Mediclaim Rebate In Income Tax 2021 22 Verkko 8 jouluk 2023 nbsp 0183 32 What is Section 80D Every individual or HUF can claim a deduction for medical insurance premiums paid in the financial year under Section 80D This

Verkko 29 syysk 2023 nbsp 0183 32 Explore Section 80D amp 80D Deduction Understand income tax deductions for medical insurance find out who s eligible and unlock the tax benefits Verkko 21 jouluk 2016 nbsp 0183 32 Section 80D allows a tax deduction of up to Rs 25 000 per financial year on medical insurance premiums Section 80D also includes a Rs 5 000 deduction

Mediclaim Rebate In Income Tax 2021 22

Mediclaim Rebate In Income Tax 2021 22

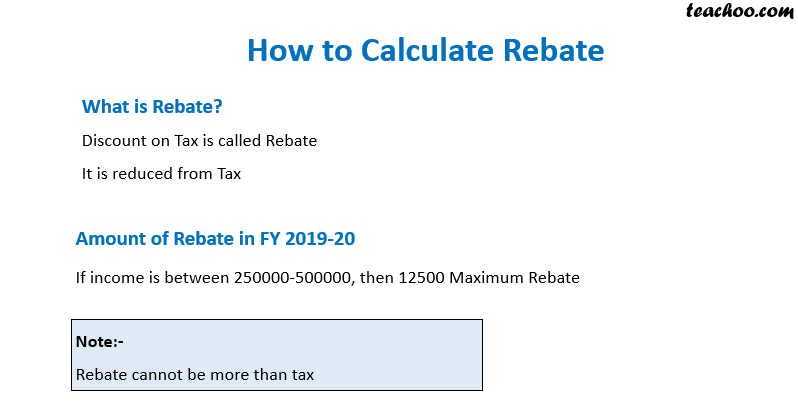

https://d77da31580fbc8944c00-52b01ccbcfe56047120eec75d9cb2cbd.ssl.cf6.rackcdn.com/4f3e8d40-1fcf-4c08-b717-2df0bca83a73/rebate-1.png

Rebate And Releif Of Tax Rebate 87a Of Income Tax Rebate And Relief

https://i.ytimg.com/vi/IrYTqu6Hohg/maxresdefault.jpg

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template

https://www.signnow.com/preview/585/571/585571881/large.png

Verkko 24 maalisk 2017 nbsp 0183 32 Section 80 Deductions A complete guide on Income Tax deduction under section 80C 80CCD 1 80CCD 1B 80CCC Find out the deduction under Verkko 4 kes 228 k 2022 nbsp 0183 32 2 Payment of medical insurance premium on policy of his spouse Rs 4 000 3 Payment of medical insurance premium on policy of his younger daughter

Verkko As amended upto Finance Act 2023 Deduction Under Section 80D Assessment Year Status Assessee Spouse amp dependent Children Assesee s parents Payment for Verkko 30 hein 228 k 2023 nbsp 0183 32 Whereas Section 80DD allows for tax deductions if you incur medical expenses for a disabled dependent It is important to understand that deduction under

Download Mediclaim Rebate In Income Tax 2021 22

More picture related to Mediclaim Rebate In Income Tax 2021 22

Rebate Allowable Under Section 87A Of Income Tax Act

https://taxguru.in/wp-content/uploads/2020/08/Tax-Rebate.jpg

LIVE Demo How To File Income Tax Return For FY 2021 22 AY 2022 23 Claim

https://i.ytimg.com/vi/USY_P-afSLY/maxresdefault.jpg

Form For Renters Rebate RentersRebate

https://i0.wp.com/www.rentersrebate.net/wp-content/uploads/2022/10/rent-rebate-form-1-free-templates-in-pdf-word-excel-download-15.png?fit=768%2C1024&ssl=1

Verkko 1 helmik 2023 nbsp 0183 32 Step 7 Fill in the Details of your Parents Under column 2 of Schedule 80D specify whether or not your parents are senior citizens If you select No option Verkko 16 jouluk 2020 nbsp 0183 32 Section 80D Tax Benefit under the New Tax Regime AY 2021 22 Can I claim Health Insurance Premium Section 80D Income Tax Benefit under the New Tax

Verkko 26 kes 228 k 2018 nbsp 0183 32 1 Medical insurance premium on his policy of Rs 15 000 will qualify for deduction 2 Medical insurance premium on policy of his spouse of Verkko 26 marrask 2020 nbsp 0183 32 Sections 80DD of the Income Tax Act covers deduction for the medical expenditure incurred for self or for a dependent person A dependent person

Council Tax Rates For 2021 22 Will Your Bills Be More Expensive From

https://media.product.which.co.uk/prod/images/original/gm-452fcbf4-8a65-4c0a-9c70-a54b62fe840a-council-tax-feb-2020-2.jpeg

Epf Contribution Table For Age Above 60 2019 Frank Lyman

https://static.pbcdn.in/cdn/images/articles/health/80d-deduction-is-allowed.jpg

https://cleartax.in/s/medical-insurance

Verkko 8 jouluk 2023 nbsp 0183 32 What is Section 80D Every individual or HUF can claim a deduction for medical insurance premiums paid in the financial year under Section 80D This

https://tax2win.in/guide/section-80d-deduction-medical-insurance...

Verkko 29 syysk 2023 nbsp 0183 32 Explore Section 80D amp 80D Deduction Understand income tax deductions for medical insurance find out who s eligible and unlock the tax benefits

The Money Edge 2021 22 Federal Budget Personal Income Tax Changes

Council Tax Rates For 2021 22 Will Your Bills Be More Expensive From

How To Deal With An Income Tax Notice Wealthzi

2021 Child Tax Credit And Payments What Your Family Needs To Know

How To Calculate Tax Rebate In Income Tax Of Bangladesh

Province Of Manitoba School Tax Rebate

Province Of Manitoba School Tax Rebate

Income Tax Rebate Under Section 87A

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

Income Tax Rules 2021 22 Telplus in

Mediclaim Rebate In Income Tax 2021 22 - Verkko As amended upto Finance Act 2023 Deduction Under Section 80D Assessment Year Status Assessee Spouse amp dependent Children Assesee s parents Payment for