Are Tax Refunds Taxable The Next Year Does a tax refund count as income when you file the following year By Anuradha Garg Mar 2 2022 Published 9 05 a m ET Source Unsplash The IRS tax season started on January 24 2022 and the

State income tax refunds can sometimes be considered taxable income according to the IRS You must report them on Schedule A of Form 1040 if you claimed a deduction for state and local taxes the year before The simple rule of thumb is this IRS tax refunds are not taxable on a 1040 income tax return If you used the standard deduction on your IRS return your IRS refund is not taxable and your state refund is not taxable

Are Tax Refunds Taxable The Next Year

Are Tax Refunds Taxable The Next Year

http://providencefinancialinc.com/wp-content/uploads/2013/03/bigstock-Tax-Refund-41648152.jpg

Tips To Get A Bigger Tax Refund This Year Money Savvy Living

https://i1.wp.com/moneysavvyliving.com/wp-content/uploads/2020/02/tax-refund-scaled.jpg?fit=2560%2C1707&ssl=1

Taxes 2019 Why Is My Refund Smaller This Year

https://www.gannett-cdn.com/-mm-/9e1f6e2ee20f44aa1f3be4f71e9f3e52b6ae2c7e/c=0-110-2121-1303/local/-/media/2019/02/12/USATODAY/usatsports/tax-refund_gettyimages-663281702.jpg?width=3200&height=1680&fit=crop

If you and your employer have an agreement that your employer pays your social security and Medicare taxes without deducting them from your gross wages you must report the amount of tax paid for you as taxable wages on your tax return United States citizens are required to file tax returns once they hit the income thresholds for their filing statuses which ranges from 12 950 to 27 300 for tax year 2022

Refund recipients who itemized on their federal returns for Tax Year 2021 will receive a Form 1099 G from the Department of Revenue by January 31 of the year following the year in which the It is possible that your state refund is taxable income You may need to claim all or part of it if You received a state or local income tax refund credit or offset You itemized deductions on your federal income tax return You had the option to choose to deduct either state and local income taxes or general sales taxes

Download Are Tax Refunds Taxable The Next Year

More picture related to Are Tax Refunds Taxable The Next Year

Taxable Refunds Credits Or Offsets Of State And Local Income Taxes

https://i.ytimg.com/vi/O0FErGyvHzY/maxresdefault.jpg

Solved Four Independent Situations Are Described Below Each Chegg

https://media.cheggcdn.com/media/0c4/0c4f6d2b-4b27-4f28-a061-b83200553416/phpXaXizV.png

