Are Medicare Part B Payments Deductible Medicare Part B premiums may qualify as deductible medical expenses under the Internal Revenue Code IRC Section 213 These expenses are deductible only if they exceed

Medicare Part B premiums are a significant expense for many retirees often deducted directly from Social Security benefits Understanding whether these premiums can Yes you can deduct your Medicare Part B premiums However it typically requires you to itemize your deductions instead of opting for the standard deduction

Are Medicare Part B Payments Deductible

Are Medicare Part B Payments Deductible

https://medicareworld.com/wp-content/uploads/2017/03/3-9-17_MW_MedicareCostsATG_Infographic.png

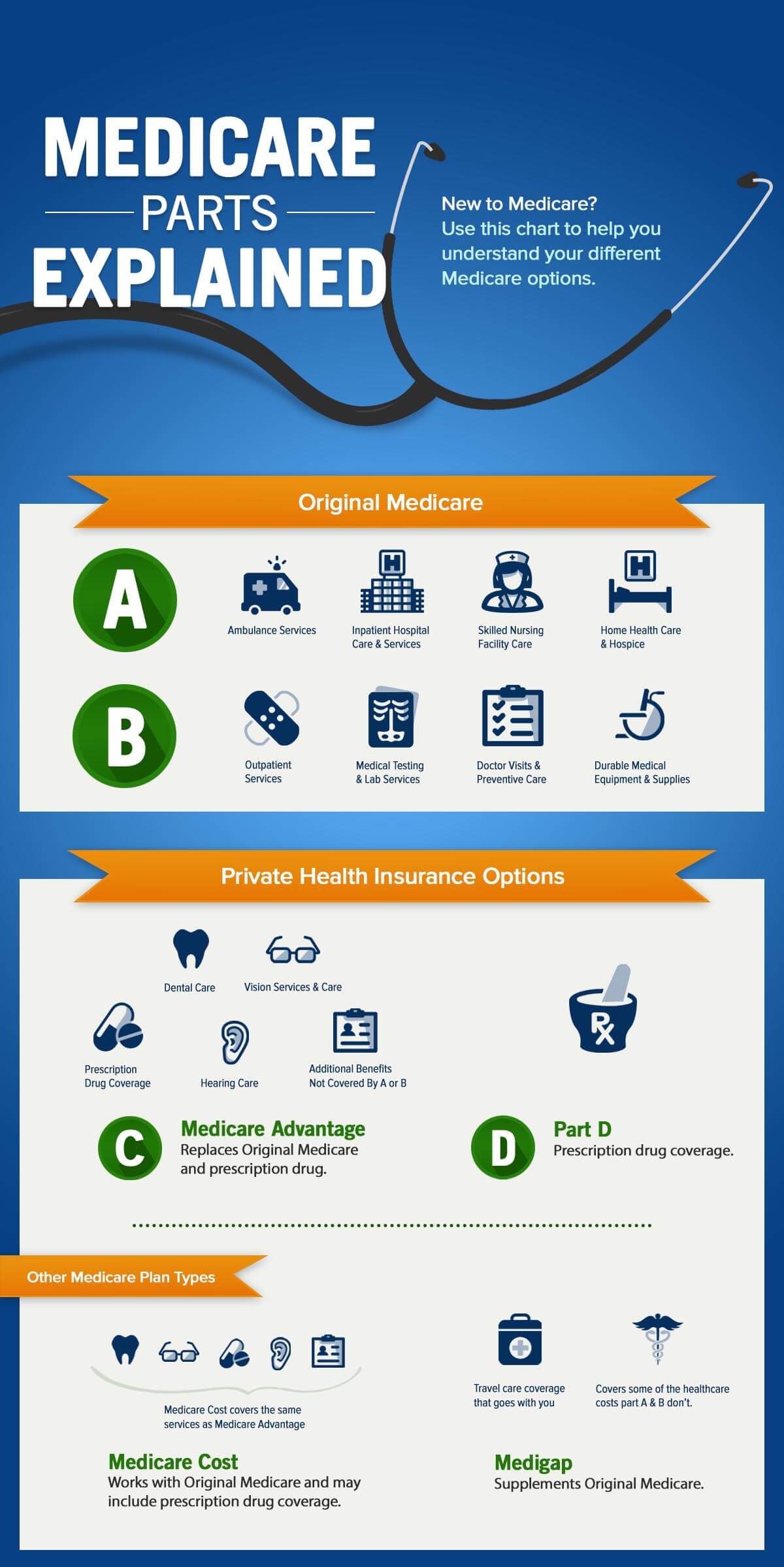

What Is Medicare Part C D MedicareTalk

https://www.medicaretalk.net/wp-content/uploads/medicare-facts-what-you-need-to-know-health-partners.jpeg

