Are Hsa Contributions Tax Deductible If you contribute more than the annual contribution limit set by the Internal Revenue Service IRS within a tax year those excess contributions won t be tax deductible In 2024 the HSA contribution limits are 4 150 for individuals and 8 300 for families

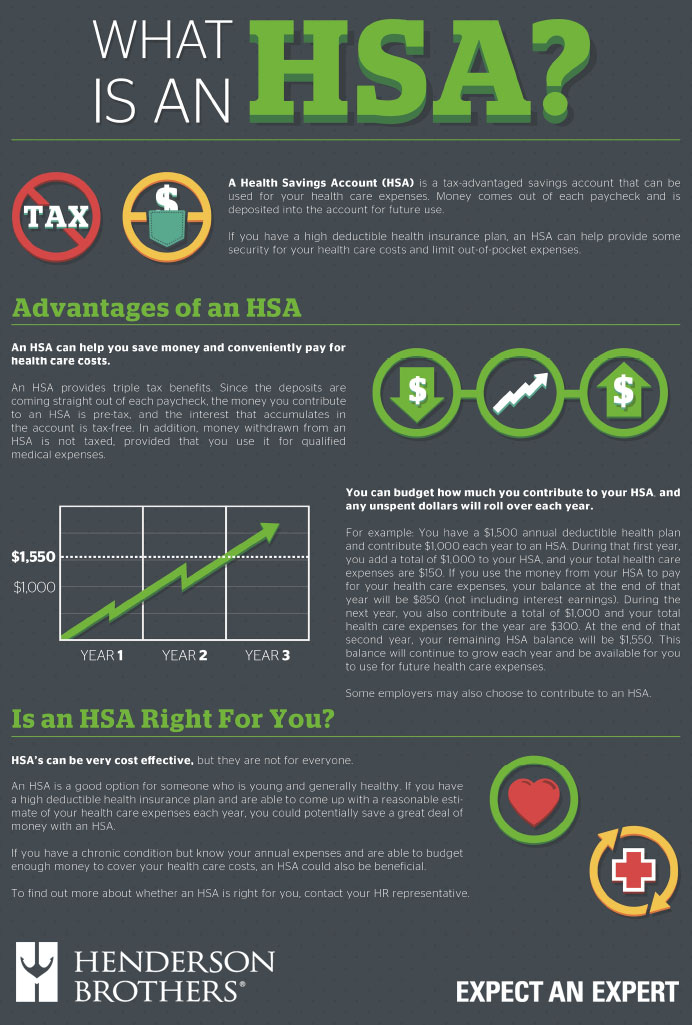

Contributions to HSAs offer valuable tax benefits Under U S tax law they are tax deductible even for those who do not itemize deductions reducing adjusted gross income AGI and potentially lowering tax liability Your health savings account HSA contributions may be tax deductible Learn the rules for HSA deductions and contributions and how they affect your taxes

