Housing Loan Principal Rebate In Income Tax Web 28 mars 2017 nbsp 0183 32 Deduction on principal repayment The principal portion of the EMI paid for the year is allowed as a deduction under Section 80C The maximum amount that can be

Web 9 f 233 vr 2018 nbsp 0183 32 For an individual or Hindu Undivided Family HUF the amount that goes towards the repayment of the principal on a Home Web 31 mai 2022 nbsp 0183 32 Is it possible to get a tax exemption on the principal repaid on a housing loan Ans Yes under Section 80C of the Income Tax Act you can get tax benefits on the repaid principal amount

Housing Loan Principal Rebate In Income Tax

Housing Loan Principal Rebate In Income Tax

https://lh5.googleusercontent.com/proxy/_to2OsQ67tRR4OwClZoiK8C99OHj3utcTVj3Q3bWbdpZVdQj_PtSnOS_64ZT2jiqSPfBqvnDWsCyETNMDekbIwWLP_7zi7sagEKJarz_V0esJDVAQsIgvY3jjvwKYw=w1200-h630-p-k-no-nu

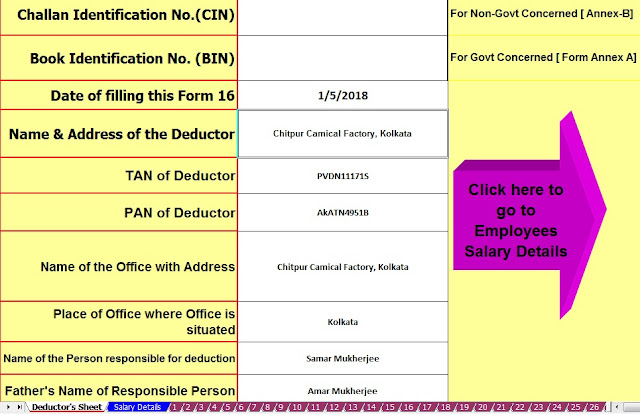

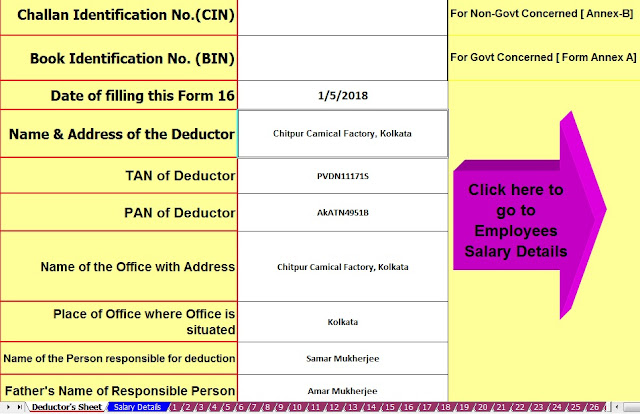

Housing Loan Principal Repayment Deduction For Ay 2017 18 House Poster

https://1.bp.blogspot.com/-JEikAPP-8mg/WhrmzgzoLYI/AAAAAAAAF6s/_b6piZ2zxgY7oNEK5gMAptqIz0TB5xV4QCLcBGAs/s640/100%2Bemployees%2BMaster%2Bof%2BForm%2B16%2BPart%2BA%2526B%2BPage%2B1.jpg

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

https://1.bp.blogspot.com/-oW8FNR-IJDU/XikG4UEcNwI/AAAAAAAAHps/3fzchCO4L400lsdyUEyhQ4S0xHA0wQ9tQCLcBGAsYHQ/w1200-h630-p-k-no-nu/FORM12C_2015_16_001.jpg

Web 12 juin 2023 nbsp 0183 32 Home Loan Tax Benefit How To Save Income Tax On Your Home Loan By Hemanth Parthiban Updated on Jun 15th 2023 9 min read CONTENTS Show Web Yes the home loan principal is part of Section 80C of the Income Tax Act Under this section an individual is entitled to tax deductions on the amount paid as repayment of

Web Section 80C under Section 80C of the Income Tax Act you can claim a maximum home loan tax deduction of up to 1 5 lakh from your annual taxable income on the principal Web 24 ao 251 t 2023 nbsp 0183 32 Updated 24 08 2023 09 31 08 AM The Government of India offers home loan tax benefits of up to Rs 5 lakh to individuals deduction of up to

Download Housing Loan Principal Rebate In Income Tax

More picture related to Housing Loan Principal Rebate In Income Tax

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

https://assets-news.housing.com/news/wp-content/uploads/2022/09/09092126/Income-tax-rebate-on-home-loan.jpg

Mortgage Repayment Proportion In 2020 Mortgage Quotes Mortgage

https://i.pinimg.com/originals/82/a8/65/82a86524d2f840a3bb2848816e00713a.jpg

Section 80EE Income Tax Deduction For Interest On Home Loan Tax2win

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

Web 2 ao 251 t 2021 nbsp 0183 32 There is no threshold limit for claiming principal repayment of home loans hence any principal payment amount up to Rs 1 5 lakh irrespective of whether it is pre Web Income tax rebate on home loan Tax deductions Homebuyers in India may deduct up to Rs 1 5 lakhs in principal payments under Section 80C and up to Rs 2 million in interest