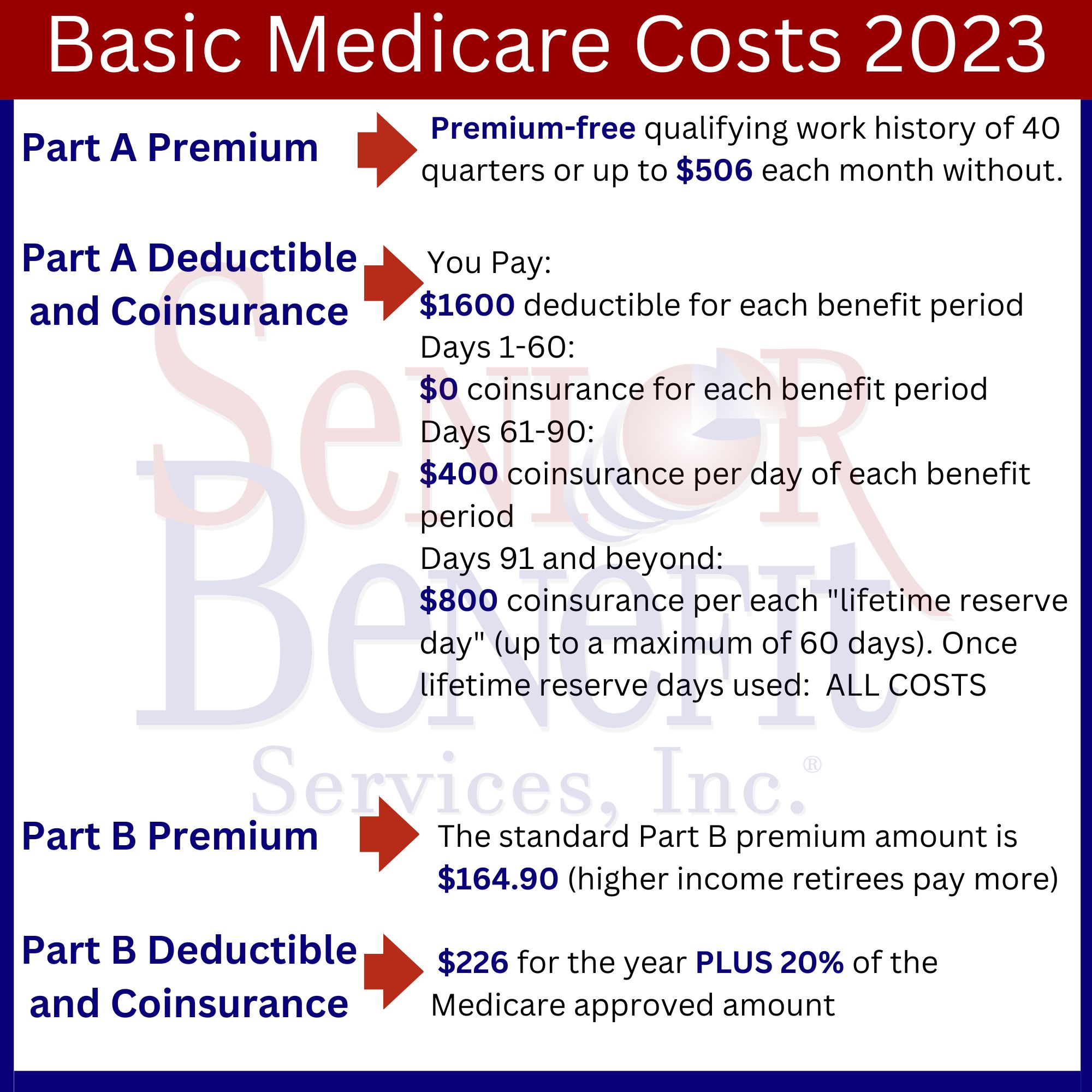

What Will Medicare Cost Me In 2023 Senior Benefit Services

https://seniorbenefitclient.com/wp-content/uploads/2022/09/Basic-Medicare-Costs-2023.jpg

When dealing with medical expenses like those from Medicare Part B premiums paid out of pocket or long term care costs related to specific conditions you may ask if these are tax deductible The simple answer is yes Medicare Part B premiums covering outpatient care and doctor services are deductible for those who itemize The standard monthly premium for Part B in 2024 is

