Business Tax Credits For Solar Panels This webpage provides an overview of the federal investment and production tax credits for businesses that own solar facilities including both photovoltaic PV and concentrating solar thermal power CSP

This resource from the U S Department of Energy DOE Solar Energy Technologies Office SETO provides an overview of the federal investment and production tax credits for Clean Energy Tax Incentives for Businesses The Inflation Reduction Act of 2022 IRA makes several clean energy tax credits available to businesses IRS gov CleanEnergy

Business Tax Credits For Solar Panels

Business Tax Credits For Solar Panels

https://i.ytimg.com/vi/u46G0bvoXlY/maxresdefault.jpg

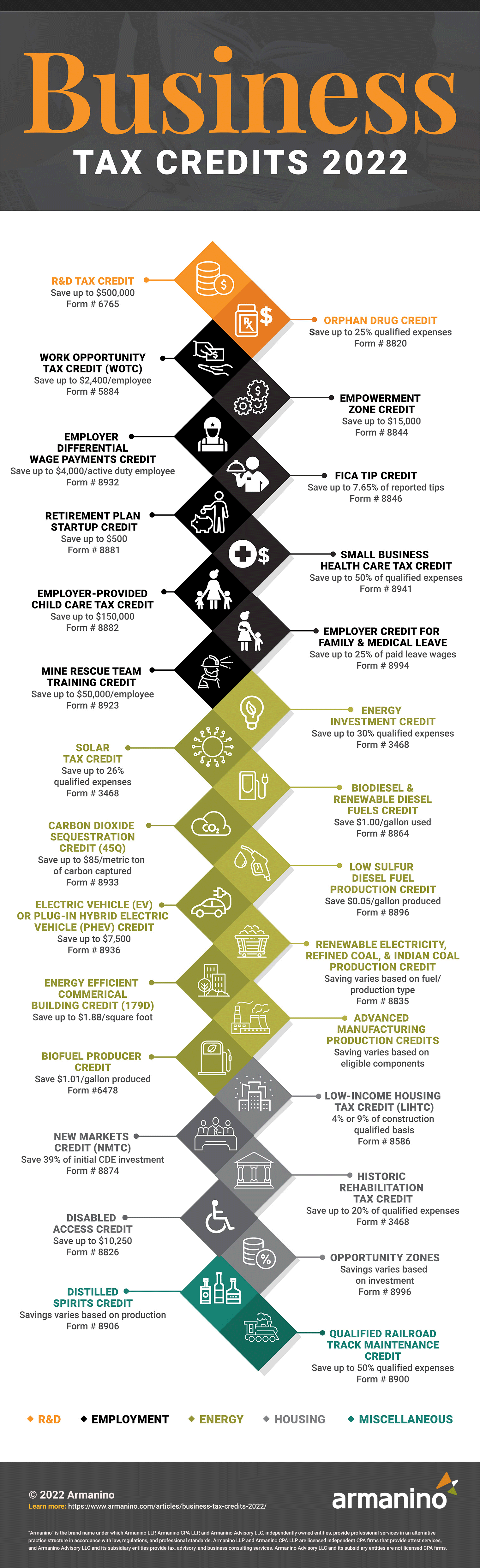

2022 Business Tax Credits Armanino

https://www.armanino.com/-/media/images/articles/business-tax-credits-2022-infographic.jpg

Solar Panels Other DIY Electricity Solutions Rethink Green

https://re-thinkgreen.com/wp-content/uploads/2016/03/Solar_Panels_square-1024x1024.jpg

