Buying A Home Tax Deductions First time Homebuyers Exemption From Transfer Tax Tax Deduction Credit for Housing Loan Interest Capital Gains on Property Tax Exemption Tax Credit for Renovations Household Expenses Related Links Primary sources of information for this page Finnish Tax Administration Verohallinto Finnish Ministry of Finance

Tax Deductions for Homeowners Most of the favorable tax treatment that comes from owning a home is provided in the form of deductions They re itemized deductions entered on If you own your own home you might be able to save on your tax returns Get the most value from your home with these eight tax deductions

Buying A Home Tax Deductions

Buying A Home Tax Deductions

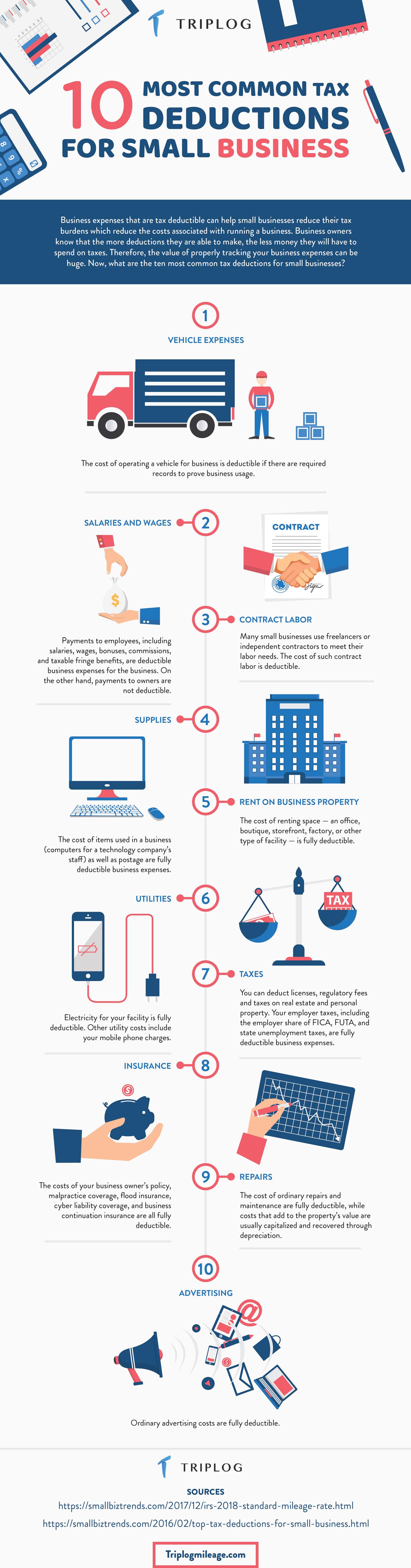