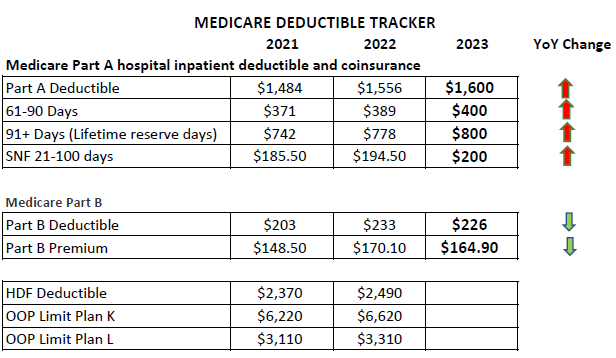

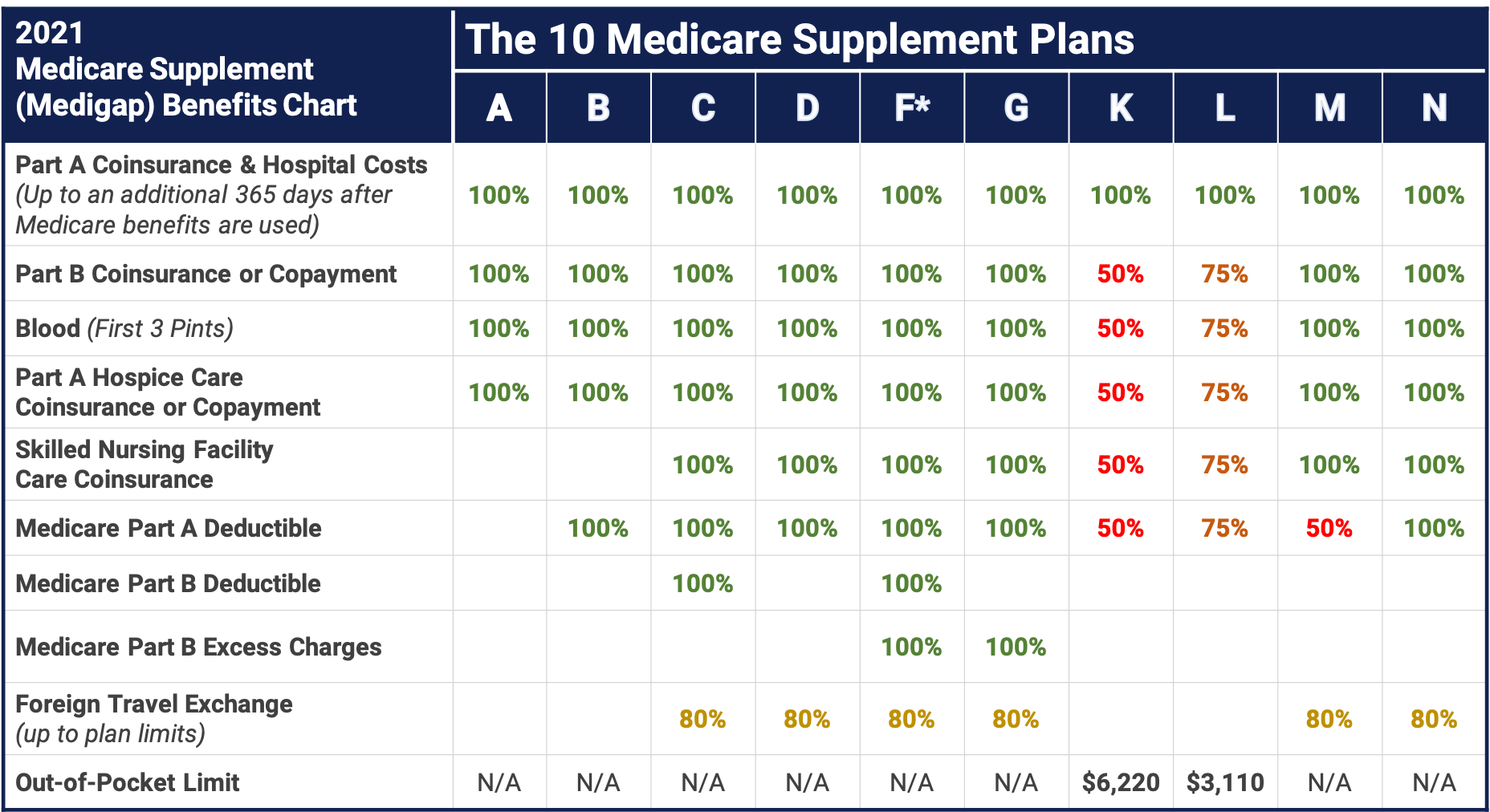

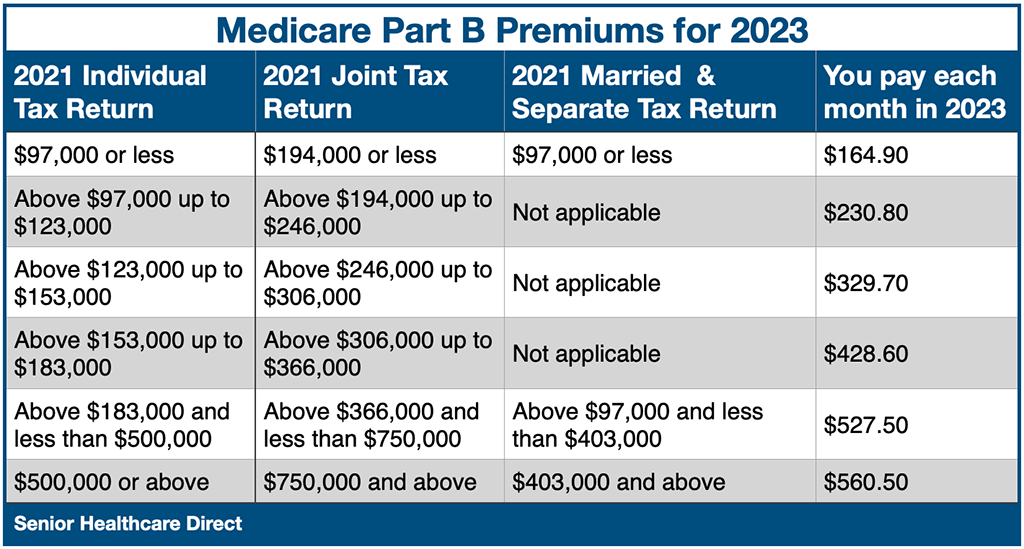

As of 2023 the standard premium for Medicare Part B is 164 90 or higher depending on your income Medical expenses in general are deductible on your federal tax return but there are Potential Deduction Medical premiums including those for Medicare Part B fall under tax deductible medical expenses Taxpayers can deduct these if they itemize their deductions

Download Are Medicare Part B Payments Deductible

More picture related to Are Medicare Part B Payments Deductible

2021 Medicare Part B Overview

https://medicareworld.com/wp-content/uploads/2020/12/12-3-20_MW_INFO_2021-Part-B-Premiums.png

