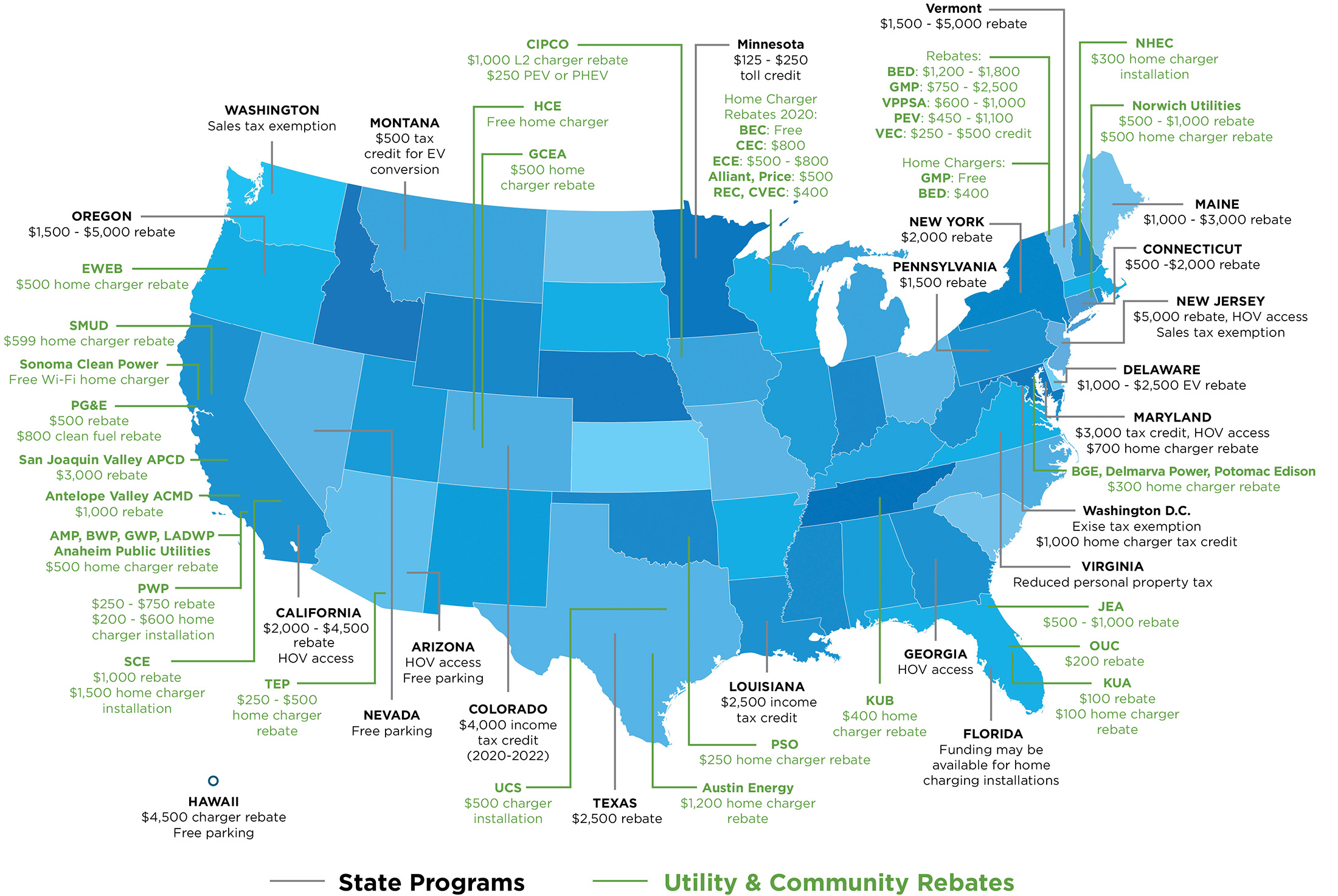

Tax Credits State Rebates For Hybrid Web 23 ao 251 t 2023 nbsp 0183 32 Several states have implemented financial incentives including tax credits rebates and registration fee reductions designed to promote EV adoption For example

Web 20 mars 2023 nbsp 0183 32 A small but growing number of states are offering tax credits or rebates on the purchase of pre owned electric vehicles Some allow credits or rebates with Web 30 juin 2023 nbsp 0183 32 Florida electric vehicle rebates Georgia will give you tax credit to convert your vehicle electric Illinois offers a 4 000 electric vehicle rebate instead of a tax credit Maine electric

