Are Home Equity Lines Of Credit Tax Deductible For tax years before 2018 and after 2025 for home equity loans or lines of credit secured by your main home or second home interest you pay on the borrowed funds may be

You can only deduct the portion of the loan or line of credit you used to buy build or substantially improve the home that is used to secure the loan or line of credit This requirement began with Interest paid on a home equity loan or a home equity line of credit HELOC can still be tax deductible Don t take out a home equity loan or a HELOC just for the tax deduction

Are Home Equity Lines Of Credit Tax Deductible

Are Home Equity Lines Of Credit Tax Deductible

https://www.caminofcu.org/wp-content/uploads/2017/03/42189927_l.jpg

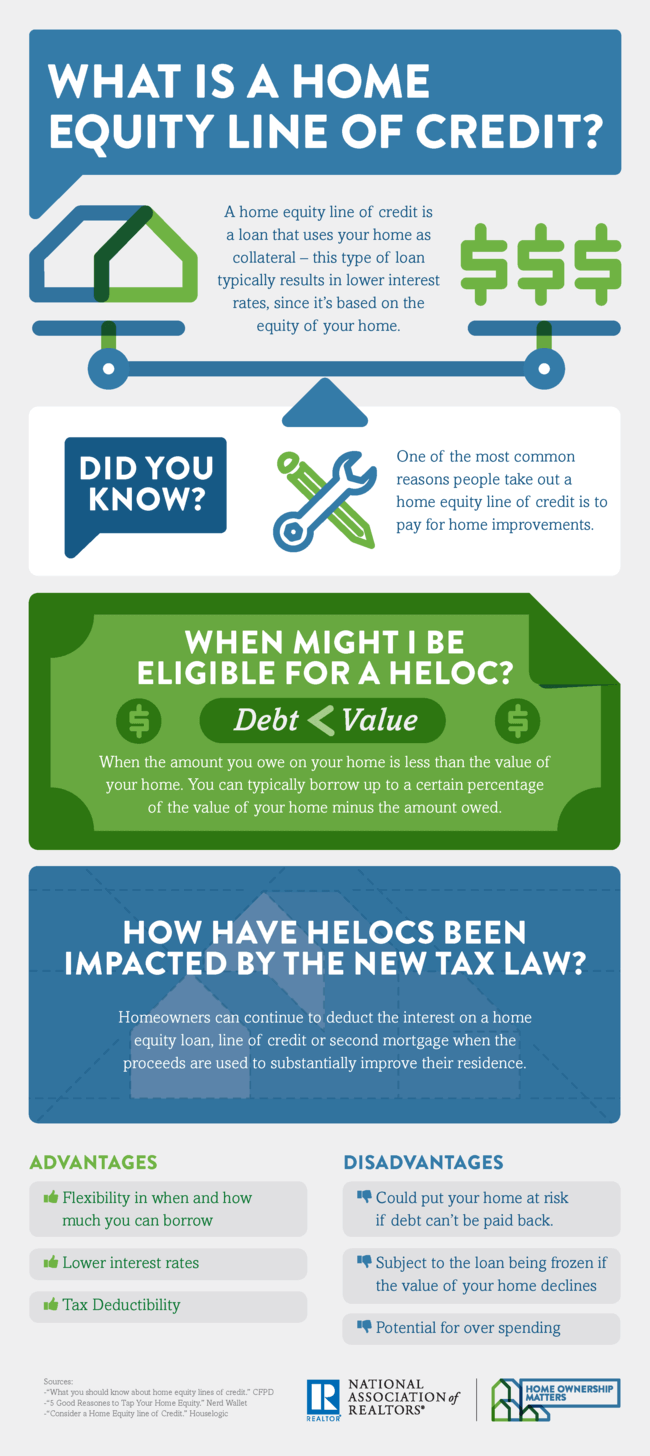

Home Ownership Matters Is Interest Still Deductible On Home Equity

https://homeownershipmatters.realtor/wp-content/uploads/2018/03/HELOC_Image_1200x628.png

Home Equity Loan Vs Line Of Credit Cobalt Credit Union

https://www.cobaltcu.com/sites/default/files/2022-01/Home-Equity-Loan-VS-Line-of-Credit.png

Since you re already at the cap you cannot deduct any interest on a home equity loan Prior to the TCJA you could deduct up to 1 million in home mortgage debt plus Before the tax year 2018 home equity loans or lines of credit secured by your main or second home and the interest you pay on those borrowed funds may be deductible or

Typically the interest on a home equity line of credit is tax deductible if you use the funds for home improvements like adding a new room or renovating your kitchen For As of 2023 interest on HELOCs is deductible only on debt up to 750 000 or 375 000 if married filing separately This limit is inclusive of any other mortgages the

Download Are Home Equity Lines Of Credit Tax Deductible

More picture related to Are Home Equity Lines Of Credit Tax Deductible

Is Home Equity Line Of Credit Interest Tax Deductible

https://homeownershipmatters.realtor/wp-content/uploads/2018/07/HELOC_Infographic-Normal.png

How Home Equity Loans Affect Taxes

https://optimataxrelief.com/wp-content/uploads/2022/10/2022-optima-tax-home-equity-loans-scaled.jpg

Valley Credit Union Home Equity Lines Of Credit Pros And Cons And

https://www.valleycu.org/getattachment/4c960026-f2bb-42b4-afc4-f4ca817e3336/home-equity-line-of-credit-pros-cons

Have a home equity loan or home equity line of credit HELOC Then you ll want to know if this debt is tax deductible Here s what is and isn t It s also commonly reported that interest paid on home equity loans and HELOCs is deductible on your taxes yet this is only true when certain circumstances apply Read on to

[desc-10] [desc-11]

Home Equity Lines Of Credit Tax Liens Down Payment Assistance And

https://i.ytimg.com/vi/fFoAfvNs560/maxresdefault.jpg

What You Should Know About Home Equity Lines Of Credit Prudential Bank

https://www.psbanker.com/wp-content/uploads/2020/07/What-should-you-know-about-home-equity-lines-of-credit.jpg

https://www.irs.gov › faqs › itemized-deductions...

For tax years before 2018 and after 2025 for home equity loans or lines of credit secured by your main home or second home interest you pay on the borrowed funds may be

https://ttlc.intuit.com › turbotax-support › en-us › ...

You can only deduct the portion of the loan or line of credit you used to buy build or substantially improve the home that is used to secure the loan or line of credit This requirement began with

What Exactly Are Home Equity Loans And Home Equity Lines Of Credit

Home Equity Lines Of Credit Tax Liens Down Payment Assistance And

30 Iowa Take Home Pay Calculator EditRozali

Home Equity Lines Of Credit Greenlight Capital Landing Page

How Does A Home Equity Line Of Credit Work Advance Financial Tips

Home Equity Lines Of Credit How Is The Rate Determined For A Home

Home Equity Lines Of Credit How Is The Rate Determined For A Home

How Does A Home Equity Line Of Credit Work Ariel J Baverman

Why Home Equity Lines Of Credit Have Been Getting More Popular

Home Equity Loan Or Line Of Credit Which Is Right For You Dupaco

Are Home Equity Lines Of Credit Tax Deductible - Before the tax year 2018 home equity loans or lines of credit secured by your main or second home and the interest you pay on those borrowed funds may be deductible or