Are Medicare Part B Premiums Taxable You can withdraw money tax free from a health savings account HSA to pay Medicare premiums after you turn 65 including premiums for Medicare Part A Part B Part D prescription drug plans and Medicare

Yes your monthly Medicare Part B premiums are tax deductible However you can only benefit from the medical expense deduction by following specific rules You ll need to file your taxes in a certain way itemizing your Probably nothing needed Medicare part B and D premiums are carried to your medical expenses for itemized deduction If you take the standard deduction then you are not

Are Medicare Part B Premiums Taxable

Are Medicare Part B Premiums Taxable

https://www.gannett-cdn.com/-mm-/f50d65112840d65906f199ee8f6e8e21c838c6fe/c=0-625-3996-2883&r=x1683&c=3200x1680/local/-/media/2016/11/16/USATODAY/USATODAY/636149009520911237-GettyImages-513798878.jpg

What Are The 2024 Medicare Part B Premiums And IRMAA Independent

https://help.ihealthagents.com/hc/article_attachments/16628776683415

How To Pay For Part B Medicare MedicareTalk

https://www.medicaretalk.net/wp-content/uploads/medicare-part-b-what-does-it-cover-my-medicare-supplement-plan.png

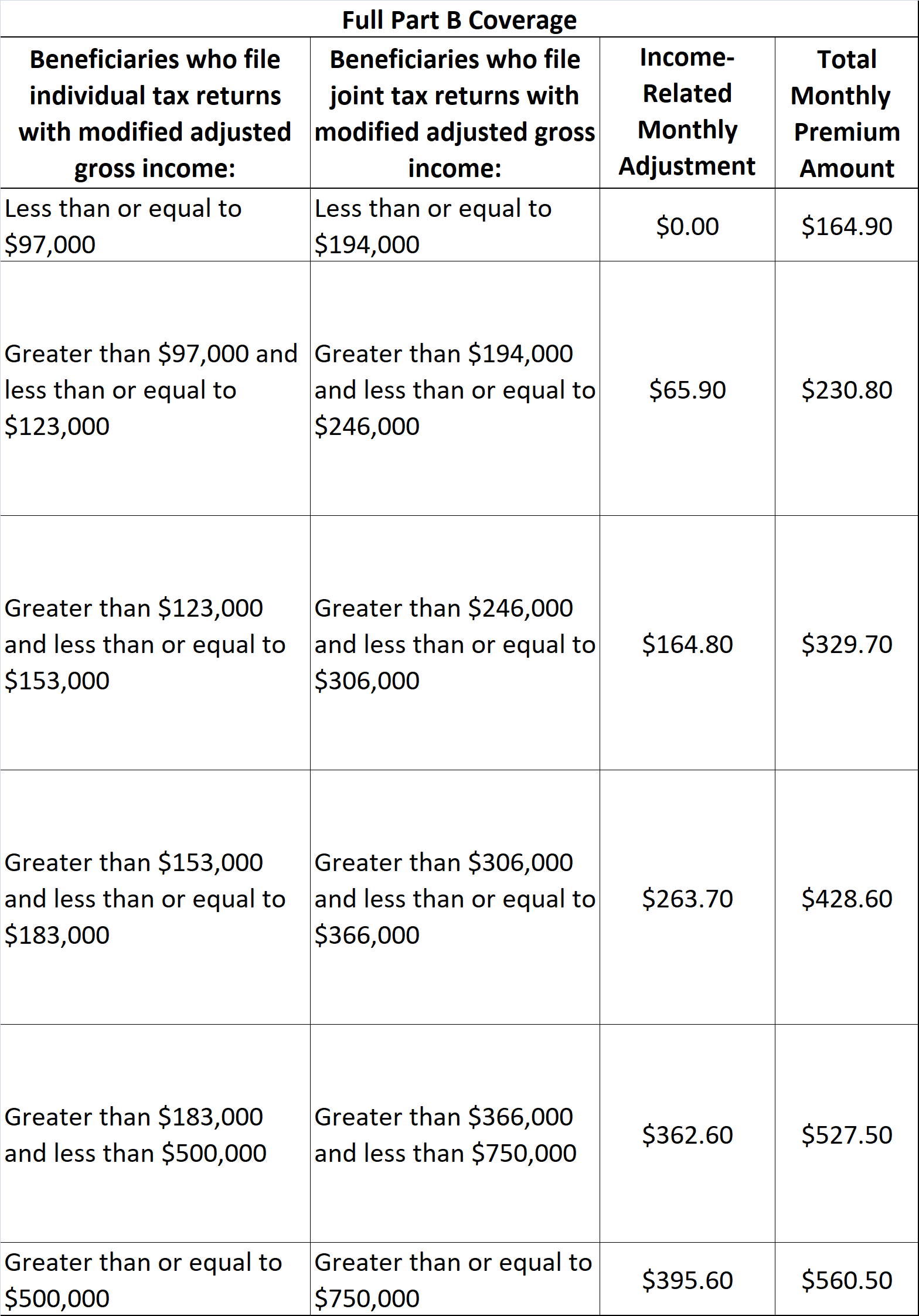

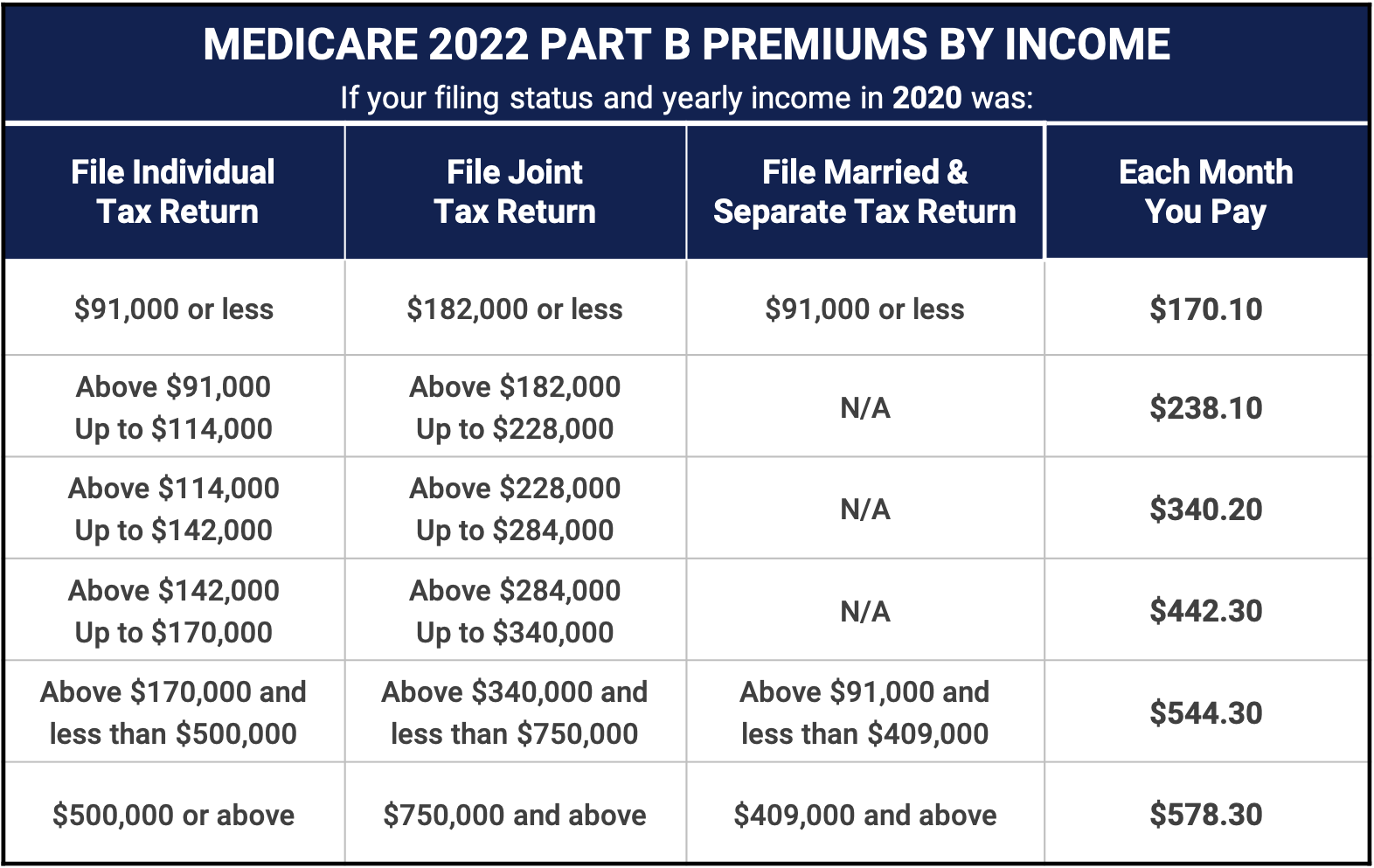

Medicare Part B premiums covering outpatient care and doctor services are deductible for those who itemize The standard monthly premium for Part B in 2024 is Part A Most people do not pay Part A premiums However if you do not qualify for premium free Part A you can deduct your monthly premium from your taxes Part B Part B premiums are dependent on income The standard

