Are Pensioners Exempt From Income Tax Both the definition of pension scheme and the exemption required in the residence state of pension recipients are contained in the US Model income tax treaty 2006 and in many treaties concluded by the US in the 21st Century

Exempt E most investment growth of the assets held within registered pension schemes is exempt from income and capital gains tax Taxed T Most payments to scheme members are The Government of India provides some exemptions in order to reduce your income tax burdens Section 10 of the Income tax Act 1961 talks about those exemption provisions and the terms and conditions on which one can avail a tax exemption Here s more on this matter

Are Pensioners Exempt From Income Tax

Are Pensioners Exempt From Income Tax

https://www.theportugalnews.com/uploads/news/page1_pension_people_1.jpg

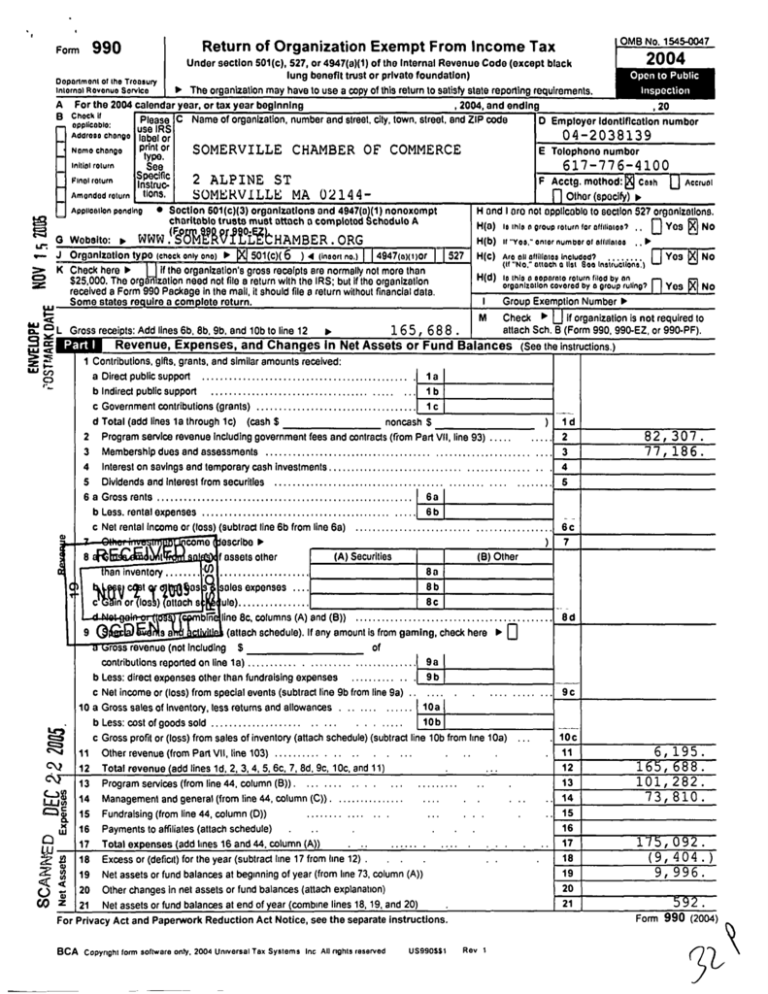

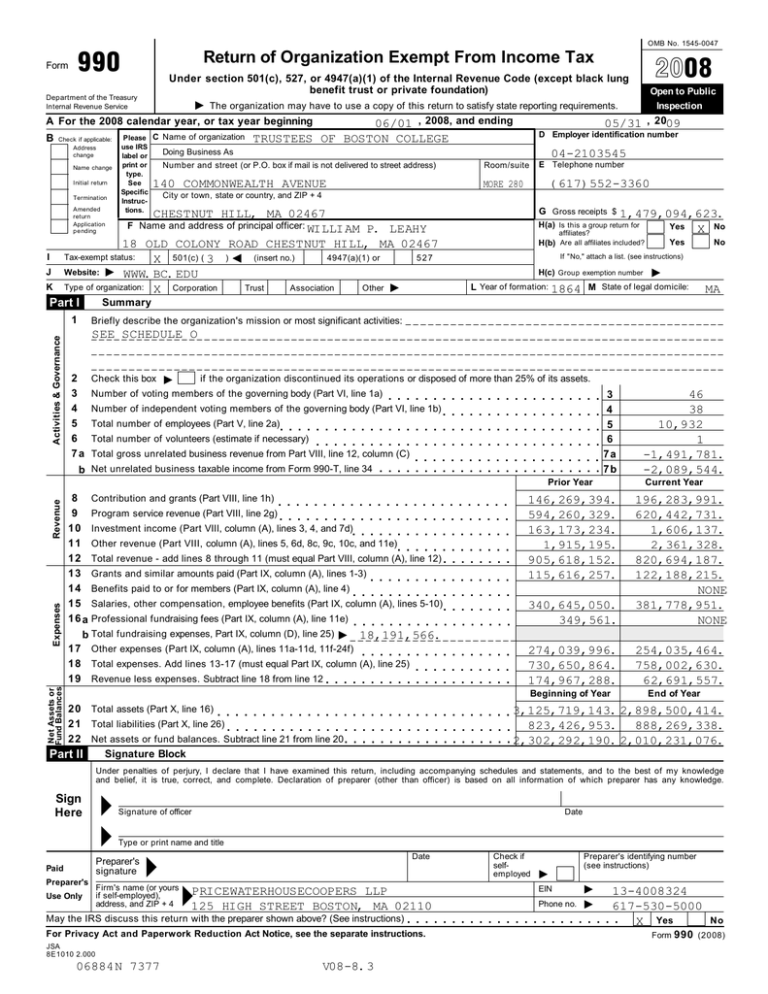

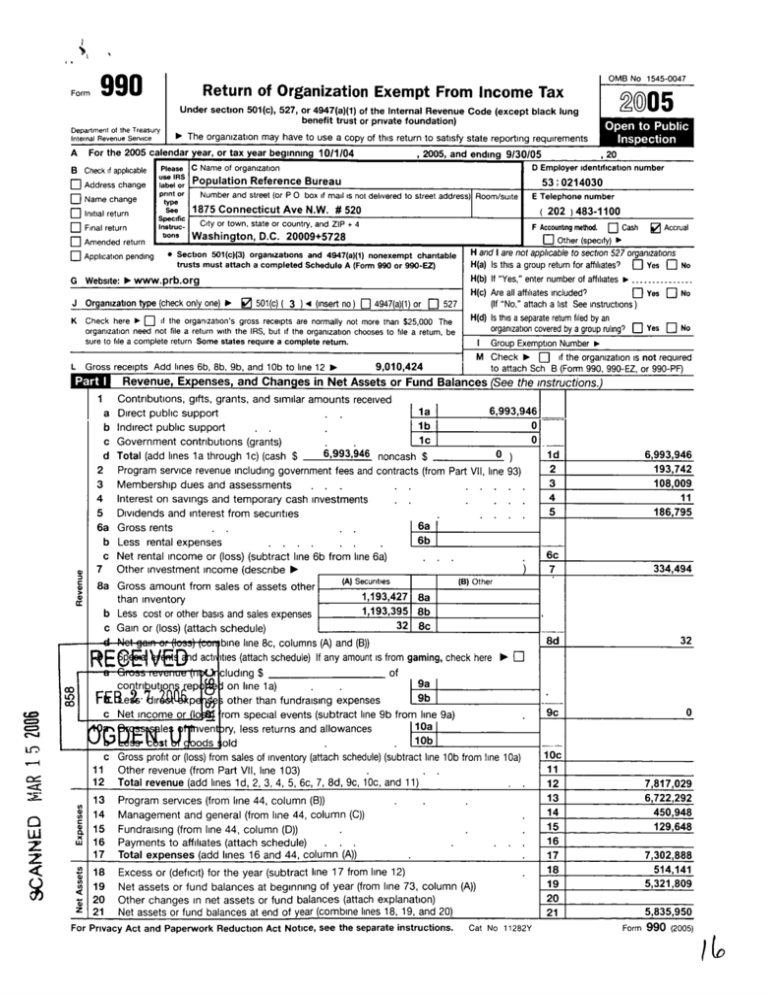

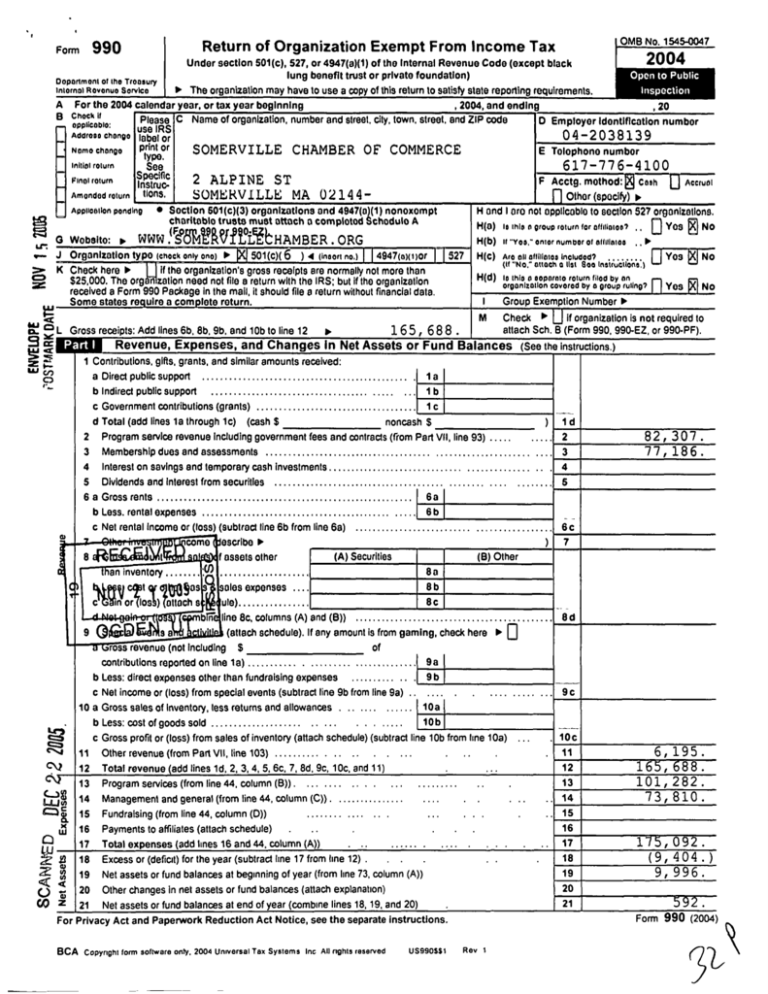

Return Of Organization Exempt From Income Tax

https://s3.studylib.net/store/data/008803372_1-0745cfb1d5b84f2ed4a8a101bc9718d1-768x994.png

Central Government Pensioners ALERT Senior Citizens Can Avoid Paying

https://english.cdn.zeenews.com/sites/default/files/2022/12/05/1125724-income-tax-pixabay1.jpg

Certain pensions are exempt from Income Tax when paid to recipients who are not resident in the UK A person is taken to be not resident only if a successful claim is made to HMRC Yes pension income is taxable under the head salaries What is the ITR limit for pensioners The ITR limit for pensioners is based on the total income and age For senior citizens aged 60 80 years income up to Rs 3 00 000 is exempted from tax

You may have to pay Income Tax at a higher rate if you take a large amount from a private pension You may also owe extra tax at the end of the tax year Pensioners individuals who receive regular payments from a fund or employer post retirement are subject to income tax on their pension income Nevertheless pensioners also enjoy specific benefits and exemptions under the Income Tax Act of 1961 aimed at reducing their overall tax liability

