Are Montana Property Taxes Paid In Arrears On November 22 2023 the Montana Supreme Court ruled that all county governments must collect the 95 mill state school equalization levy for Tax Year 2023 property tax collections rather than the 77 9 mils previously billed by 49 of the state s 56 counties Your county may be sending you a revised property tax bill that complies with Montana law

Annual tax bill is 1 200 January 1 through December 31 1 200 divided by 365 days 3 2877 per day January 1 through March 15 74 days 74 x 3 2877 243 29 charged to the seller and credited to the buyer The first half taxes become delinquent on December 1 The second half taxes become delinquent June 1 of the Owners who paid property taxes in 2022 can file to receive up to 675 back House Bill 222 provides a rebate for property taxes paid in tax years 2022 and 2023 Eligible taxpayers can begin to claim the rebate through the Montana TransAction Portal beginning August 15 2023 through October 1 2023

Are Montana Property Taxes Paid In Arrears

Are Montana Property Taxes Paid In Arrears

https://invoice-funding.co.uk/wp-content/uploads/2021/10/paid-in-arrears.jpg

What Does Paid In Arrears Mean

https://www.deskera.com/blog/content/images/2022/02/Untitled-design--20-.png

Thoughts After Paying My Montana Property Taxes This Week

https://townsquare.media/site/109/files/2022/12/attachment-Montana-property-tax.jpg?w=1200&h=0&zc=1&s=0&a=t&q=89

3 Tax bills are allocated proportionally to each property s share of the tax base This is typically done by calculating millage rates more on those in a bit but the important thing to understand is that your taxes are proportional to your taxable value So for example a home that represents 8 of the tax base is responsible for 8 of It is important to remember that property taxes are not limited to property owners Renters pay a portion of the property taxes paid on rental properties because the taxes are passed through by the landlords when setting the rent amount 7

