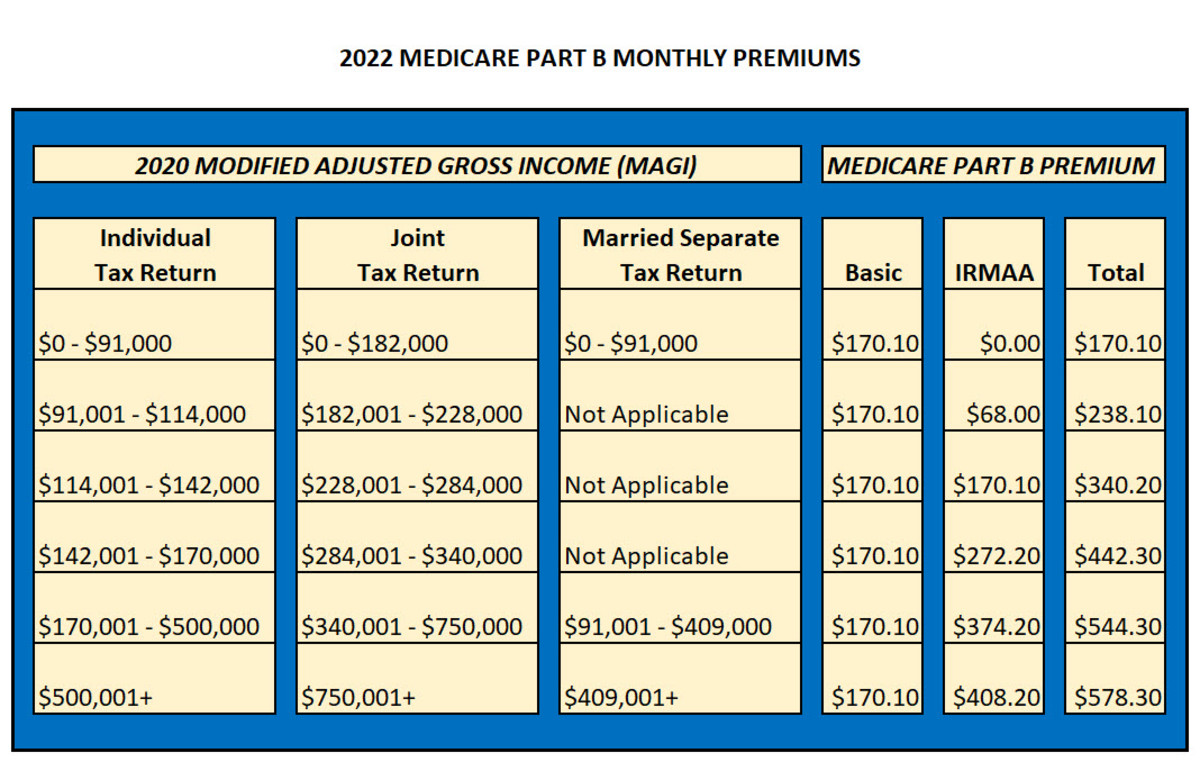

Are Medicare Part B Premiums Included In Taxable Income If you have to pay a high income surcharge for Part B premiums also called the Income Related Monthly Adjustment Amount IRMAA your full premiums

Part B premiums are tax deductible as long as you meet the income rules Part C premiums You can deduct Part C premiums if you meet the income rules Part What is the Medicare Part B deductible for 2023 The deductible for Medicare Part B is 240 in 2024 Once you ve spent that amount out of pocket for Part B services Medicare will