Tax Credits State Rebates For Hybrid

Tax Credits State Rebates For Hybrid

https://cdn.osvehicle.com/do_hybrid_cars_get_a_tax_rebate.png

Electric Cars Tax Breaks Incentives And Rebates In The Us 2023

https://www.carrebate.net/wp-content/uploads/2022/08/are-there-still-tax-credits-for-hybrid-vehicles-tax-walls-1.jpg

Hybrid EV Tax Incentives In CA Community Chevrolet BURBANK

https://media.assets.sincrod.com/websites/content/gmps-community-chevy/promotion/bf4791a922b746d087239519cbd1ca06_1759x423.jpg

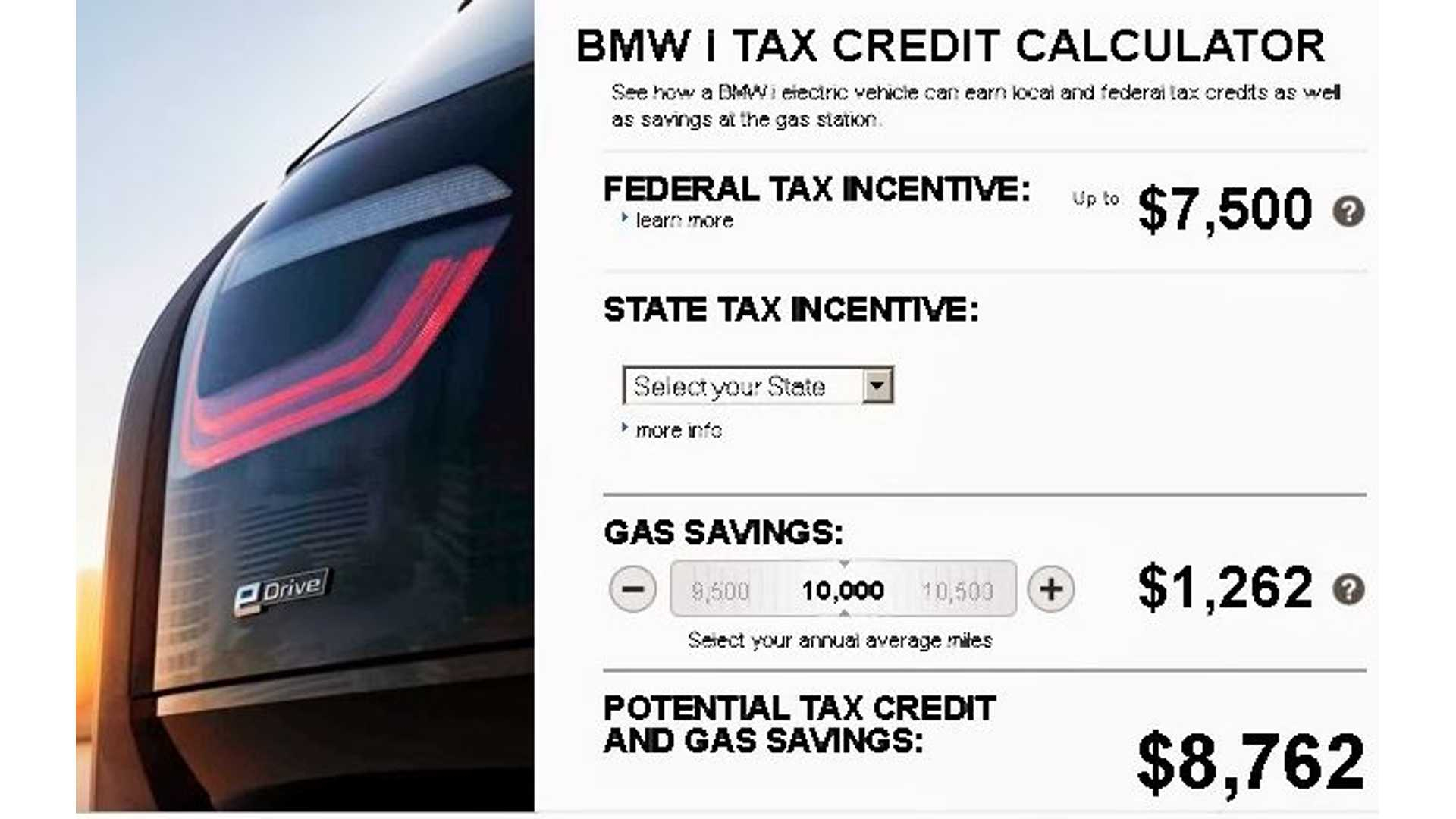

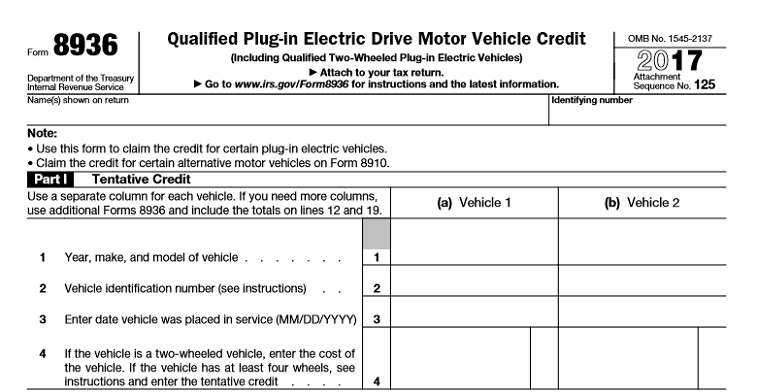

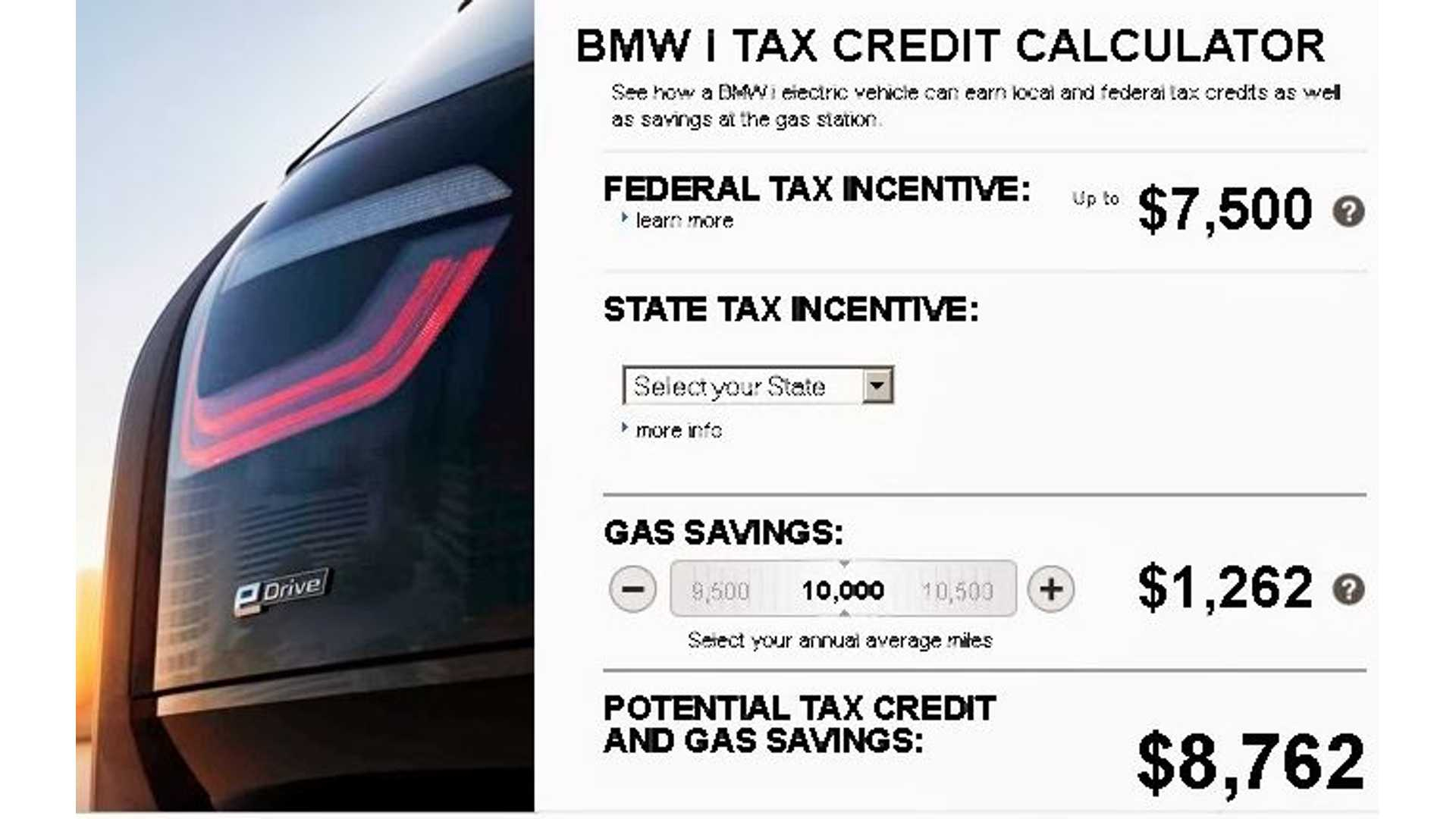

Web 16 mai 2022 nbsp 0183 32 If you purchased a new all electric vehicle EV or plug in hybrid electric vehicle PHEV during or after 2010 you may be eligible for a federal income tax credit of up to 7 500 according to the U S Web 25 janv 2022 nbsp 0183 32 Several states and even some eco minded cities offer their own incentives for EV and plug in hybrid buyers that typically take the form of either a tax credit or a

Web As of 2023 preowned plug in electric and fuel cell EVs qualify for a credit of up to 30 of their purchase price maxing out at 4 000 The used EV tax credit can only be claimed Web If you place in service a new plug in electric vehicle EV or fuel cell vehicle FCV in 2023 or after you may qualify for a clean vehicle tax credit Find information on credits for

Download Tax Credits State Rebates For Hybrid

