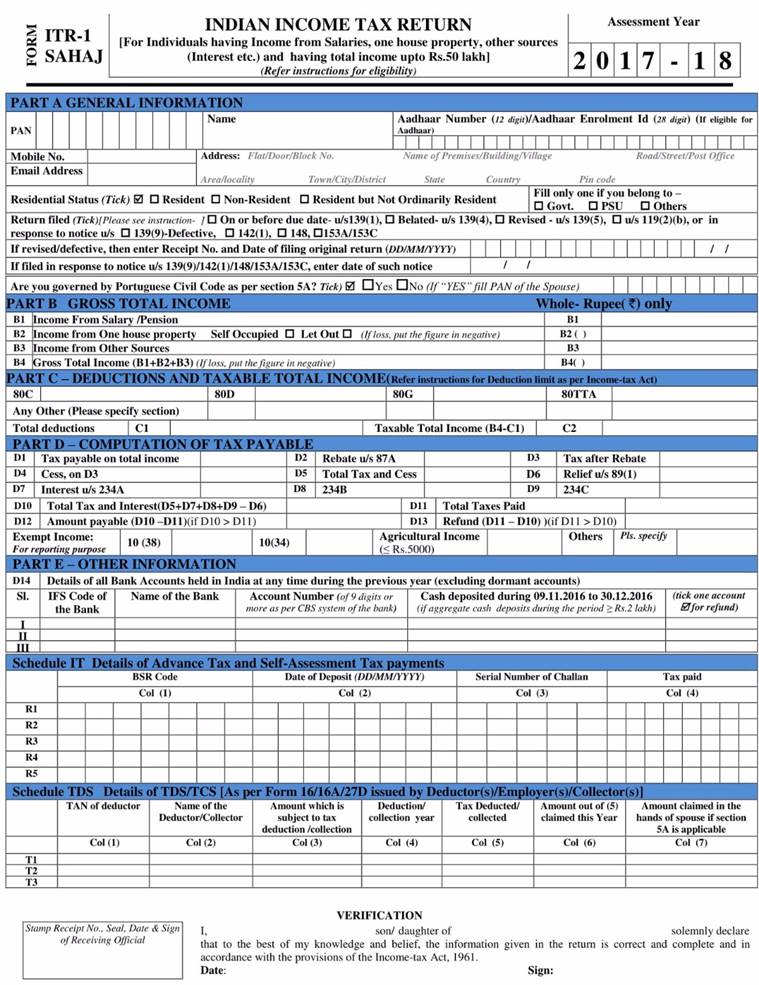

Rebate Of Mediclaim In Income Tax Web 17 mai 2021 nbsp 0183 32 17 May 2021 13 104 Views 2 comments Section 80D Deduction in respect of Medical Insurance Premium Mediclaim Tax deductions can be availed on

