Are Leased Vehicles Eligible For Ev Tax Credit Beginning Jan 1 2023 eligible vehicles may qualify for a tax credit of up to 7 500 The amount of the credit depends on when the eligible new clean vehicle is placed in service

Buyers can get federal tax credits for EV models not on the list allowed by the Inflation Reduction Act if they lease them Clean vehicle tax credits We ll help you determine whether your purchase of an electric vehicle EV or fuel cell vehicle FCV qualifies for a tax credit based on whether you

Are Leased Vehicles Eligible For Ev Tax Credit

Are Leased Vehicles Eligible For Ev Tax Credit

https://blog.greenenergyconsumers.org/hubfs/Federal Tax Credit Blog header.png

New EV Tax Credits The Details Virginia Automobile Dealers Association

https://vada.com/wp-content/uploads/2022/08/EV-Tax-Credits-Facebook-Post.png

Payne How EV Tax Credit Bills Disadvantage Foreign Domestic Models

https://www.gannett-cdn.com/presto/2021/11/02/PDTN/af46539a-106d-4d75-bc9e-c93935bf56ca-EVcredits_FordMustangMachEGT.jpg?crop=3181

Similarly leased vehicles can also qualify for a 7 500 tax credit without some of the strict rules about the car s batteries and final assembly meaning consumers If you bought or leased a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under IRC 30D

The short answer is that very few models currently qualify for the full 7 500 electric vehicle tax credit Others qualify for half that amount and some don t qualify at all Eligible Leased Vehicles Updated June 6 2024 Below is a list of every electrified 2023 and 2024 car truck and SUV that offers a 7 500 or higher lease

Download Are Leased Vehicles Eligible For Ev Tax Credit

More picture related to Are Leased Vehicles Eligible For Ev Tax Credit

EV Tax Credit Rules Are Becoming More Complicated Local News Today

https://i2.wp.com/image.cnbcfm.com/api/v1/image/106916725-1627308432240-gettyimages-1330261567-bth_014_7-21-2021_chargingstationforelectricvehicleinpennsyl.jpeg

New US EV Tax Credit Here s Everything You Need To Know

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AAX9y19.img?w=1920&h=1080&m=4&q=50

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

https://www.autopromag.com/usa/wp-content/uploads/2022/08/EV-Federal-Tax-Credits-5MgJUp.jpeg?is-pending-load=1

Purchases of used EVs and PHEVs after Jan 1 are now eligible for a tax credit of 30 of the sale price up to a maximum of 4 000 The credit also has restrictions though fewer than for new Per the new IRS fact sheet on the Inflation Reduction Act leased vehicles can qualify for the commercial vehicle tax credit which doesn t require North American assembly If you

Cars bought by leasing companies are considered commercial vehicles by the government and can earn a 7 500 tax credit under a separate less restrictive program People who buy new electric vehicles may be eligible for a tax credit of up to 7 500 and used electric car buyers may qualify for up to 4 000 New in 2024

Why Getting A 7 500 EV Tax Credit Will Be Easier In 2024 WSJ

https://images.wsj.net/im-865215/social

California s Gas Car Sale Ban Has Exception For Plug in Hybrids

https://s.hdnux.com/photos/01/26/70/73/22777536/10/rawImage.jpg

https://www.irs.gov/newsroom/topic-a-frequently...

Beginning Jan 1 2023 eligible vehicles may qualify for a tax credit of up to 7 500 The amount of the credit depends on when the eligible new clean vehicle is placed in service

https://www.caranddriver.com/news/a44131850/leasing-an-ev-tax-credit

Buyers can get federal tax credits for EV models not on the list allowed by the Inflation Reduction Act if they lease them

