Are Hsa Contributions Tax Deductible In California Within limits contributions to an HSA made by or on behalf of an eligible individual are deductible by the individual in determining adjusted gross income AGI

The contributions to an HSA are tax deductible and the account s earnings if invested are tax free as are withdrawals for eligible medical expenses Tax Deductibility Contributions to an HSA are tax deductible Tax Free Earnings Earnings on HSA contributions grow tax free Tax Free Withdrawals Withdrawals for certain medical costs are not taxed

Are Hsa Contributions Tax Deductible In California

Are Hsa Contributions Tax Deductible In California

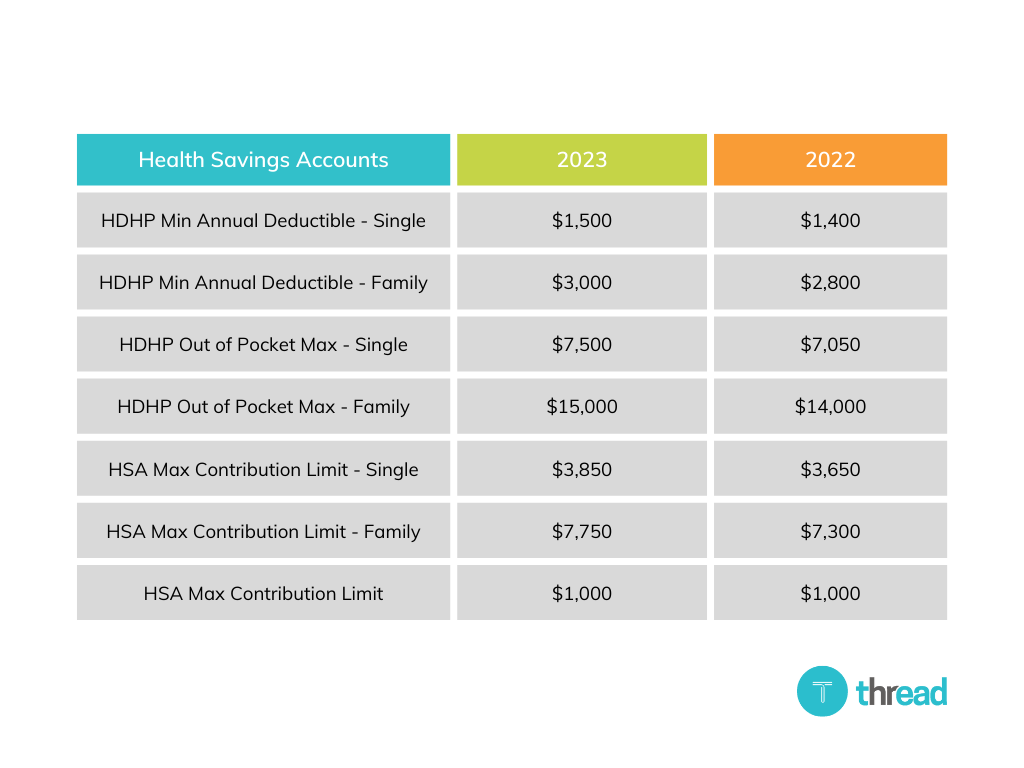

https://blog.threadhcm.com/hs-fs/hubfs/HSA Contribution Limits Table.png?width=1024&name=HSA Contribution Limits Table.png

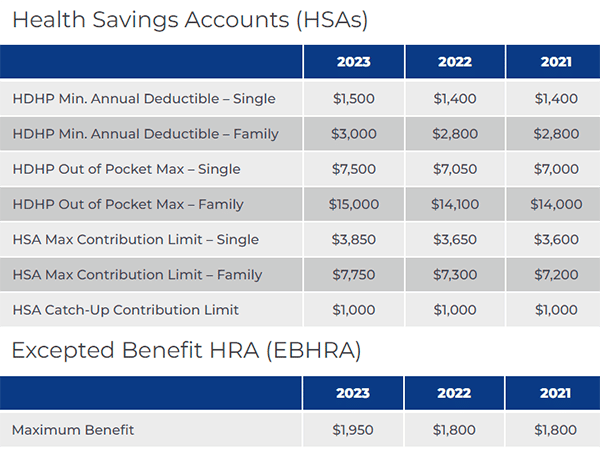

2024 HSA HDHP Limits

https://www.cbiz.com/Portals/0/CBIZ_HCM/Images/2024-HSA-HDHP-Limits-Graphics.jpg

Blog 2023 Health Savings Account Limits Gold Standard Tax Photos

https://www.hrpro.com/wp-content/uploads/2022/05/HSA-Limits-Chart-600.png

In most cases the answer is yes As of February 2020 here is a list of caveats 1 HSA contributions are taxed by California and New Jersey 2 These states don t have state income taxes so the state tax benefit is not applicable Alaska Florida Nevada New Hampshire South Dakota Tennessee Texas Washington and Wyoming 3 Health Savings Accounts HSAs allow enrollees to save money on a tax favored basis to pay for medical expenses A business can allow employees to open a California HSA account only after the employee has enrolled in a

You can deduct all of your contributions to your HSA on your taxes You can save money in both the short term and the long term Your HSA contributions accrue interest and grow tax free You ll pay a lower premium when you have a high deductible health insurance plan that is HSA compatible Although California has not conformed to HSAs California law does conform to the federal rules for Medical Savings Accounts MSAs and allows a deduction equal to the amount deducted on the federal return for the same taxable year

Download Are Hsa Contributions Tax Deductible In California

More picture related to Are Hsa Contributions Tax Deductible In California

Max Hsa Contribution 2024 Family Deductions Audi Marena

https://medcombenefits.com/images/uploads/blog/2023_HSA_Limits_Table.jpg

[img_title-5]

[img-5]

[img_title-6]

[img-6]

Are HSA contributions tax deductible Yes HSA contributions may be tax deductible depending on how the funds are added to the account If you contribute money to your HSA through your paycheck you can not deduct the contribution on your tax return An HSA lets you set aside pre tax money to pay for certain medical expenses Contributions are pre tax your account can grow tax deferred and withdrawals for qualifying medical expenses are

Yes HSA is just a taxable income investment vehicle for CA purposes Contributions are not tax deductible for CA franchise tax purposes And you can have taxable gains and losses for CA purposes on any Deposits paid directly to your health savings account HSA can result in an HSA tax deduction However contributions paid through your employer are already excluded from your income on your W 2 So the HSA deduction rules don t allow an additional deduction for those contributions

[img_title-7]

[img-7]

[img_title-8]

[img-8]

https://www.ftb.ca.gov/tax-pros/law/legislation/...

Within limits contributions to an HSA made by or on behalf of an eligible individual are deductible by the individual in determining adjusted gross income AGI

https://www.nerdwallet.com/article/taxes/fsa-hsa-taxes

The contributions to an HSA are tax deductible and the account s earnings if invested are tax free as are withdrawals for eligible medical expenses

[img_title-9]

[img_title-7]

[img_title-10]

[img_title-11]

[img_title-12]

[img_title-13]

[img_title-13]

[img_title-14]

[img_title-15]

[img_title-16]

Are Hsa Contributions Tax Deductible In California - Although California has not conformed to HSAs California law does conform to the federal rules for Medical Savings Accounts MSAs and allows a deduction equal to the amount deducted on the federal return for the same taxable year