Part of the Medicare program known as Medicare Part B requires monthly premiums deducted from beneficiaries Social Security payments Social Security benefits are Yes you can deduct your Medicare Part B premiums However it typically requires you to itemize your deductions instead of opting for the standard deduction What insurance premiums are tax deductible

Download Are Medicare Part B Premiums Taxable

More picture related to Are Medicare Part B Premiums Taxable

Medicare Part B Premiums Rise For Some

https://s.yimg.com/uu/api/res/1.2/TTF6wjMWmMRyN6yRGXHQdQ--~B/aD04NDI7dz0xMjgwO3NtPTE7YXBwaWQ9eXRhY2h5b24-/http://media.zenfs.com/en-US/homerun/kiplinger.com/30375f7f858da93164af02caf9a154a6

Medicare Part B Premiums Springwater Wealth Management

https://springwaterwealth.com/wp-content/uploads/2020/03/Medicare-Part-B-Premiums-184515_992x675.png

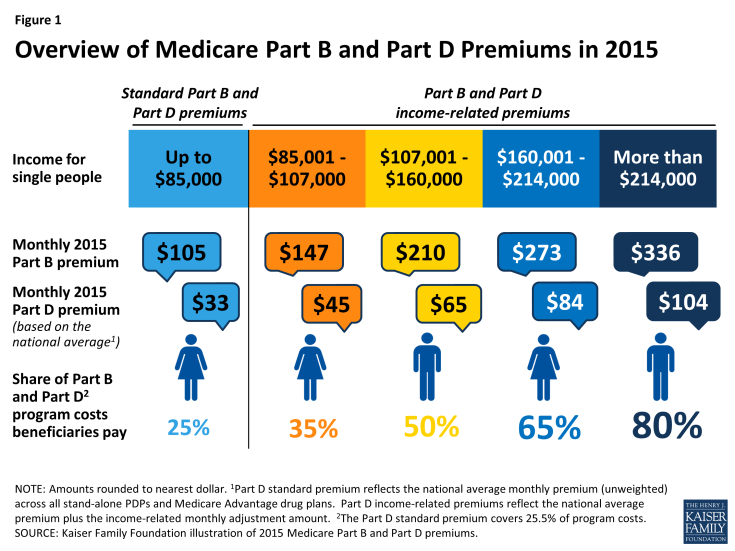

Medicare s Income Related Premiums A Data Note KFF

https://www.kff.org/wp-content/uploads/2015/05/8706-figure-1.png?w=735&h=551&crop=1

When dealing with medical expenses like those from Medicare Part B premiums paid out of pocket or long term care costs related to specific conditions you may ask if these are tax deductible The simple answer is yes If you re self employed and your business shows a profit you can claim your health insurance premiums as a tax deduction This includes premiums for Medicare Parts A and B Medicare Advantage Part D

Any medicare premiums paid for part B would be entered as an itemized deduction on Schedule A Just enter the SSA 1099 as received and if the medicare part B premiums are Are Medicare premiums deducted from Social Security tax deductible Yes In fact if you are signed up for both Social Security and Medicare Part B the portion of Medicare

2017 Medicare Part B Premiums Announced FedSmith

https://www.fedsmith.com/wp-content/uploads/2016/11/medicare-benjamins.jpg

Medicare Part B Premium 2024 Chart

https://medicarehero.com/wp-content/uploads/2022/09/2023-Medicare-Part-B-Premium-Chart.png

https://www.aarp.org › health › medicare-q…

You can withdraw money tax free from a health savings account HSA to pay Medicare premiums after you turn 65 including premiums for Medicare Part A Part B Part D prescription drug plans and Medicare

https://medicareguide.com

Yes your monthly Medicare Part B premiums are tax deductible However you can only benefit from the medical expense deduction by following specific rules You ll need to file your taxes in a certain way itemizing your

