Are Hsa Contributions Tax Deductible For Self Employed So technically the money you contribute to your HSA as a self employed worker is pre tax you just have to pay the taxes at the end of the year when you file your return Though you ll miss out on the automatic

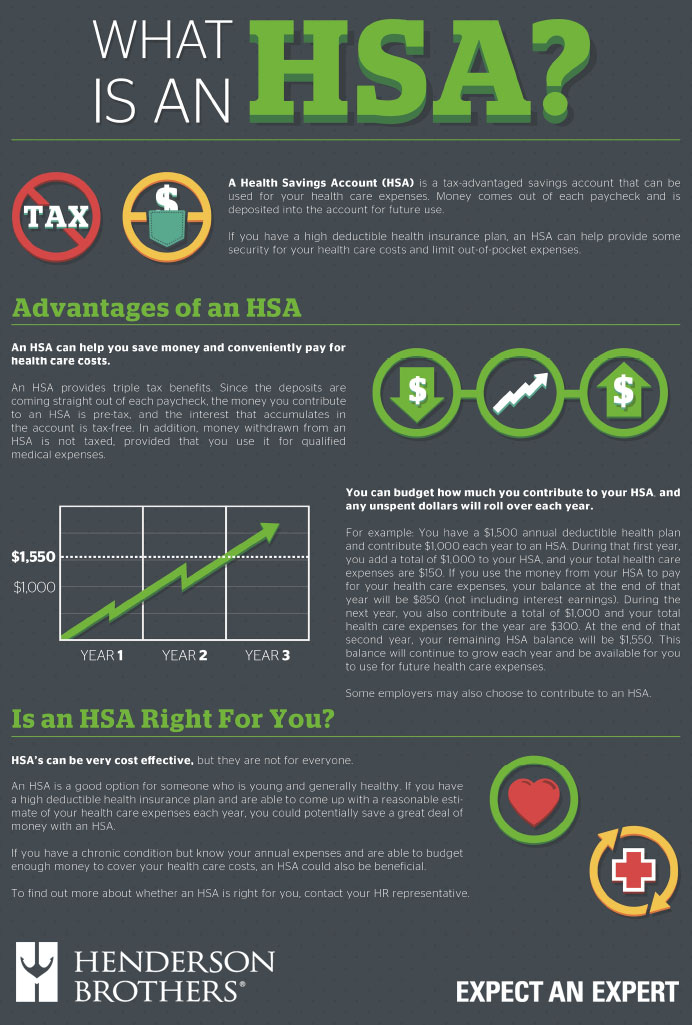

Due to the cost of health insurance many self employed individuals have high deductible healthcare plans or no insurance at all Read more on how an HSA works its tax benefits how much you can contribute to While many who are traditionally employed can contribute to their HSA on a pretax basis as a self employed individual you can make HSA contributions with after tax dollars and then do a line item deduction

