Exemption Of Mediclaim Under Income Tax Verkko 26 kes 228 k 2018 nbsp 0183 32 1 Medical insurance premium on his policy of Rs 15 000 will qualify for deduction 2 Medical insurance premium on policy of his spouse of Rs 4 000 will qualify for 3 Medical insurance premium on policy of Rs 3 000 of his younger daughter who is dependent on him will qualify for deduction

Verkko 23 huhtik 2020 nbsp 0183 32 Under the Income Tax Act there is a tax exemption of up to Rs 15 000 on medical reimbursements Medical Reimbursement Rules The Income Tax Act prescribes some conditions for eligibility as mentioned below The employee must have spent the money on medical treatment expenses only Verkko The expenditure is allowed for the deduction when no medical insurance premium is paid for the senior citizen The term medical expenditure has not been defined under the income tax act but generally it will include medical expenses such as medical consultation fees medicines impairment aid etc The maximum deduction amount is

Exemption Of Mediclaim Under Income Tax

Exemption Of Mediclaim Under Income Tax

https://cdn.turtlemint.com/wp-content/uploads/Health-Insurance-Tax-Benefits-min-e1619004325612.jpg

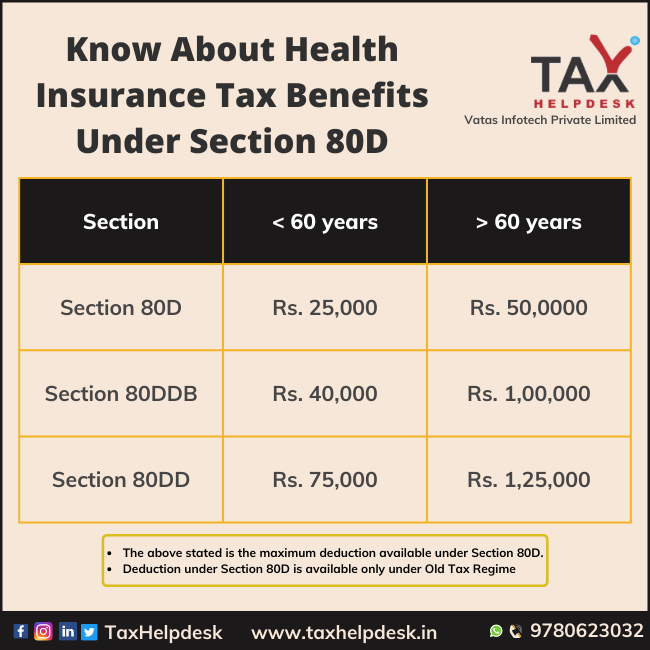

Know About Health Insurance Tax Benefits Under Section 80D

https://www.taxhelpdesk.in/wp-content/uploads/2022/04/Know-About-Health-Insurance-Tax-Benefits-Under-Section-80D.png

Section 13 OF THE INCOME TAX ACT

https://www.legalmantra.net/admin/assets/upload_image/blog/INCOME_TAX2.jpg

Verkko 5 marrask 2019 nbsp 0183 32 Cash payments made for the premium do not qualify for the mediclaim Section 80D tax benefits You are eligible to get tax exemptions even if you receive medical treatment outside India For ensuring this your mediclaim insurance policy must have this provision and should be approved by the IRDAI Verkko 21 jouluk 2016 nbsp 0183 32 Ans You can avail tax exemption of up to Rs 25 000 in a financial year on health insurance premiums and preventive health check ups under Section 80D of the Income Tax Act 1961 However if you or your spouse or your parents are senior citizens you can avail a tax rebate of up to Rs 50 000 per financial year

Verkko 21 maalisk 2015 nbsp 0183 32 1 Introduction Section 80D of the Income tax Act seeks to provide deduction of INR 15 000 to a taxpayer who has incurred expenditure on health insurance of himself spouse and dependent children A further deduction of INR 15 000 is provided if the expenditure is incurred on behalf of the parents Verkko The premium you pay towards a mediclaim or health insurance policy qualifies for tax deduction under Section 80D of the Income Tax Act 1961 That is it reduces your tax liability Therefore health insurance is vital to grow

Download Exemption Of Mediclaim Under Income Tax

More picture related to Exemption Of Mediclaim Under Income Tax

Tax Benefit Without Mediclaim Under Section 80D Income Tax Act How

https://i.ytimg.com/vi/XcfJ7qHxbmQ/maxresdefault.jpg

Standard Deduction For Salaried Employees Impact Of Standard

https://i.pinimg.com/originals/05/8c/32/058c32cbbbd99e3ad8dfee9a313112a1.jpg

Filing Income Tax Return Get Mediclaim And Avail Tax Exemption On Up

https://cdn.zeebiz.com/sites/default/files/styles/zeebiz_850x478/public/2019/07/12/94479-income-tax-office-pti.jpg?itok=URroWbc7&c=c5af8c0f92ccc8e249257bf0f1cb18e8