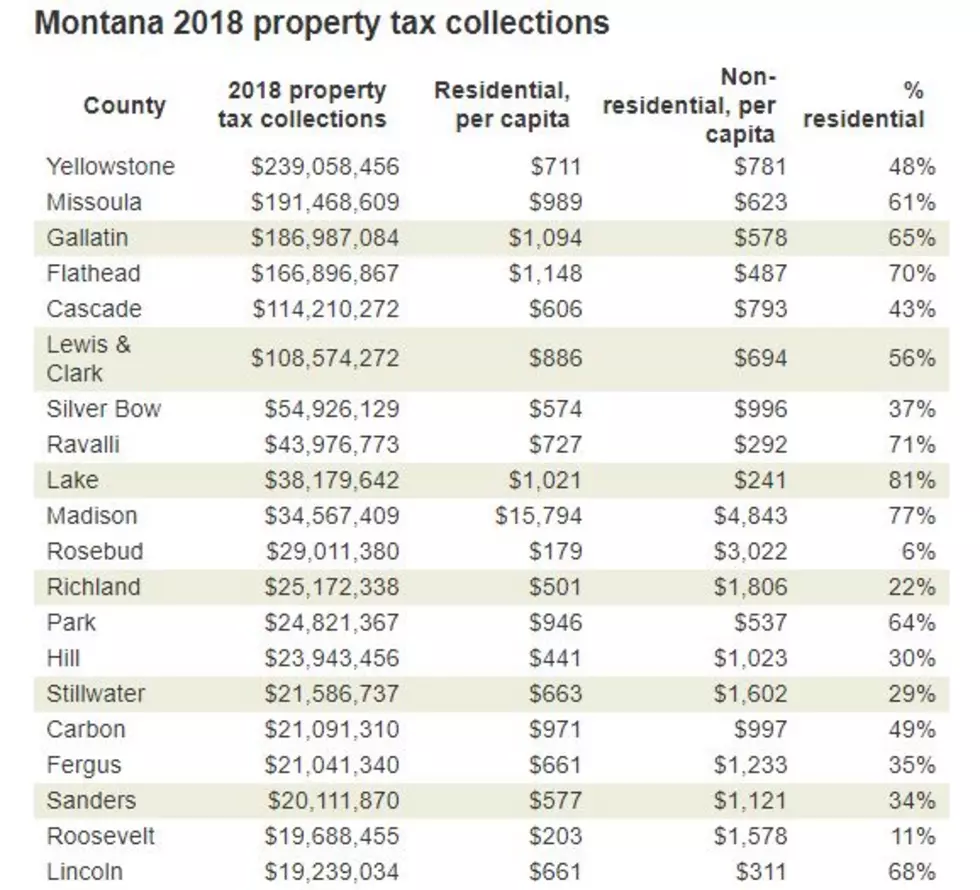

Property taxes are calculated locally by applying mills to a property s taxable value A mill is simply a unit of measurement and one mill will generate 1 dollar of property tax revenue for every 1 000 of a property s taxable value Each year local governments enact a mill levy which is a calculation determining how many Local Government Property Taxes Local total rate of property governments approximately tax collections in Montana rely on property taxes for 4 812 including per year Two those economic for schools benchmarks a and majority for local are of governments their used revenue for analysis have Since of grown TY growth 2001

Download Are Montana Property Taxes Paid In Arrears

More picture related to Are Montana Property Taxes Paid In Arrears

Montana Property Taxes Keep Rising But Missoula Isn t At The Top

https://townsquare.media/site/1098/files/2020/02/Taxes-4.jpg?w=980&q=75

Are Property Taxes Paid In Advance Or Arrears

https://media.marketrealist.com/brand-img/ez9902DsJ/0x0/are-property-taxes-paid-in-advance-1646972118878.jpg

Proposed 2022 Initiative Would Cap Montana Property Taxes Assessment

https://townsquare.media/site/1098/files/2018/08/housing-2.jpg?w=980&q=75

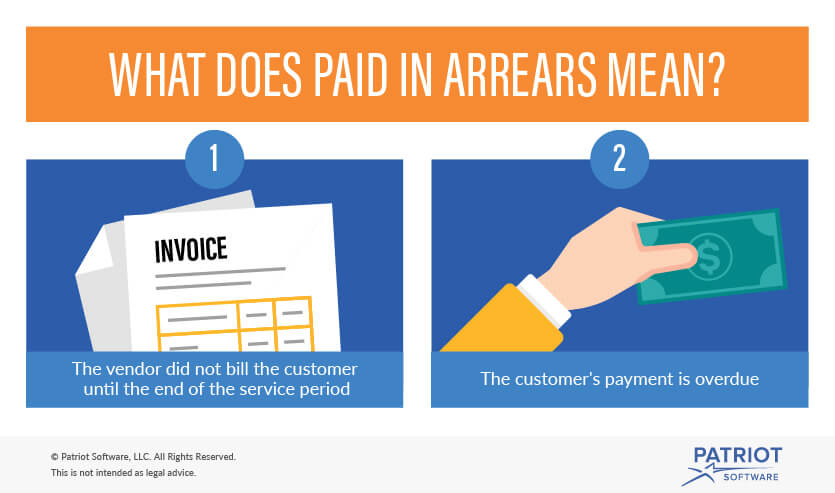

Property taxes explained with pictures This hypothetical shows how property taxes can spread the cost of running a very small school district between the five properties in the district s tax base Property taxes are the primary way Montanans pay for local government services including schools law enforcement and fire departments Edward obrien umt edu 406 243 4065 See stories by Edward F O Brien Property tax sticker shock swept through Montana this fall with many homeowners opening bills to find a spike of 20 or more Since then a blame game has erupted between lawmakers counties and the governor over who or what is responsible for the surge

