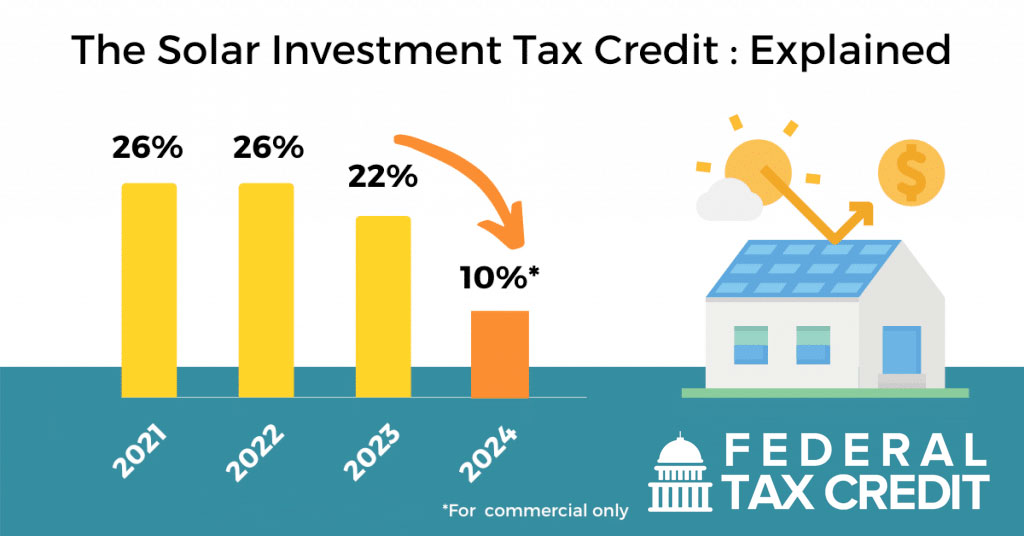

Federal Government Solar Rebates 2024 Solar wind and geothermal power generation Solar water heaters Fuel cells Battery storage beginning in 2023 The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 to 2032 30 no annual maximum or lifetime limit 2033 26 no annual maximum or lifetime limit

The Federal Solar Tax Credit for 2024 is 30 this is an increase from 26 in recent years and extends through to 2032 Tax credits and incentives can help bring the price down such as the The U S government offers a solar tax credit that can reach up to 30 of the cost of installing a system that uses the sun to power your home Simple tax filing with a 50 flat fee for every

Federal Government Solar Rebates 2024

Federal Government Solar Rebates 2024

https://captaingreen.com.au/wp-content/uploads/2021/05/federal.jpg

Federal Incentives Solar Rebates For Solar Power Solar Choice

https://www.solarchoice.net.au/wp-content/uploads/STC-Zones-in-Australia-as-of-1st-January-2019-1024x599.jpg

Is The Federal Government Subsidizing Solar Panel Installation

https://www.gannett-cdn.com/-mm-/6756f0576e26b57a13add179d066d19941b8e701/c=0-84-1600-984/local/-/media/2020/09/11/Austin/ghows-TX-200909302-e6a2b0eb.jpg?width=1600&height=900&fit=crop&format=pjpg&auto=webp

On Aug 16 2022 President Joseph R Biden signed the landmark Inflation Reduction Act which provides nearly 400 billion to support clean energy and address climate change including 8 8 billion for the Home Energy Rebates The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid for by the taxpayer Other types of renewable energy are also eligible for similar credits but are beyond the scope of this guidance

WASHINGTON June 28 2023 Today the U S Environmental Protection Agency EPA launched a 7 billion grant competition through President Biden s Investing in America agenda to increase access to affordable resilient and clean solar energy for millions of low income households How does the 2024 federal solar tax credit work The solar tax credit is a dollar for dollar reduction of what you owe in federal income taxes So if you owed 15 000 in income taxes and earned a 6 000 solar tax credit your tax liability would drop to 9 000 Will the tax credit increase my tax refund

Download Federal Government Solar Rebates 2024

More picture related to Federal Government Solar Rebates 2024

Federal Solar Tax Credit What It Is How To Claim It For 2023

https://www.ecowatch.com/wp-content/uploads/2022/10/Solar-Investment-Tax-Credit-5-1-2.png

The Federal Government Is Paying Homeowners To Go Solar The Price Chopper

https://www.thepricechopper.com/wp-content/uploads/2022/01/solar_gov_tax_incentive.jpg

Government Shutdown 2018 What s Open What s Closed What s Different

https://www.gannett-cdn.com/-mm-/79612d1d110c0dd9bb019c69bf16cfb66d15d11e/c=0-16-580-342&r=x1683&c=3200x1680/local/-/media/2018/01/13/USATODAY/usatsports/congress-capitol-building-laws-budget-washington-getty_large.jpg

The solar tax credit which is among several federal Residential Clean Energy Credits available through 2032 allows homeowners to subtract 30 percent of the cost of installing solar heating This annual funding opportunity will award 6 5 million for seedling R D projects that focus on innovative and novel ideas in photovoltaics PV and concentrating solar thermal power CSP and are riskier than research ideas based on established technologies

The Federal Solar Tax Credit covers 30 of the following Solar powered equipment that generates electricity or heats water Solar power storage equipment for 2022 but a capacity of at least 3 kilowatt hours kWh is required beginning in 2023 Qualifying installation and labor costs Sales taxes paid for eligible solar installation expenses 9 30 2024 Notice of Funding Opportunity Rural Energy for America Program REAP Department of Agriculture To help agricultural producers and rural small businesses invest in renewable

Household Solar Rebates State By State 2022 SolarRun

https://www.solarrun.com.au/wp-content/uploads/2022/05/shutterstock_370520669.jpeg

Federal Government Announces 2 Billion Social Housing Investment

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA1cGWIS.img?w=1920&h=1080&m=4&q=94

https://www.irs.gov/credits-deductions/home-energy-tax-credits

Solar wind and geothermal power generation Solar water heaters Fuel cells Battery storage beginning in 2023 The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 to 2032 30 no annual maximum or lifetime limit 2033 26 no annual maximum or lifetime limit

https://www.forbes.com/home-improvement/solar/solar-tax-credit-by-state/

The Federal Solar Tax Credit for 2024 is 30 this is an increase from 26 in recent years and extends through to 2032 Tax credits and incentives can help bring the price down such as the

2022 ACT Solar And Battery Rebates Who Qualifies Solar Rebates ACT

Household Solar Rebates State By State 2022 SolarRun

Solar Tax Credits Rebates Missouri Arkansas

Our Guide To The Government Solar Rebate WA IBreeze

Pin On Solar Power Info graphics

Complete Guide For WA Solar Panel Rebates 2023

Complete Guide For WA Solar Panel Rebates 2023

Solar Rebate Perth WA Government Solar Rebate 2021

What Types Of Government Rebates Are Available For Solar Panels In VIC NSW Solar Emporium

Solar Panel Rebates Incentives Grants Available In Alberta

Federal Government Solar Rebates 2024 - WASHINGTON June 28 2023 Today the U S Environmental Protection Agency EPA launched a 7 billion grant competition through President Biden s Investing in America agenda to increase access to affordable resilient and clean solar energy for millions of low income households