Are Health Insurance Premiums Tax Deductible For Businesses Q Are health insurance premiums a deductible business expense for an LLC A It depends If your LLC is taxed as a C Corp the company deducts them directly as a

Health insurance premiums paid with your own after tax dollars are tax deductible For example if you purchased insurance on your own through a health insurance exchange or Tax deductible costs include monthly premiums contributions to an HSA and tax advantaged dollars A business owner that enrolls in group coverage will most likely pay at

Are Health Insurance Premiums Tax Deductible For Businesses

Are Health Insurance Premiums Tax Deductible For Businesses

http://static1.squarespace.com/static/623b48a3293e2847ebe155cc/625e95a79c5ec522c5f3c38d/628632b30484eb3b330be95b/1654612213254/are-health-insurance-premiums-tax-deductible.png?format=1500w

Are Health Insurance Premiums Tax Deductible Investing BB

https://www.investingbb.com/wp-content/uploads/2020/09/Untitled1.png

Do Health Insurance Premiums Reduce Taxable Income KnowYourInsurance

https://www.knowyourinsurance.net/wp-content/uploads/how-does-health-insurance-affect-my-tax-return-health.png

For example employer sponsored premiums paid under a premium conversion plan cafeteria plan or any other medical and dental expenses paid by the plan aren t If you re self employed you re allowed to deduct your health insurance premiums note that you can only deduct the portion you pay so if you receive a premium subsidy you

However the cost of health insurance benefits must be included in the wages of S corporation employees who own more than two percent of the S corporation two percent shareholders If you are asking yourself are health insurance premiums tax deductible the answer is usually yes When you enroll in group health insurance you will likely pay at least

Download Are Health Insurance Premiums Tax Deductible For Businesses

More picture related to Are Health Insurance Premiums Tax Deductible For Businesses

Can I Deduct Health Insurance Premiums Insurance Noon

https://insurancenoon.com/wp-content/uploads/2020/12/Can-I-Deduct-Health-Insurance-Premiums-800x534.jpg

Are Health Insurance Premiums Tax Deductible For Retirees Vim Ch i

https://www.vimchi.info/wp-content/uploads/2021/09/are-health-insurance-premiums-tax-deductible-for-retirees.png

Are Medigap Premiums Tax Deductible 65Medicare

https://65medicare.org/wp-content/uploads/2017/04/Man-doing-taxes.jpg

The Internal Revenue Service views some insurance premiums as a cost of doing business and may accept them as tax deductions This article helps small business owners Health insurance premiums require special consideration as the rules differ based on your business structure Sole Proprietors Partners and S Corp Shareholders Can generally

[desc-10] [desc-11]

What Is Health Insurance Marketplace What You Need To Know Health

https://www.healthplansinoregon.com/wp-content/uploads/2017/06/Photo-minimal-new-product-neutral-social-media-4-2.png

Which Is Better Paying Health Insurance Premiums Pre Tax Or Post Tax

https://i1.wp.com/goneonfire.com/wp-content/uploads/2019/12/014b_Which-is-Better_-Paying-Health-Insurance-Premiums-Pre-Tax-or-Post-Tax_.png?fit=1920%2C1280&ssl=1

https://taxsharkinc.com › can-you-deduct-health...

Q Are health insurance premiums a deductible business expense for an LLC A It depends If your LLC is taxed as a C Corp the company deducts them directly as a

https://blog.turbotax.intuit.com › health-care › when...

Health insurance premiums paid with your own after tax dollars are tax deductible For example if you purchased insurance on your own through a health insurance exchange or

Are Health Insurance Premiums Tax Deductible For Retirees Vim Ch i

What Is Health Insurance Marketplace What You Need To Know Health

Qualified Business Income Deduction And The Self Employed The CPA Journal

Medicare Blog Moorestown Cranford NJ

Are Health Insurance Premiums Tax Deductible In The USA WikiMonday

Is Health Insurance Tax Deductible Get The Answers Here

Is Health Insurance Tax Deductible Get The Answers Here

Tax Deductions You Can Deduct What Napkin Finance

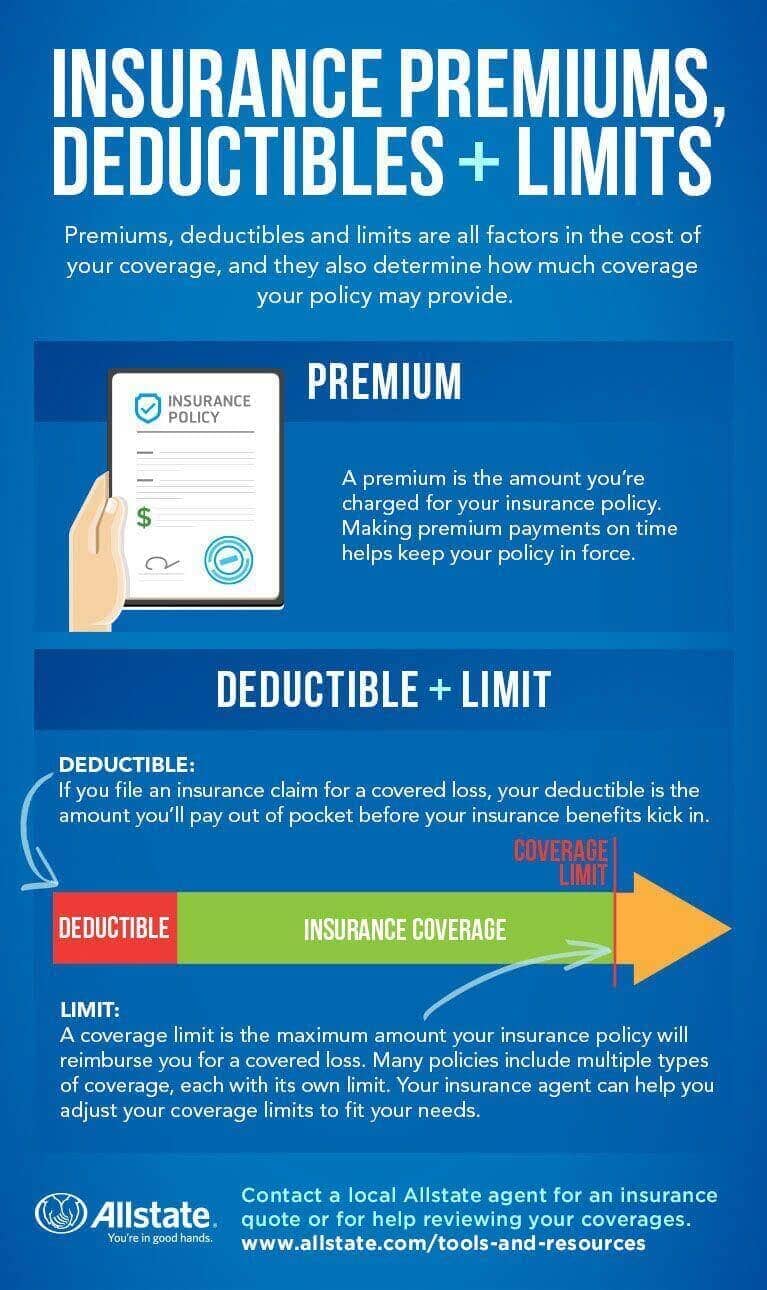

Canonprintermx410 25 Images Auto Insurance Deductible Explained

Premiums Deductibles Copay s How It All Works

Are Health Insurance Premiums Tax Deductible For Businesses - [desc-14]