Are Medicare Part B Premiums Included In Taxable Income

Are Medicare Part B Premiums Included In Taxable Income

https://help.ihealthagents.com/hc/article_attachments/16628776683415

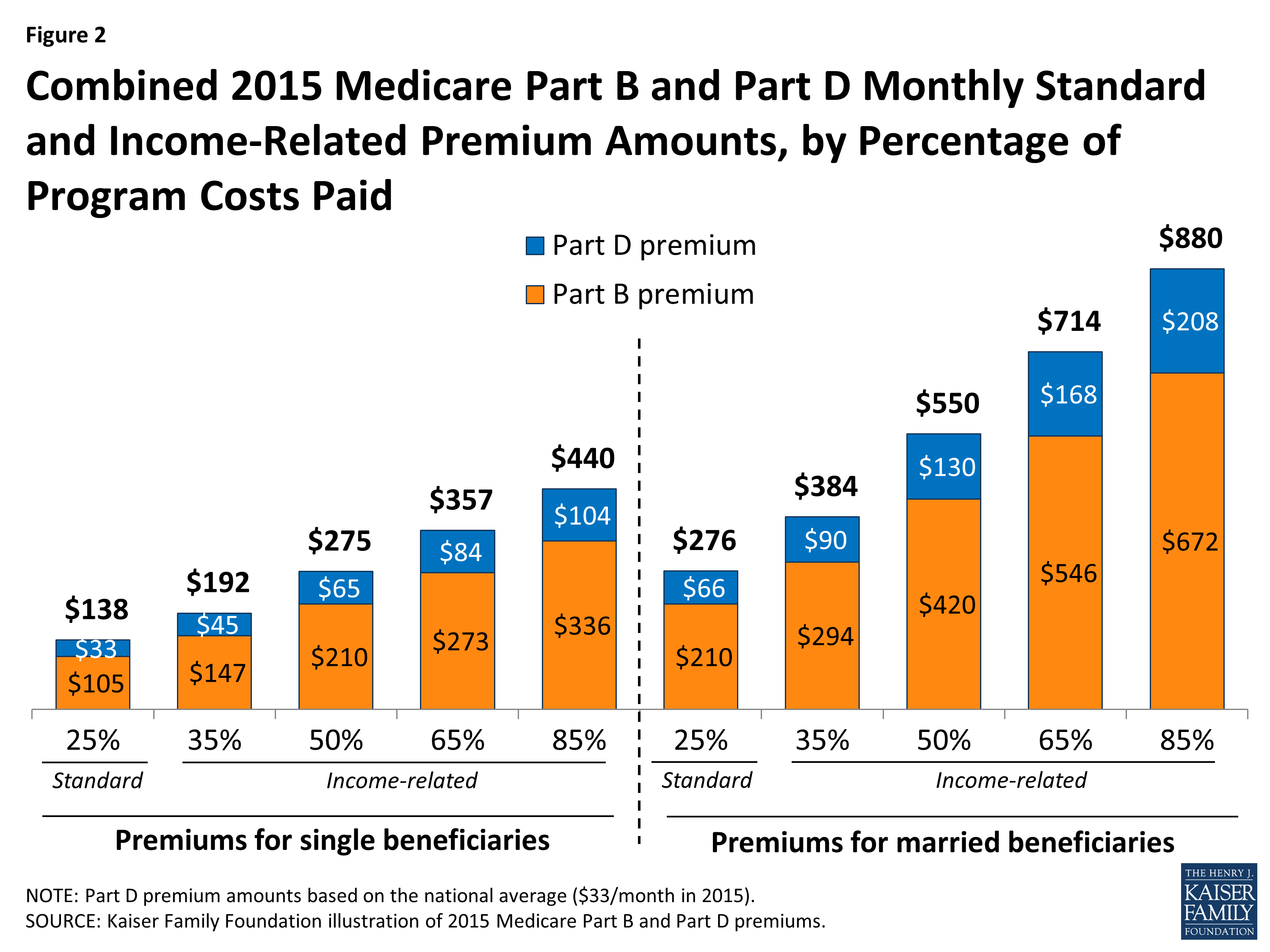

2022 Medicare Part B Premiums Announced Retirement Daily On TheStreet

https://www.thestreet.com/.image/t_share/MTg1MzUwNzg3MTAxMTA3ODM5/historic-irmaa.png

How Much Is Medicare Deductible For 2021 MedicareTalk

https://www.medicaretalk.net/wp-content/uploads/2020-part-b-premiums-archives-medicare-life-health.jpeg