Download Are Pensioners Exempt From Income Tax

More picture related to Are Pensioners Exempt From Income Tax

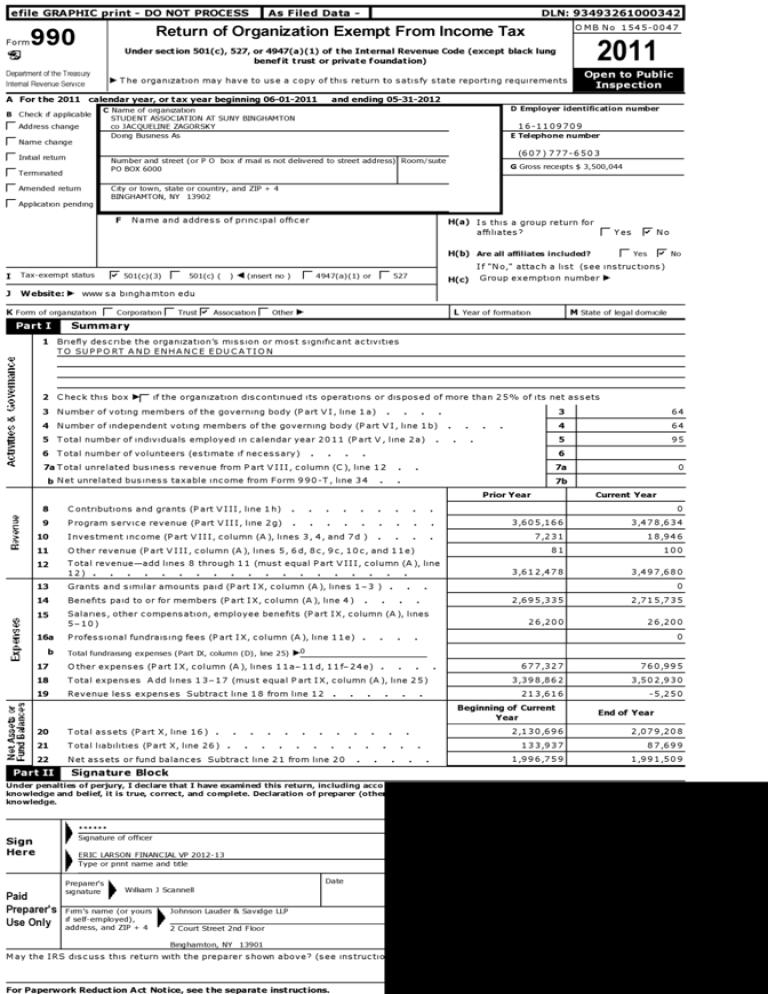

Return Of Organization Exempt From Income Tax

https://s3.studylib.net/store/data/008745489_1-48b7bcba1320697857246c3686c37f93-768x994.png

/non-profit-sales-tax-rules-56d49ae03df78cfb37d83da5.jpg)

Sales Tax Considerations For Non Profit Organizations

https://fthmb.tqn.com/TkBu74BN521MLc-ZQ6f3Ppme2QY=/1746x1722/filters:fill(auto,1)/non-profit-sales-tax-rules-56d49ae03df78cfb37d83da5.jpg

Return Of Organization Exempt From Income Tax

https://s2.studylib.net/store/data/011162563_1-682d946a30ca6322d9d33ebd26b9794a-768x994.png

Finance Act 2021 inserted a new section 194P which provided conditions for exempting senior citizens from filing income tax returns aged 75 years and above New Section 194P will become applicable from 1st April 2021 If you are a pensioner with more than one source of annuity income the South African Revenue Service SARS has changed the way your PAYE tax is calculated so that you pay more in tax each

A new tax exemption pertaining to pension income has been introduced through the publication of Legal Notice LN 98 of 2022 which was recently amended by Legal Notice 220 of 2022 the updated legislation is entitled Pensions Tax Income from military pensions is tax exempt The exemption amount for pension and annuity income is 20 000 which means some taxpayers may qualify for a total exemption of 40 000

Money Received From Relatives Is Exempt From Income Tax

https://cdn.dnaindia.com/sites/default/files/styles/full/public/2019/06/25/840973-itr-filing-istock-052219.jpg

Return Of Organization Exempt From Income Tax

https://s3.studylib.net/store/data/008733308_1-2ea0af8207645bfb0c93fee46f07cfef-768x994.png

https://kluwertaxblog.com/2015/04/08/employees-of...

Both the definition of pension scheme and the exemption required in the residence state of pension recipients are contained in the US Model income tax treaty 2006 and in many treaties concluded by the US in the 21st Century

https://www.gov.uk/.../pensions-tax-manual/ptm024100

Exempt E most investment growth of the assets held within registered pension schemes is exempt from income and capital gains tax Taxed T Most payments to scheme members are

Pensioners Body Urges Govt To Exempt Pension From Income Tax Seeks PM

Money Received From Relatives Is Exempt From Income Tax

These Are The Pensioners Exempt From Making The Income Statement In

Georgia Sales Tax Exemption Form St 5 ExemptForm

Return Of Organization Exempt From Income Tax The Nature Fill

2017 PAFPI Certificate of TAX Exemption Certificate Of

2017 PAFPI Certificate of TAX Exemption Certificate Of

Illinois Tax Exempt Certificate Five Mile House

Who Is Eligible For The Earned Income Tax Credit Medium

Invest In These Schemes To Get Exemption On Income Tax Zee News

Are Pensioners Exempt From Income Tax - Pensioners individuals who receive regular payments from a fund or employer post retirement are subject to income tax on their pension income Nevertheless pensioners also enjoy specific benefits and exemptions under the Income Tax Act of 1961 aimed at reducing their overall tax liability