Basic Exemption For Long Term Capital Gains Verkko 18 hein 228 k 2019 nbsp 0183 32 How to calculate Long Term Capital Gains tax What is the correct method of adjusting LTCG against Basic Exemption

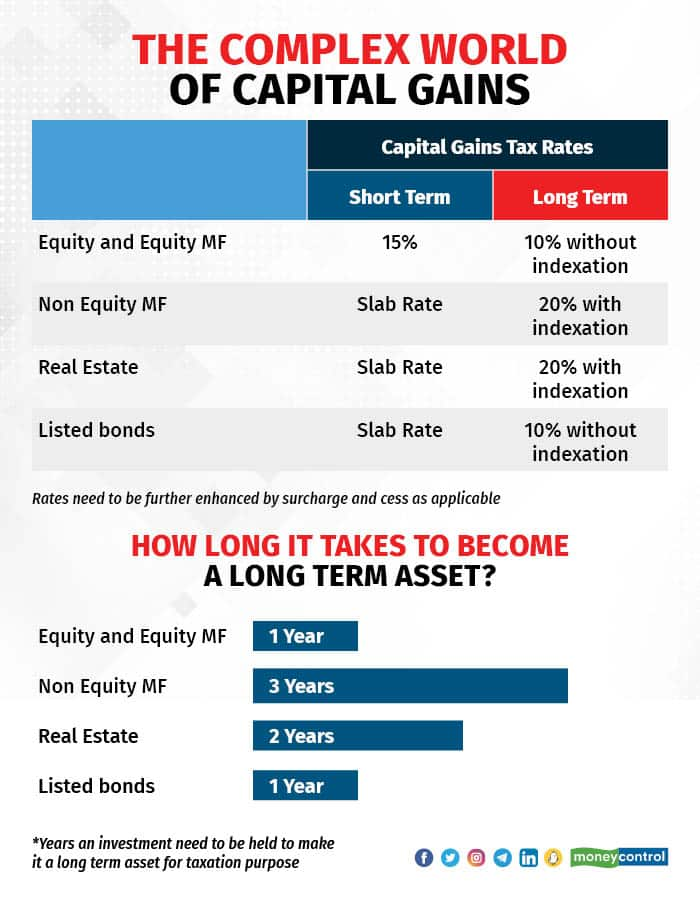

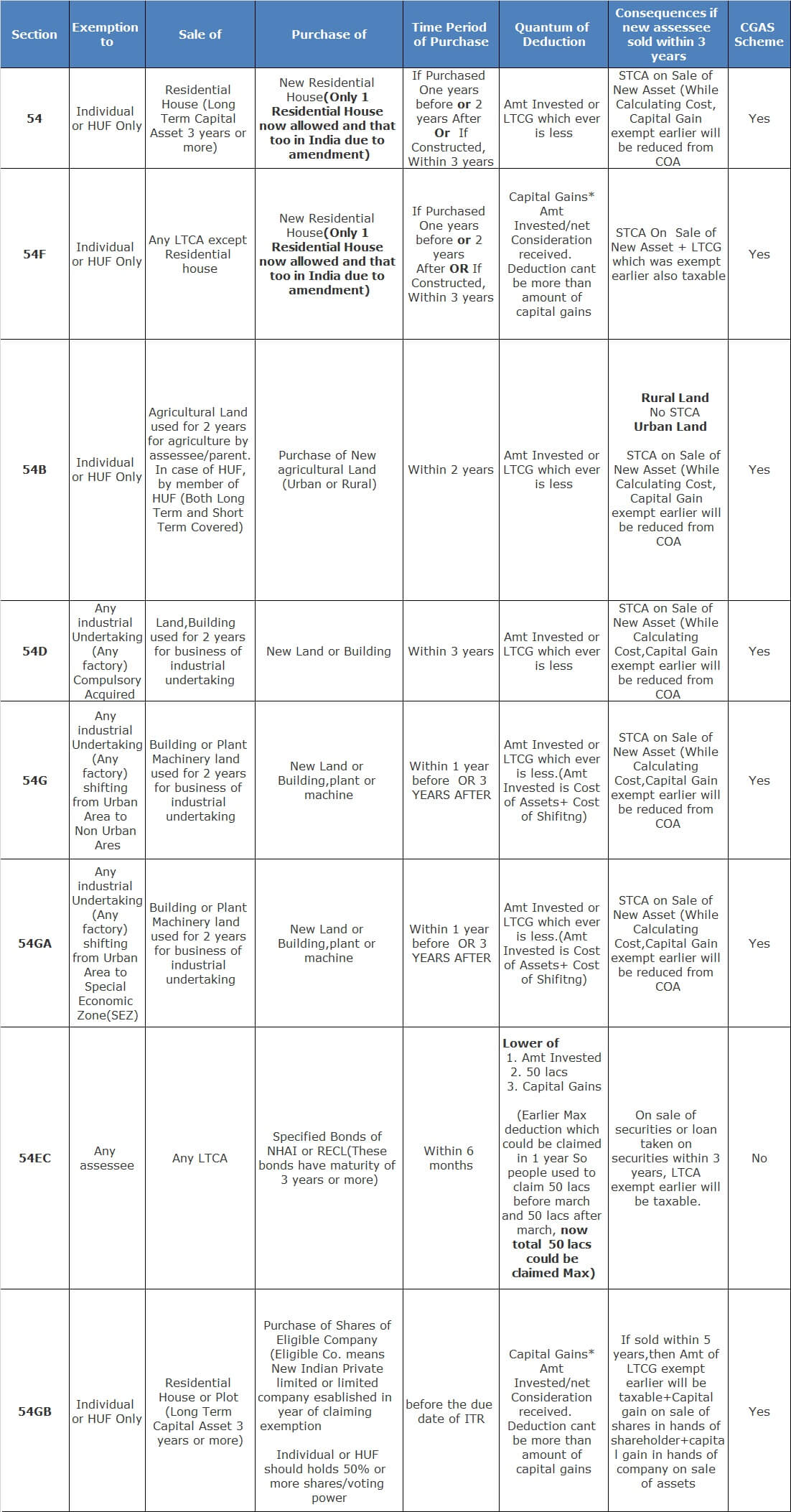

Verkko 4 kes 228 k 2022 nbsp 0183 32 Articles discusses Meaning of Capital Assets What Constitutes a Capital and what is not a capital Asset How to Apply Indexation Provisions Period Verkko Section 54EC allows an exemption from the capital gains arising from the transfer of a long term capital asset being land or buildings or both This exemption is

Basic Exemption For Long Term Capital Gains

.png)

Basic Exemption For Long Term Capital Gains

https://uploads-ssl.webflow.com/629b1dcd203ede574e478a11/62e28e665829870892a428da_Jordensky_Tax One person company to private (3).png