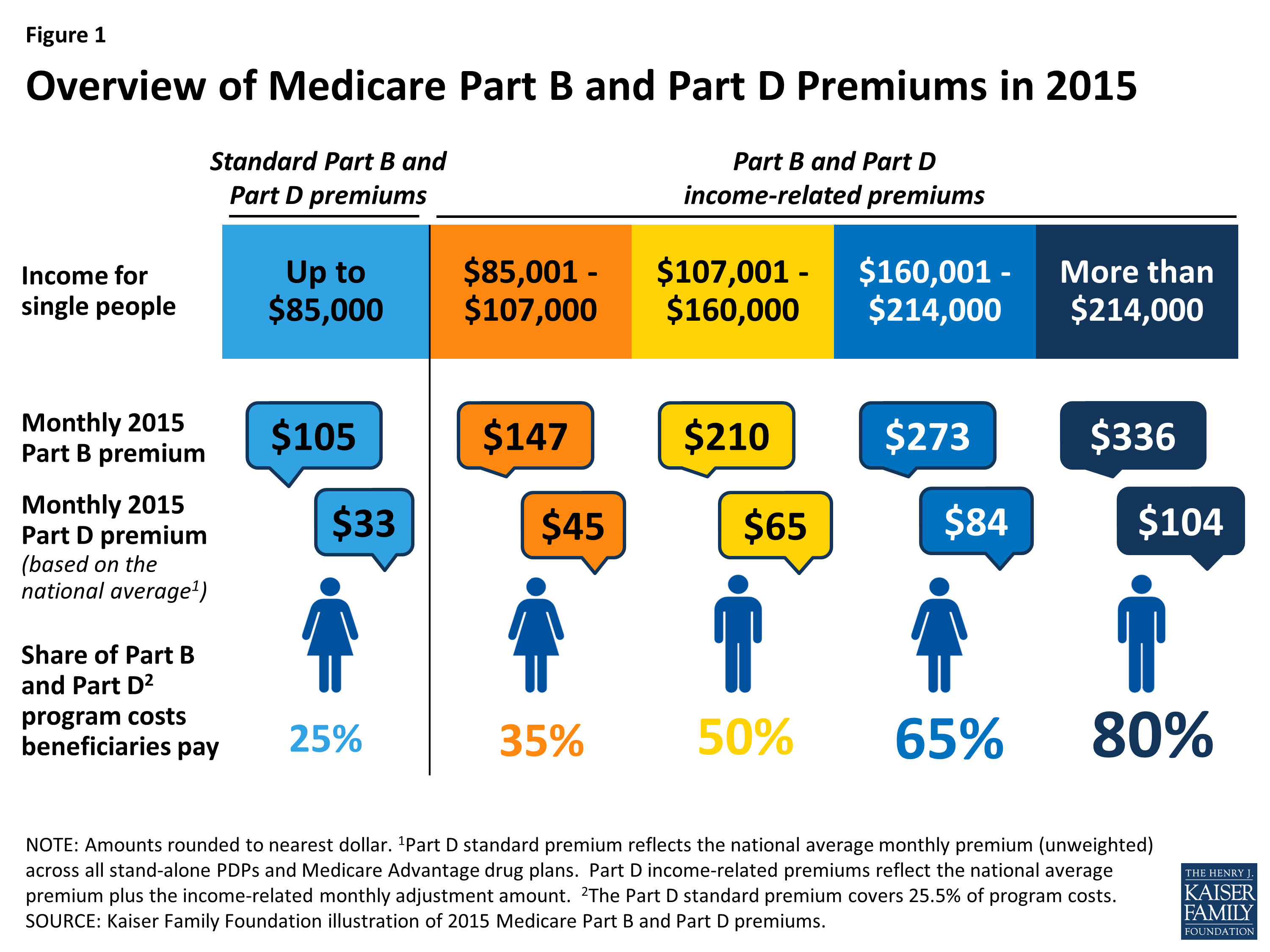

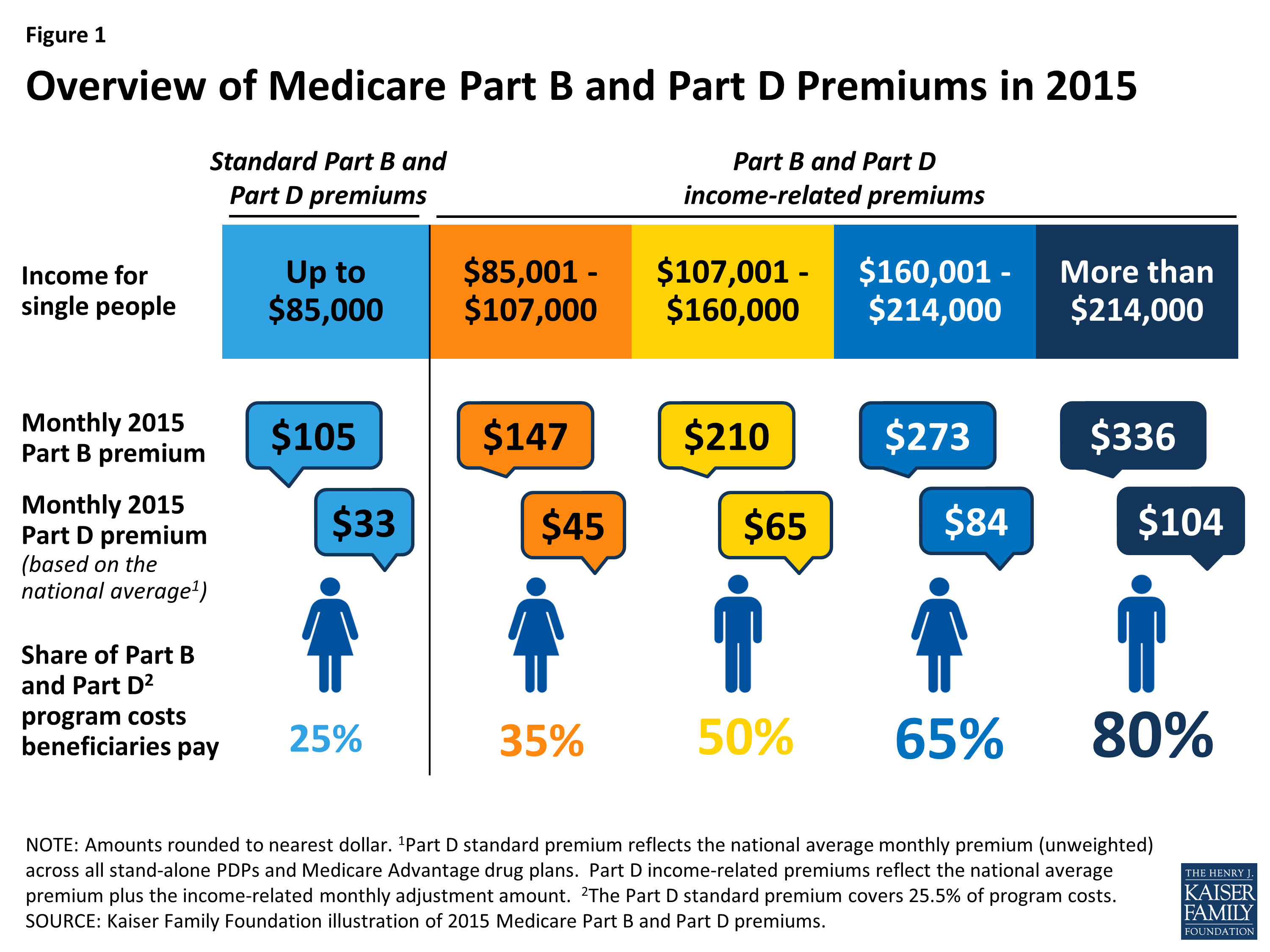

The law requires an adjustment to your monthly Medicare Part B medical insurance and Medicare prescription drug coverage premiums If You Have a Higher Income If you Medical expenses include dental expenses and in this publication the term medical expenses is often used to refer to medical and dental expenses You can deduct on Schedule A Form 1040 only

To do this you ll need to keep receipts and records to prove the expenses If you have an AGI of 60 000 for example you ll be able to deduct any medical expenses that exceed 4 500 That first 4 500 isn t As long as you use them for a qualified medical expense which includes premiums for Medicare Parts A B C and D you don t have to pay taxes on the

Download Are Medicare Part B Premiums Included In Taxable Income

More picture related to Are Medicare Part B Premiums Included In Taxable Income

How Much Is Medicare A B MedicareTalk

https://www.medicaretalk.net/wp-content/uploads/medicare-part-b-coverage-medicare-plan-finder.png

IRMAA Income Related Monthly Adjustment Amounts Guide To Health

https://d33v4339jhl8k0.cloudfront.net/docs/assets/5f43fba9042863444aa0c3c3/images/635832dd2a22cc147576cbdf/file-3okIMoYMRM.png