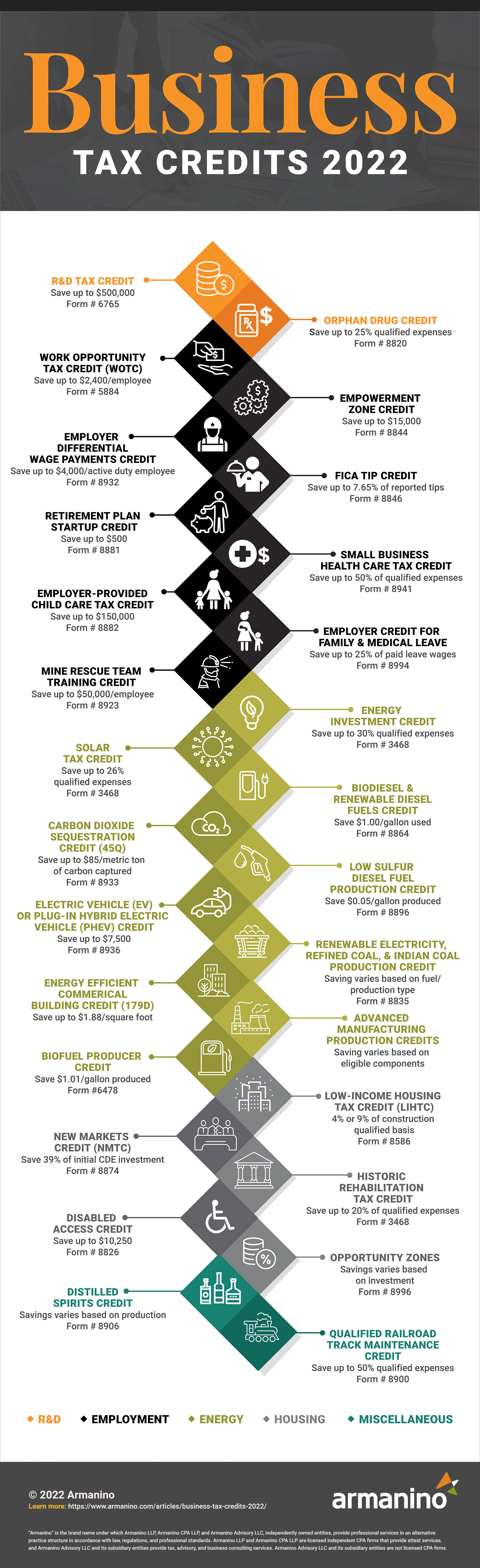

The commercial solar tax credit officially known as the Investment Tax Credit ITC is a federal incentive that allows you to claim a percentage of the cost of The solar investment tax credit ITC is a tax credit that can be claimed on federal corporate income taxes for 30 of the cost of a solar photovoltaic PV system that is

Business use up to 20 full credit Business use more than 20 credit based on share of expenses allocable to nonbusiness use Find more on who can claim Claiming the solar tax credit can provide tax savings to ease the burden of the initial outlay This guide explains the solar tax credit for businesses which expenses qualify and how to claim the

Download Business Tax Credits For Solar Panels

More picture related to Business Tax Credits For Solar Panels

Understanding Tax Credits For Solar Energy Systems

https://thenewutility.com/wp-content/uploads/2016/11/solar-tax-credits.jpg

Solar Tax Credit 2022 Incentives For Solar Panel Installations

https://quickelectricity.com/wp-content/uploads/2020/12/Federal-Solar-Tax-Credit-Extension-2022.jpg

Get The Power Of Tax Credits For Your Businesses

https://imageio.forbes.com/specials-images/imageserve/6382a9dd088a90f846f35930/0x0.jpg?format=jpg&crop=3207,3207,x0,y0,safe&width=1200

Basics of the Business Energy Credit We turn to a closer examination of the commercial solar credit In the tax literature the commercial solar credit may be For tax years 2022 to 2032 you can get a credit for up to 30 of the expense of installing solar panels this may include the price of the panels themselves sales taxes and labor costs

There are two tax credits to help defray costs for homeowners making energy efficient improvements to their primary or secondary residence In some cases There are two tax credits available for businesses nonprofits and local governments The Investment Tax Credit ITC reduces the federal income tax liability

Federal Solar Tax Credits For Businesses Department Of Energy

https://www.energy.gov/sites/default/files/styles/full_article_width/public/2022-10/Summary-ITC-and-PTC-Values-Table.png?itok=_72eWNBC

Illinois Solar Panel Guide Pricing Incentives Tax Credits For 2023

https://thumbor.forbes.com/thumbor/fit-in/900x510/https://www.forbes.com/home-improvement/wp-content/uploads/2022/05/featured-image-illinois.jpeg.jpg

https://www.energy.gov/eere/solar/feder…

This webpage provides an overview of the federal investment and production tax credits for businesses that own solar facilities including both photovoltaic PV and concentrating solar thermal power CSP

https://www.energy.gov/sites/default/files/2023-03/...

This resource from the U S Department of Energy DOE Solar Energy Technologies Office SETO provides an overview of the federal investment and production tax credits for

California Solar Tax Credit LA Solar Group

Federal Solar Tax Credits For Businesses Department Of Energy

Solar Tax Credit Calculator NikiZsombor

Illinois Tax Rebates For Solar Panels Electric Cars And Chargers Save

Can You Get A Tax Credit For Your Energy Saving Roof Slate Slate

When Are Tax Credits Ending How To Apply For Universal Credit

When Are Tax Credits Ending How To Apply For Universal Credit

HMRC Issue Tax Credits Claim Reminder Adapt Accountancy

Plan Your Solar Transition With A 30 Solar Tax Credit KC Green Energy

Texas Solar Incentives Tax Credits Rebates More In 2023

Business Tax Credits For Solar Panels - Are commercial solar panels eligible for tax credits Not only will businesses pay less on average for solar equipment but they have access to the 30