Business Tax Credits A business tax credit is an amount of money that companies can subtract from their federal and or state taxes owed It reduces a business tax bill on a dollar for dollar

Find information about credits and deductions for businesses and how to claim them on your tax return A credit is an amount you subtract from the tax you owe A deduction is an amount you subtract from your income when you file so you don t pay tax on it This publication has information on business income expenses and tax credits that may help you as a small business owner file your income tax return This publication does not cover the topics listed in the following table

Business Tax Credits

Business Tax Credits

https://www.patriotsoftware.com/wp-content/uploads/2019/03/Tax-Credit-1.png

10 Tax Credits All Small Businesses Should Know About

https://marketbusinessnews.com/wp-content/uploads/2019/11/RD-tax-credit-thumbnail-image-4994994994.jpg

Business Tax Credits To Provide Leave To Employees During COVID 19

https://www.omnitaxhelp.com/wp-content/uploads/2020/04/Business-Tax-Credits-to-provide-leave-to-employees-during-COVID-19.jpg

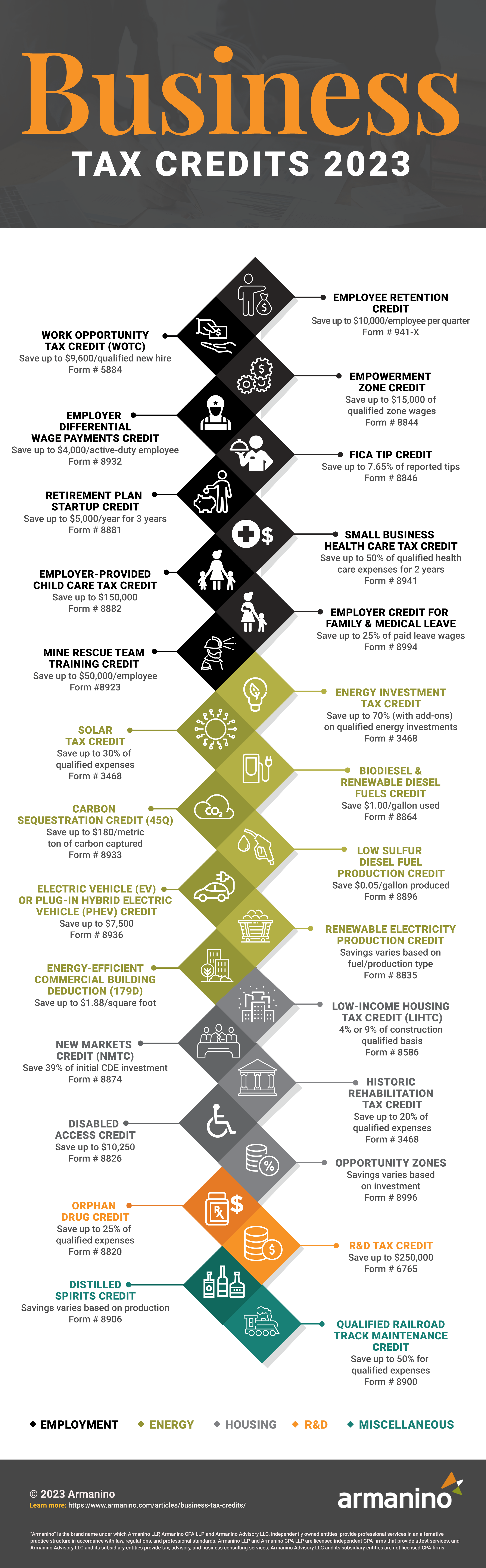

This guide explains how tax credits work the best small business tax credits and what forms you need to file for each one Tax credits are one of the best ways to save money on your tax bill But keeping track of them all can be difficult Here s our definitive guide to all of the small business tax credits you might be eligible for and which forms you need to file for each one

One way to lower your tax liability is to claim business tax credits And due to the coronavirus pandemic there are also a number of temporary tax credits for employers to claim Read on to learn what is a tax credit Every business owner wants to save money on taxes which means that you should know if you qualify for a tax credit and how to claim it Use this guide to quickly and accurately identify the small business tax credits that will keep more money in your pocket at tax time

Download Business Tax Credits

More picture related to Business Tax Credits

Federal Solar Tax Credits For Businesses Department Of Energy

https://www.energy.gov/sites/default/files/styles/full_article_width/public/2023-05/Summary-ITC-and-PTC-Values-Chart-2023.png?itok=_P0koCpu

Business Tax Credits 2023 Armanino

https://www.armanino.com/-/media/images/articles/business-tax-credits-2023-infographic.png

Business Tax Credits Alert IRS Clarifies Two Revised Credits Tax Law

https://gordonlawltd.com/wp-content/uploads/2019/03/business-tax-credits-685.jpg

In essence business tax credits are a dollar for dollar reduction in a business s tax bill Unlike tax deductions that lower taxable income tax credits decrease the actual tax owed often leading to substantial savings Business tax credits provide a powerful opportunity for companies to significantly reduce their tax liability while encouraging beneficial practices By leveraging these incentives businesses can save money and drive strategic decisions that

[desc-10] [desc-11]

7 Business Tax Credits You Can t Afford To Miss Out On

https://www.engineeryourfinances.com/wp-content/uploads/2019/03/business-tax-credits.jpg

Business Tax Credits To Look For HubPages

https://images.saymedia-content.com/.image/t_share/MTgwNjgyMDUyNjkyMTU3ODAw/business-tax-credits-to-look-for.jpg

https://www.investopedia.com › terms › business-tax-credits.asp

A business tax credit is an amount of money that companies can subtract from their federal and or state taxes owed It reduces a business tax bill on a dollar for dollar

https://www.irs.gov › credits-deductions › businesses

Find information about credits and deductions for businesses and how to claim them on your tax return A credit is an amount you subtract from the tax you owe A deduction is an amount you subtract from your income when you file so you don t pay tax on it

Your Complete Guide To 2020 U S Small Business Tax Credits

7 Business Tax Credits You Can t Afford To Miss Out On

Startup Business Tax Credits You Need To Know Zeni

27 Small Business Tax Credits You Should Know About Lendio

Business Tax Credits Credit Vs Deduction Types Of Credits More

Seu Guia Completo Para 2021 U S Small Business Tax Credits

Seu Guia Completo Para 2021 U S Small Business Tax Credits

Individual And Business Tax Credits An Explanation

Federal Solar Tax Credits For Businesses Department Of Energy

4 Key Tax Credits For Small Business Owners Incentax

Business Tax Credits - [desc-14]