Are Hsa Contributions Tax Deductible For Self Employed

Are Hsa Contributions Tax Deductible For Self Employed

https://www.hrpro.com/wp-content/uploads/2022/05/HSA-Limits-Chart-600.png

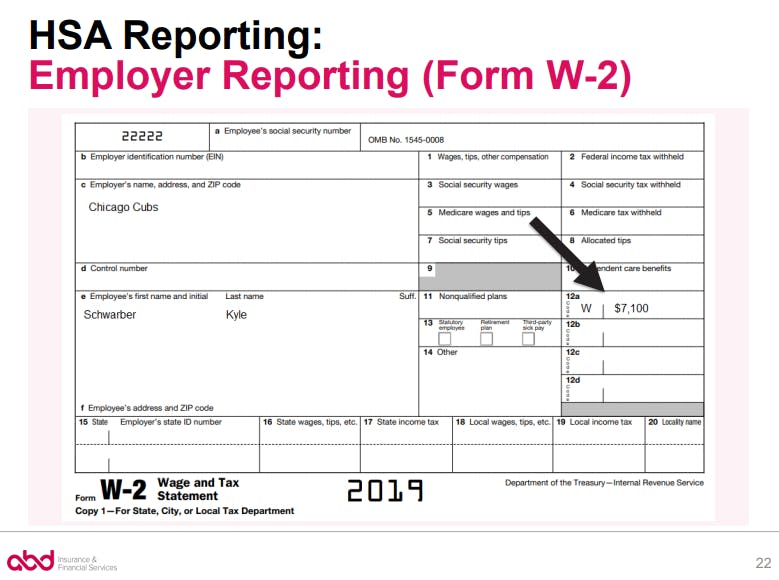

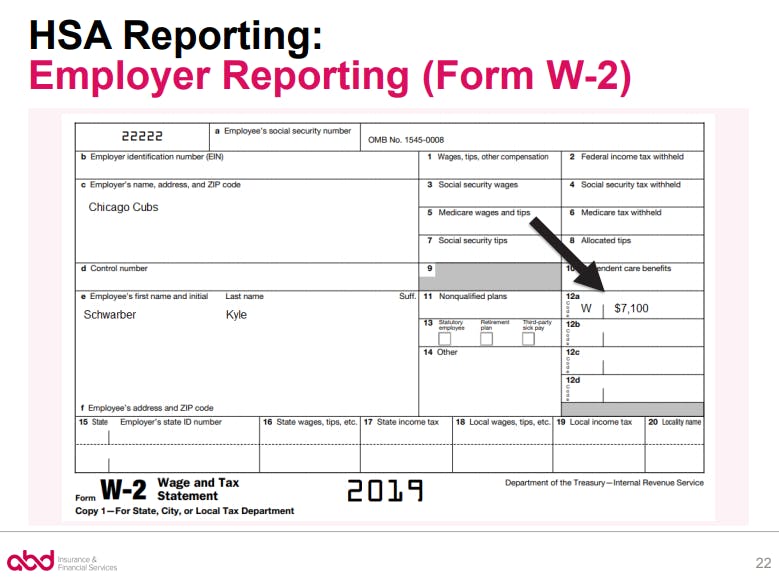

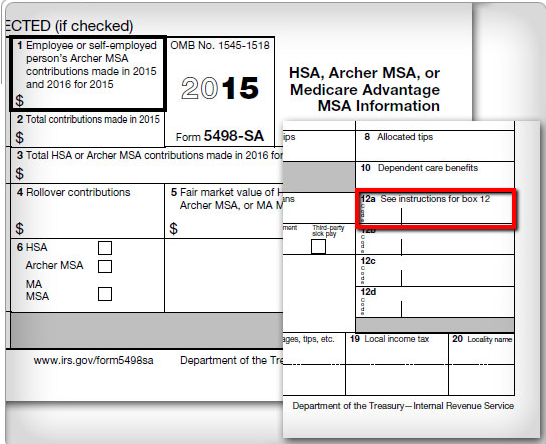

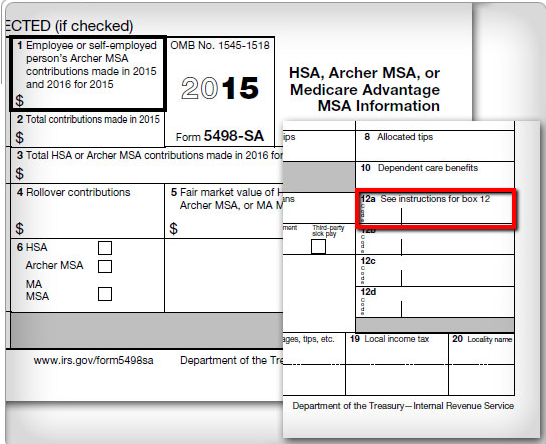

HSA Form W 2 Reporting

https://images.prismic.io/newfront/NmUwZDEzZDgtY2E4Ni00NDVlLTgwY2MtOThiNDgxZDUzZDM3_4_24_20_chart1.png?auto=compress,format&rect=0,0,779,580&w=779&h=580