2023 IRMAA Part B Premiums Get Insurance Anywhere

https://www.getinsuranceanywhere.com/media/2023-IRMAA-Part-B-Premiums.png

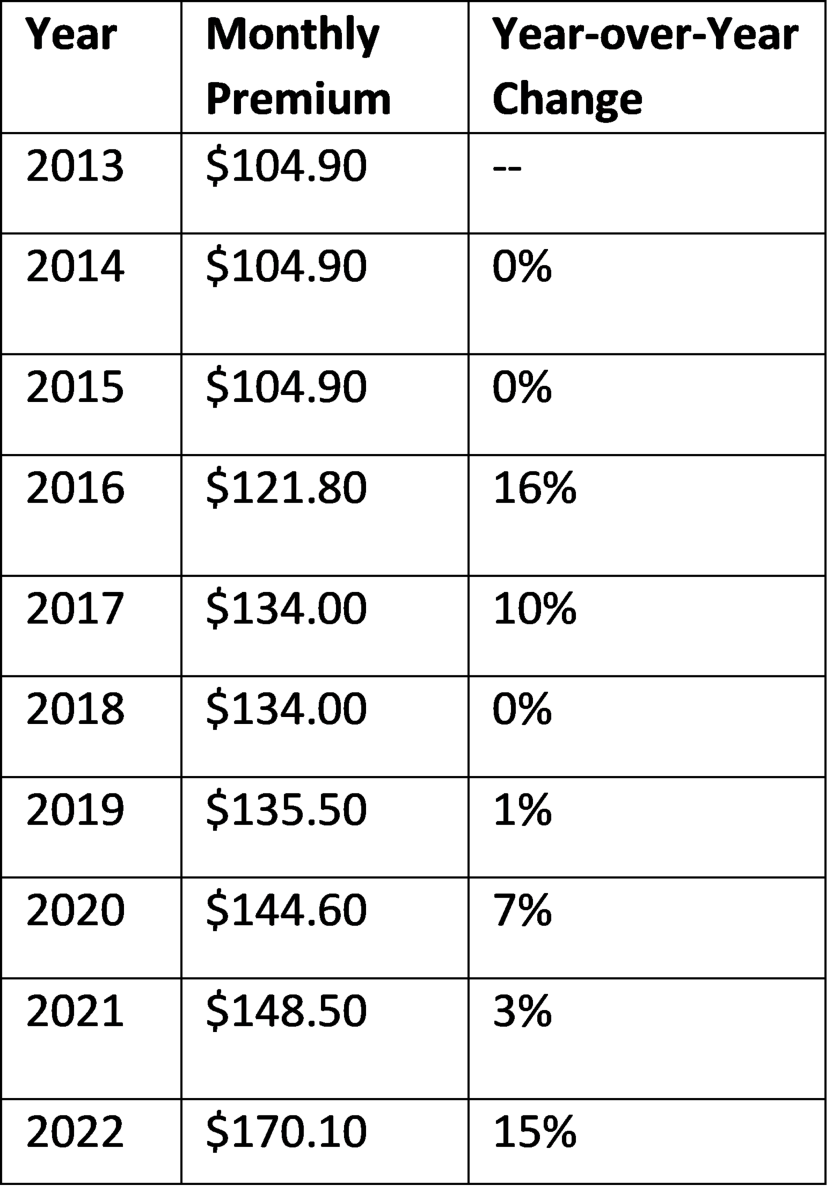

The standard monthly premium for Medicare Part B enrollees will be 148 50 for 2021 an increase of 3 90 from 144 60 in 2020 The annual deductible for all Medicare B This is supplemental insurance and you can include it Medicare Part D This is voluntary insurance and it s always includable You can deduct medical

The Medicare Trustees report estimates that the lowest possible monthly premium for Medicare Part B 164 90 in 2023 could rise to over 230 per person in The Part B premium on the other hand is based on income In 2020 the monthly premium starts at 144 60 referred to as the standard premium Once you exceed

