Bush Tax Cuts Research shows no evidence that tax cuts have any impact on the spending habits of upper income taxpayers The Bush tax cuts would only increase growth enough to make up 10 of their long run cost Maintaining the cuts has been estimated to

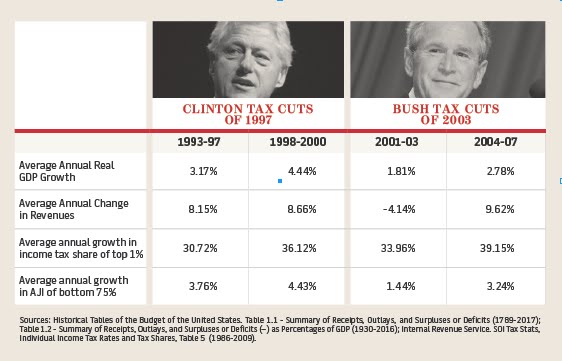

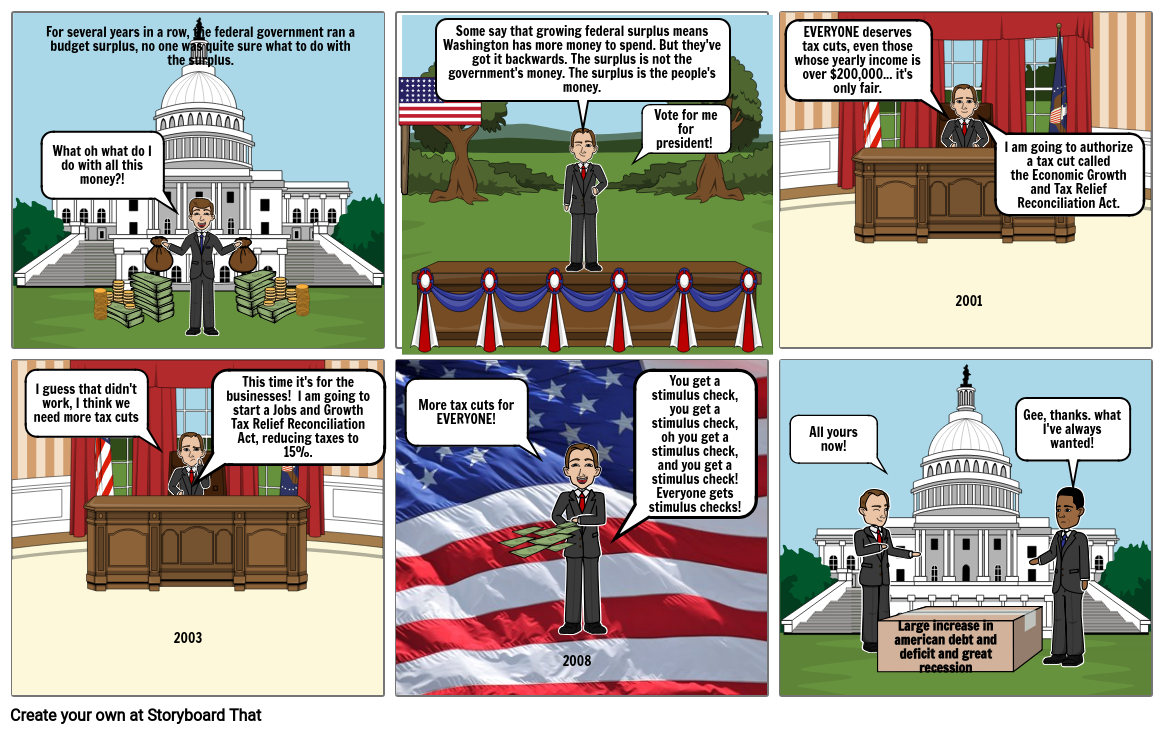

The biggest tax policy changes enacted under President George W Bush were the 2001 and 2003 tax cuts often referred to as the Bush tax cuts but formally named the Economic Growth and Tax What Are the Bush Tax Cuts The Bush tax cuts were a series of temporary income tax relief measures enacted by President George W Bush in 2001 and 2003

Bush Tax Cuts

Bush Tax Cuts

http://itep.org/wp-content/uploads/0710-Figure1-Historical-Report.jpg

As Clock Ticks Lawmakers Revisit Bush Tax Cuts NCPR News

https://media.npr.org/assets/news/2010/09/03/taxcut2003-b4727cb168962f5ea0a3ec08bdfb1bf4a033f845.jpg

