Are Tax Refunds Taxable The Following Year Does a tax refund count as income when you file the following year By Anuradha Garg Mar 2 2022 Published 9 05 a m ET Source Unsplash The IRS tax

If you used the standard deduction on your IRS return your IRS refund is not taxable and your state refund is not taxable If you used the itemized deduction method on your IRS State income tax refunds can sometimes be considered taxable income according to the IRS You must report them on Schedule A of Form 1040 if you claimed a deduction for state and local taxes the

Are Tax Refunds Taxable The Following Year

Are Tax Refunds Taxable The Following Year

https://phantom-marca.unidadeditorial.es/85f470bc4347750c5c1af76fa51f8e45/resize/1200/f/jpg/assets/multimedia/imagenes/2023/01/03/16727600289467.jpg

2022 Taxes Due Deadlines Refunds Extensions And Credits This Year

https://www.gannett-cdn.com/media/2022/03/09/USATODAY/usatsports/MotleyFool-TMOT-330a0898-b9a0c9a4.jpg

Tips To Get A Bigger Tax Refund This Year Money Savvy Living

https://i1.wp.com/moneysavvyliving.com/wp-content/uploads/2020/02/tax-refund-scaled.jpg?fit=2560%2C1707&ssl=1

When you file your 2020 tax return you calculate that you owe 5 000 in federal taxes However your employer withheld 7 000 from your paychecks for federal Yes report last year s state or local tax refund and we ll figure out if it s taxable or not If all three of the following are true your refund counts as taxable income

First federal income tax refunds are not taxable as income Second interest from both the federal and state governments is considered taxable income and should You can expect to get a refund if you overpaid your taxes during the year This generally happens when taxes are deducted from your paycheck every time you get paid by your employer

Download Are Tax Refunds Taxable The Following Year

More picture related to Are Tax Refunds Taxable The Following Year

Solved Four Independent Situations Are Described Below Each Chegg

https://media.cheggcdn.com/media/0c4/0c4f6d2b-4b27-4f28-a061-b83200553416/phpXaXizV.png

How To Maximize Your Tax Refund Providence Financial 2019

http://providencefinancialinc.com/wp-content/uploads/2013/03/bigstock-Tax-Refund-41648152.jpg

IRS Tax Refunds Are You Eligible For Up To 900 Payments Latin Post

https://1622179098.rsc.cdn77.org/data/images/full/147941/irs-tax-refunds-are-you-eligible-for-up-to-900-payments.jpg

You ll likely get a refund if your tax withholdings or estimated payments exceed your tax liability for a tax year The IRS is aware of questions involving special tax refunds or payments made by certain states related to the pandemic and its associated consequences in

Refund recipients who itemized on their federal returns for Tax Year 2021 will receive a Form 1099 G from the Department of Revenue by January 31 of the year In general if you didn t deduct state and local income taxes last year you don t need to pay taxes on your refunds this year For instance if you didn t itemize