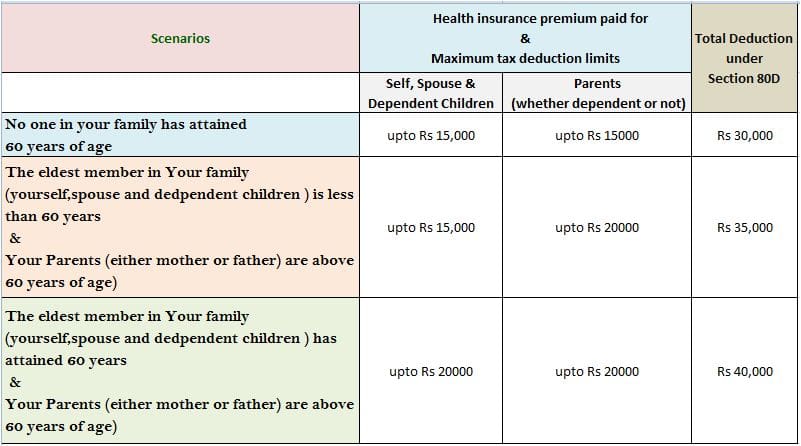

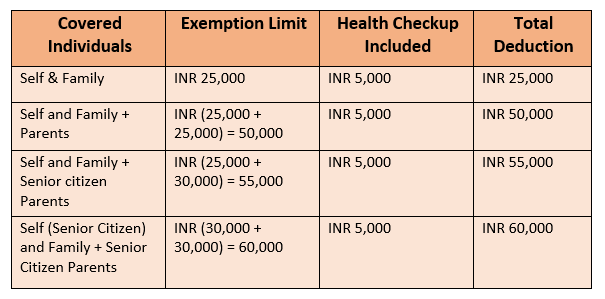

Web 1 f 233 vr 2023 nbsp 0183 32 As per the Income Tax provisions the tax assessees can claim a deduction under section 80D of the Income Tax for the premium paid towards a mediclaim insurance In this article we will discuss in Web 27 janv 2023 nbsp 0183 32 What is Deduction under section 80D Section 80D of Income Tax Act allows a deduction to an Individual including non resident individuals or HUF for the

Rebate Of Mediclaim In Income Tax

Rebate Of Mediclaim In Income Tax

https://www.careinsurance.com/upload_master/media/posts/February2023/image20230201153943.jpg

Section 80D Of Income Tax 80D Deduction For Medical Insurance Mediclaim

https://www.fincash.com/b/wp-content/uploads/2017/01/80c-deductions.png

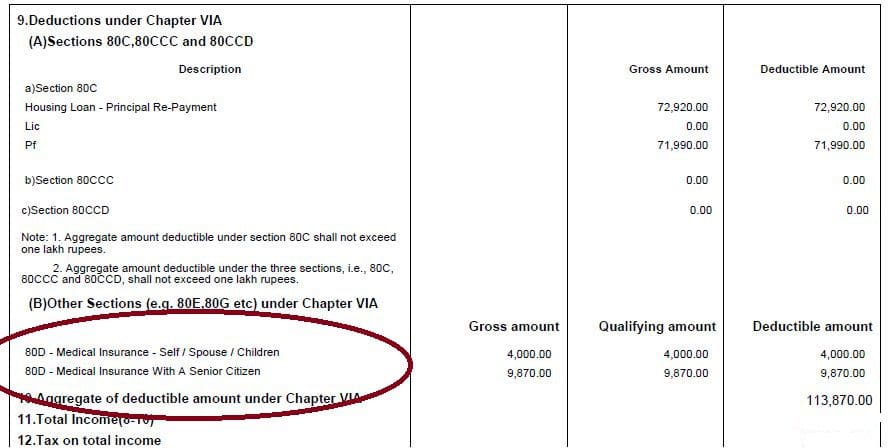

Section 80D Tax Benefits Health Or Mediclaim Insurance FY 2017 18

http://www.relakhs.com/wp-content/uploads/2014/11/Medical-allowance-form-16.jpg

Web 4 juin 2022 nbsp 0183 32 TAX BENEFITS DUE TO LIFE INSURANCE POLICY HEALTH INSURANCE POLICY AND EXPENDITURE ON MEDICAL TREATMENT Introduction Payment of Web 26 juin 2018 nbsp 0183 32 Deduction Under Section 80D in respect of Medical Insurance Premium Mediclaim paid to keep in force insurance by individual either on his own health or on the health of spouse parents and dependent

Web 12 juin 2020 nbsp 0183 32 3 Income Tax treatment in case of medical insurance reimbursement under mediclaim policy for both salaried as well as non salaried people Money received through a claim under a medical policy Web 5 nov 2019 nbsp 0183 32 Having a good mediclaim policy in India not only helps you deal with the huge hospitalization costs but also brings you many tax benefits under section 80D of the

Download Rebate Of Mediclaim In Income Tax

More picture related to Rebate Of Mediclaim In Income Tax

Section 80D Tax Benefits Health Or Mediclaim Insurance

http://www.relakhs.com/wp-content/uploads/2014/11/health-insurance-premium-section-80d-deductions.jpg

Section 80D Tax Benefits Health Or Mediclaim Insurance FY 2017 18

http://www.relakhs.com/wp-content/uploads/2014/11/Mediclaim-section-80d-form-16.jpg