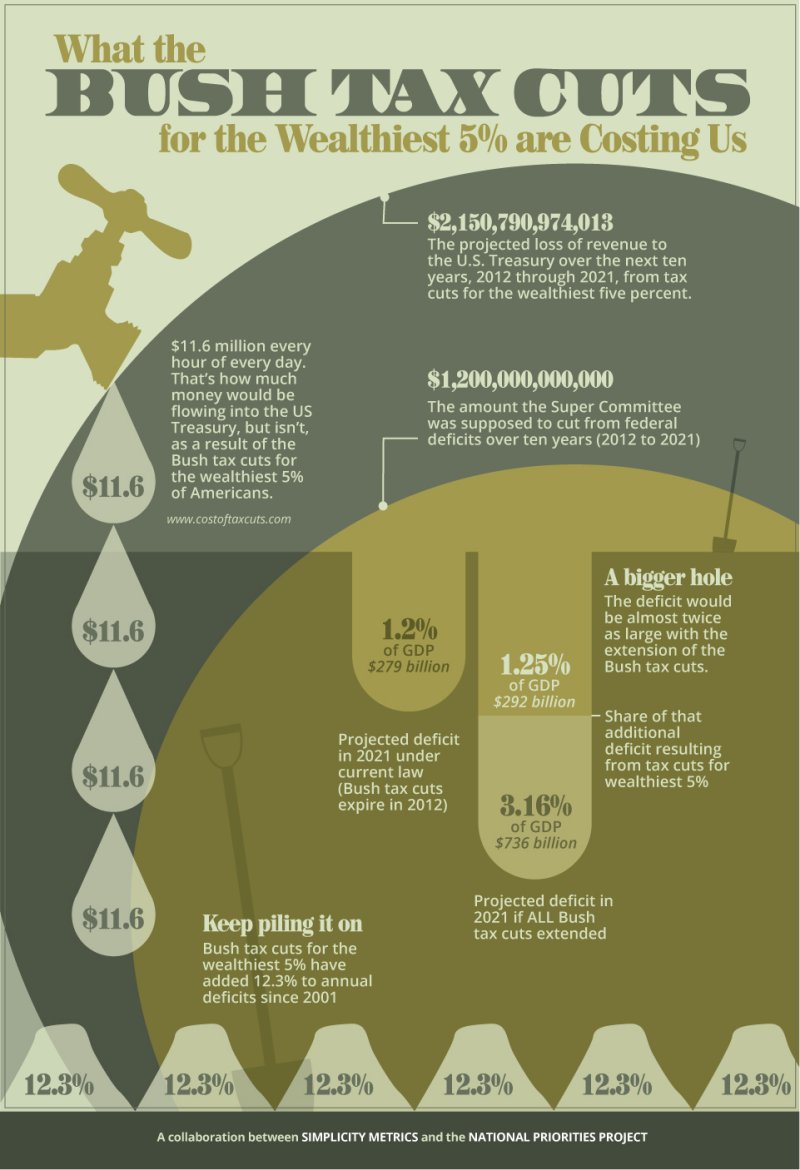

Tax Cuts For The Top 5 The Budget For 2012 Bud Meyers

http://1.bp.blogspot.com/-J7kqJuoNwOU/Tv9j05qS2bI/AAAAAAAABFM/yZZMmjuE2fc/s1600/bush_tax_cuts.jpg

After Republicans re took control of the Senate during the 2002 mid term elections Bush proposed further tax cuts With little support among Democrats Congress passed the Jobs and Growth Tax Relief Reconciliation Act of 2003 JGTRRA which cut Among other provisions the act accelerated certain tax changes passed in the Economic Growth and Tax Relief Reconciliation Act of 2001 increased the exemption amount for the individual Alternative Minimum Tax and lowered taxes of income from dividends and capital gains

President Obama and Congress had allowed some of the Bush tax cuts for the rich to expire Many Bush era provisions still in effect benefited the rich but this was partly offset by tax increases on high income individuals that are part of the Affordable Care Act The George W Bush tax cuts were implemented to stop the 2001 recession The government cut the top income tax rate from 39 6 to 35 in 2001 Bush also reduced the top tax rate on long term capital gains from 20 to 15