More picture related to Tax Credits State Rebates For Hybrid

Are There Any Tax Rebates For Hybrid Cars In 2022 2022 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/08/does-a-hybrid-qualify-for-tax-credit-2022the-2.jpg

How The Federal EV Tax Credit Amount Is Calculated For Each EV EVAdoption

https://evadoption.com/wp-content/uploads/2019/03/Sample-EVs-Federal-EV-tax-credit-amount-calculation.png

Claiming The 7 500 Electric Vehicle Tax Credit A Step by Step Guide

https://www.cheatsheet.com/wp-content/uploads/2018/09/Untitled.png

Web 7 sept 2023 nbsp 0183 32 Consumer Reports details the list of 2022 2023 and 2024 model year electric vehicles and plug in hybrids that qualify for federal tax credits of up to 7 500 Web 17 ao 251 t 2022 nbsp 0183 32 All electric and plug in hybrid vehicles purchased new from 2010 through 2022 may be eligible for a federal income tax credit of up to 7 500 The credit amount

Web Before January 1 2026 a 2 000 tax credit for purchase and 1 500 for lease of a light duty EV or plug in hybrid electric vehicle per calendar year For a light duty electric truck 2 800 for Web 17 oct 2022 nbsp 0183 32 Starting on Jan 1 2023 people who purchase eligible electric vehicles can receive 2 500 to 7 500 in tax credits The value of the credit can be directly

Electric Car Tax Credits And Rebates Charged Future

https://www.chargedfuture.com/wp-content/uploads/2020/03/EV-Tax-Credits-and-Rebates.jpeg