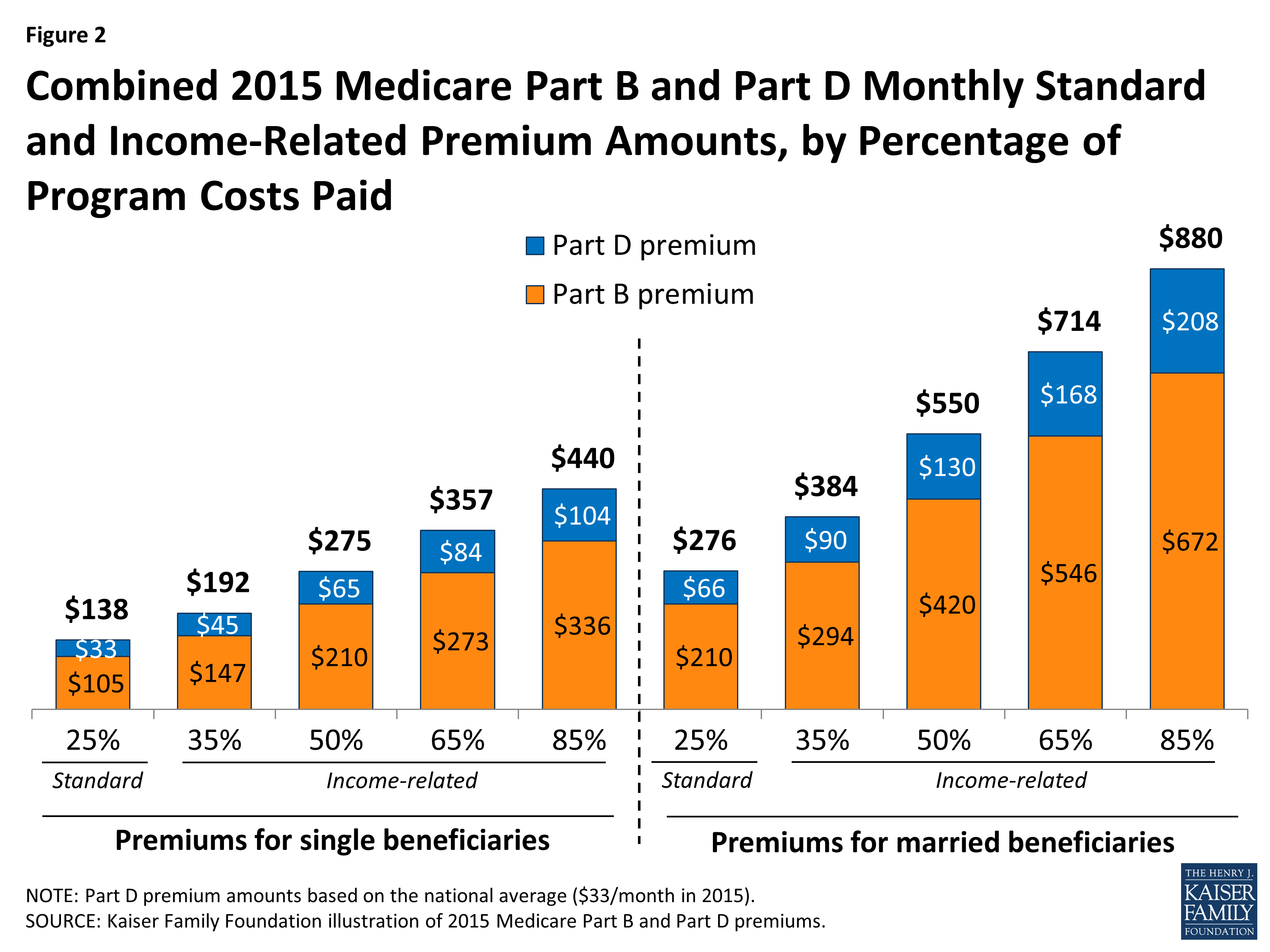

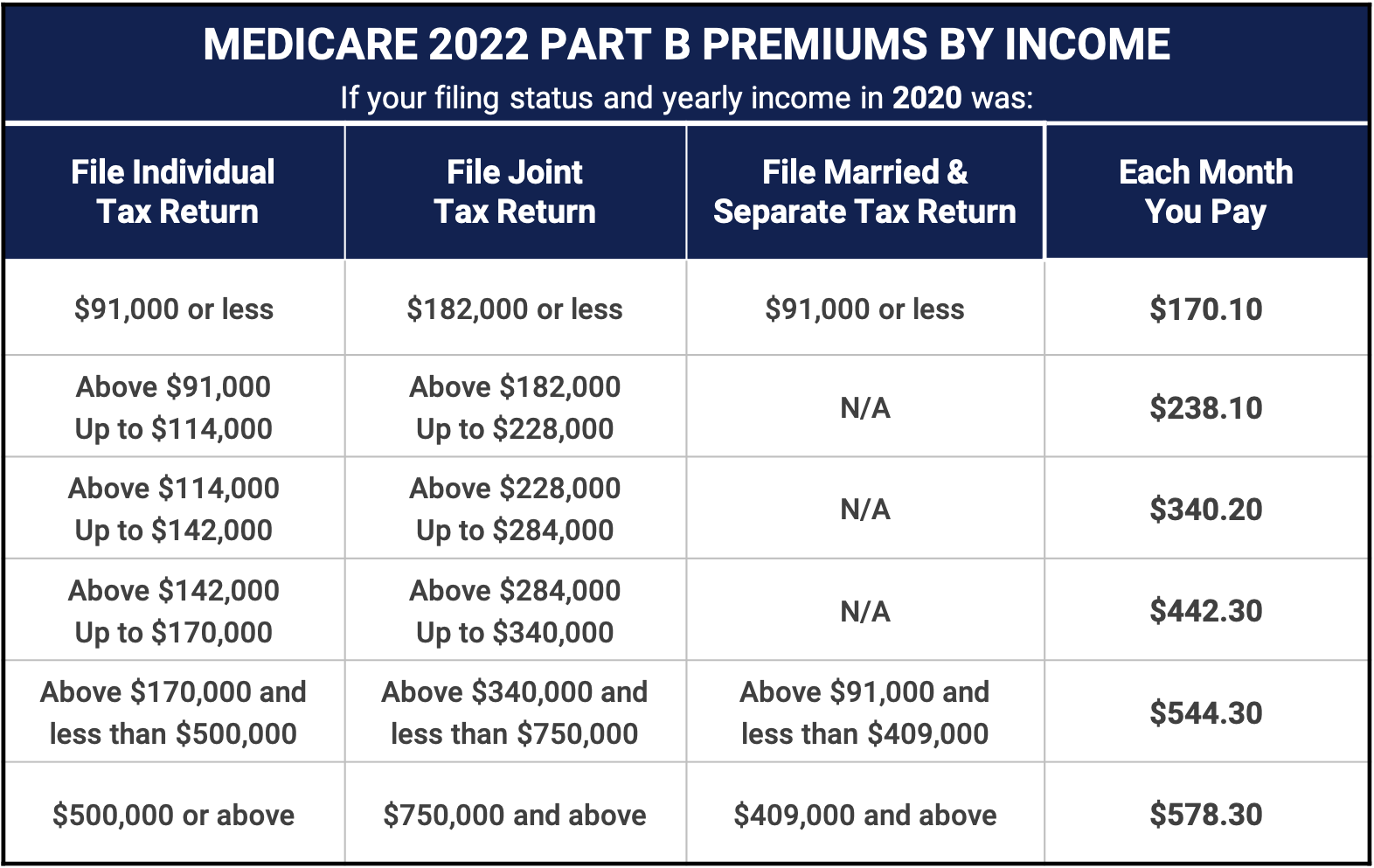

Medicare s Income Related Premiums A Data Note KFF

https://www.kff.org/wp-content/uploads/2015/05/8706-figure-1.png?resize=2048

2023 Medicare Parts A B Premiums And Deductibles 2023 Medicare Part D

https://trustedmedicareanswers.com/wp-content/uploads/2022/09/Full-Coverage-Part-B.jpg

https://www.aarp.org/health/medicare-qa-tool/are...

If you have to pay a high income surcharge for Part B premiums also called the Income Related Monthly Adjustment Amount IRMAA your full premiums

https://www.healthline.com/health/medicare/is-the...

Part B premiums are tax deductible as long as you meet the income rules Part C premiums You can deduct Part C premiums if you meet the income rules Part

How Does Income Affect Medicare Part B Premiums Retirement Daily On

Medicare s Income Related Premiums A Data Note KFF

Medicare Announces 2023 Medicare Cost Senior HealthCare Solutions

Cost Of Medicare Part B In 2023 Q2023H

Medicare Part B Premiums Will Go Up If You Don t Watch Your Income

Medicare s Income Related Premiums A Data Note KFF

Medicare s Income Related Premiums A Data Note KFF

Medicare Cost Medicare Hero

Medicare Questions Medicare Frequently Asked Questions

Medicare s Income Related Premiums Under Current Law And Changes For

Are Medicare Part B Premiums Included In Taxable Income - Last year 2022 it went down by 170 10 each month for 2023 my monthly check was reduced by 329 70 How could this be When we spoke last year you