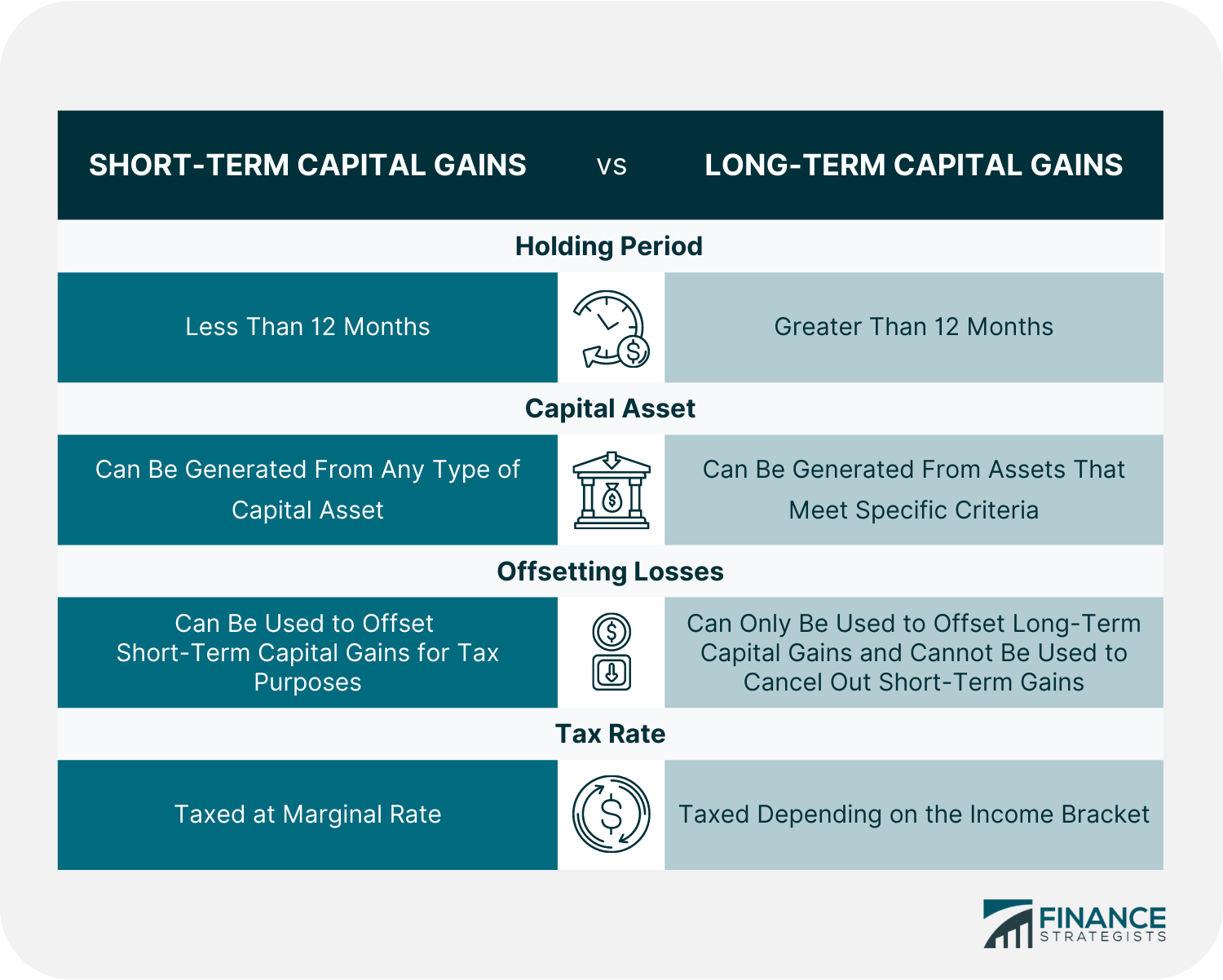

Short Term Vs Long Term Capital Gains Definition And Tax Rates

https://learn.financestrategists.com/wp-content/uploads/Short-term_vs_Long-Term_Capital_Gains_no_title.png