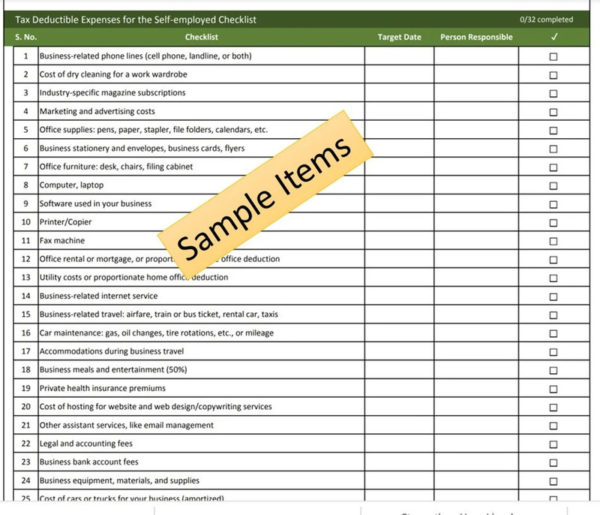

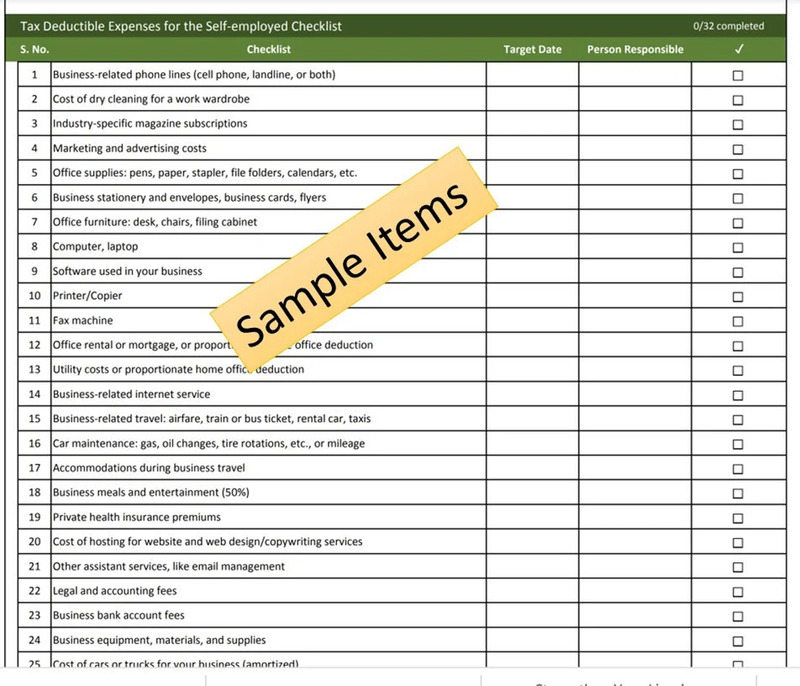

Tax Deductible Expenses For The Self employed Checklist

https://www.checklisted.us/wp-content/uploads/2022/05/Tax-Deductible-Expenses-for-the-Self-employed-Checklist-1-600x515.jpg