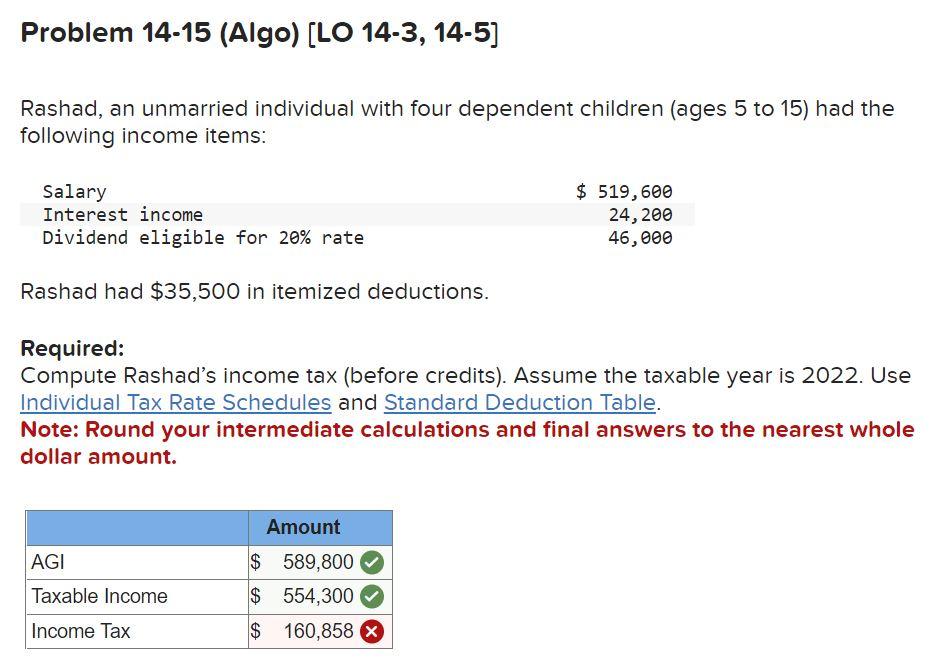

Solved Rashad An Unmarried Individual With Four Dependent Chegg

https://media.cheggcdn.com/media/69c/69c6479d-0301-4d39-a23a-0cc8a9486fa2/php3OsQbw

How To Calculate Taxable Income A Comprehensive Guide The Tech Edvocate

https://www.thetechedvocate.org/wp-content/uploads/2023/09/TaxableIncome_Final_4188122-0fb0b743d67242d4a20931ef525b1bb1.jpg

https://marketrealist.com/p/does-tax-refund-count-as-income

Does a tax refund count as income when you file the following year By Anuradha Garg Mar 2 2022 Published 9 05 a m ET Source Unsplash The IRS tax

https://www.efile.com/are-tax-refunds-taxable

If you used the standard deduction on your IRS return your IRS refund is not taxable and your state refund is not taxable If you used the itemized deduction method on your IRS