https://triplogmileage.com/wp-content/uploads/2018/08/rev02-01-min-33-min.jpg

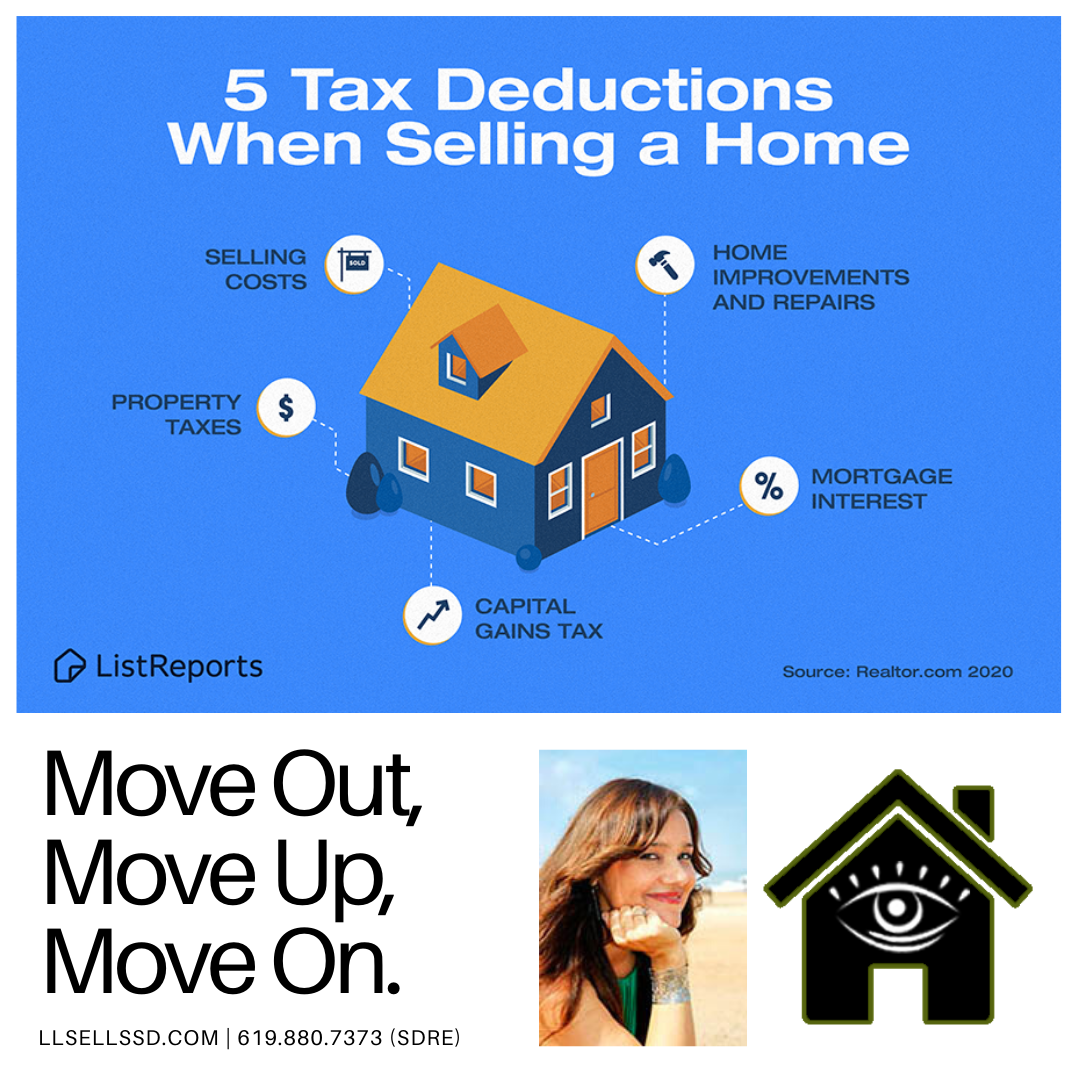

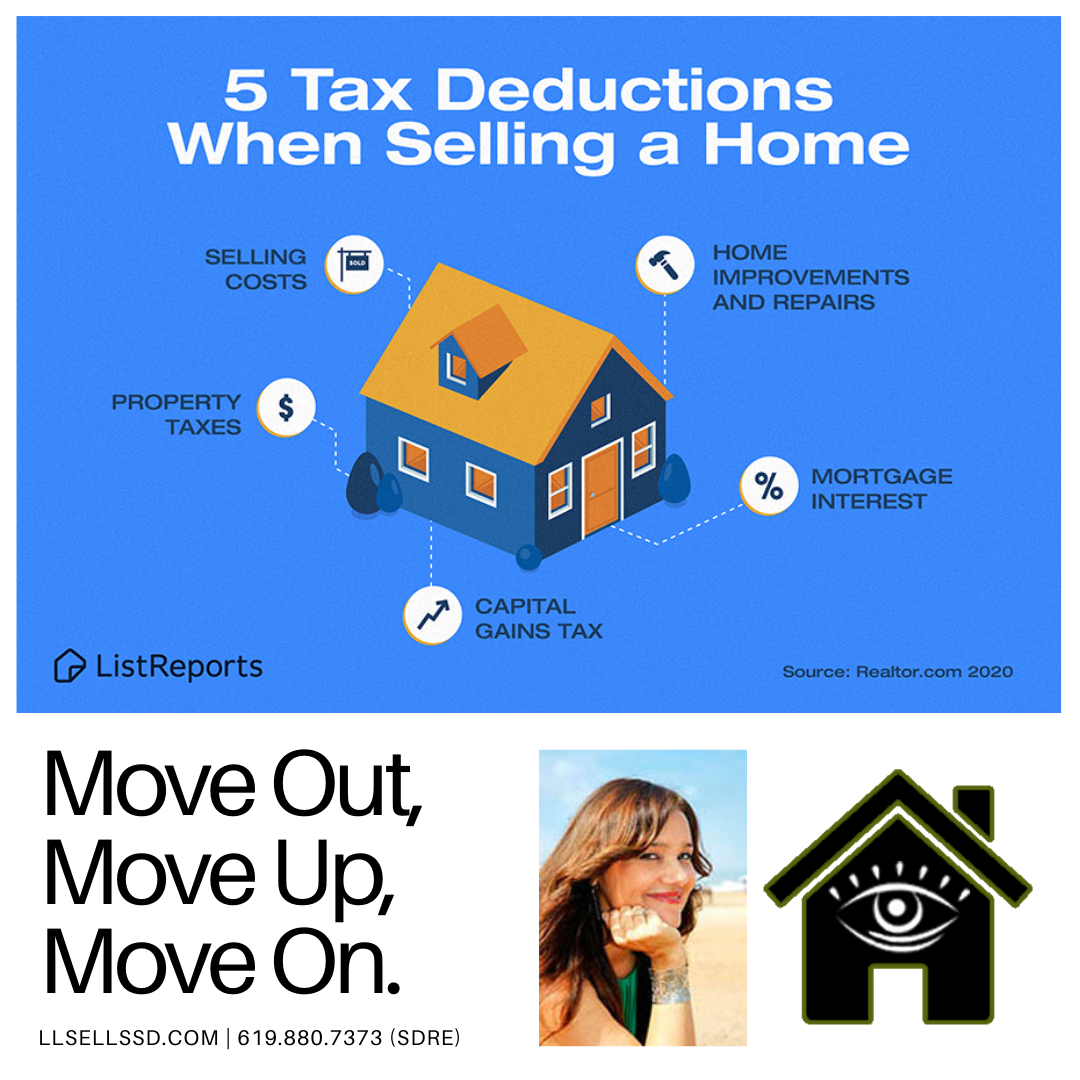

5 Tax Benefits From Selling A Home San Diego Realtor Listing Agent

http://llsellssd.com/wp-content/uploads/2020/06/tax-deductions-branded.png

Mountain West Website

https://lhp-public-images.s3.amazonaws.com/lhp/e-102238/uploads/AFLc7N1IVmtaxes.jpg

If you have a home loan you can no longer be given tax deductions for its interest expenses The change in tax rules came into force on 1 January 2023 No more deductions are available regarding home loans for purchasing a permanent dwelling and loans credits and other borrowing related to home repair If you just bought a house you may be able to deduct Mortgage interest including points Property real estate tax Mortgage insurance PMI or MIP Unless it s a rental you won t be able to deduct homeowner s insurance repairs or home improvements Also moving expenses are no longer deductible for most taxpayers

Home Ownership Tax Deductions Written by a TurboTax Expert Reviewed by a TurboTax CPA Updated for Tax Year 2023 October 19 2023 7 57 AM OVERVIEW You know that you can get an income tax OVERVIEW Buying your first home is a huge step but tax deductions available to you as a homeowner can reduce your tax bill TABLE OF CONTENTS Home ownership and taxes Tax breaks ease the cost of mortgage Mortgage interest Click to expand Key Takeaways

