Calculation Of Income Tax Rebate On Hra Verkko Calculating HRA Exemption in Income Tax HRA exemption gets calculated according to Income Tax Rule 2A Under it the minimum of the following cases gets exempted from an employee s salary under Section 10 13A Actual HRA received by the employee

Verkko Income Tax Department gt Tax Tools gt House rent allowance calculator As amended upto Finance Act 2023 HOUSE RENT ALLOWANCE Basic salary DA forming part of salary Commission as of turnover achieved by the employee HRA Received Rent Paid Tick if residing in metro city Tick if Yes Exempted House Rent Allowance Verkko Yes you may claim both HRA exemption and home loan interest deduction Try out our free HRA calculator to determine your HRA exemption This calculator shows you on what part of your HRA you have to pay taxes i e how much of your HRA is taxable and exempt from tax

Calculation Of Income Tax Rebate On Hra

Calculation Of Income Tax Rebate On Hra

https://wp.sqrrl.in/wp-content/uploads/2019/08/FOR-ANAND-3-1024x796.png

HRA Exemption Calculator In Excel House Rent Allowance Calculation

https://fincalc-blog.in/wp-content/uploads/2021/09/hra-exemption-calculator-house-rent-allowance-to-save-income-tax-salaried-employees-video.webp

HRA Exemption Calculator For Salaried Employees FinCalC Blog

https://fincalc-blog.in/wp-content/uploads/2021/12/how-to-calculate-hra-to-save-income-tax-1024x576.webp

Verkko Select the location of your residence whether it is in the metro city or non metro city Enter the total rent paid amount After entering all the information the calculator will show you the taxable HRA amount and applicable tax on the HRA Also it will show the HRA amount exempted from taxation Verkko 19 jouluk 2023 nbsp 0183 32 The amount of tax deduction that can be claimed will be the least of the following Actual rent paid 10 of the basic salary Rs 12 000 10 of Rs 23 000 Rs 9 700 or Actual HRA offered by the employer Rs 15 000 or 50 of the basic salary 50 of Rs 23 000 Rs 11 500

Verkko 22 syysk 2022 nbsp 0183 32 Even if you have forgotten to submit rental receipts you can claim an HRA rebate while filing your income tax returns All you have to do is manually calculate the HRA tax exemption using the formula mentioned above and then report this as an expense under Section 10 13A in ITR1 Verkko 1 hein 228 k 2022 nbsp 0183 32 The HRA exemption that a salaried person is eligible to receive is the lowest of the following amounts according to Rule 2A of the IT Rules 1962 The actual HRA you get 50 of your basic salary plus dearness allowance DA if you live in metro cities or 40 for non metros

Download Calculation Of Income Tax Rebate On Hra

More picture related to Calculation Of Income Tax Rebate On Hra

Cukai Pendapatan How To File Income Tax In Malaysia Jobstreet Malaysia

https://media.graphassets.com/j9n1ArmpRreKvI9fooEq

Income Tax Rebate Under Section 87A

https://life.futuregenerali.in/media/mu2i0shn/income-tax-rebate-under-section-87a.jpg

How To Get Full Rebate On HRA In Income Tax

https://4.bp.blogspot.com/-MstZZqwHN2I/WJs7rd_yvRI/AAAAAAAADPI/D_ZiTxYk4Vsn0NSbSomUZGbQCM6JL6AjwCLcB/s1600/hra-exemptoin.JPG

Verkko What is House Rent Allowance or HRA HRA or the House Rent Allowance is one of the sub components of the employee s salary for which deductions are fully or partially taxable under Section 10 13A of the Income Tax Act The HRA calculation depends on the following factors The salary of the employee The actual rent paid by the employee Verkko 23 marrask 2023 nbsp 0183 32 The best part Salaried individuals who live in a rented house can claim tax exemption on HRA under Section 10 13A of the Income Tax Act HRA is subject to full or partial tax deductions An employee has to submit Form 12BB to the employer to claim the exemptions like HRA LTA etc and Income Tax deductions

