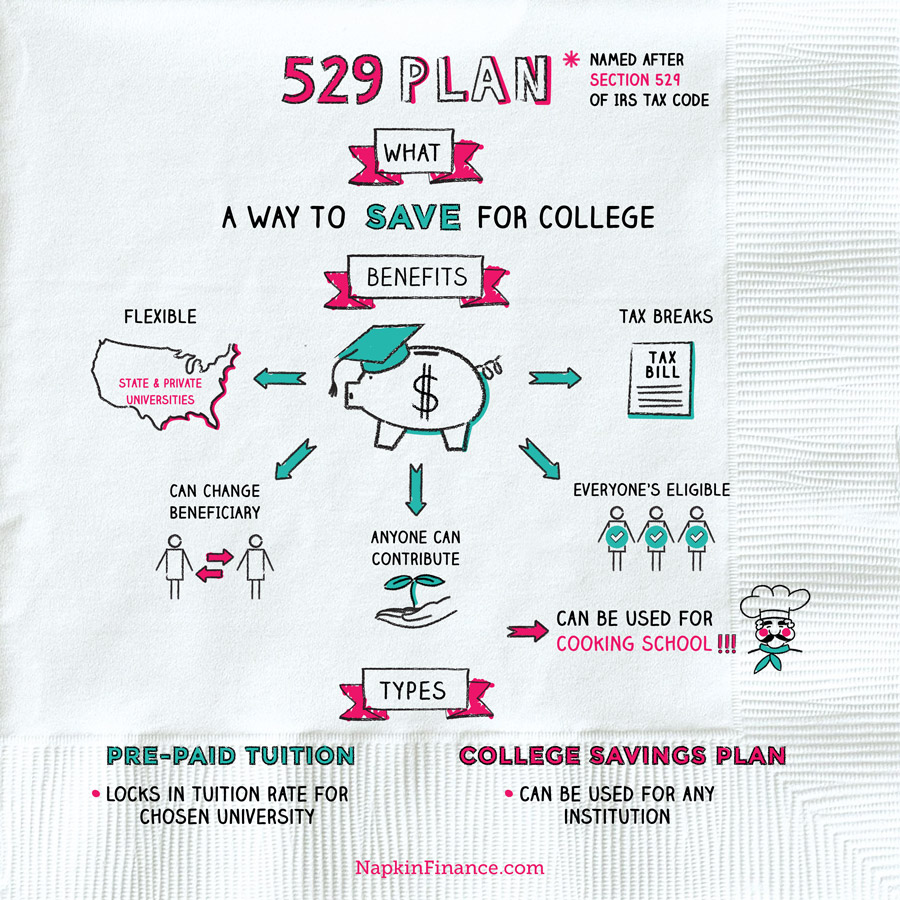

Overview of the Tax Deduction You can contribute up to 520 000 per beneficiary Come tax time you may deduct up to 5 000 of your contributions from New York State taxable income or a total of 10 000 for married filers filing jointly Unfortunately the federal government does not allow families to deduct contributions to a 529 plan There is no indication that this rule will change anytime soon Families should note that while the federal government does not reward 529 contributions it does penalize early withdrawals

Are Contributions To 529 Plans Tax Deductible In Ny

Are Contributions To 529 Plans Tax Deductible In Ny

https://i.pinimg.com/originals/4b/87/6c/4b876c40b2c14ce091d74f7fd8ede86f.jpg

Are 529 Contributions Tax Deductible In Virginia Tax Walls

https://image.cnbcfm.com/api/v1/image/104664652-GettyImages-521516194.jpg?v=1532563775&w=678&h=381