Are Hsa Contributions Tax Deductible

Are Hsa Contributions Tax Deductible

https://www.hrpro.com/wp-content/uploads/2022/05/HSA-Limits-Chart-600.png

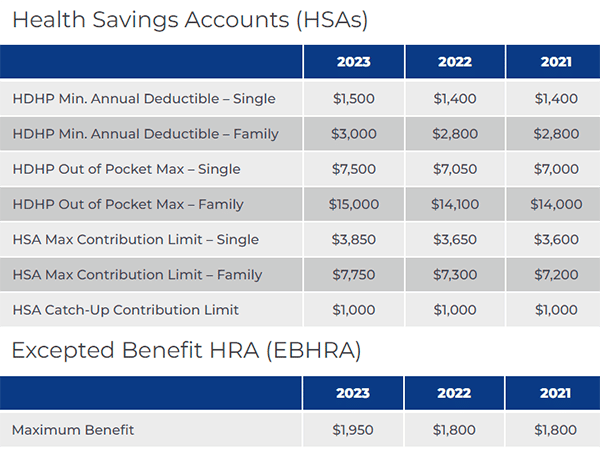

2024 HSA HDHP Limits

https://www.cbiz.com/Portals/0/CBIZ_HCM/Images/2024-HSA-HDHP-Limits-Graphics.jpg

Max Hsa Contribution 2024 Family Deductions Audi Marena

https://medcombenefits.com/images/uploads/blog/2023_HSA_Limits_Table.jpg

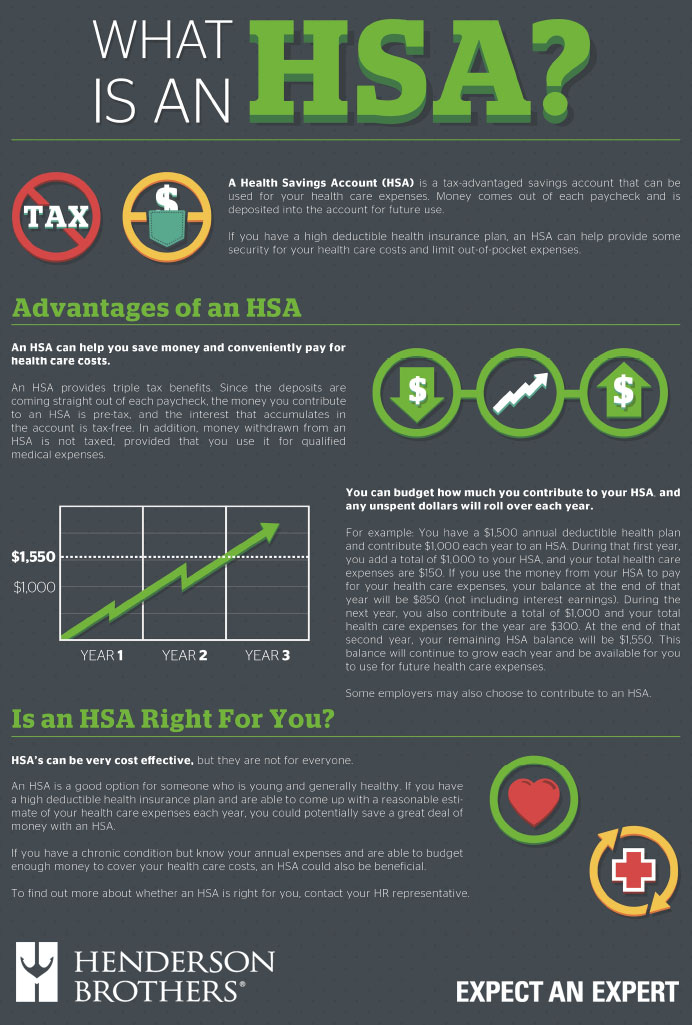

When you reach age 65 there s no longer a penalty for withdrawing HSA funds to use for non medical expenses but you will owe income tax on the withdrawals What happens if you switch to a health plan that s not HSA qualified How do you report HSA contribution and withdrawal details to the IRS Tax deductible Contributions to an HSA are tax deductible Growth without tax liability Any interest on the earnings in your HSA account grows tax free Tax free withdrawals Any withdrawal for a qualified medical expense is not subject to federal income tax

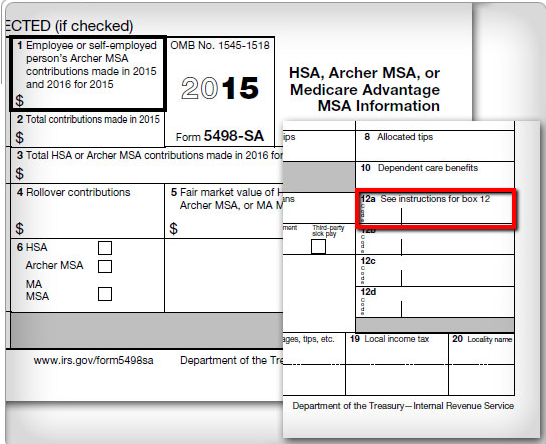

Tax Deductible Contributions Contributions to an HSA reduce your taxable income If contributions are made through payroll deductions they are pre tax reducing Social Security and Medicare taxes as well Tax Free Growth Interest and investment gains in an HSA grow tax free allowing your account balance to compound over time Tax Free When preparing your tax return you must calculate your total HSA contributions for the year Only contributions you make directly are tax deductible Employer contributions are excluded from taxable income Here s a quick list of steps for claiming the deduction Ensure contributions are within IRS limits Record contributions on your tax