How To Get Tax Breaks On Hybrids YourMechanic Advice

https://res.cloudinary.com/yourmechanic/image/upload/dpr_auto,f_auto,q_auto/v1/article_images/3_How_to_Get_Tax_Breaks_on_Hybrids_doc_pdf

https://www.ncsl.org/energy/state-policies-promoting-hybrid-and...

Web 23 ao 251 t 2023 nbsp 0183 32 Several states have implemented financial incentives including tax credits rebates and registration fee reductions designed to promote EV adoption For example

https://cars.usnews.com/cars-trucks/advice/state-ev-tax-credits

Web 20 mars 2023 nbsp 0183 32 A small but growing number of states are offering tax credits or rebates on the purchase of pre owned electric vehicles Some allow credits or rebates with

Evaluating Tax Rebates For Hybrid Vehicles

Electric Car Tax Credits And Rebates Charged Future

How Does The Electric Car Tax Credit Work TaxProAdvice

EV Tax Credit Support Climate Nexus May 2019

Electric Vehicle EV Incentives Rebates

Going Green States With The Best Electric Vehicle Tax Incentives The

Going Green States With The Best Electric Vehicle Tax Incentives The

Tax Credits And Rebates

EV Charging Station Rebates And Tax Credits By State Ev Charging

Rebates And Incentives Clean Vehicle Rebate Project

Tax Credits State Rebates For Hybrid - Web 25 juil 2023 nbsp 0183 32 You may qualify for an EV tax credit of up to 7 500 according to the IRS if you buy a new qualified plug in EV or fuel cell electric vehicle The credit is available to