Verkko 28 kes 228 k 2018 nbsp 0183 32 Calculate your House Rent Allowance HRA exemption know HRA exemption Calculation Formula and download HRA Calculator in excel format for easy calculation of exempt HRA Allowance out of Total HRA received by Salaried Assessee Employees generally receive a house rent allowance HRA from their employers Verkko 16 helmik 2021 nbsp 0183 32 As per the above calculations the Actual rent paid minus 10 of Basic Salary is the lowest amount of all three at Rs 78 000 Hence this is the amount that will be considered for your Income Tax rebate Rules to be Followed while Claiming HRA Rebate Your total HRA cannot be more than 50 of your basic salary

How To Obtain Your Tax Calculations And Tax Year Overviews

https://brookfieldfinance.com/wp-content/uploads/2021/06/Picture-1-1.png

Calculate My Income Tax SuellenGiorgio

https://razorpay.com/learn-content/uploads/2022/02/Facebook-post-17-1024x908.png

https://fi.money/blog/posts/how-to-calculate-hra-tax-exemption-in...

Verkko Calculating HRA Exemption in Income Tax HRA exemption gets calculated according to Income Tax Rule 2A Under it the minimum of the following cases gets exempted from an employee s salary under Section 10 13A Actual HRA received by the employee

https://incometaxindia.gov.in/.../house-rent-allowance-calculator.aspx

Verkko Income Tax Department gt Tax Tools gt House rent allowance calculator As amended upto Finance Act 2023 HOUSE RENT ALLOWANCE Basic salary DA forming part of salary Commission as of turnover achieved by the employee HRA Received Rent Paid Tick if residing in metro city Tick if Yes Exempted House Rent Allowance

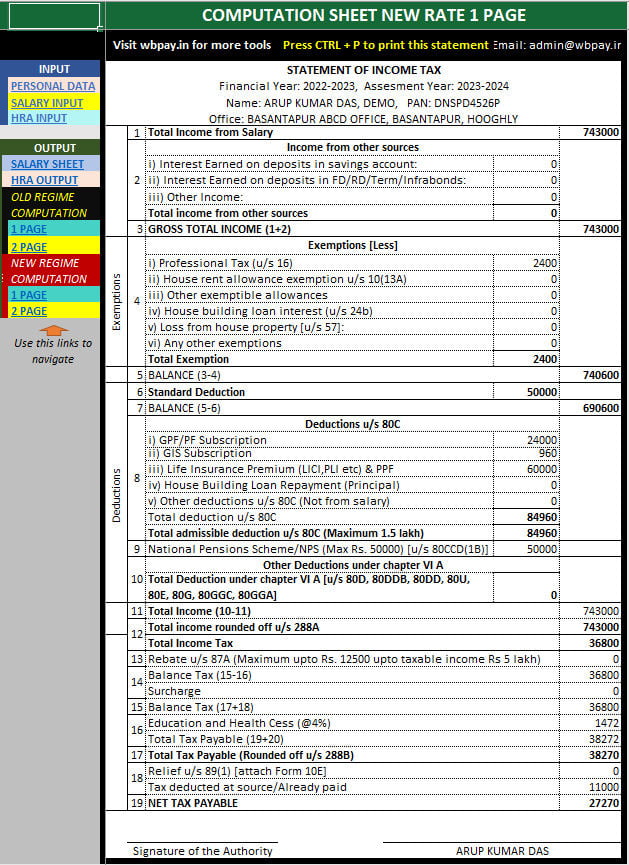

All In One Income Tax Calculator For The FY 2022 23

How To Obtain Your Tax Calculations And Tax Year Overviews

Budget 2022 Different Types Of Taxable Incomes Income Tax Slab Rates

HRA Calculation Taxability Hindi Video House Rent Allowance Tax

Extension Of Timelines For Filing Of Income tax Returns And Various

Income Tax Calculation Example 2 For Salary Employees 2023 24

Income Tax Calculation Example 2 For Salary Employees 2023 24

4 TAX REBATE U s 87A New TAX REBATE EXAMPLES Income Tax

Income Tax 2022 Malaysia Calculator Latest News Update

How To Calculate Income Tax Calculator Ay 2019 2020 Carfare me 2019 2020

Calculation Of Income Tax Rebate On Hra - Verkko 5 toukok 2020 nbsp 0183 32 HOW MUCH DEDUCTION CAN BE TAKEN Deduction available is least of the following i Actual HRA Received ii 50 of Basic salary DA for living in Metro Cities 40 for Non Metro Cities iii Actual Rent paid less 10 of Basic Salary DA Let us understand with the help of some Examples below 3