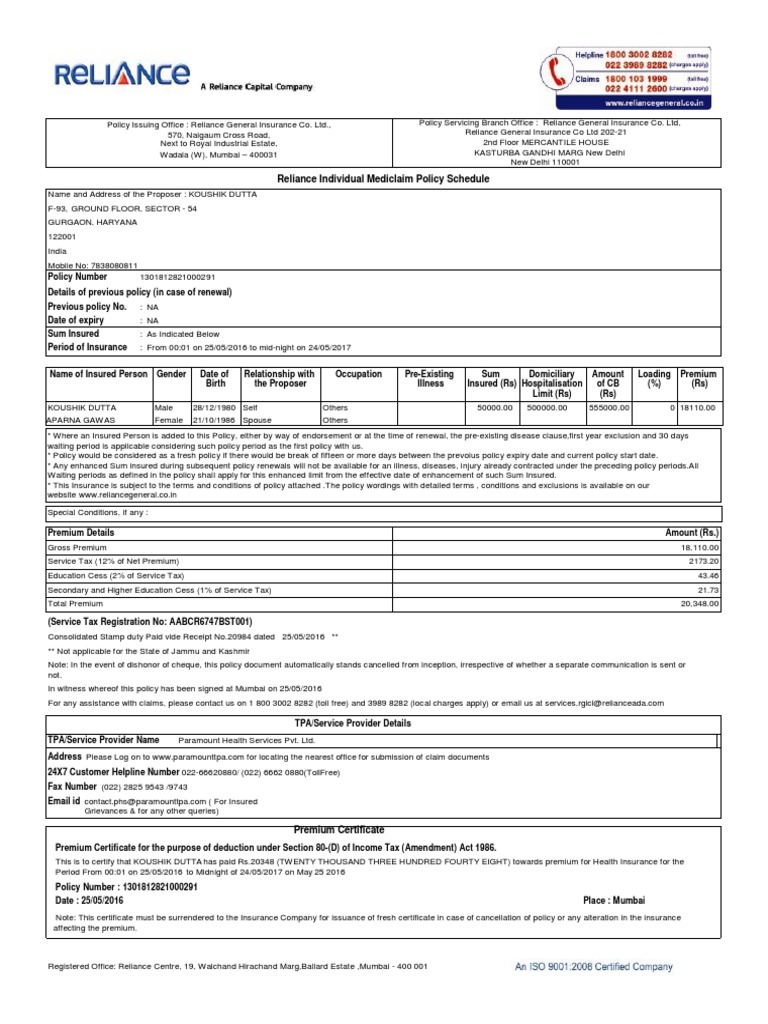

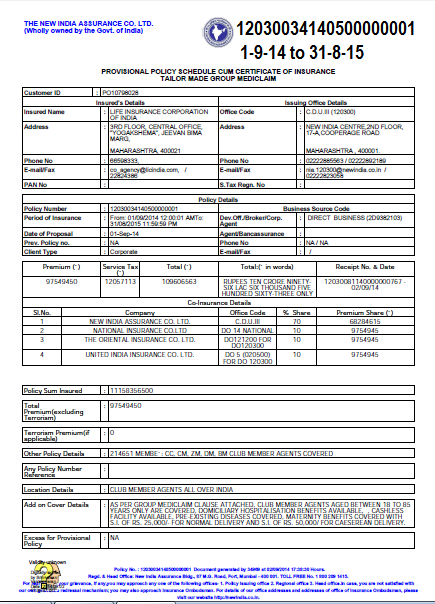

Mediclaim Receipt Insurance Taxes

https://imgv2-2-f.scribdassets.com/img/document/368529097/original/d24413953c/1547041318?v=1

Web 3 ao 251 t 2023 nbsp 0183 32 What is Section 80D of the Income Tax Act Who is eligible to claim Tax deductions under Section 80D What is the maximum deduction that can be claimed under Section 80D A Medical Insurance Web 18 d 233 c 2022 nbsp 0183 32 How to avail tax rebate on mediclaim policy 1 min read 18 Dec 2022 08 52 PM IST Parizad Sirwalla As per the current provisions of the section an individual taxpayer is eligible for

Web 23 avr 2020 nbsp 0183 32 Under the Income Tax Act there is a tax exemption of up to Rs 15 000 on medical reimbursements Medical Reimbursement Rules The Income Tax Act Web Section 80D allows a tax deduction of up to Rs 25 000 per financial year on medical insurance premiums Section 80D also includes a Rs 5 000 deduction for any expenses