Download Bush Tax Cuts

More picture related to Bush Tax Cuts

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/4061086/bush-cuts-graphic.jpg)

Study 53 Percent Of Jeb Bush s Tax Cuts Would Go To The Top 1 Percent

https://cdn.vox-cdn.com/thumbor/R7Fqw1Sauipf6PzrUq3lu4kcQqg=/0x0:1109x2235/920x0/filters:focal(0x0:1109x2235):no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/4061086/bush-cuts-graphic.jpg

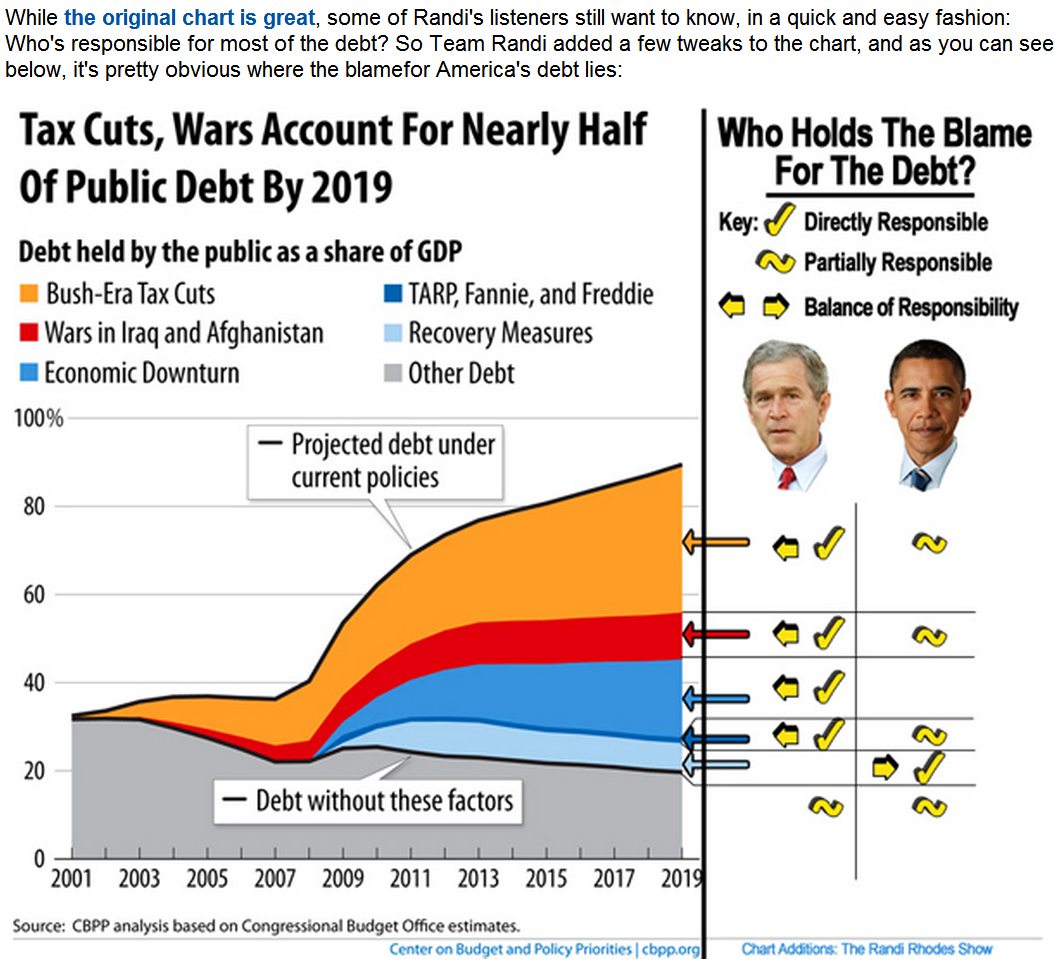

DemoCurmudgeon Bush Tax Cuts Inflate Deficit

https://3.bp.blogspot.com/-8pfW7oVFmnw/UEe4J-2dXYI/AAAAAAAAI88/l9EoNjhI0dI/s1600/Obama+Tax+Cut+Bush.jpg

Tax Cuts Can Do More Harm Than Good Al Jazeera America

http://america.aljazeera.com/content/ajam/opinions/2014/9/tax-cuts-economicsreaganbush/jcr:content/image.img.jpg

