Are Tax Credits Dollar For Dollar A tax credit is a dollar for dollar amount taxpayers claim on their tax return to reduce the income tax they owe Eligible taxpayers can use them to reduce their tax bill and

A tax credit is an amount of money that taxpayers are permitted to subtract dollar for dollar from the income taxes that they owe Tax credits are more favorable than tax deductions because A tax credit is a dollar amount that you can subtract from your income tax to reduce your overall tax liability So while a tax refund simply represents the difference between the taxes you paid versus the

Are Tax Credits Dollar For Dollar

Are Tax Credits Dollar For Dollar

https://www.expatustax.com/wp-content/uploads/2022/05/Tax-Credit-vs-Tax-Deduction.jpg

How Much Can You Earn And Still Get Tax Credits Who Can Claim And How

https://www.thescottishsun.co.uk/wp-content/uploads/sites/2/2018/04/nintchdbpict000379813847.jpg?strip=all&quality=100&w=1200&h=800&crop=1

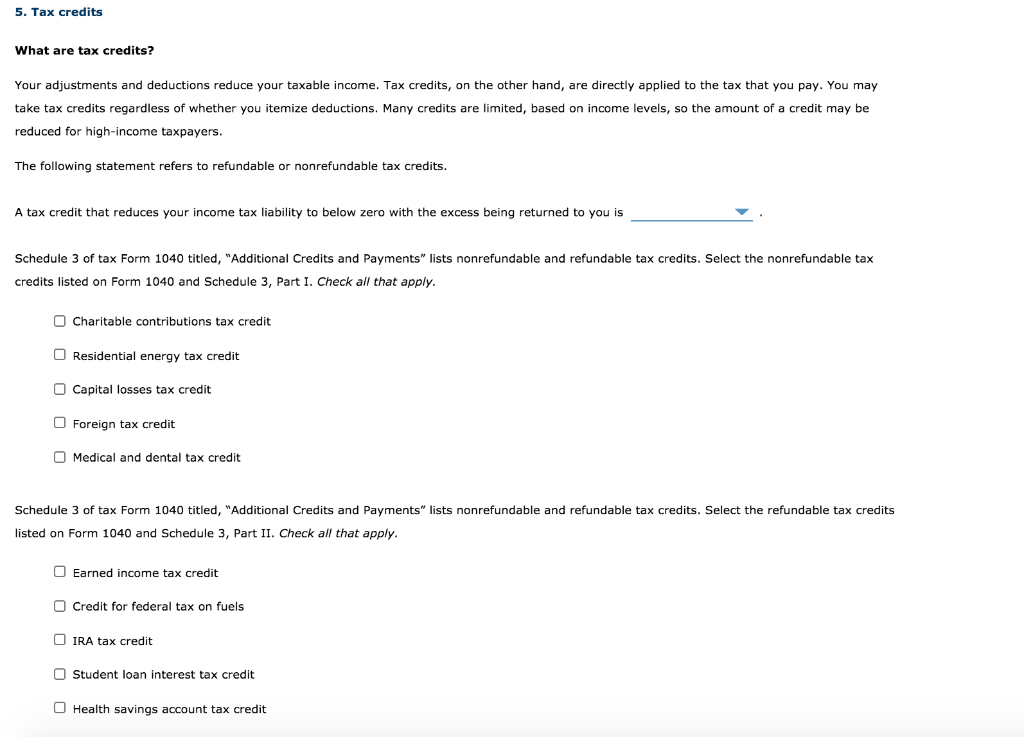

What Are Tax Credits Your Adjustments Deductions And Exemptions

https://img.homeworklib.com/questions/6715d9a0-0f03-11eb-8c88-c90d31bb6c59.png?x-oss-process=image/resize,w_560

Tax credits are subtracted directly from a person s tax liability they therefore reduce taxes dollar for dollar Credits have the same value for everyone who can claim their full value Most tax credits are Tax credits directly reduce the amount of tax you owe giving you a dollar for dollar reduction of your tax liability A tax credit valued at 1 000 for instance lowers your tax

A tax credit is the dollar for dollar amount of money that taxpayers subtract directly from the income taxes owed A federal tax credit is granted by the federal government Tax credits are dollar for dollar reductions of your tax bill Credits can reduce your tax burden better than tax deductions because deductions only reduce your

Download Are Tax Credits Dollar For Dollar

More picture related to Are Tax Credits Dollar For Dollar

Business Tax Credits Types Of Credits Available How To Claim

https://www.patriotsoftware.com/wp-content/uploads/2019/03/Tax-Credit-1.png

STERLING SILVER COIN BEZEL For The US Dollar For The MORGAN PEACE

https://i.ebayimg.com/images/g/cysAAOSwSVdbzgbP/s-l1600.jpg

Tax Credits Save You More Than Deductions Here Are The Best Ones

https://www.gannett-cdn.com/-mm-/14ee05d59f10019b9af859e1b8044dff44c16b5c/c=0-64-2118-1261&r=x1683&c=3200x1680/local/-/media/2017/03/28/USATODAY/USATODAY/636262972570306279-tax-credits.jpg

First let s clear up any confusion between tax credits and tax deductions because there s an important difference Tax deductions reduce the amount of taxable income you have which in turn reduces A tax credit reduces the income tax bill dollar for dollar that a taxpayer owes based on their tax return Some tax credits such as the Earned Income Tax