Verkko As per Section 80D terms you are eligible for Tax deduction of Rs 32 000 on Rs 32 000 paid as health insurance premium for you and your dependents Tax deduction of Rs 35 000 for your parents senior citizens out of the overall payment of Rs 35 000 Verkko 27 tammik 2023 nbsp 0183 32 Section 80D of Income Tax Act allows a deduction to an Individual including non resident individuals or HUF for the amount paid towards medical insurance premium medical expenditure and preventive health checkup in a financial year Top up health plans and critical illness plans are also eligible for 80D deduction

Verkko 4 elok 2020 nbsp 0183 32 Section 80D provides that the single premium paid should be divided over the years for which the benefit of health insurance is available While filing the Income Tax Return ITR Arup Sahay Verkko 9 maalisk 2023 nbsp 0183 32 What is the limit of deduction under section 80D of Income Tax You can claim a deduction of up to Rs 25 000 for medical insurance premiums for yourself your spouse and your children If you are paying your parents health insurance premium you can claim an additional deduction of Rs 25 000

Income Exempted U s 10 Lecture Notes INCOME EXEMPTED FROM TAX U S

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/1e6ed41ab1579da043d5061a9e55bffc/thumb_1200_1553.png

Mediclaim Letter Sample Declaration Sample Declaration Letter YouTube

https://i.ytimg.com/vi/u8_fH1k7uug/maxresdefault.jpg

https://taxguru.in/income-tax/all-about-deduction-us-80d-for-mediclaim...

Verkko 26 kes 228 k 2018 nbsp 0183 32 1 Medical insurance premium on his policy of Rs 15 000 will qualify for deduction 2 Medical insurance premium on policy of his spouse of Rs 4 000 will qualify for 3 Medical insurance premium on policy of Rs 3 000 of his younger daughter who is dependent on him will qualify for deduction

https://www.careinsurance.com/blog/health-insurance-articles/a-guide...

Verkko 23 huhtik 2020 nbsp 0183 32 Under the Income Tax Act there is a tax exemption of up to Rs 15 000 on medical reimbursements Medical Reimbursement Rules The Income Tax Act prescribes some conditions for eligibility as mentioned below The employee must have spent the money on medical treatment expenses only