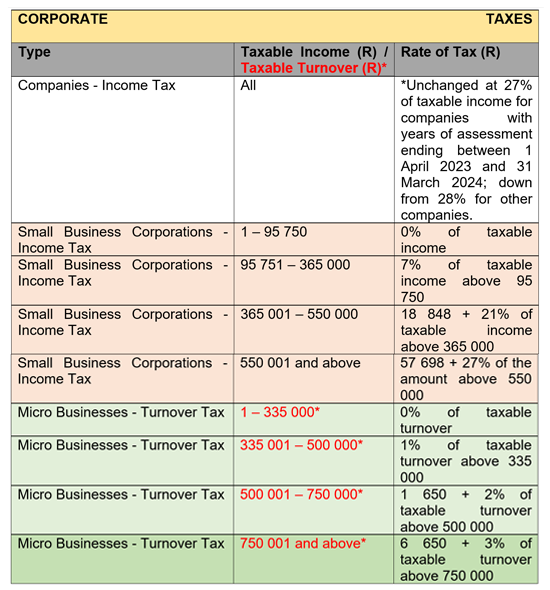

Budget 2023 Your Tax Tables And Tax Calculator Millenium Belasting

Solved Rashad An Unmarried Individual With Four Dependent Chegg

Income Tax Refund Not Received Refund Less Received incometaxrefund

Taxable Refunds Credits Or Offsets Of State And Local Income Taxes

Taxable Refunds Credits Or Offsets Of State And Local Income Taxes

Monday Is The Deadline To Claim Your 2019 Tax Refund WNKY News 40

Monday Is The Deadline To Claim Your 2019 Tax Refund WNKY News 40

Mass Nearly Done Distributing 62F Tax Refunds To Eligible Taxpayers

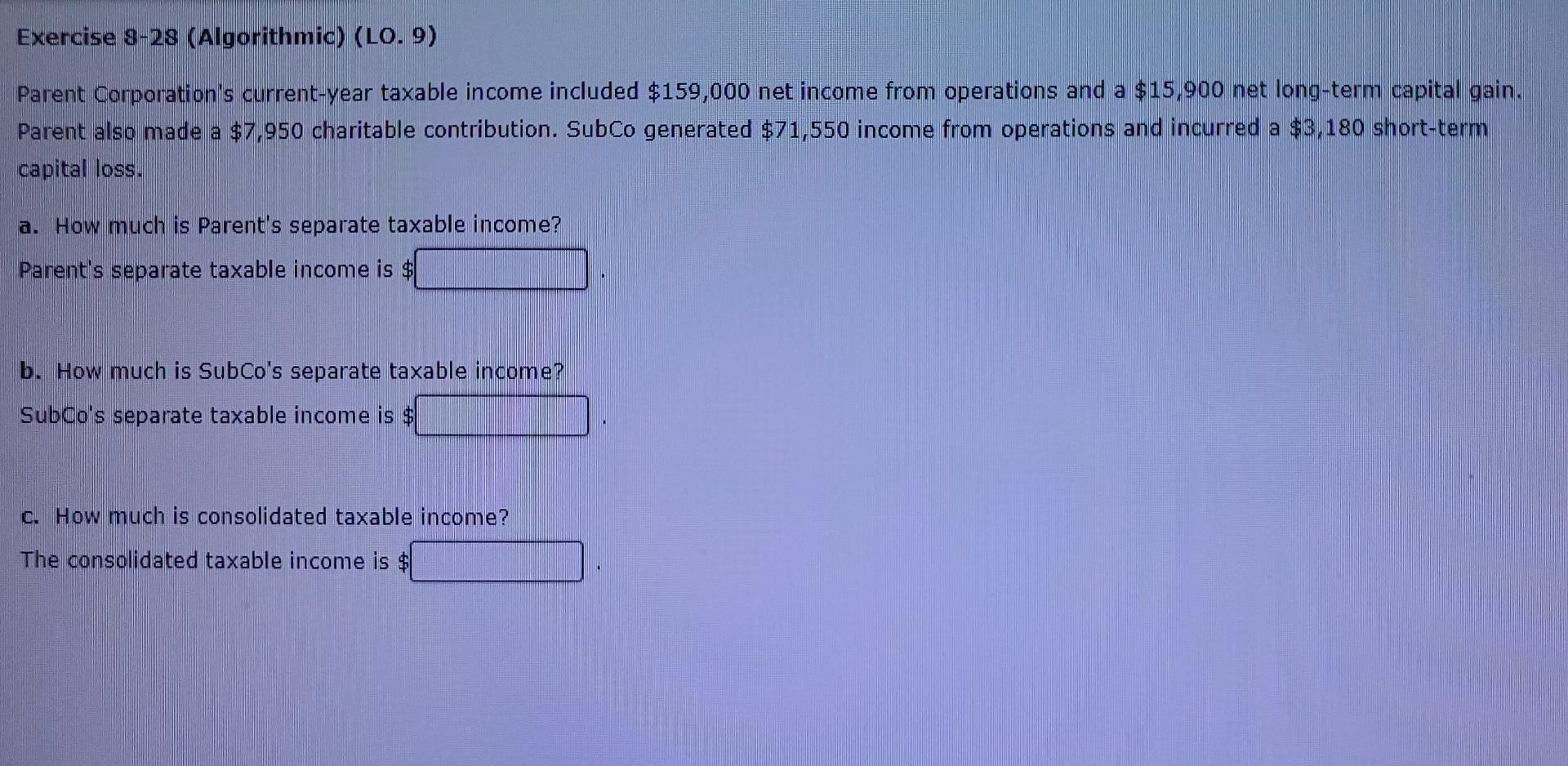

Solved Parent Corporation s Current year Taxable Income Chegg

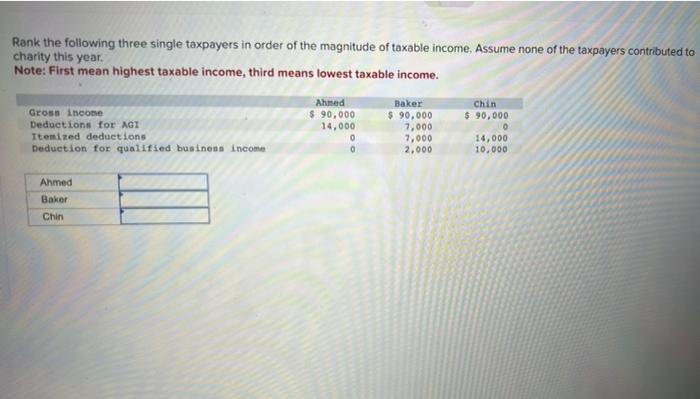

Solved Rank The Following Three Single Taxpayers In Orde

Are Tax Refunds Taxable The Following Year - First federal income tax refunds are not taxable as income Second interest from both the federal and state governments is considered taxable income and should