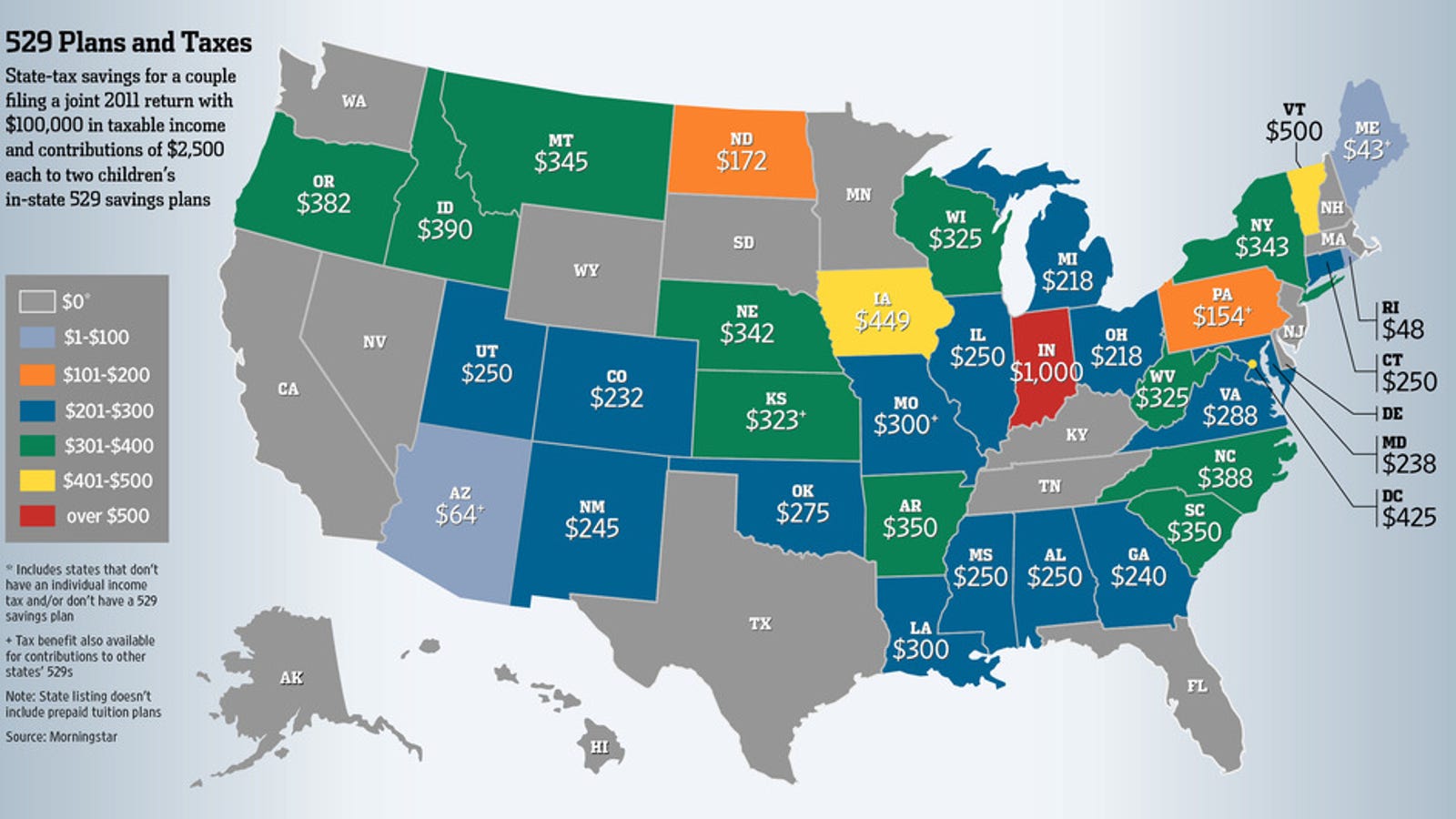

How Much Is Your State s 529 Plan Tax Deduction Really Worth

https://webresources-savingforcollege.s3.amazonaws.com/images/original-state-map-2017-12.png

Contributions to New York 529 plans may be deducted on the state income tax return but not on federal income tax returns The state income tax deduction is capped at 5 000 in contributions by single filers and at 10 000 for married couples filing joint state income tax returns Can I deduct contributions to each of my beneficiaries from New York state income taxes Yes but only up to the maximum allowed deduction for your tax filing status Account owners can deduct up to 5 000 in Plan contributions from New York state income taxes each year if single and 10 000 if married filing jointly