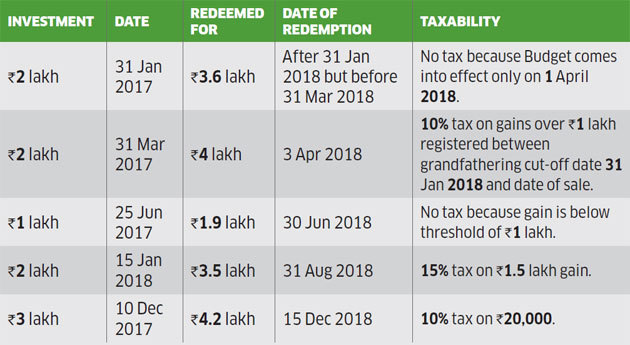

Budget 2023 Will Long term Capital Gains Exemption Limit Go Up

https://images.moneycontrol.com/static-mcnews/2022/12/capital-gains-0712_001.jpg

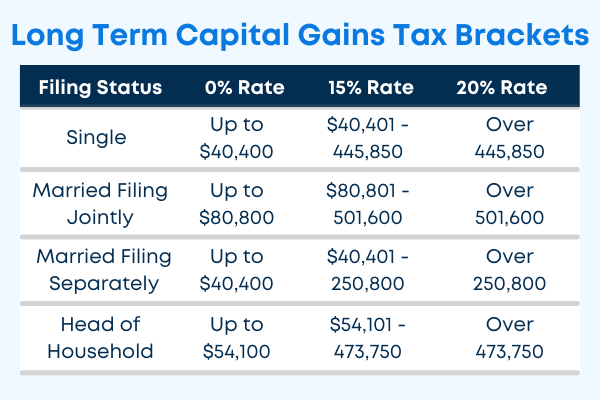

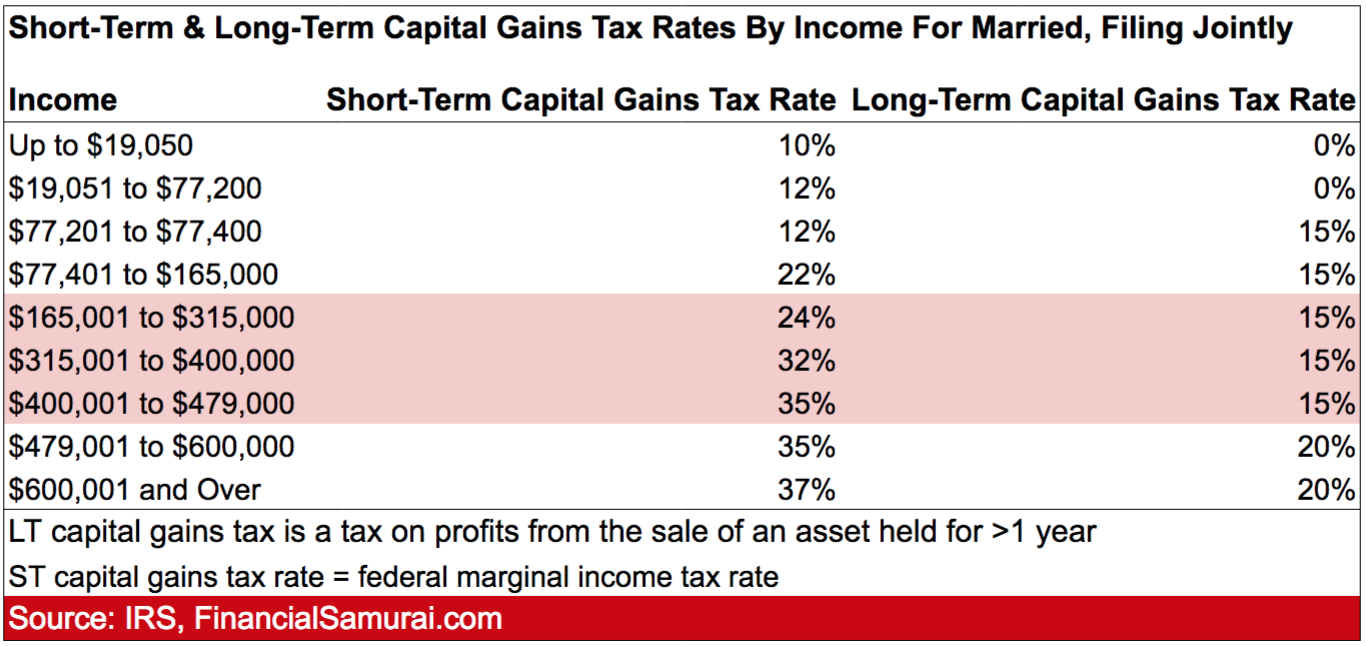

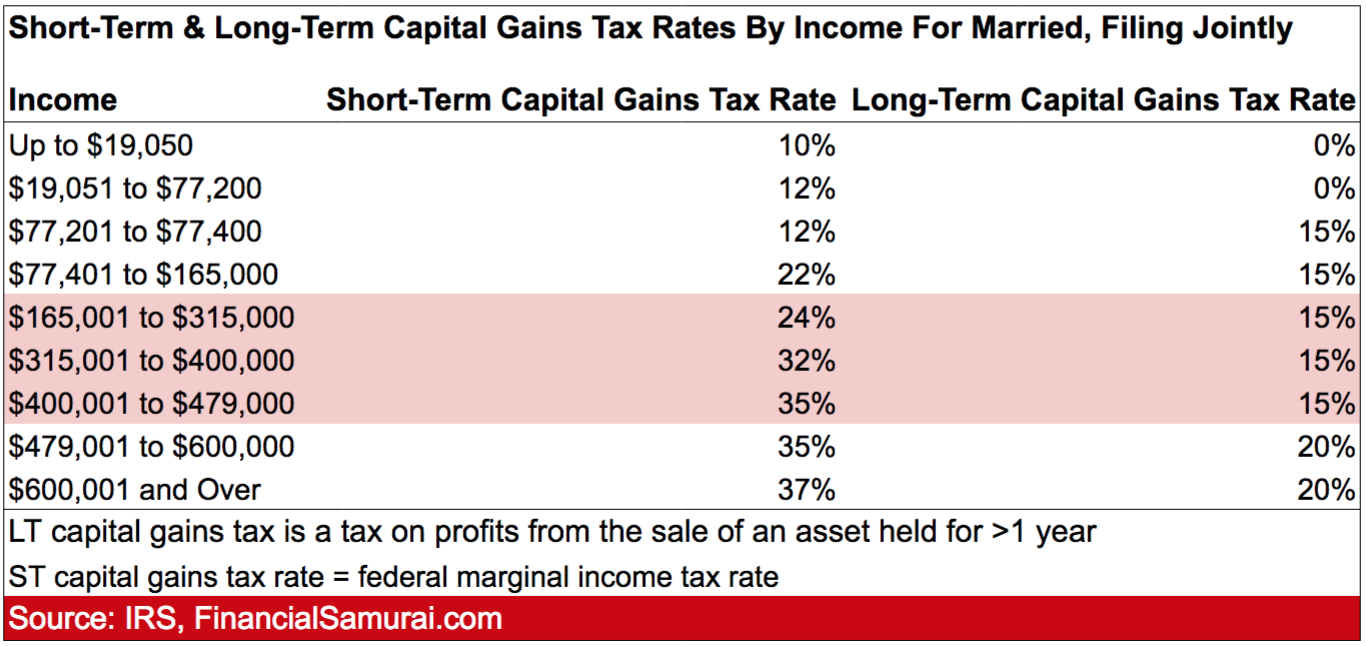

Verkko 22 jouluk 2023 nbsp 0183 32 Long term capital gains are taxed at 0 15 or 20 according to graduated income thresholds The tax rate for most taxpayers who report long term Verkko 2 tammik 2024 nbsp 0183 32 How the capital gain is taxed depends on filing status taxable income and how long the asset was owned before selling The capital gains tax rate is 0

Verkko 15 marrask 2022 nbsp 0183 32 Long Term Capital Gains Taxes Long term capital gains are taxed at lower rates than ordinary income How much you owe depends on your annual taxable income You ll pay a tax rate of 0 Verkko 4 tammik 2024 nbsp 0183 32 Calculating your long term capital gains The fundamental arithmetic is not too onerous Subtract the cost of acquiring the asset from the sale price What

Download Basic Exemption For Long Term Capital Gains

More picture related to Basic Exemption For Long Term Capital Gains

Long Term Vs Short Term Capital Gains Tax Ultimate Guide Ageras

https://assets-prod.ageras.com/assets/frontend/upload/resources/lt-capital-gains-tax-brackets.png