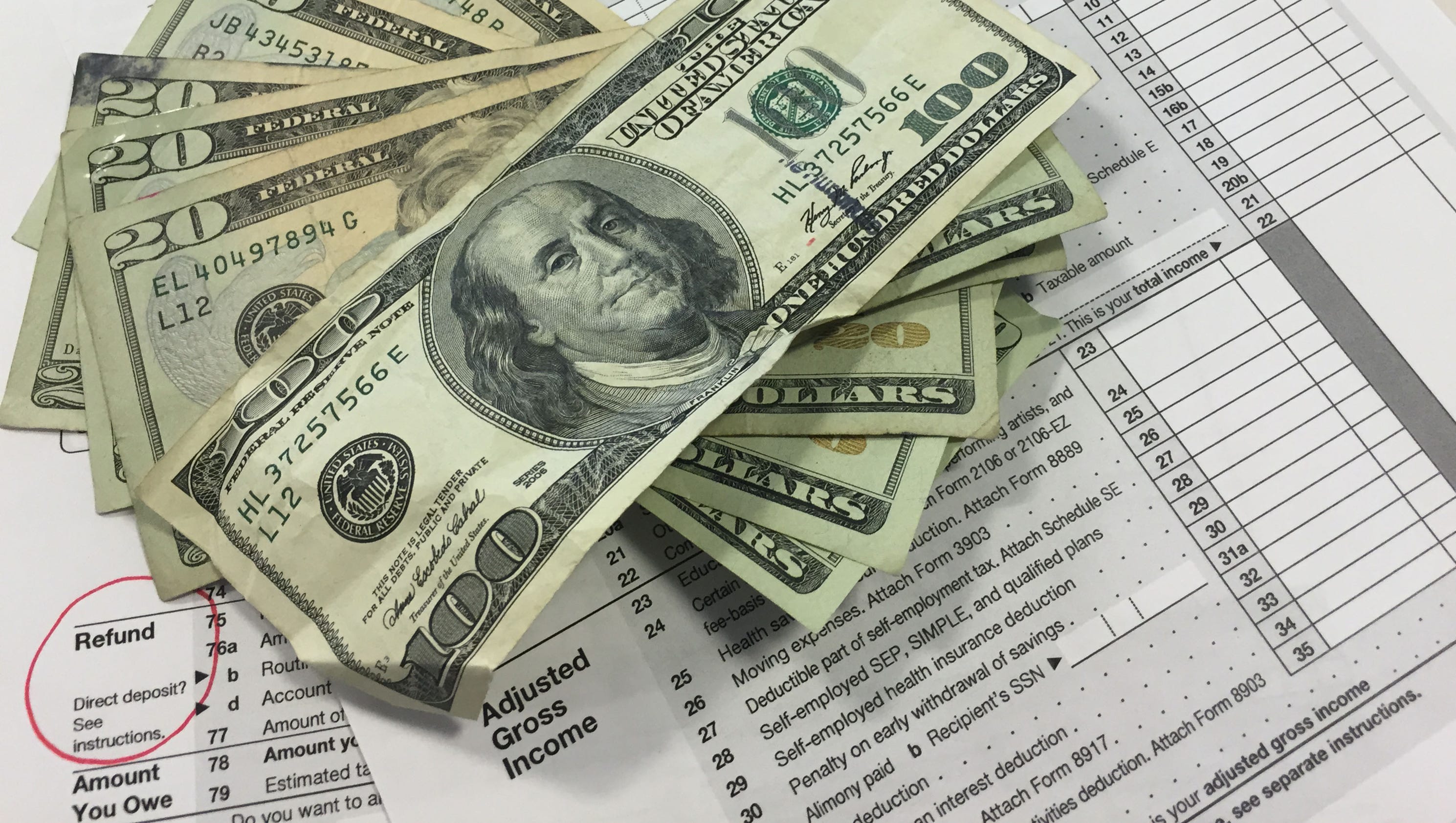

Solved E Apply The Tax Rates Shown In The Table Below To Chegg

https://media.cheggcdn.com/study/ff0/ff01d6ed-b06c-472c-9507-0ae6a6d4109a/image

Yes report last year s state or local tax refund and we ll figure out if it s taxable or not If all three of the following are true your refund counts as taxable income You itemized deductions last year instead of taking the standard deduction The IRS is aware of questions involving special tax refunds or payments made by certain states related to the pandemic and its associated consequences in 2022 A variety of state programs distributed these payments in 2022 and the rules surrounding their treatment for federal income tax purposes are complex

[desc-10] [desc-11]

Tax Refunds 1 1B In Unclaimed Money Awaits Tax Returns

https://www.gannett-cdn.com/-mm-/c854498003ddfe79bd56377d5c65f844b5eb72ce/c=0-444-2398-1799&r=x1683&c=3200x1680/local/-/media/2018/03/08/DetroitFreeP/DetroitFreePress/636561017843565093-tax-refund.jpg

Are State Tax Refunds Taxable Taxation Portal

https://taxationportal.com/wp-content/uploads/2022/01/Taxes.jpg

https://marketrealist.com/p/does-tax-refund-count-as-income

Does a tax refund count as income when you file the following year By Anuradha Garg Mar 2 2022 Published 9 05 a m ET Source Unsplash The IRS tax season started on January 24 2022 and the

https://www.thebalancemoney.com/taxable-refunds-3193090

State income tax refunds can sometimes be considered taxable income according to the IRS You must report them on Schedule A of Form 1040 if you claimed a deduction for state and local taxes the year before