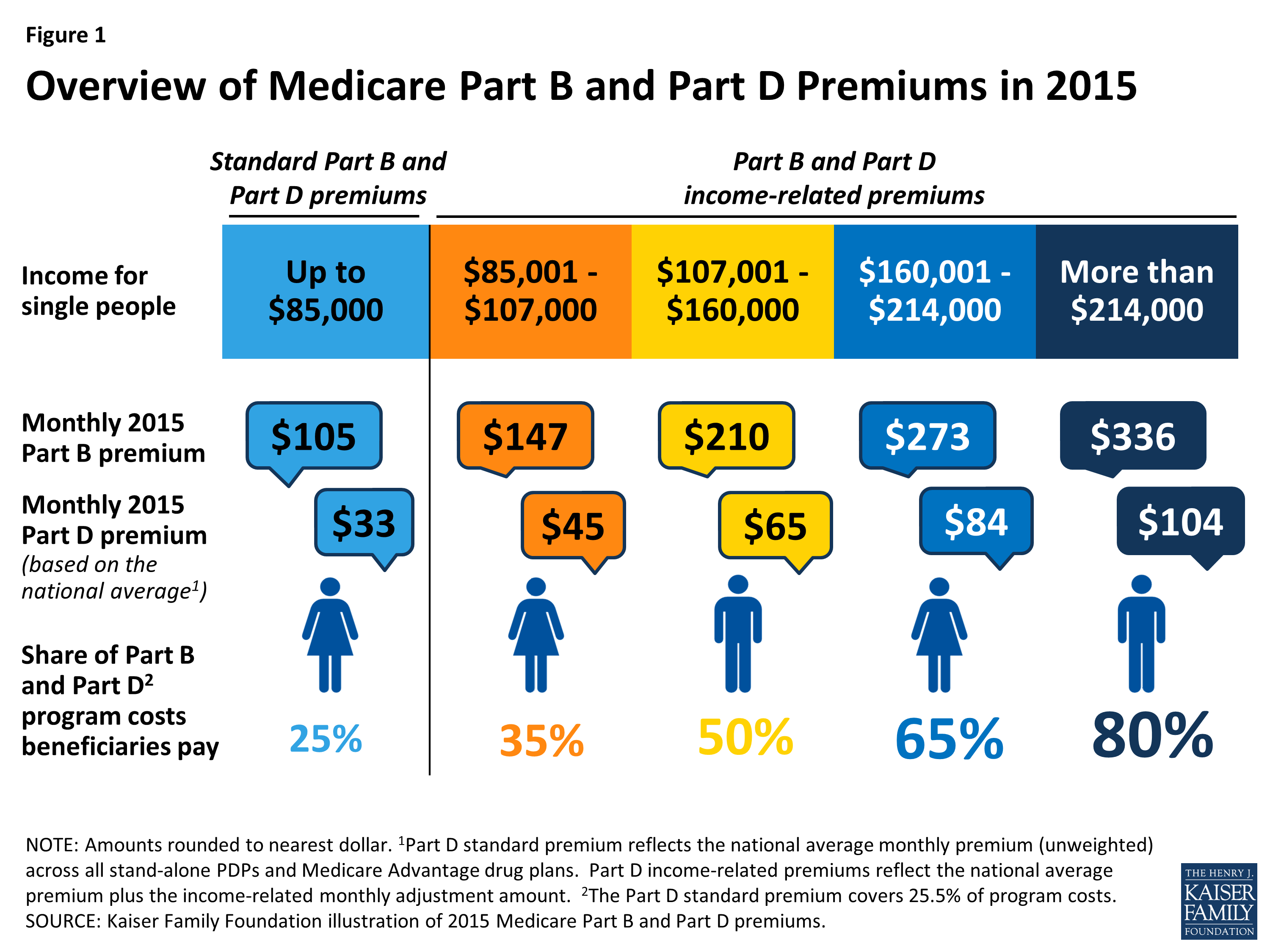

Medicare s Income Related Premiums A Data Note KFF

https://www.kff.org/wp-content/uploads/2015/05/8706-figure-1.png

2023 Medicare Parts A B Premiums And Deductibles

https://www.psmbrokerage.com/hubfs/image-png-Sep-30-2022-02-08-23-83-PM.png

Part B Part B premiums are dependent on income The standard premium is 185 You can deduct your monthly premium from your taxes Part C Medicare Advantage Original Medicare includes Part A hospital insurance and Part B medical insurance Most people who have Part A do not pay premiums However a person may deduct from their taxes the Part B

Medicare Part B Deductible Medical Insurance The standard Part B deductible is 250 in 2024 up slightly from previous years This covers outpatient care preventive Similar to Medicare Part B as long as you meet the income requirements and spend 7 5 of your income on health care costs you can deduct your Medicare Part C