Tax credit A tax credit gives you a dollar for dollar reduction in your tax bill For example if your federal tax bill is 10 000 and you are entitled to a 2 500 tax credit that credit A tax credit is a provision that reduces a taxpayer s final tax bill dollar for dollar A tax credit differs from deductions and exemptions which reduce taxable income rather than

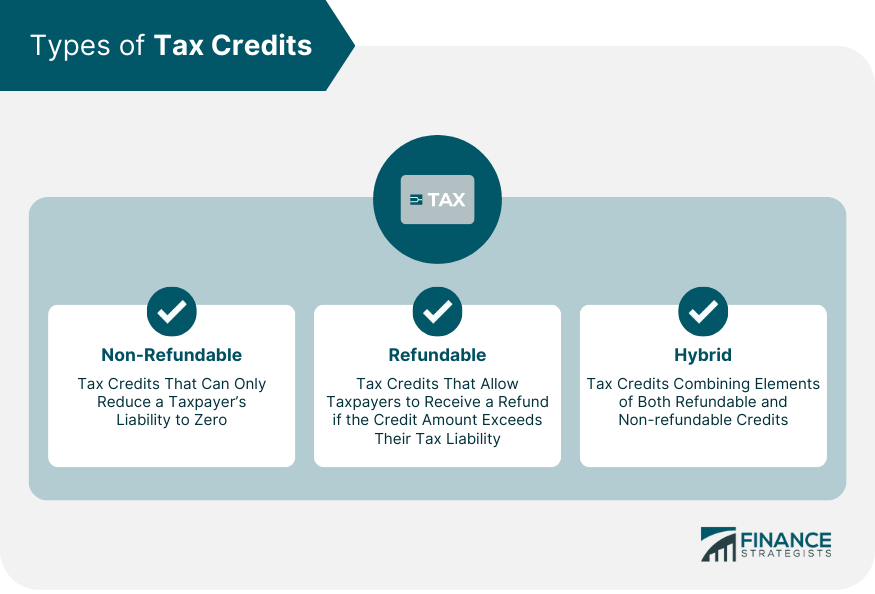

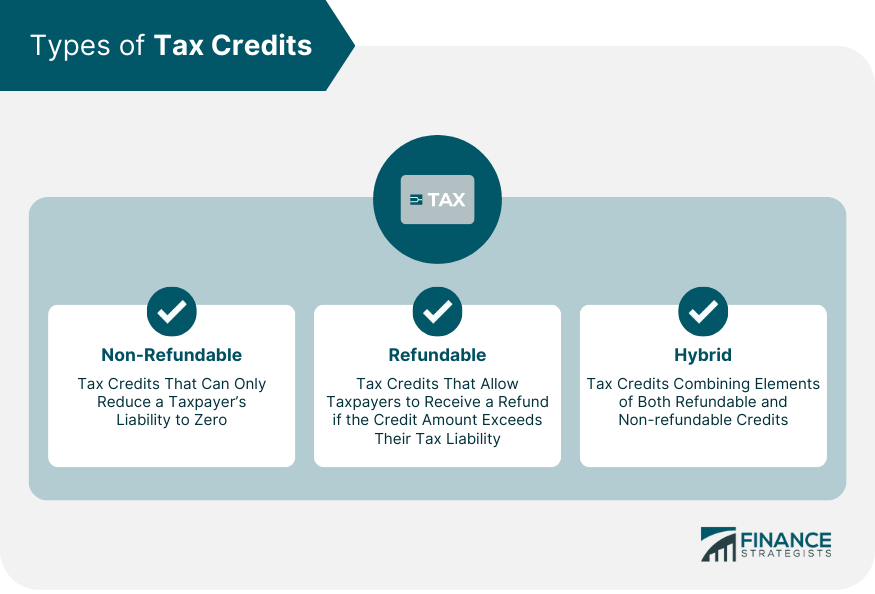

Tax Credits Definition Types Qualifications And Limitations

https://www.financestrategists.com/uploads/Types_of_Tax_Credits.png

Charts Show Shocking News On Treasury Bonds USD

https://image.cnbcfm.com/api/v1/image/102335275-euros-dollars.jpg?v=1532564354

https://www.irs.gov/newsroom/tax-credits-for...

A tax credit is a dollar for dollar amount taxpayers claim on their tax return to reduce the income tax they owe Eligible taxpayers can use them to reduce their tax bill and

https://www.investopedia.com/.../tax/0…

A tax credit is an amount of money that taxpayers are permitted to subtract dollar for dollar from the income taxes that they owe Tax credits are more favorable than tax deductions because

Solved 5 Tax Credits What Are Tax Credits Your Adjustments Chegg

Tax Credits Definition Types Qualifications And Limitations

The Complete List Of Tax Credits For Individuals

For Tax Purposes gross Income Is All The Money A Person Receives In

Rates Commodities The Globe And Mail

How To Reduce Your Tax Bill With The Help Of The Saver s Credit Cursor

How To Reduce Your Tax Bill With The Help Of The Saver s Credit Cursor

How Tax Credits Work YouTube

Tax Credits Transform State Taxes Into Positive Social Benefits

10 Tax Credits All Small Businesses Should Know About

Are Tax Credits Dollar For Dollar - Tax credits are subtracted directly from a person s tax liability they therefore reduce taxes dollar for dollar Credits have the same value for everyone who can claim their full value Most tax credits are