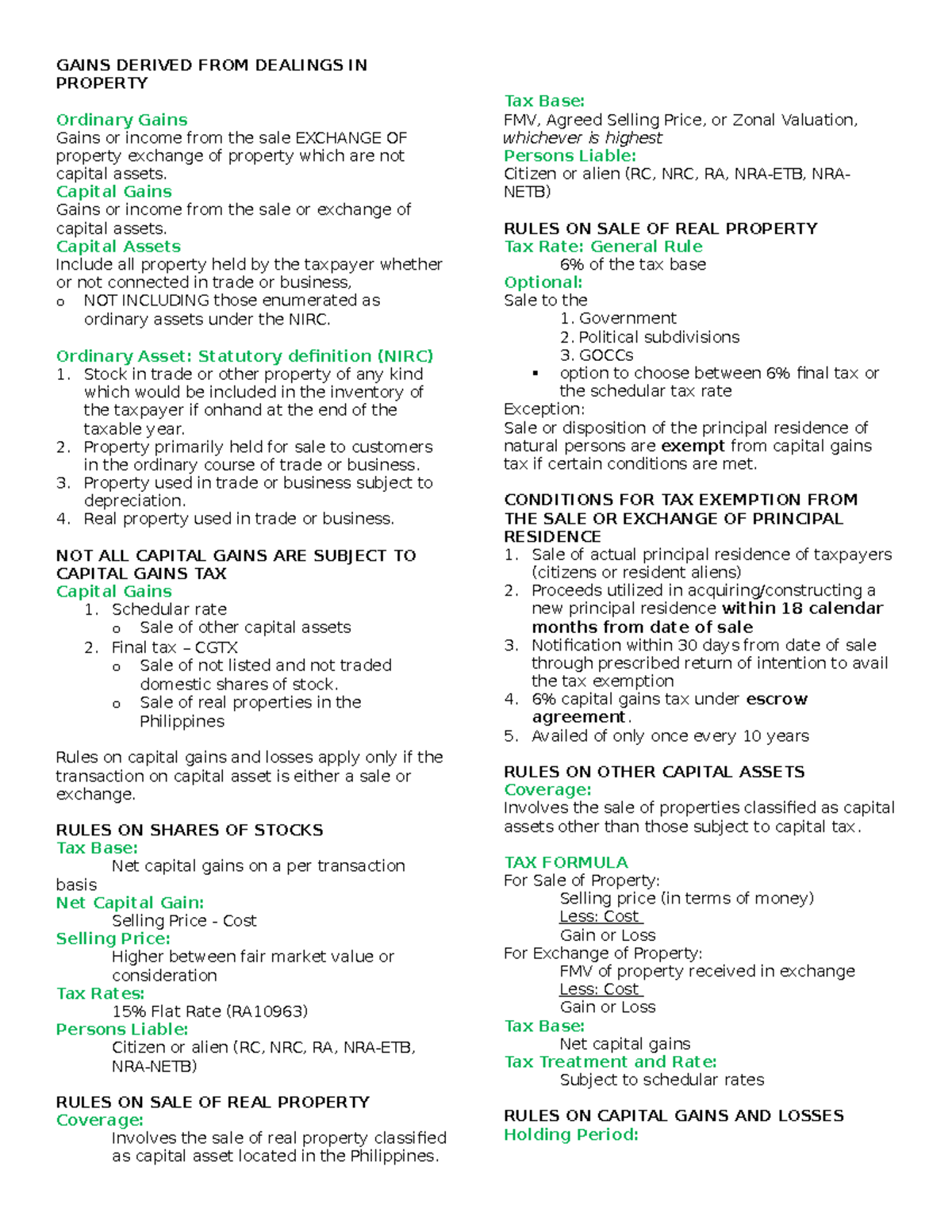

Can Deductions Offset Capital Gains Learn how to report and deduct capital losses on your tax return and how they can offset capital gains or other income Find out the rules categories and

Taxpayers can offset capital gains with capital losses in order to lower their capital gains taxes with tax loss harvesting strategies aimed at maximizing this effect Losses on Capital losses can offset capital gains reducing your taxable income If your losses exceed your gains you can deduct the excess from other income or carry it forward to future years

Can Deductions Offset Capital Gains

Can Deductions Offset Capital Gains

https://www.infocomm.ky/wp-content/uploads/2020/09/1600288283.jpeg

Can Passive Loss Tax Deductions Offset Capital Gains

https://s.yimg.com/ny/api/res/1.2/Jjn4rVZsyGzH7Rx2_9Nsxg--/YXBwaWQ9aGlnaGxhbmRlcjt3PTk2MDtoPTUyNw--/https://media.zenfs.com/en/smartasset_475/a9b15a12a8855ab5ab1c7a9d390e7837