Are State Tax Refunds Taxable The TurboTax Blog

Tax Refunds 1 1B In Unclaimed Money Awaits Tax Returns

Tax Refunds On 10 200 Of Unemployment Benefits Start In May IRS

Are State Tax Refunds Taxable The TurboTax Blog

How Long To Get Colorado Tax Refund Coots Nathan

Are State Tax Refunds Taxable The TurboTax Blog

Are State Tax Refunds Taxable The TurboTax Blog

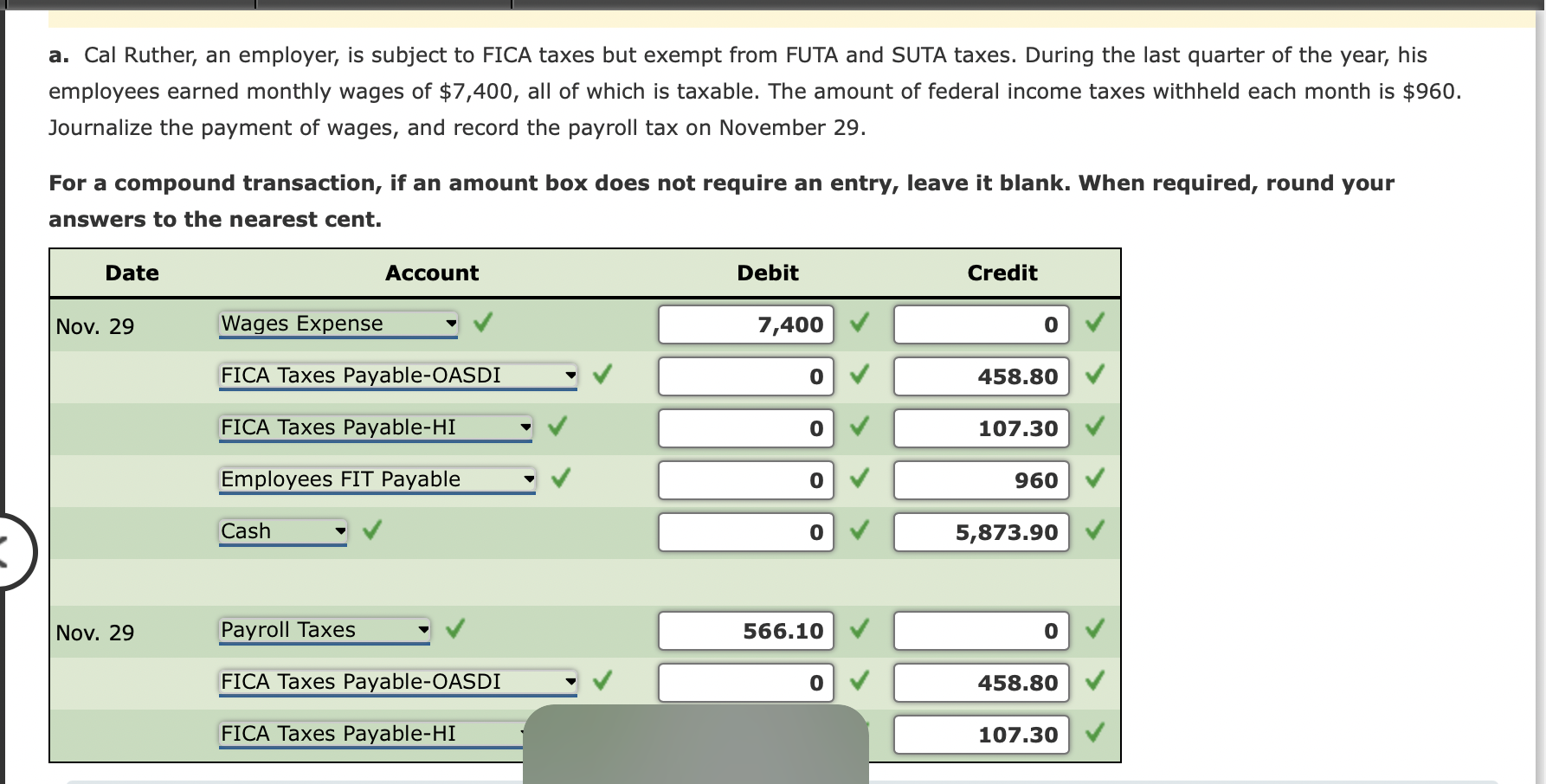

Solved Example 6 5 The Journal Entry To Record The Payroll Chegg

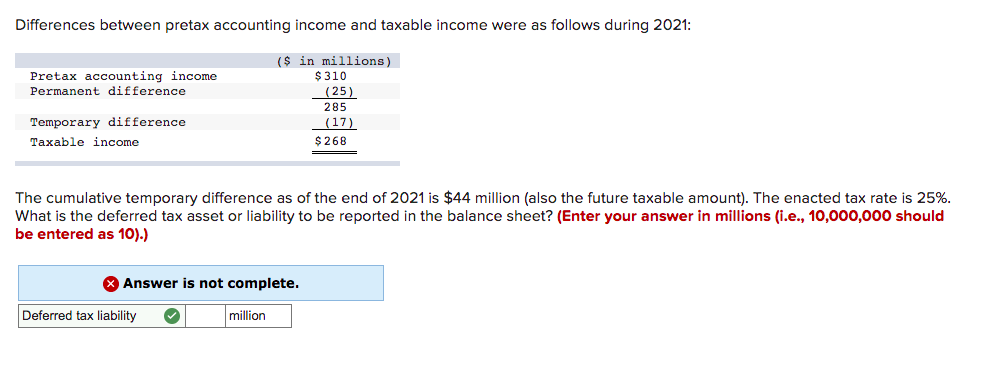

Solved Differences Between Pretax Accounting Income And Chegg

State Tax Refunds Are State Tax Refunds Taxable

Are Tax Refunds Taxable The Next Year - Refund recipients who itemized on their federal returns for Tax Year 2021 will receive a Form 1099 G from the Department of Revenue by January 31 of the year following the year in which the