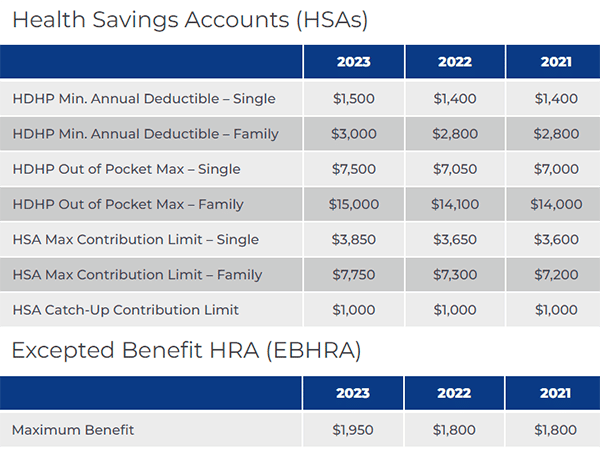

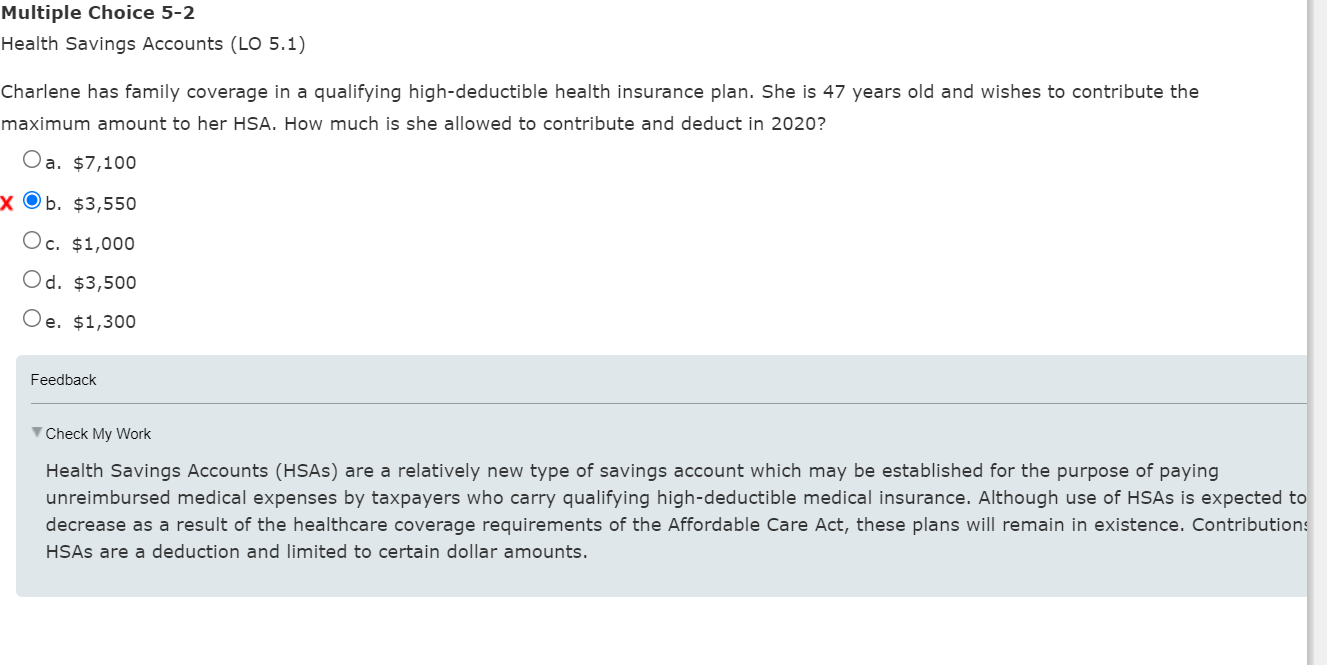

Reminder The HSA contribution limits for 2023 are 3 850 for self only coverage and 7 750 for family coverage Those who are 55 and older and not enrolled in Medicare Contributing to an HSA can help you offset taxes along with other advantages like tax deferred savings and tax free withdrawals on qualified medical expenses And

Employers are permitted but are not required to make deductible contributions to HSAs set up for their employees subject to the same dollar limits and eligibility rules According to the Self Employed Contributions Act SECA if you re self employed you must pay both the employer and employee share of FICA taxes which fund Social

Download Are Hsa Contributions Tax Deductible For Self Employed

More picture related to Are Hsa Contributions Tax Deductible For Self Employed

Tax Deductible Expenses For The Self employed Checklist

https://www.checklisted.us/wp-content/uploads/2022/05/Tax-Deductible-Expenses-for-the-Self-employed-Checklist-1.jpg

Are HSA Contributions Tax Deductible GoodRx

https://images.ctfassets.net/4f3rgqwzdznj/7nuqGogqKypoDF7X1qkjfG/d89154ee1a48fad1a053fcb6d55b1640/smiling_couple_finances_1282868177.jpg

IRS Announces 2023 HSA Contribution Limits

https://blog.threadhcm.com/hs-fs/hubfs/HSA Contribution Limits Table.png?width=1024&name=HSA Contribution Limits Table.png