Download Buying A Home Tax Deductions

More picture related to Buying A Home Tax Deductions

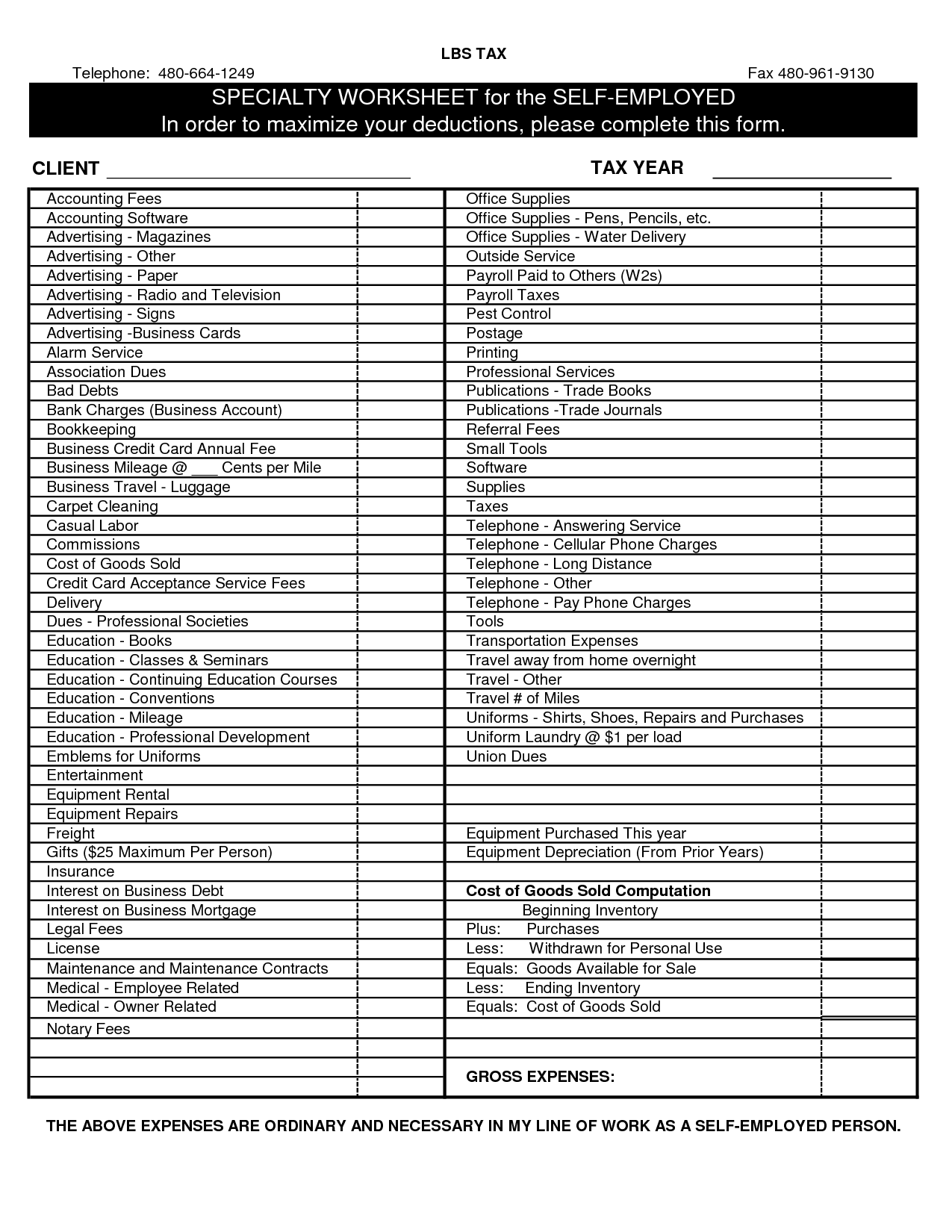

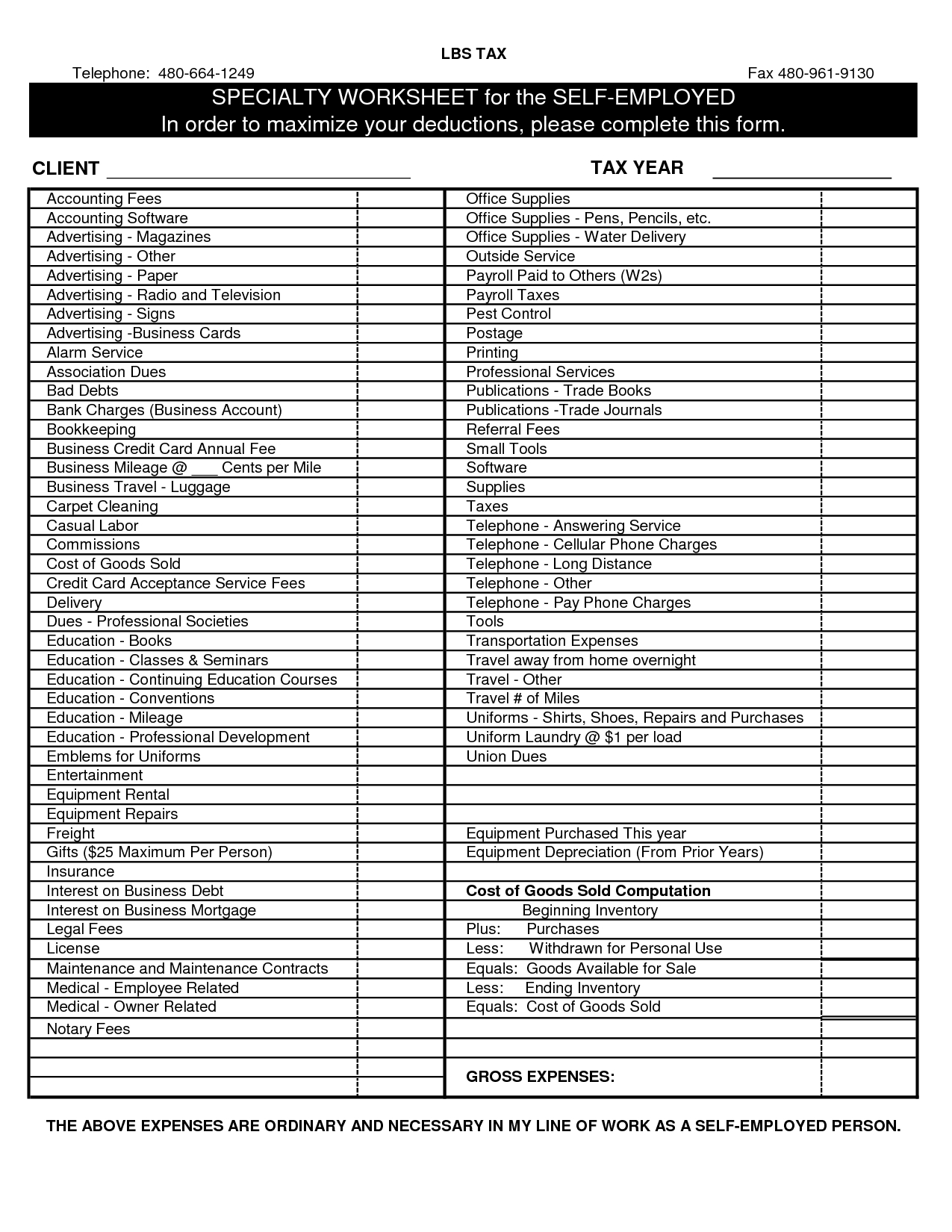

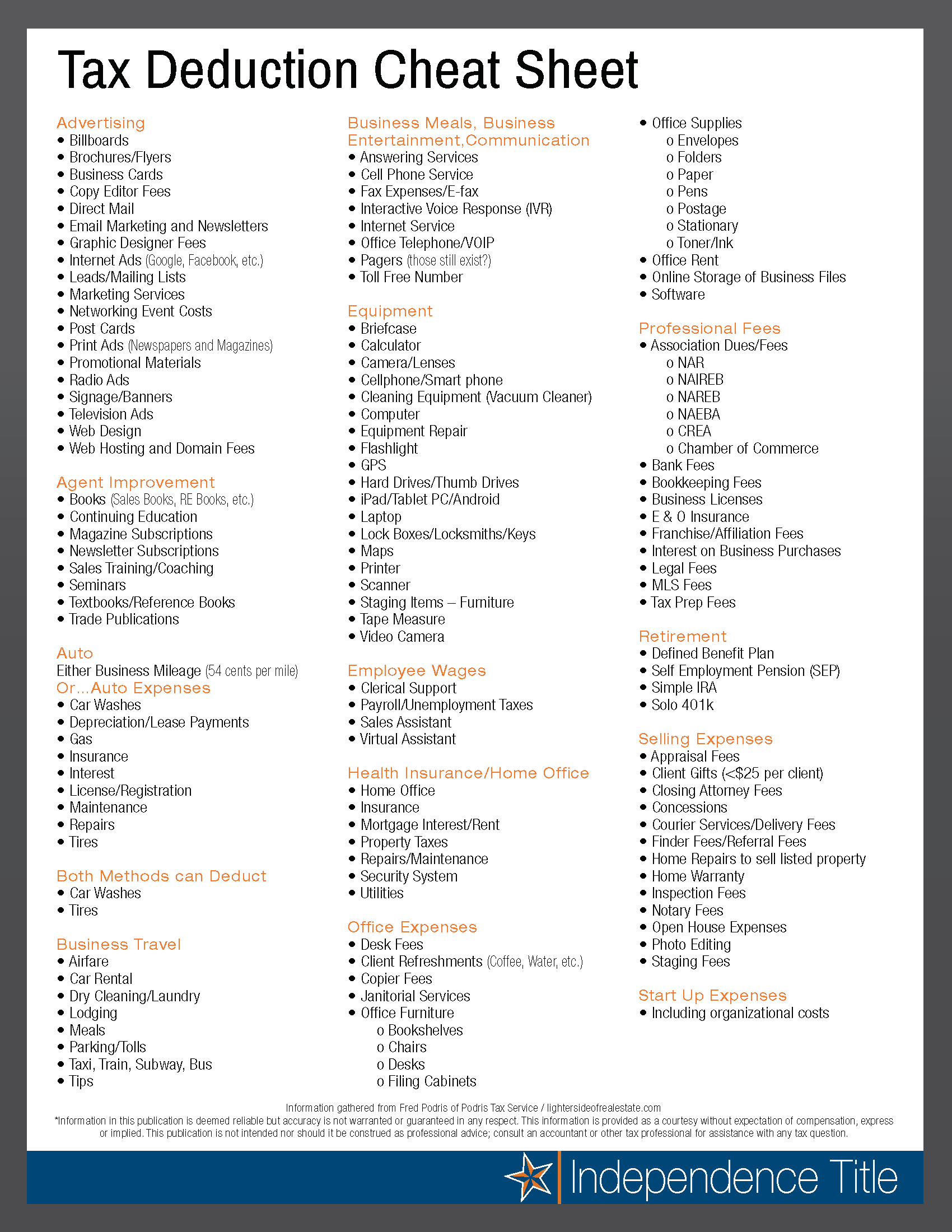

Farm Expenses Spreadsheet Charlotte Clergy Coalition

https://www.charlotteclergycoalition.com/wp-content/uploads/2018/08/farm-expenses-spreadsheet-farm-expense-spreadsheet-for-taxes.jpg

Home Based Business Expense Spreadsheet For Farm Expenses Spreadsheet

https://db-excel.com/wp-content/uploads/2019/01/home-based-business-expense-spreadsheet-for-farm-expenses-spreadsheet-charlotte-clergy-coalition.jpg

The Deductions You Can Claim Hra Tax Vrogue

https://images.ctfassets.net/ifu905unnj2g/5pTiksjFeNz6NJxIHRTFCO/1a3452b342e68decbc284efdc894ead5/Small_Business_Tax_Deductions_graphic.png

