Are Veterans Exempt From Property Taxes In Nj Active Military Service Property Tax Deferment An active serviceperson who is deployed or mobilized for active service in time of war may qualify for a deferment of a property

Veteran Property Tax Deduction and the Disabled Veteran Property Tax Exemption Public Law 2019 chapter 203 extends the annual 250 property tax deduction to 100 Disabled Veteran Property Tax Exemption 250 Veteran Property Tax Deduction Active Military Service Property Tax Deferment

Are Veterans Exempt From Property Taxes In Nj

Are Veterans Exempt From Property Taxes In Nj

https://assets.site-static.com/userFiles/3705/image/dis-vet-tax-do.jpg

Should You Protest Your Property Taxes In Austin

https://activerain-store.s3.amazonaws.com/blog_entries/935/5744935/original/RelayThat_save_on_property_tax_dollars.jpg?1660084904

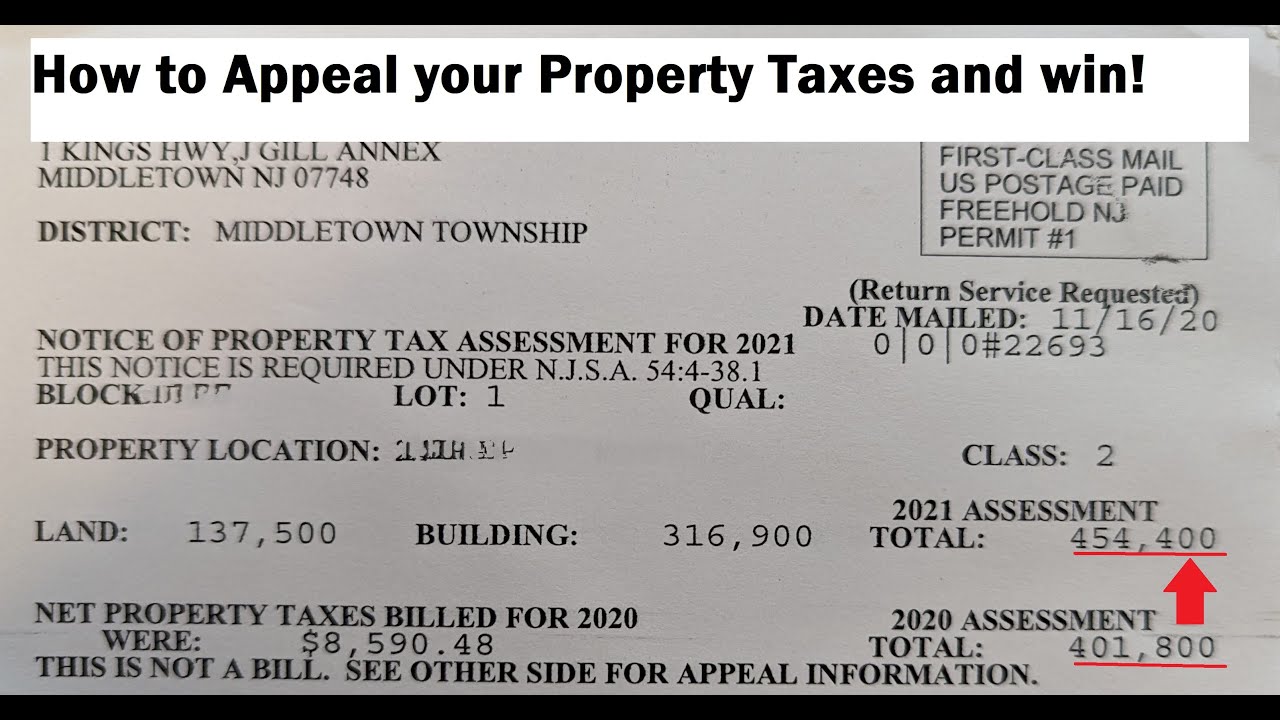

How To Appeal Your Property Taxes In NJ YouTube

https://i.ytimg.com/vi/udQcGl3ONaM/maxresdefault.jpg

The Disabled Veteran Property Tax Exemption can begin as soon as all eligibility prerequisites are met Active Duty Military Service Honorable Discharge and VA If you are an honorably discharged veteran with active duty military service you may qualify for an annual 250 Property Tax Deduction Reservists and National

You are eligible for a 6 000 exemption on your New Jersey Income Tax return if you are a military veteran who was honorably discharged or released under honorable New Jersey has long provided a property tax deduction of 250 to some wartime veterans and their surviving spouses A ballot measure extending that

Download Are Veterans Exempt From Property Taxes In Nj

More picture related to Are Veterans Exempt From Property Taxes In Nj

How High Are Property Taxes In Your State American Property Owners

https://propertyownersalliance.org/wp-content/uploads/2020/10/property-taxes-by-state-2020-FV-01-1024x868-1.png

Military Exempt From State Taxes AChance2Talk

https://i0.wp.com/www.veteransunited.com/assets/craft/images/blog/VeteranPropertyTaxExemptions_Mobile4.png?strip=all