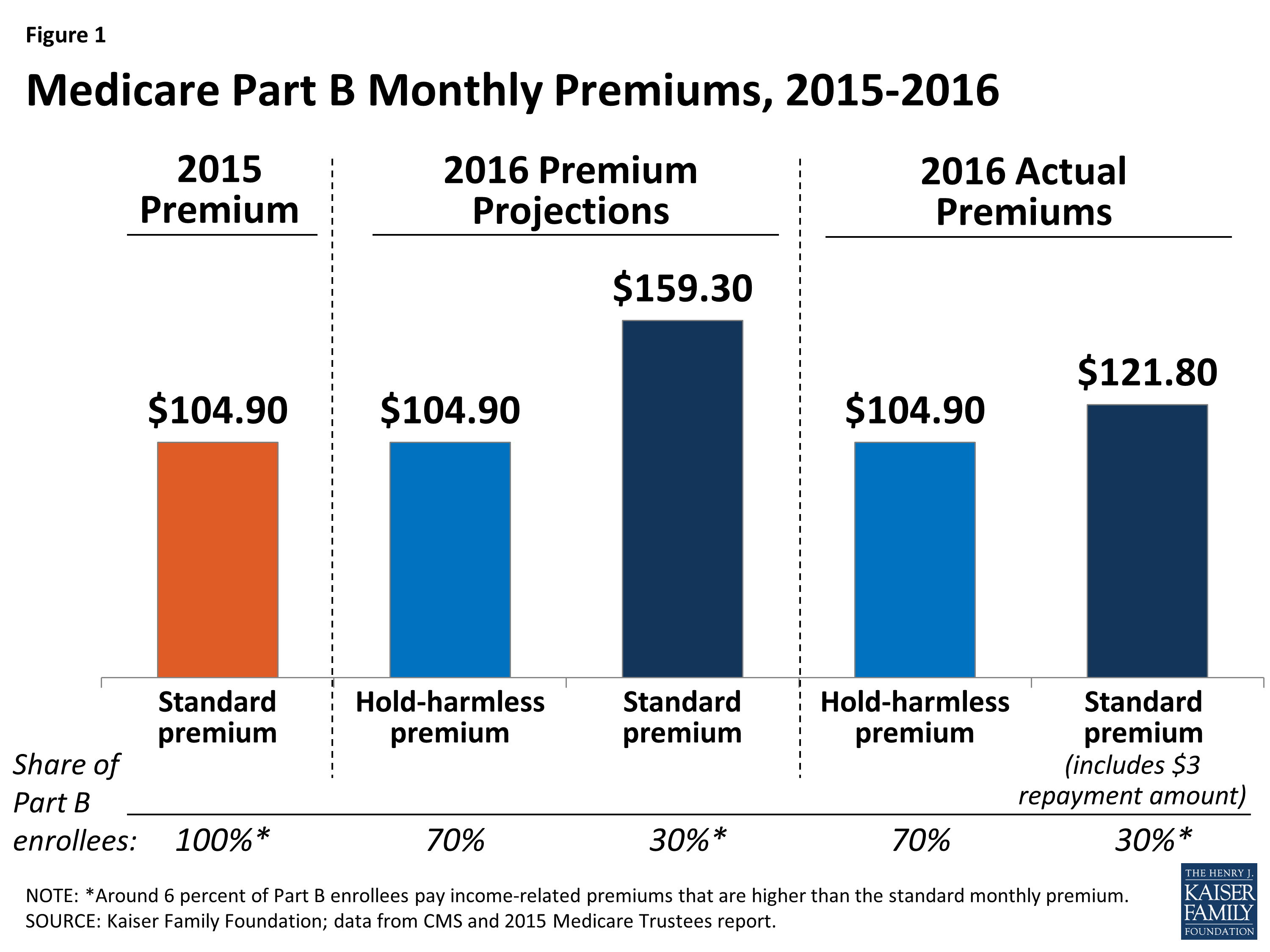

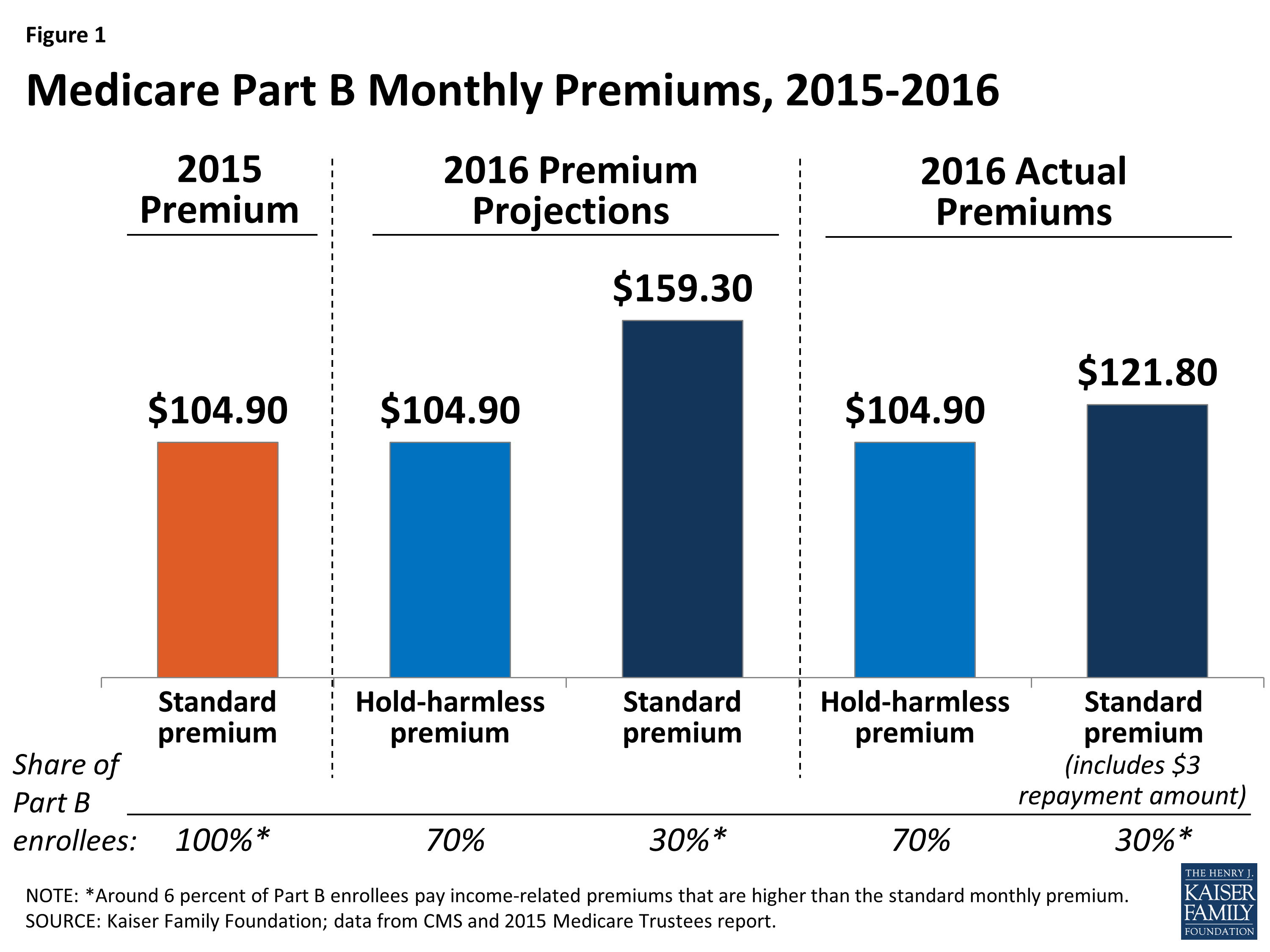

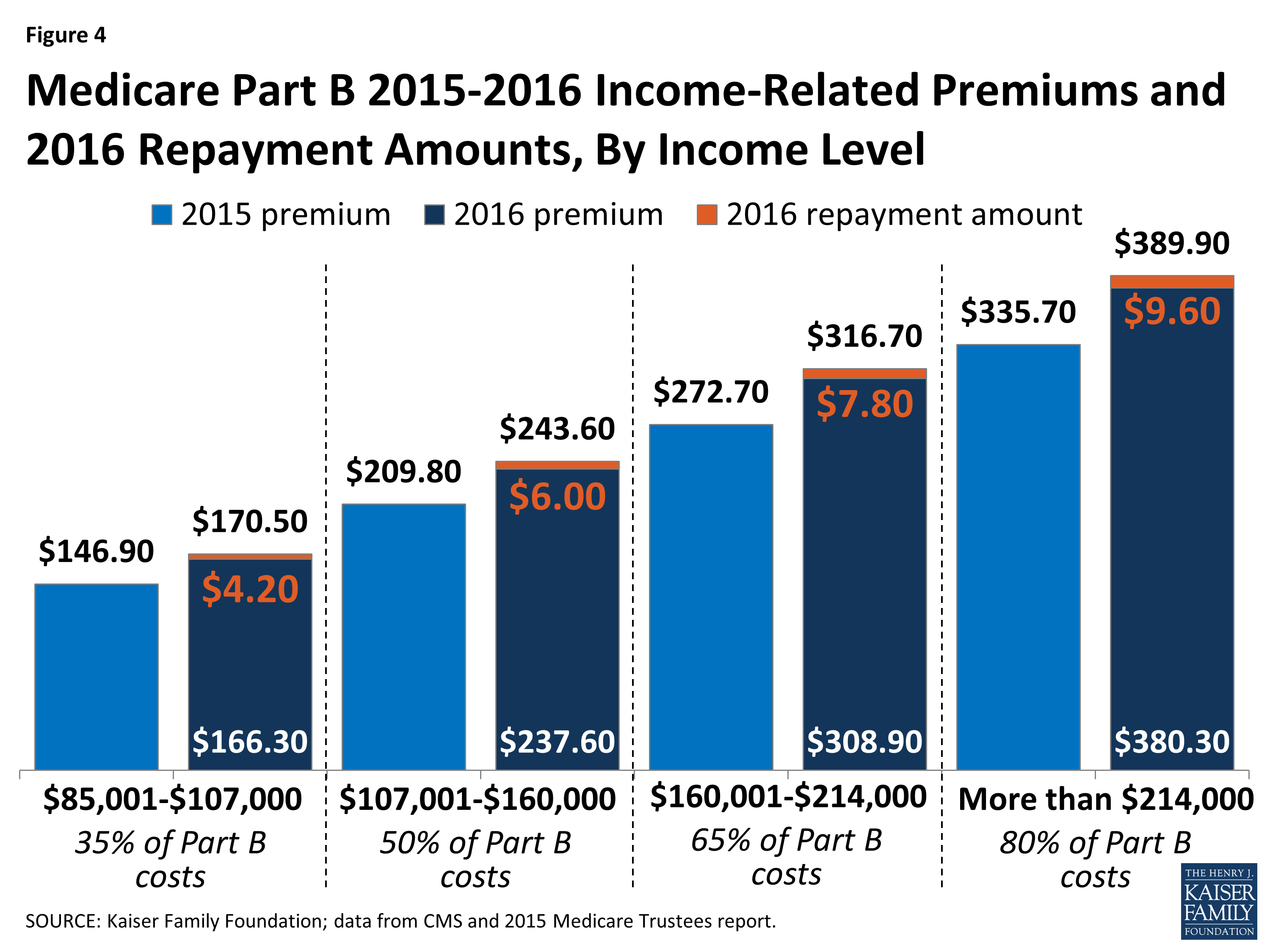

What s In Store For Medicare s Part B Premiums And Deductible In 2016

https://www.kff.org/wp-content/uploads/2015/11/8804-figure-1.png?resize=698

MACRA s Medicare Part B Payments Under MIPS Coker

https://cokergroup.com/wp-content/uploads/2019/03/MACRA’S-MEDICARE-PART-B-PAYMENTS-UNDER-MIPS.jpg

https://accountinginsights.org › where-do-i-deduct...

Medicare Part B premiums may qualify as deductible medical expenses under the Internal Revenue Code IRC Section 213 These expenses are deductible only if they exceed

https://accountinginsights.org › can-medicare-b...