Tax Tip 2023 96 July 27 2023 The summer months are a popular time to buy or sell a house New homeowners should put reviewing the tax deductions programs and housing allowances they may be eligible for on their move in to do list The tax code grants tax benefits that reduce your costs of buying owning fixing up and selling a home Here are brief descriptions of tax benefits of owning a home the deductions the

Updated on June 14 2022 Reviewed by Doretha Clemon In This Article Photo Thomas Barwick Getty Images You can get a tax break for buying a house through tax deductions and credits for a few expenses you pay every month but rules and limits apply and you must itemize No matter when the indebtedness was incurred for tax years beginning in 2018 through 2025 you cannot deduct the interest from a loan secured by your home to the extent the loan proceeds weren t used to buy build or substantially improve your home Homeowner Assistance Fund

Home Buying Tax Deductions What s Tax Deductible Buying A House

https://i.pinimg.com/originals/30/26/f9/3026f9783021dc4033a434beea75f45d.jpg

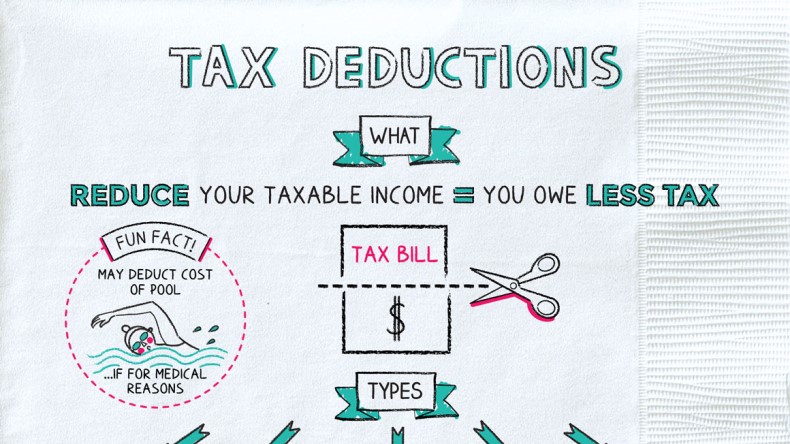

What Are Tax Deductions Napkin Finance

https://napkinfinance.com/wp-content/uploads/2016/11/taxdeductions.jpg

https://www.expat-finland.com/housing/tax_advantages_for_housing.html

First time Homebuyers Exemption From Transfer Tax Tax Deduction Credit for Housing Loan Interest Capital Gains on Property Tax Exemption Tax Credit for Renovations Household Expenses Related Links Primary sources of information for this page Finnish Tax Administration Verohallinto Finnish Ministry of Finance

https://www.investopedia.com/articles/personal...