Mediclaim Deduction U s 80d Under Income Tax Act Health Insurance

https://i.ytimg.com/vi/ur_SJznr2TM/maxresdefault.jpg

InsureRelaxInfo Agents Club Members Group Mediclaime Policy 2014 15

http://4.bp.blogspot.com/-zRFL-W3SRts/VDYK5UuTuoI/AAAAAAAAClo/yqDSUGRLvis/s1600/2014%2Bmediclaime%2Bpolicy.png

https://taxguru.in/income-tax/section-80d-deduction-mediclaim-medic…

Web 17 mai 2021 nbsp 0183 32 17 May 2021 13 104 Views 2 comments Section 80D Deduction in respect of Medical Insurance Premium Mediclaim Tax deductions can be availed on

https://www.careinsurance.com/blog/health-in…

Web 1 f 233 vr 2023 nbsp 0183 32 As per the Income Tax provisions the tax assessees can claim a deduction under section 80D of the Income Tax for the premium paid towards a mediclaim insurance In this article we will discuss in

Govt Introduces New Simplified ITR Form All You Need To Know The

Mediclaim Deduction U s 80d Under Income Tax Act Health Insurance

Section 80d Of Income Tax Act Ay 2020 21 Worthen Althiche

Income Tax Deductions List FY 2019 20 How To Save Tax For AY 20 21

Tax Planning For Salaried Individual Accounting Taxation How To

Tax Planning And Wealth Management

Tax Planning And Wealth Management

Conclusion Of Life Insurance Policy Keijupolypuoti

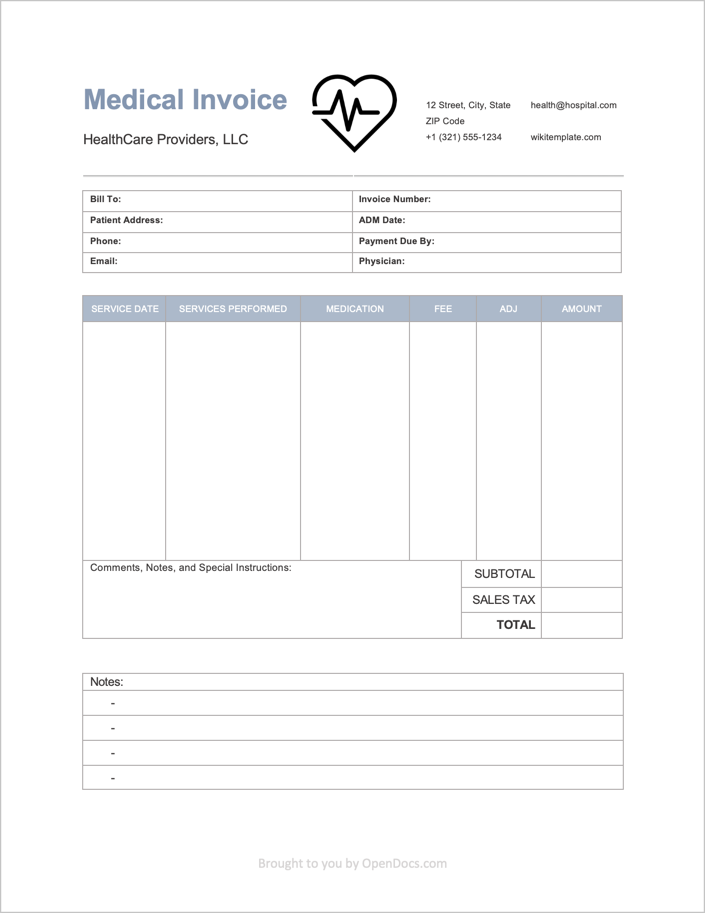

Medical Billing Invoice Template Best Template Ideas

LIVE Demo How To File Income Tax Return For FY 2021 22 AY 2022 23 Claim

Rebate Of Mediclaim In Income Tax - Web You need to claim tax benefits on medical insurance when you file your Income Tax Returns ITR for the said financial year Follow the steps below to get the health