The Electric Vehicle Tax Credit Abdo

Why Getting A 7 500 EV Tax Credit Will Be Easier In 2024 WSJ

What The U S EV Tax Credit Means For Canada Financial Post

Ev Car Tax Rebate Calculator 2024 Carrebate

The EV Tax Credit Is Changing In 2024 Here Are 10 Cars That Still

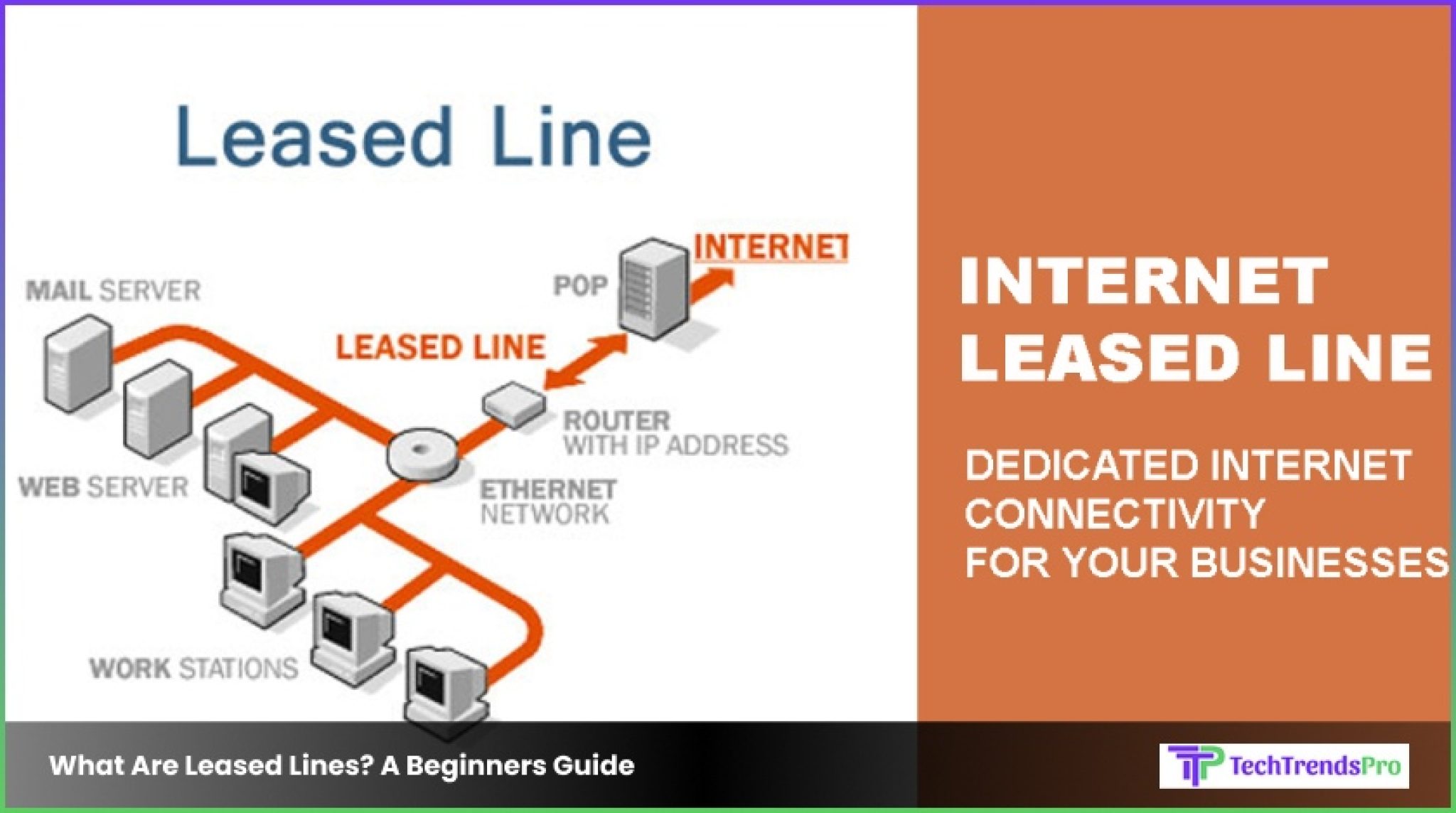

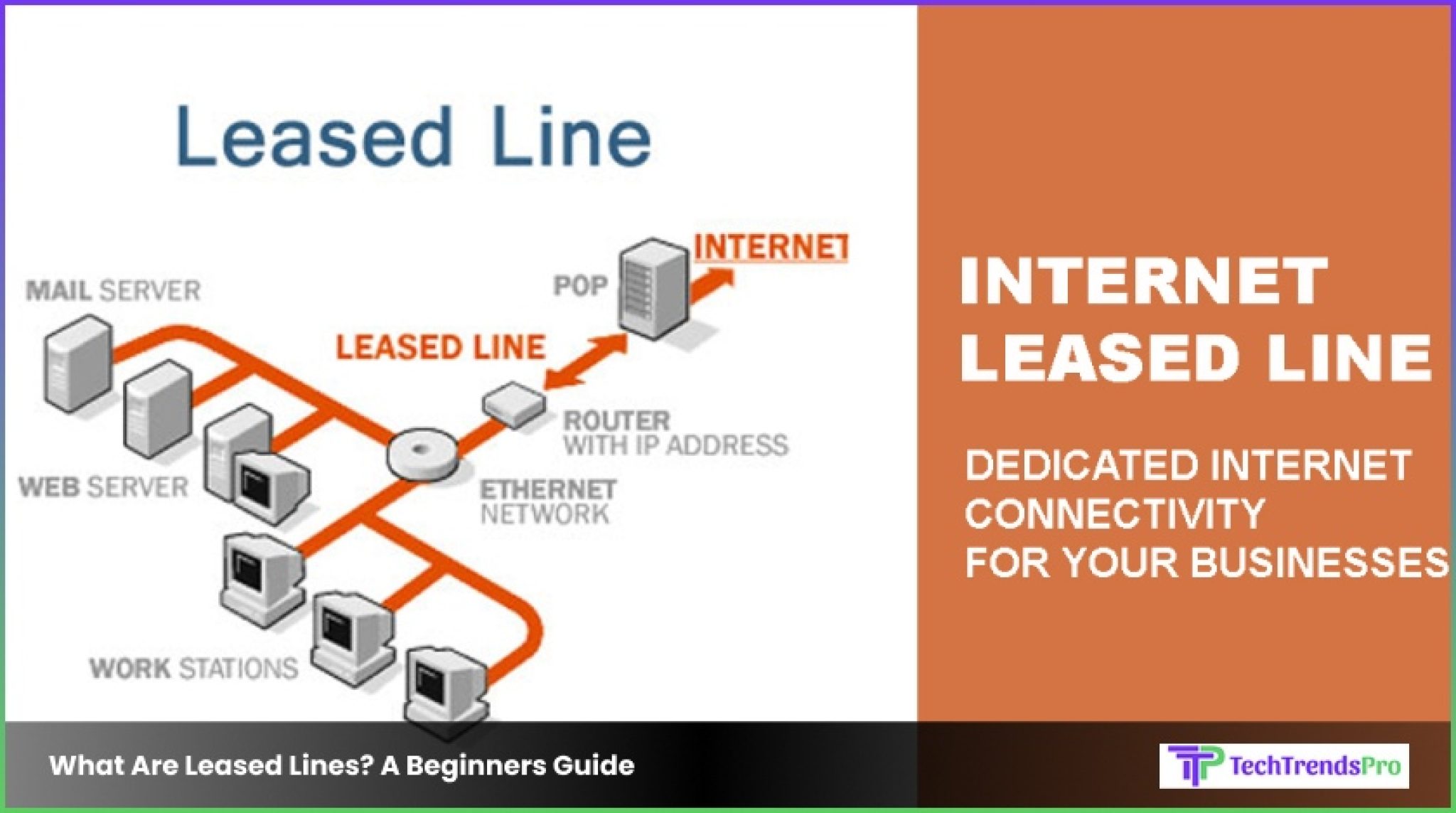

What Are Leased Lines A Beginners Guide To Ethernet Options TTP

What Are Leased Lines A Beginners Guide To Ethernet Options TTP

What Cars Are Eligible For The 7500 EV Tax Credit It s Complicated

Treasury Department Lays Out EV Tax Credit Foreign Sourcing Rules

This Tax Day End The EV Tax Credit Taxpayers Protection Alliance

Are Leased Vehicles Eligible For Ev Tax Credit - If you bought or leased a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under IRC 30D