Tax Deductions for Homeowners Most of the favorable tax treatment that comes from owning a home is provided in the form of deductions They re itemized deductions entered on

Tax Deductions For Home Buyers

Home Buying Tax Deductions What s Tax Deductible Buying A House

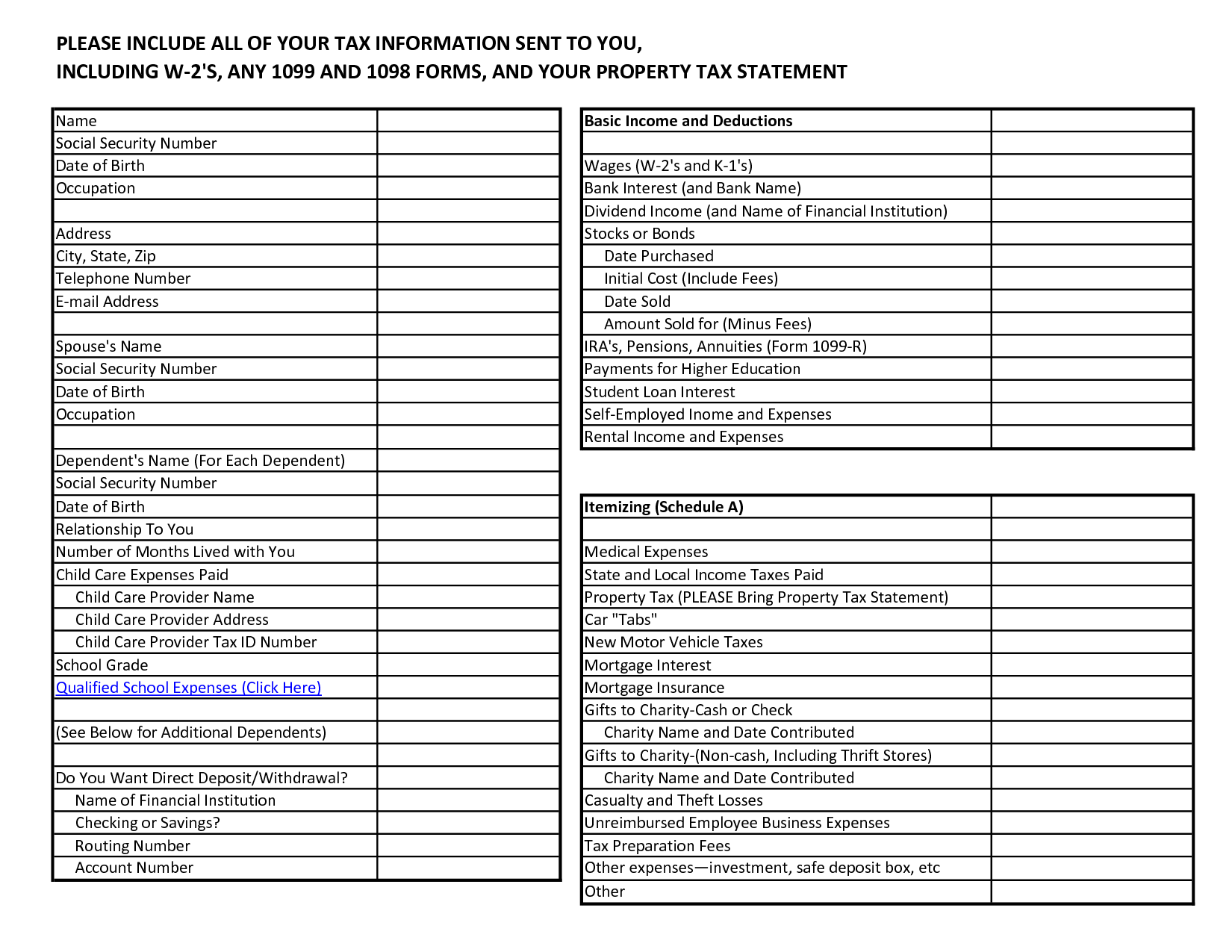

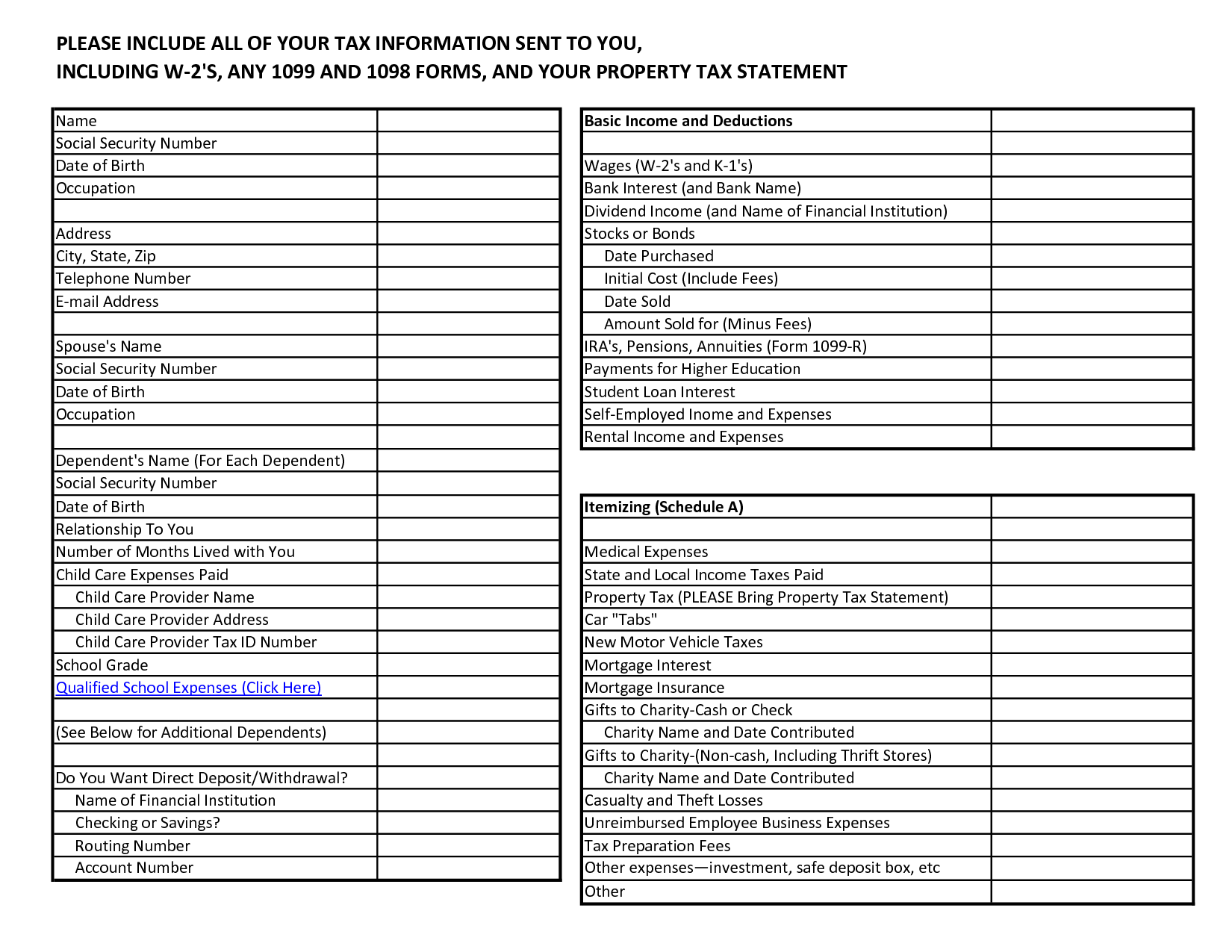

Client Tax Organizer Worksheet Worksheet Resume Examples

Tax Deduction Spreadsheet Throughout Tax Deduction Cheat Sheet For Real

Tax Deduction Definition TaxEDU Tax Foundation

10 Home Based Business Tax Worksheet Worksheeto

10 Home Based Business Tax Worksheet Worksheeto

Home Buying Tax Deductions Home Buying Tax Deductions Tax Refund

What Are Tax Deductions Napkin Finance

Laurenstuckeydesigns If I Bought A Home Tax Deductions

Buying A Home Tax Deductions - OVERVIEW Buying your first home is a huge step but tax deductions available to you as a homeowner can reduce your tax bill TABLE OF CONTENTS Home ownership and taxes Tax breaks ease the cost of mortgage Mortgage interest Click to expand Key Takeaways