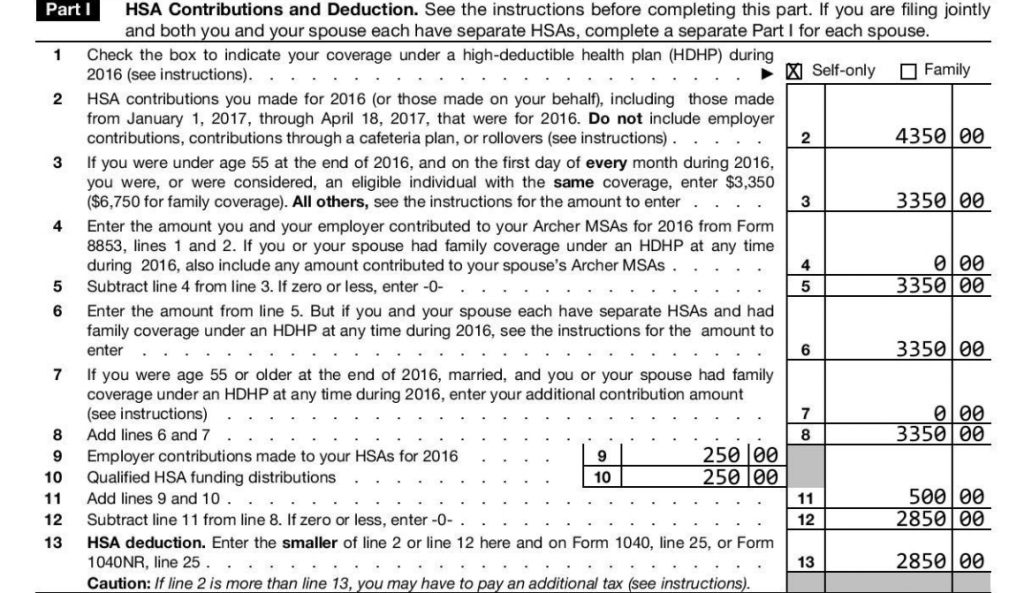

An individual s direct contributions to an HSA are 100 tax deductible from the employee s income Earnings in the account are also tax free Yes HSA contributions may be tax deductible depending on how the funds are added to the account If you contribute money to your HSA through your paycheck you can not

The contributions to an HSA are tax deductible and the account s earnings if invested are tax free as are withdrawals for eligible medical expenses As a self employed individual you must be enrolled in an HSA eligible high deductible health plan HDHP and meet specific conditions to qualify for a Health Savings Account

/GettyImages-1129640389-00d4c7c7013548bf8fc2f475f25195d7.jpg)

Are FSA Contributions Tax Deductible

https://www.investopedia.com/thmb/u2wJjKORNGwYIkLIUBgzZkTPInY=/1500x1000/filters:fill(auto,1)/GettyImages-1129640389-00d4c7c7013548bf8fc2f475f25195d7.jpg

Max Hsa Contribution 2024 Family Deductions Audi Marena

https://medcombenefits.com/images/uploads/blog/2023_HSA_Limits_Table.jpg

https://www.starshiphsa.com › articles …

So technically the money you contribute to your HSA as a self employed worker is pre tax you just have to pay the taxes at the end of the year when you file your return Though you ll miss out on the automatic

https://www.goodrx.com › ... › fsa-hsa …

Due to the cost of health insurance many self employed individuals have high deductible healthcare plans or no insurance at all Read more on how an HSA works its tax benefits how much you can contribute to

Solved Multiple Choice 5 2 Health Savings Accounts LO 5 1 Chegg

/GettyImages-1129640389-00d4c7c7013548bf8fc2f475f25195d7.jpg)

Are FSA Contributions Tax Deductible

Self Employed Tax Deductions Worksheet

2023 HSA Contribution Limits Increase Considerably Due To Inflation

HSAs Health Savings Accounts Henderson Brothers

How Do Employer Contributions Affect My HSA Limit HSA Edge

How Do Employer Contributions Affect My HSA Limit HSA Edge

How To Handle Excess Contributions On Form 8889 HSA Edge

Business Tax Credit Vs Tax Deduction What s The Difference

How To Prep For Your Self Employed Taxes A Survival Guide

Are Hsa Contributions Tax Deductible For Self Employed - HSAs allow the self employed to pay for medical expenses with pre tax dollars For eligible self employed people the ACA s tax credits make individual health insurance