Section 54 Income Tax Act Capital Gains Exemption Chart Teachoo

https://d1avenlh0i1xmr.cloudfront.net/576b54f6-1ee4-4666-afef-508fe3b1808d/section-54-income-tax-act---capital-gain-chart.jpg

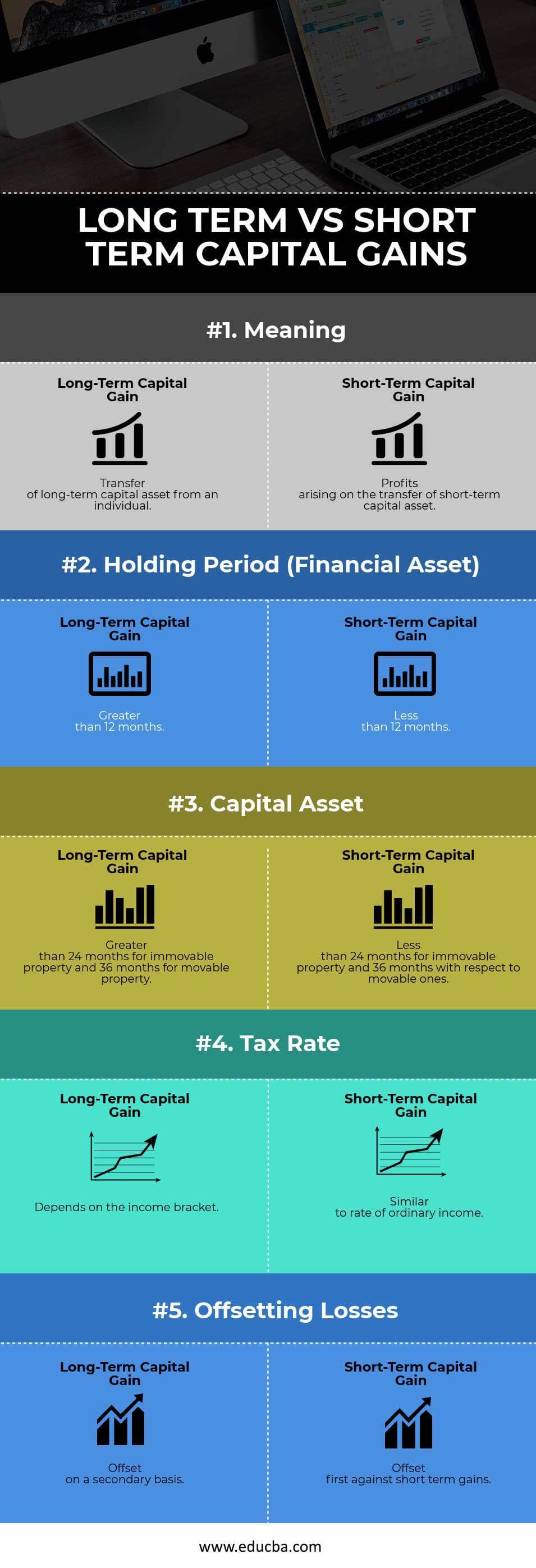

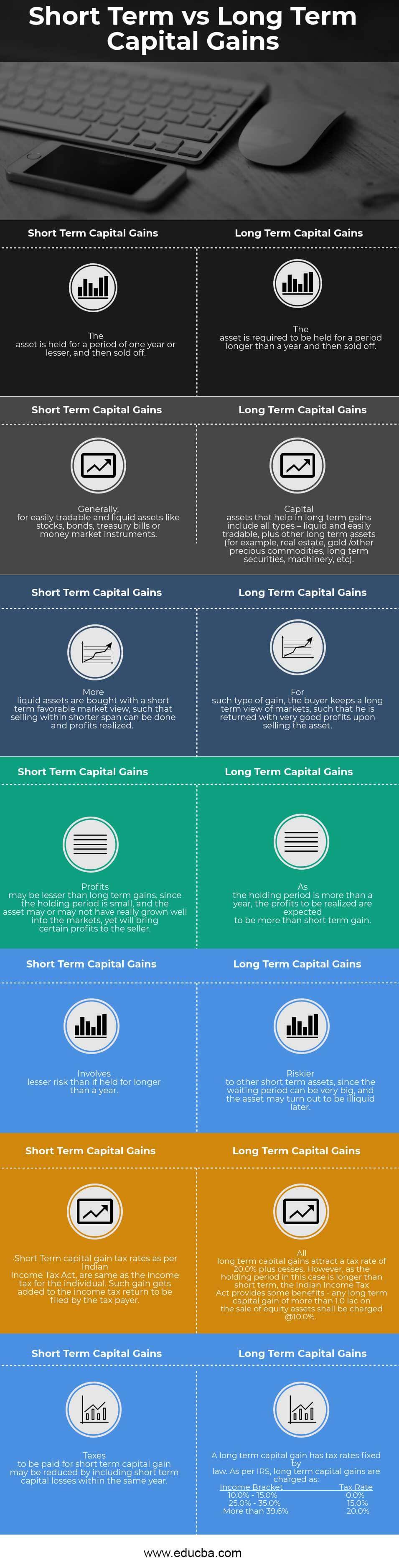

Long term Vs Short term Capital Gains 5 Useful Differences

https://www.educba.com/academy/wp-content/uploads/2018/07/LONG-TERM-VS-SHORT-TERM-CAPITAL-GAINS.jpg

Verkko 4 p 228 iv 228 228 sitten nbsp 0183 32 How capital gains tax rates work depending on your income Investment income is treated differently from wages by the tax code There is a Verkko 19 lokak 2023 nbsp 0183 32 For example If you have 50 000 in long term gains from the sale of one stock but 20 000 in long term losses from the sale of another then you may