529 plans and state tax benefits In addition to federal tax deferred growth potential and tax free qualified withdrawals many 529 education plans offer state tax benefits 1 The Advisor Guided 529 Plan offers tax deductible contributions to account owners who are New York taxpayers ME WA MT ND MN NH VT MA OR NY ID SD WI MI RI CT WY PA IA Described below and contributed to the New York 529 Plan can be deducted pursuant to section 612 c 32 of the Tax Law in determining New York adjusted gross income Petitioner submits the following facts as the basis for this Advisory Opinion The New York 529 Plan was established under Article 14 A of the Education Law

Download Are Contributions To 529 Plans Tax Deductible In Ny

More picture related to Are Contributions To 529 Plans Tax Deductible In Ny

Are Contributions To A 529 Plan Tax Deductible Sootchy

https://global-uploads.webflow.com/5e7af514190cb858e85adbbe/5f9c2480d8e12e5446ae4d45_shutterstock_1109910923-min.jpg

529 Plans Tax Time

https://cdn.zephyrcms.com/e112549c-a559-40fd-93fb-638041043470/-/progressive/yes/-/format/jpeg/-/stretch/off/-/resize/1200x/529-plans-tax-time-gennext-sm.jpg

Is The NC 529 Plan Tax Deductible CFNC

https://www.cfnc.org/media/sjshnqm0/fafsa-tax-forms.jpg

Potential tax savings for residents of other states In some states contributions to any 529 plan are eligible for a state income tax deduction and residents are not required to choose the in state plan to get the benefit Your financial Contributions to the New York 529 plans are deductible on state income tax returns Contributions of up to 5 000 for single filers and 10 000 for joint filers may be deducted on New York state income tax returns

The value of tax deductions and tax credits for 529 contributions also varies from state to state In Massachusetts for example the maximum deduction allowed for a single filer is 1 000 or 2 000 for joint filers but in New Mexico the full contribution amount for the year is tax deductible The federal government offers some tax deductions for education but a deduction for 529 plan contributions isn t one of them You can however deduct interest paid to student loans The American Opportunity Tax Credit and the Lifetime Learning Tax Credit can also be claimed to offset higher education expenses 529 Tax Deduction by

Tax Benefits Of A 529 Plan

https://wiserinvestor.com/wp-content/uploads/2023/04/Copy-of-Website-Image-Blog.jpg

The Tax Benefits Of College 529 Savings Plans Compared By State

https://i.kinja-img.com/gawker-media/image/upload/s--1ZmmFPnG--/c_fill,fl_progressive,g_center,h_900,q_80,w_1600/1005722794300725574.jpg

https://www.upromise.com/articles/your-guide-to...

Yes residents in the state of New York can deduct contributions to 529 plans from their New York state taxable income Currently one can deduct up to 5 000 per year for single New York filers and 10 000 per year for New York taxpayers who are married filing jointly

https://www.thebalancemoney.com/ny-529-tax-benefits-795336

Overview of the Tax Deduction You can contribute up to 520 000 per beneficiary Come tax time you may deduct up to 5 000 of your contributions from New York State taxable income or a total of 10 000 for married filers filing jointly

Personal Loan Tax Deduction Tax Benefit On Personal Loan EarlySalary

Tax Benefits Of A 529 Plan

California 529 Plans Tax Benefit Good Paying Jobs Self Made

529 Plan Napkin Finance

529 Plan Tax Deductible College Savings Plans

529 Plan Tax Free College Savings Plan

529 Plan Tax Free College Savings Plan

Are Your Contributions To A 529 Savings Plan Tax Deductable YouTube

/close-up-of-diploma-and-banknotes--studio-shot-150973797-b97794ab5e8f4535b64517d016b1220e.jpg)

Are Contributions To 529 Plans Tax Deductible In Virginia Tax Walls

Tax Deductible Closing Costs 2011

Are Contributions To 529 Plans Tax Deductible In Ny - 529 plans and state tax benefits In addition to federal tax deferred growth potential and tax free qualified withdrawals many 529 education plans offer state tax benefits 1 The Advisor Guided 529 Plan offers tax deductible contributions to account owners who are New York taxpayers ME WA MT ND MN NH VT MA OR NY ID SD WI MI RI CT WY PA IA