Are Rebates Taxable In Ny We recently began mailing nearly three million checks for the 2022 homeowner tax rebate credit HTRC to eligible New Yorkers The credit provides direct property tax relief in the

The fiscal year 2023 property tax rebate is for homeowners whose New York City property is their primary residence and whose combined income is 250 000 or less Most recipients People who itemize receive a federal deduction for taxes paid to state and local governments including property taxes also known as the SALT deduction which is capped at 10 000 annually If a

Are Rebates Taxable In Ny

Are Rebates Taxable In Ny

http://villageofsolvay.com/wp-content/uploads/2022/09/REBATES.jpeg

Are Buyer Agent Commission Rebates Taxable In NYC Buyers Agent Nyc

https://i.pinimg.com/originals/bc/c1/7b/bcc17b5a2a858c471178a165423a4ef8.jpg

What Income Is Taxable Blog hubcfo

http://blog.hubcfo.com/wp-content/uploads/2015/04/What-Income-is-Taxable.png

Income eligible New Yorkers may be able to receive additional State and federal rebates along with the incentives and rebates listed below Home Clean Electricity Products STAR is a property tax exemption program that provides property tax reductions for homeowners in NYS NYS s website provides guidance on eligibility for

In most cases an amount included in your income is taxable unless it is specifically exempted by law Income that is taxable must be reported on your return and is subject Many companies offer cash back rewards for purchasing their product but is this reward considered taxable income Watch this video to learn more about cash back

Download Are Rebates Taxable In Ny

More picture related to Are Rebates Taxable In Ny

Tax Reductions Rebates And Credits

https://sb.studylib.net/store/data/008702919_1-5fc3b4877f75d05a02ea5cfa273ba161-768x994.png

Rebates For Seniors Mark Coure MP

https://markcoure.com.au/images/news/seniors-rebates-photo.png

Are ACA Rebates Taxable HealthPlanRate Healthplanrate

https://www.healthplanrate.com/wp-content/uploads/2020/07/ACA-rebates-tax-deductible-1-1536x1036.jpg

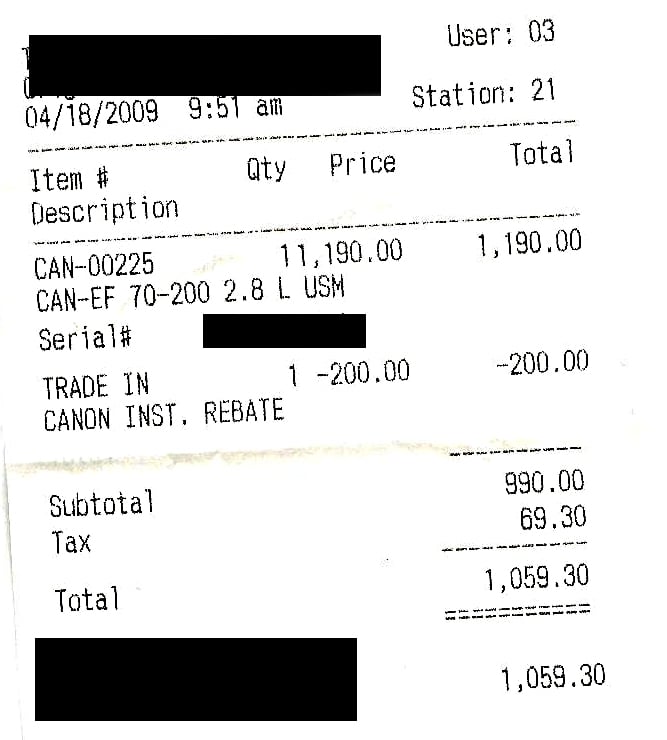

New York taxes vehicle purchases before rebates or incentives are applied to the price which means that the buyer in this scenario will pay taxes on the vehicle as if it cost the IR 2023 158 Aug 30 2023 The IRS today provided guidance on the federal tax status of refunds of state or local taxes and certain other payments made by state or local

An additional hotel unit fee in the amount of 1 50 per unit per day is imposed on every occupancy of a unit in a hotel located within New York City Bronx June 1 2019 5 35 AM No these checks are not income However if you are a homeowner and claim property taxes as an itemized deduction you will reduce your deduction by the

Are Rebates Important YouTube

https://i.ytimg.com/vi/fdKDvaa9AKw/maxresdefault.jpg

Tax Rebates Services

https://huzzaz.com/procoverphotos/tax-rebates-services.jpg?1656079144

https://content.govdelivery.com/accounts/NYTAX/bulletins/319980e

We recently began mailing nearly three million checks for the 2022 homeowner tax rebate credit HTRC to eligible New Yorkers The credit provides direct property tax relief in the

https://www.nyc.gov/site/finance/property/property-tax-rebate.page

The fiscal year 2023 property tax rebate is for homeowners whose New York City property is their primary residence and whose combined income is 250 000 or less Most recipients

Energy Rebates Don t Leave Money On The Table Schmidt Associates

Are Rebates Important YouTube

2022 Tax Brackets Married Filing Jointly Irs Printable Form

Are Cash For Clunkers Rebates Taxable The Truth About Cars

USA Rebates

Are State Tax Refunds And Rebates Federally Taxable It Depends Https

Are State Tax Refunds And Rebates Federally Taxable It Depends Https

Milwaukee Tool Rebates Printable Rebate Form

Check Back Often To See What Rebates Are Currently Available Click

Rebate Calculations 101 How Are Rebates Calculated Enable

Are Rebates Taxable In Ny - Income eligible New Yorkers may be able to receive additional State and federal rebates along with the incentives and rebates listed below Home Clean Electricity Products