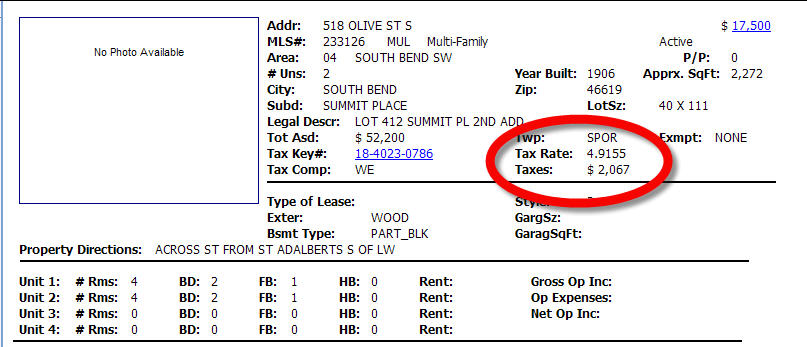

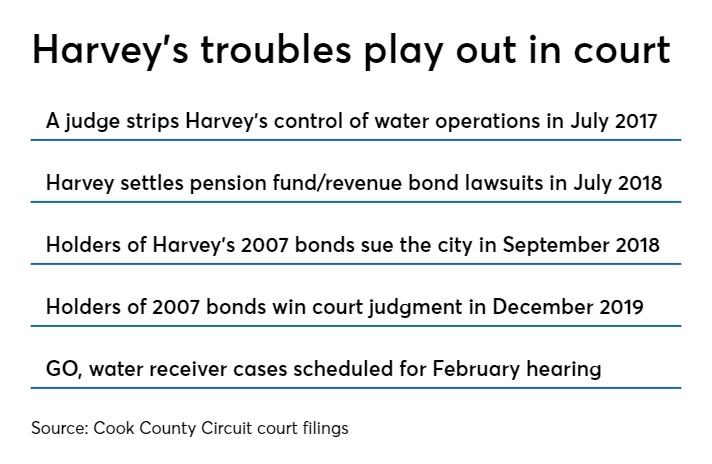

Look up the amount of property taxes you paid by using your County s Online Property Tax Lookup Below you will find a direct link to all Montana Counties who have an online platform for property owners to lookup their property tax bill information Another example of a state where property taxes are paid in arrears is Illinois Each county determines their schedule for property taxes Cook County s taxes are due on June 1 the first installment and September 1 the final payment But the taxes the Illinois homeowner pays on June 1 and September 1 are installments of the prior year s taxes

Indiana Property Taxes Paid In Arrears

http://realst8.com/images/518-olive-taxes.jpg

Where Do People Pay The Most In Property Taxes Prisma Professional

https://files.taxfoundation.org/20220912162330/Median-property-taxes-by-county-paid-property-tax-rankings.png

https:// mtrevenue.gov /property

On November 22 2023 the Montana Supreme Court ruled that all county governments must collect the 95 mill state school equalization levy for Tax Year 2023 property tax collections rather than the 77 9 mils previously billed by 49 of the state s 56 counties Your county may be sending you a revised property tax bill that complies with Montana law

https:// blog.alliancetitle.com /2017/11/...

Annual tax bill is 1 200 January 1 through December 31 1 200 divided by 365 days 3 2877 per day January 1 through March 15 74 days 74 x 3 2877 243 29 charged to the seller and credited to the buyer The first half taxes become delinquent on December 1 The second half taxes become delinquent June 1 of the

Are Property Taxes Paid In Arrears In Texas YouTube

Indiana Property Taxes Paid In Arrears

As Montana Property Taxes Climb Drumbeat For Tourist Tax Grows

Are Property Taxes Paid In Advance Or Arrears

Something Needs To Be Done About Montana Property Taxes

Illinois Property Taxes Paid In Arrears

Illinois Property Taxes Paid In Arrears

When Are Real Estate Taxes Paid In Arrears S Ehrlich

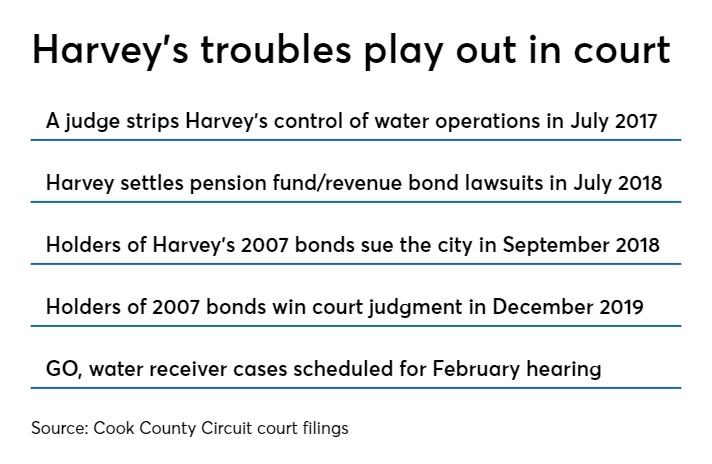

What Does Paid In Arrears Mean Arrears Meaning

What Does Paid In Arrears Mean Arrears Meaning

Are Montana Property Taxes Paid In Arrears - An example of paying a property tax in arrears is like being billed in 2022 for the services the local government offered in 2021 Whether you need to prepay or postpay the property tax on your