Form Rev 1220 Pennsylvania Exemption Certificate Printable Pdf Download

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/form-rev-1220-pennsylvania-exemption-certificate-printable-pdf-download-1.png?w=950&ssl=1

The bipartisan proposal seeking to boost the size of New Jersey s veterans property tax deduction from 250 to 2 500 via a constitutional amendment 100 percent permanently disabled veterans or their surviving spouses in New Jersey may receive a full property tax exemption on their primary residence Or

N J S A 54 4 3 30 et seq 100 permanently and totally disabled veterans or the unmarried surviving spouses of such disabled veterans are granted a full property tax exemption 100 permanently and totally disabled active duty veterans or the unremarried surviving spouses of such disabled active duty veterans are granted a full property tax exemption

100 Va Disability Military Veteran Benefits Discounts

https://static.wixstatic.com/media/d01121_77fde5c29f1f491b938c0633059c75fa~mv2.png/v1/fit/w_2500,h_1330,al_c/d01121_77fde5c29f1f491b938c0633059c75fa~mv2.png

Tax Exemption Form For Veterans ExemptForm

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/veterans-property-tax-exemption-application-form-printable-pdf-download-1.png

https://www.nj.gov/treasury/taxation/pdf/lpt/vet...

Active Military Service Property Tax Deferment An active serviceperson who is deployed or mobilized for active service in time of war may qualify for a deferment of a property

https://www.nj.gov/treasury/taxation/pdf/other...

Veteran Property Tax Deduction and the Disabled Veteran Property Tax Exemption Public Law 2019 chapter 203 extends the annual 250 property tax deduction to

State Tax Exemption Map National Utility Solutions

100 Va Disability Military Veteran Benefits Discounts

18 States With Full Property Tax Exemption For 100 Disabled Veterans

Disabled Veterans Property Tax Exemptions By State

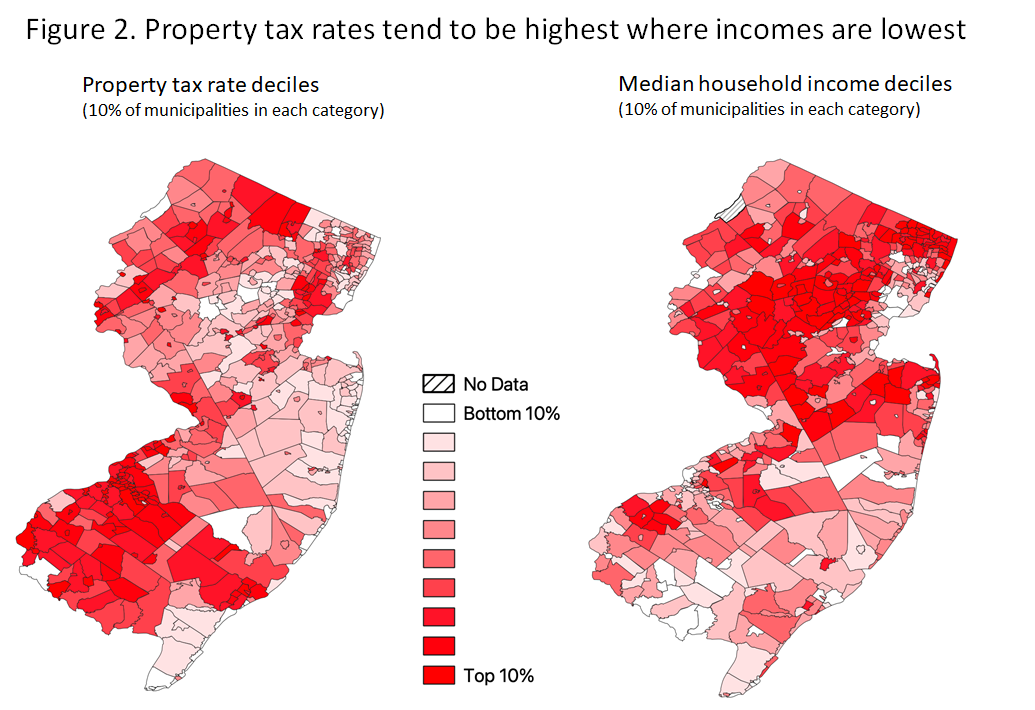

Where Do New Jersey s Property Tax Bills Hit The Hardest New Jersey

Disabled Veterans Should Never Have To Pay Property Taxes Editorial

Disabled Veterans Should Never Have To Pay Property Taxes Editorial

Hecht Group Disabled Veterans In Georgia Exempt From Property Taxes

Fl Property Tax Exemption For Disabled Veterans PRORFETY

18 States With Full Property Tax Exemption For 100 Disabled Veterans

Are Veterans Exempt From Property Taxes In Nj - The Disabled Veteran Property Tax Exemption can begin as soon as all eligibility prerequisites are met Active Duty Military Service Honorable Discharge and VA