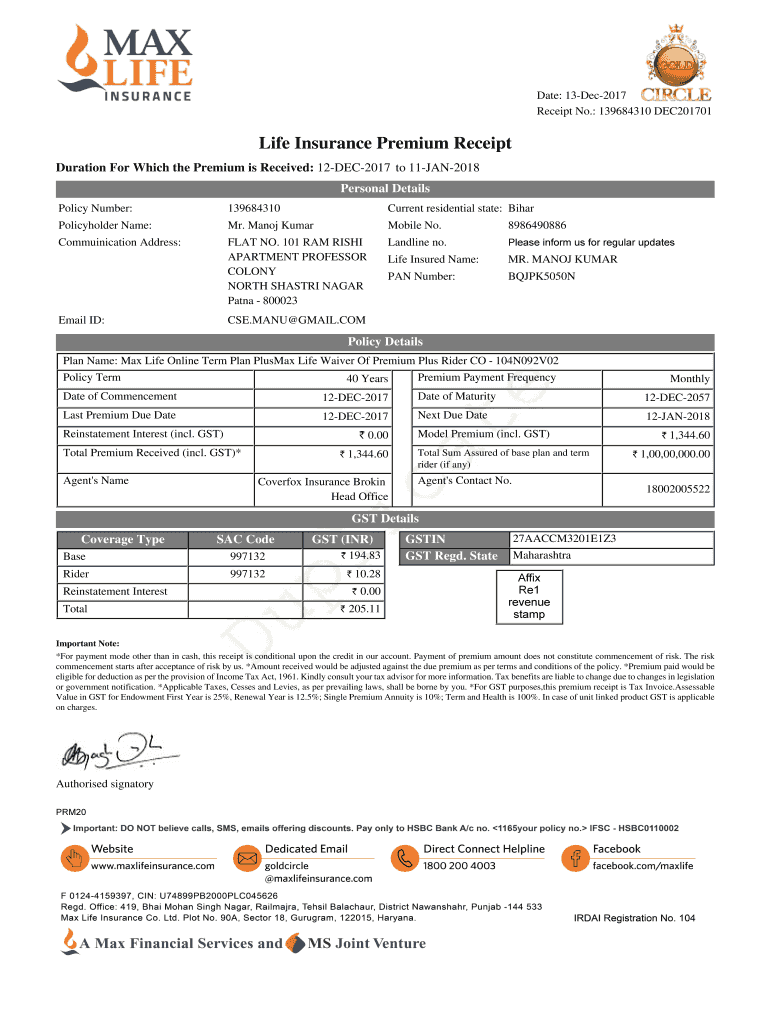

Medical Insurance Premium Receipt PDF Complete With Ease AirSlate

Income Exempted U s 10 Lecture Notes INCOME EXEMPTED FROM TAX U S

Mediclaim Deduction U s 80d Under Income Tax Act Health Insurance

Medical Insurance Premium Receipt 2019 20 PDF Deductible Insurance

All You Need To Know About Section 80D Of Income Tax Act Ebizfiling

Know About Popular Exemptions And Deductions Available Under Income Tax

Know About Popular Exemptions And Deductions Available Under Income Tax

Income Tax Act 1 3 Notes On Law Of Taxation PART THE INCOME

Epf Contribution Table For Age Above 60 2019 Frank Lyman

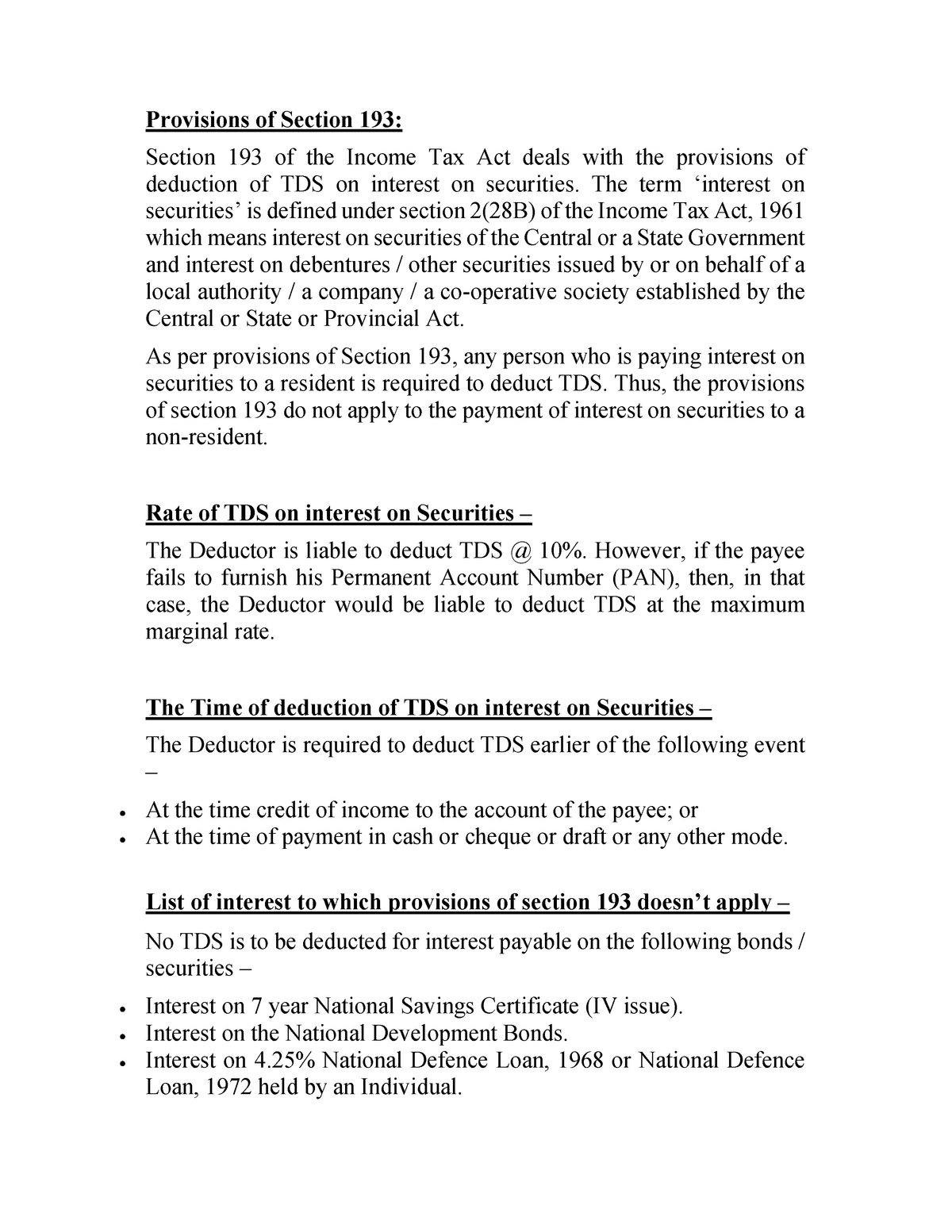

Section 193 To 194C Income Tax Act 1961 Provisions Of Section 193

Exemption Of Mediclaim Under Income Tax - Verkko 21 maalisk 2015 nbsp 0183 32 1 Introduction Section 80D of the Income tax Act seeks to provide deduction of INR 15 000 to a taxpayer who has incurred expenditure on health insurance of himself spouse and dependent children A further deduction of INR 15 000 is provided if the expenditure is incurred on behalf of the parents