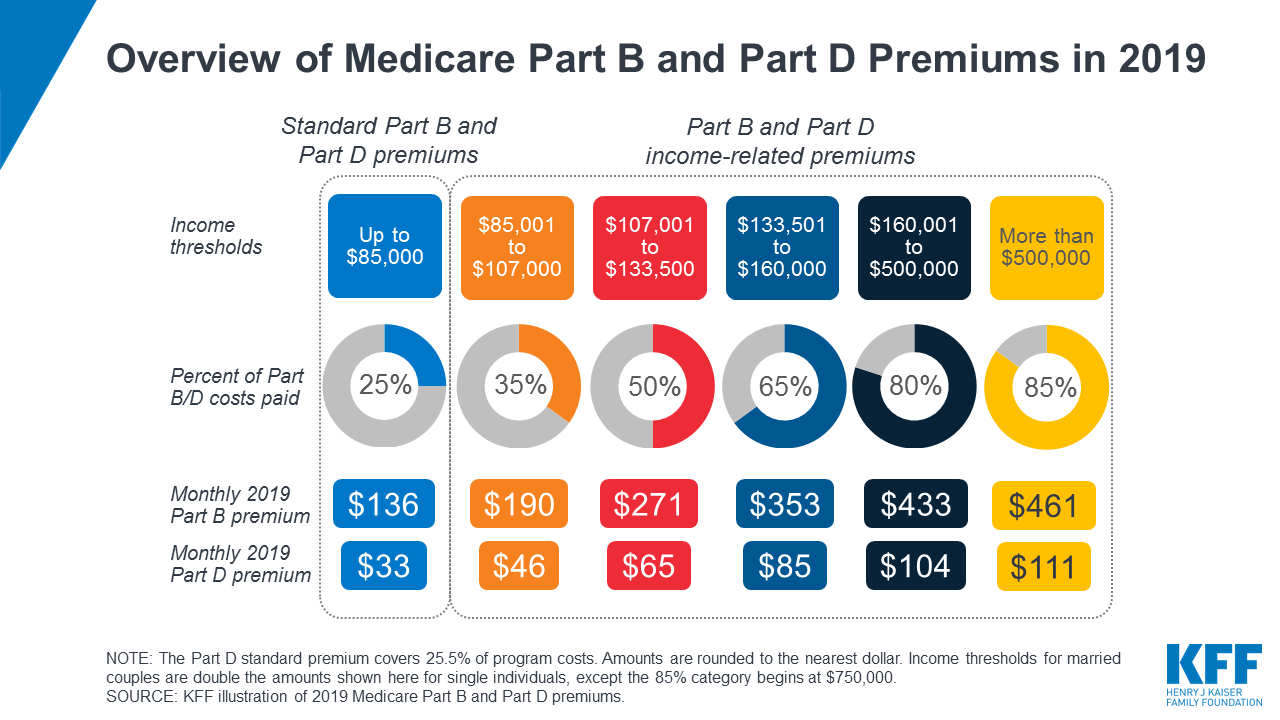

Medicare s Income Related Premiums Under Current Law And Changes For

2017 Medicare Part B Premiums Announced FedSmith

Medicare Part B Premiums To Rise 52 For 7 Million Enrollees

12 What Is The Best Supplemental Insurance For Medicare References

Medicare Part B Premiums For 2021

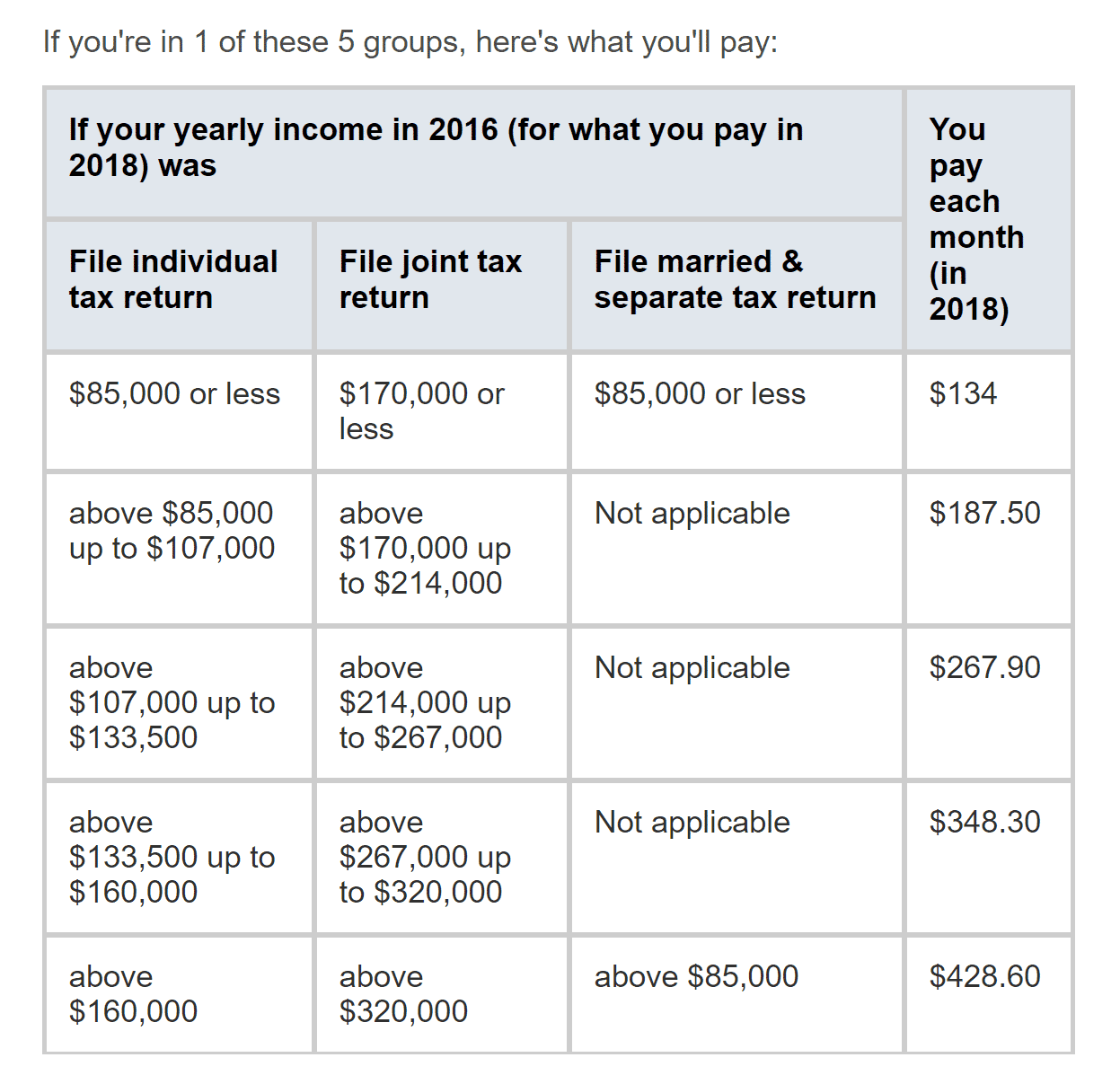

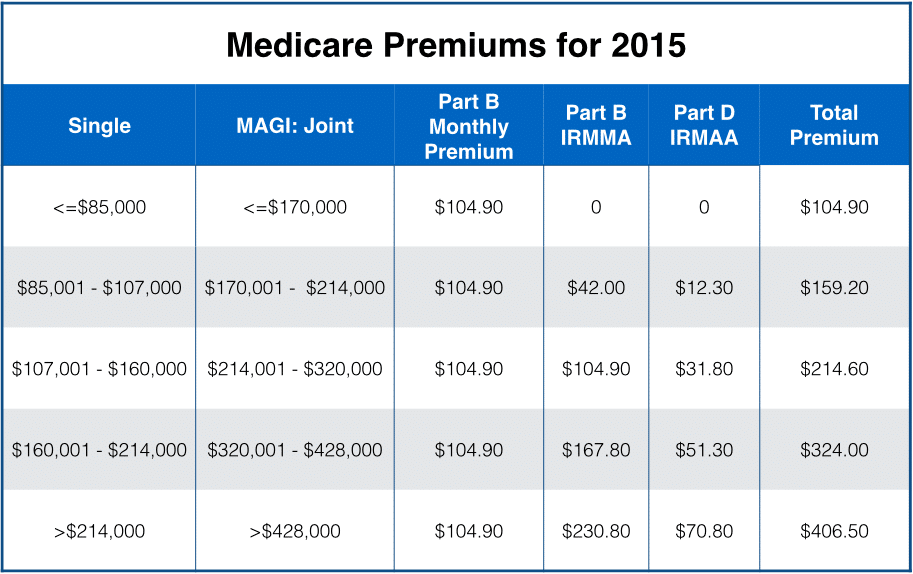

2012 Medicare Part B Monthly Premiums By Income Levels And Tax Filing

2012 Medicare Part B Monthly Premiums By Income Levels And Tax Filing

2023 Medicare Parts A B Premiums And Deductibles 2023 Medicare Part D

Medicare Cost Medicare Hero

How Medicare Sets Your Premium 2015 Medicare Premiums

Are Medicare Part B Premiums Taxable - As long as you use them for a qualified medical expense which includes premiums for Medicare Parts A B C and D you don t have to pay taxes on the money Note that other