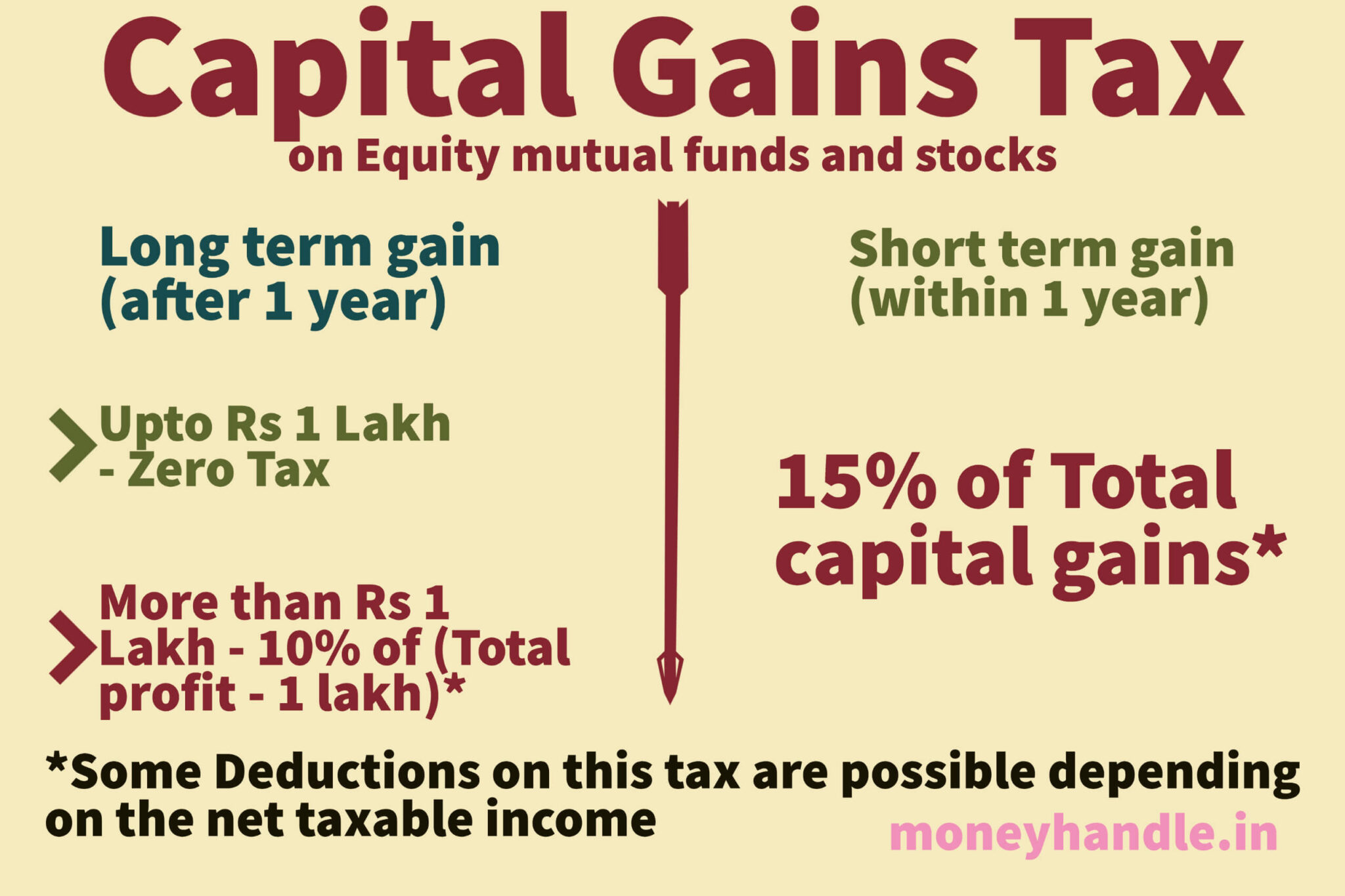

Verkko Benefit of Basic exemption limit is available to Long Term Capital gain LTCG on sale of shares If a person does not have any income other than from sale of shares Verkko 30 huhtik 2023 nbsp 0183 32 Long term capital gains Gains realized on assets that you ve sold after holding them for more than one year Both short and long term gains must be

Difference Between Short Term And Long Term Capital Gains

https://www.wallstreetmojo.com/wp-content/uploads/2018/05/Short-Term-vs-Long-Term-Capital-Gains.jpg

Long Term Capital Gain Exemptions On Sale Of Property Court Judgments

https://www.relakhs.com/wp-content/uploads/2017/10/Long-Term-Capital-Gains-tax-exemptions-sec-54-54ec-54f-on-sale-of-land-or-residential-property-LTCG-2-years.jpg

.png?w=186)

https://www.relakhs.com/adjust-long-te…

Verkko 18 hein 228 k 2019 nbsp 0183 32 How to calculate Long Term Capital Gains tax What is the correct method of adjusting LTCG against Basic Exemption

https://taxguru.in/income-tax/tax-long-term-capital-gain-income-tax...

Verkko 4 kes 228 k 2022 nbsp 0183 32 Articles discusses Meaning of Capital Assets What Constitutes a Capital and what is not a capital Asset How to Apply Indexation Provisions Period

How To Calculate Capital Gains Tax On Property How To SAVE Capital

Difference Between Short Term And Long Term Capital Gains

Short Term Vs Long Term Capital Gains Top 7 Awesome Differences

Capital Gains Tax Long Term Capital Gains Short Term Capital Gains

Long term Capital Gains Tax LTCG Investar Blog

Capital Gains Tax They Apply To Most Common Investments Such As

Capital Gains Tax They Apply To Most Common Investments Such As

Long Term Capital Gain Tax On Shares Tax Rates Exemption

Difference Between Short And Long Term Capital Gains Compare Apply

Capital Gains Tax India Simplified Read This If You Invest In Stocks

Basic Exemption For Long Term Capital Gains - Verkko 4 tammik 2024 nbsp 0183 32 Calculating your long term capital gains The fundamental arithmetic is not too onerous Subtract the cost of acquiring the asset from the sale price What