Learn more about the Bush era tax cuts through charts facts in depth analysis The first round of what have come to be known as the Bush tax cuts went into effect 12 years ago Proposals regarding the Bush tax cuts are generally not about whether or not to let the tax cuts expire as scheduled but rather about which tax cuts to extend and for how long This report examines the Bush tax cuts within the context of the current and long term economic and budgetary environment

[desc-10] [desc-11]

The Legacy Of The Bush Tax Cuts In Four Charts The Washington Post

https://www.washingtonpost.com/pbox.php?url=http://www.washingtonpost.com/blogs/wonkblog/files/2013/01/image1-1.jpg&w=1484&op=resize&opt=1&filter=antialias&t=20170517

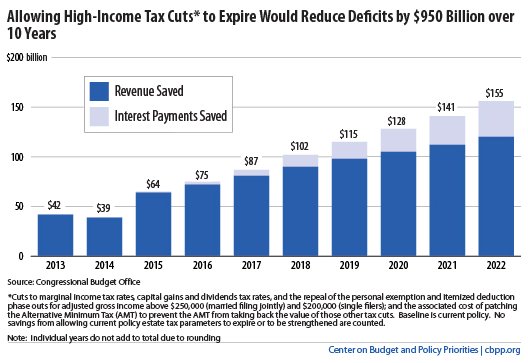

Bush Era Tax Cuts Will Cost U S Nearly 1 Trillion Over Next Decade

https://i.huffpost.com/gen/744536/original.jpg

https://www.thebalancemoney.com/president-george...

Research shows no evidence that tax cuts have any impact on the spending habits of upper income taxpayers The Bush tax cuts would only increase growth enough to make up 10 of their long run cost Maintaining the cuts has been estimated to

https://www.cbpp.org/.../the-legacy-of-the-2001-and-2003-bush-tax-cuts

The biggest tax policy changes enacted under President George W Bush were the 2001 and 2003 tax cuts often referred to as the Bush tax cuts but formally named the Economic Growth and Tax

Ten Myths About The Bush Tax Cuts The Heritage Foundation

The Legacy Of The Bush Tax Cuts In Four Charts The Washington Post

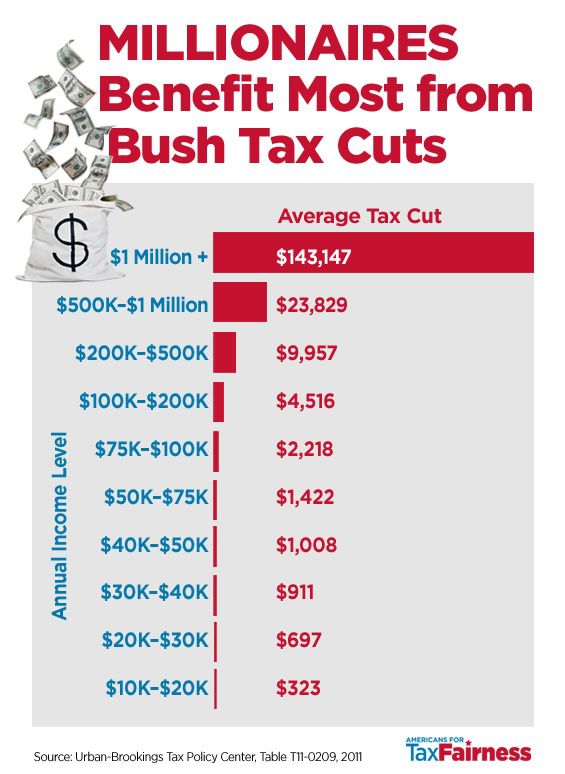

Millionaires Benefit Most From Bush Tax Cuts Americans For Tax Fairness

Bush Era Tax Cuts Fall Short Pennlive

A Tale Of Two Charts Bush Tax Cuts Created Jobs Unlike Obama s Spend

What On Earth Are Bush Tax Cuts Behind The Obama Malaise

What On Earth Are Bush Tax Cuts Behind The Obama Malaise

Congress Back In DC Decision On Bush Tax Cuts Still Pending The

Bush Tax Cuts Storyboard By Ff7aa98b

Obama Won t Back Bush Tax Cut Extension For Rich Salon

Bush Tax Cuts - President Obama and Congress had allowed some of the Bush tax cuts for the rich to expire Many Bush era provisions still in effect benefited the rich but this was partly offset by tax increases on high income individuals that are part of the Affordable Care Act