Medicare Part B premiums are a significant expense for many retirees often deducted directly from Social Security benefits Understanding whether these premiums can

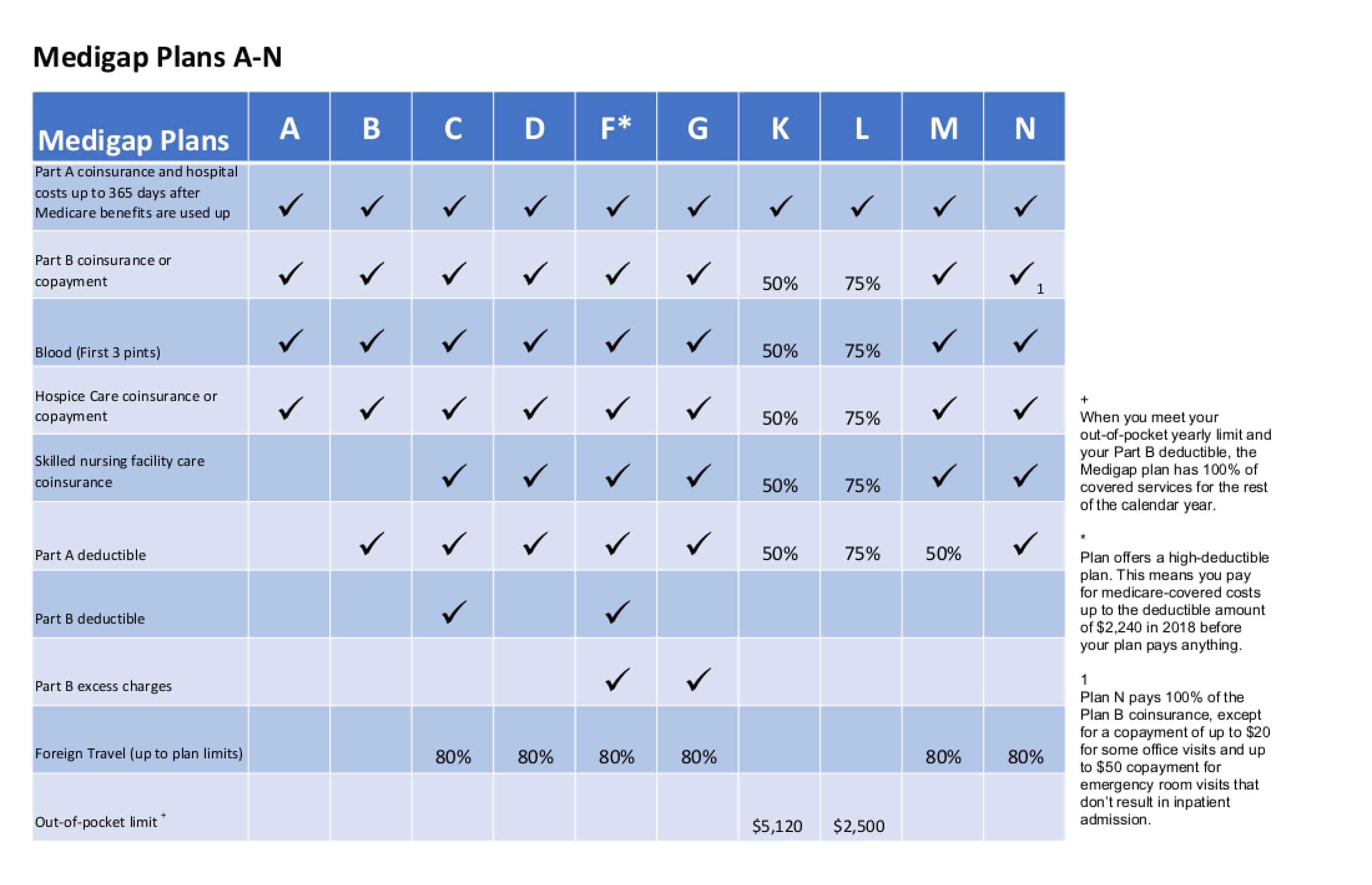

Medicare Plan G Vs Plan N Medicare Hero Free Download Nude Photo Gallery

What s In Store For Medicare s Part B Premiums And Deductible In 2016

Medicare Part D Costs 2019

What Income Is Used For Medicare Part B Premiums MedicareTalk

Medicare Cost 2023 Part B Premium And Deductible Decrease Bob s

Medicare Part B Premium 2024 Chart

Medicare Part B Premium 2024 Chart

Kaiser Medicare Plans Sales USA Save 54 Jlcatj gob mx

Medicare Supplements Freedom Connect

What s In Store For Medicare s Part B Premiums And Deductible In 2016

Are Medicare Part B Payments Deductible - Medicare Part B premiums covering outpatient care and doctor services are deductible for those who itemize The standard monthly premium for Part B in 2024 is