Download Are Hsa Contributions Tax Deductible

More picture related to Are Hsa Contributions Tax Deductible

HSA Compatible High Deductible Health Plans Www westernhealth

https://www.westernhealth.com/wha/assets/Image/Diagram-PiggyBank.jpg

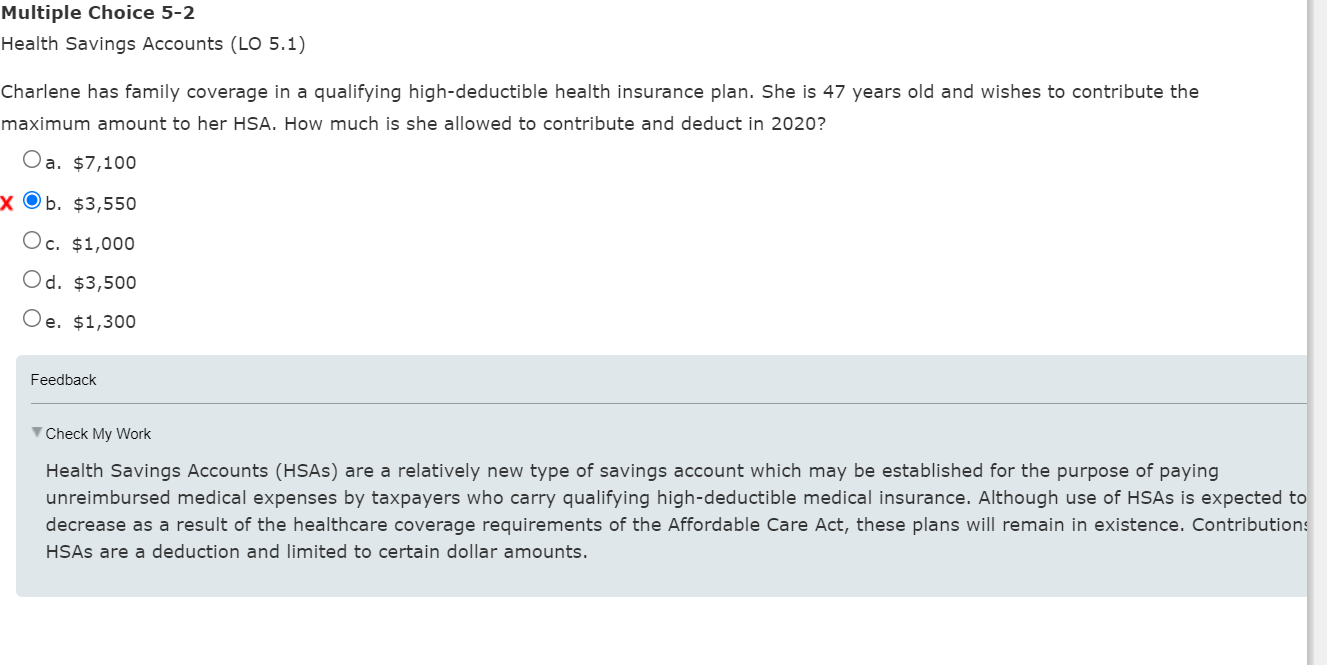

Solved Multiple Choice 5 2 Health Savings Accounts LO 5 1 Chegg

https://media.cheggcdn.com/media/fe6/fe6cf4f9-c3e3-4770-baf5-d7f0f7bc1463/phpgsLCY8

2023 HSA Contribution Limits Increase Considerably Due To Inflation

https://www.wexinc.com/wp-content/uploads/2022/05/ContributionLimitsChart_Blog_SupplementalGraphic_2023-1-1024x768.jpg

Medical expenses can take a big bite out of your wallet But two special accounts the health savings account HSA and the health flexible spending account FSA can be good remedies for both All contributions to your HSA are tax deducible or if made through payroll deductions are pre tax which lowers your overall taxable income Your contributions may be 100 percent tax deductible meaning contributions can be deducted from your gross income

[desc-10] [desc-11]

HSAs Health Savings Accounts Henderson Brothers

http://www.hendersonbrothers.com/wp-content/uploads/2017/09/HSA-inforgraphic.jpg

How Do Employer Contributions Affect My HSA Limit HSA Edge

https://hsaedge.com/wp-content/uploads/2016/09/W2_HSA_employer_contributions_box_12.png

https://www.hrblock.com › tax-center › filing › ...

If you contribute more than the annual contribution limit set by the Internal Revenue Service IRS within a tax year those excess contributions won t be tax deductible In 2024 the HSA contribution limits are 4 150 for individuals and 8 300 for families

https://accountinginsights.org › hsa-and-taxes-how...

Contributions to HSAs offer valuable tax benefits Under U S tax law they are tax deductible even for those who do not itemize deductions reducing adjusted gross income AGI and potentially lowering tax liability

Health Savings Account HSA

HSAs Health Savings Accounts Henderson Brothers

2021 Health Savings Account In Nevada Health Benefits Associates

[img_title-11]

[img_title-12]

[img_title-13]

[img_title-13]

[img_title-14]

[img_title-15]

[img_title-16]

Are Hsa Contributions Tax Deductible - When preparing your tax return you must calculate your total HSA contributions for the year Only contributions you make directly are tax deductible Employer contributions are excluded from taxable income Here s a quick list of steps for claiming the deduction Ensure contributions are within IRS limits Record contributions on your tax