Web 16 juil 2018 nbsp 0183 32 Payment of housing loan gives you an opportunity to save taxes by claiming benefit of both Interest as well as Principal repayment of the Housing Loan when you Web 2 avr 2022 nbsp 0183 32 New income tax rules from April 2022 Those first time home buyers who have got home loan sanction letter before 1st April 2022 and their property value is less than

Interim Budget 2019 20 The Talk Of The Town Trade Brains

https://tradebrains.in/wp-content/uploads/2019/02/income-tax-rebate-min.png

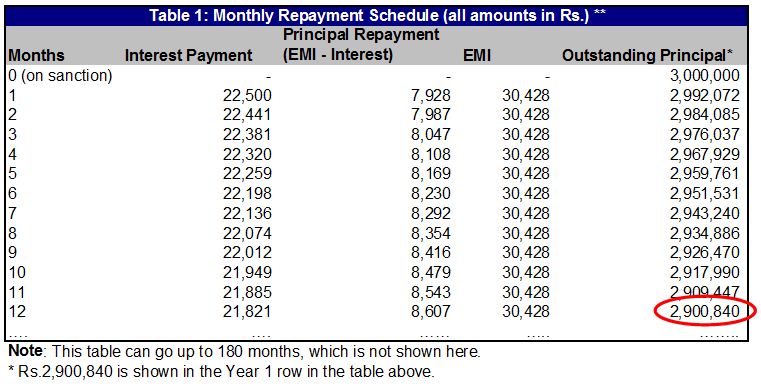

Home Loan Repayment Schedule

https://d16eikkurngyvx.cloudfront.net/wp-content/uploads/2013/08/Home-loan_11.jpg

https://cleartax.in/s/home-loan-tax-benefit

Web 28 mars 2017 nbsp 0183 32 Deduction on principal repayment The principal portion of the EMI paid for the year is allowed as a deduction under Section 80C The maximum amount that can be

https://blog.bankbazaar.com/home-loan-tax-…

Web 9 f 233 vr 2018 nbsp 0183 32 For an individual or Hindu Undivided Family HUF the amount that goes towards the repayment of the principal on a Home

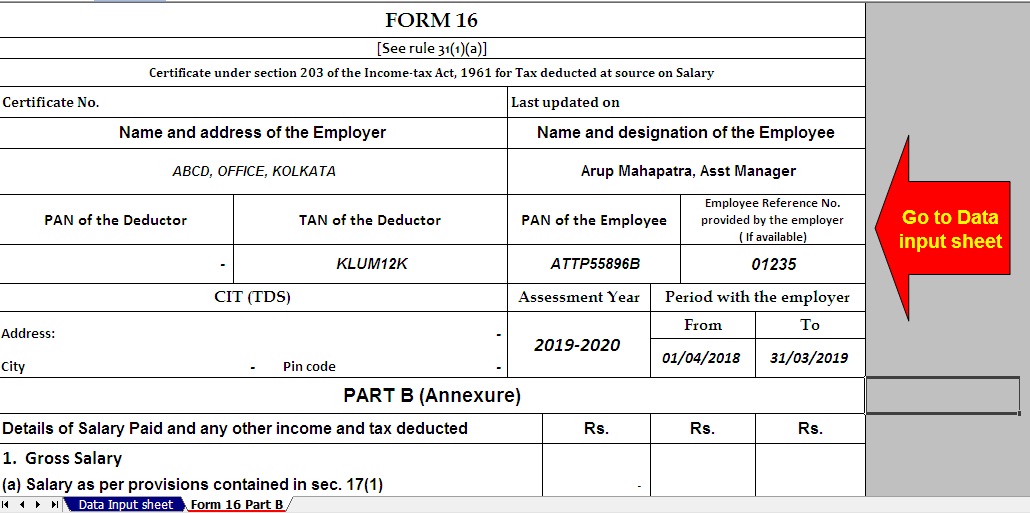

Tax Benefit On Home Loan Section 24 80EEA 80C With Automated Excel

Interim Budget 2019 20 The Talk Of The Town Trade Brains

Income Tax Rebate On Home Loan Fy 2019 20 A design system

How To Show Home Loan Interest For Self Occupied House In ITR 1 Tax

Tax Rebate 2019 Malaysia Homebuyers To Get Income Tax Rebate On

Treatment Of Housing Loan Principal And Interest Chapter 5 Income Fr

Treatment Of Housing Loan Principal And Interest Chapter 5 Income Fr

Home Loan EMI Calculator Free Excel Sheet Stable Investor

Georgia Income Tax Rebate 2023 Printable Rebate Form

Home Loan Tax Benefits In India Important Facts

Housing Loan Principal Rebate In Income Tax - Web 16 juin 2020 nbsp 0183 32 Deduction under section 80C Your home loan s Principal amount stamp duty registration fee or any other expenses is a part of Section 80C of the Income Tax