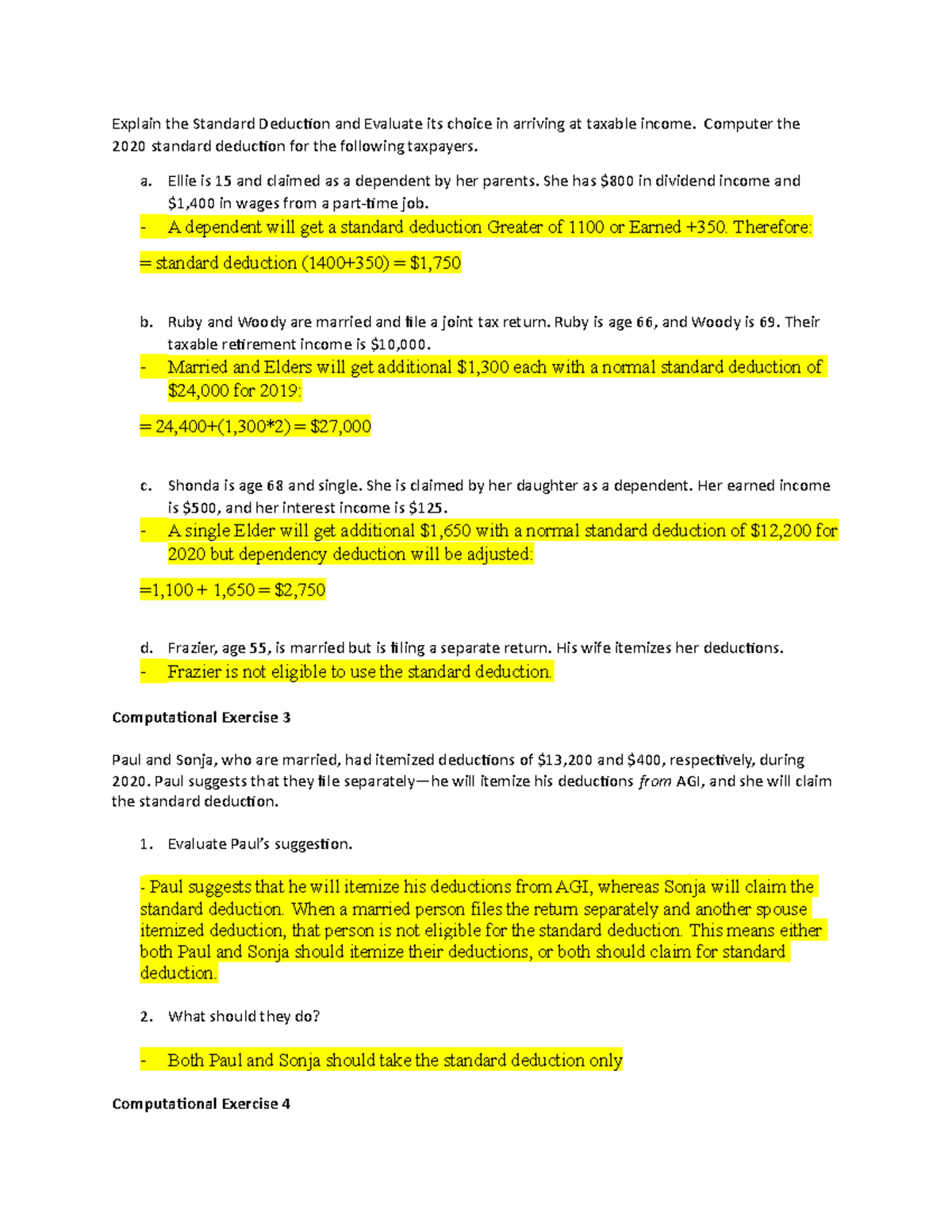

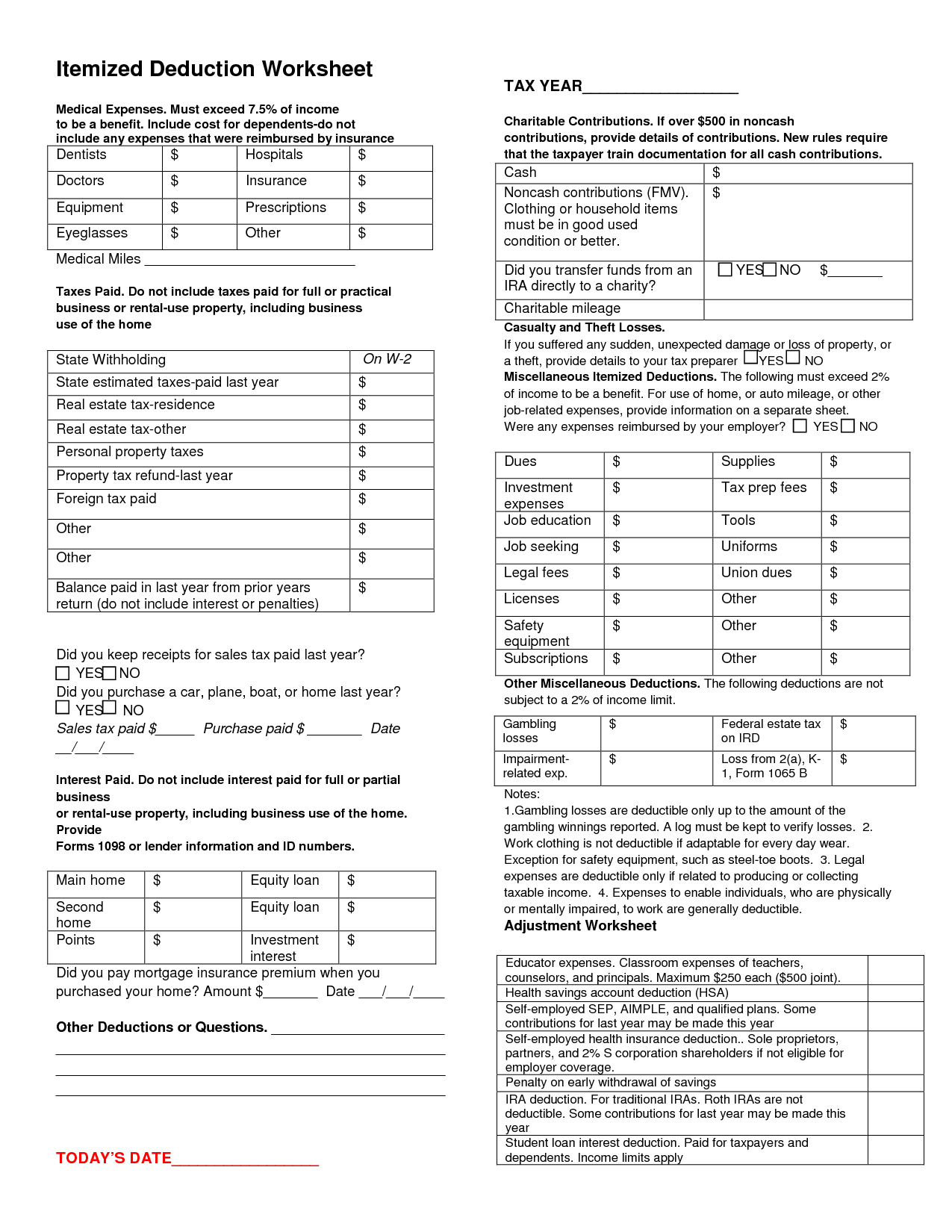

Deductions FROM Adjusted Gross Income AGI Itemized Deductions State

https://static.coggle.it/diagram/XoypUxqrZMeGAEGb/thumbnail?mtime=1586808127862

Report most sales and other capital transactions and calculate capital gain or loss on Form 8949 Sales and Other Dispositions of Capital Assets then summarize capital gains If capital losses exceed capital gains you may be able to use the loss to offset up to 3 000 of other income If you have more than 3 000 in capital losses this excess amount can be carried forward to

Investors can defer paying taxes on their capital gains until they start taking distributions from the IRA typically during retirement when they may be in a lower tax bracket You can offset a total of 1 625 of capital losses against your capital gains Plus 3 000 of your excess net capital loss is also deductible against your ordinary income

Download Can Deductions Offset Capital Gains

More picture related to Can Deductions Offset Capital Gains

The Best Self Employed Tax Deductions And Credits In 2022

https://static.helloskip.com/blog/2022/03/Untitled-design--11-.png

Cuddy Financial Services s Tax Planning Guide 2022 Tax Planning Guide

https://cdn.ltmclientmarketing.com/WEBTPG/articles/2022TPG/Chart-Capital_Gains_Tax_Brackets.jpg

Coinbase Binance Enjoy Market Share Gains After FTX Demise

https://www.tbstat.com/wp/uploads/2022/11/20221116_Earnings_Generic-1200x675.jpg

Define capital gains taxes and how they may apply to your investments and asset holdings List three areas where capital gains taxes can be avoided offset or managed for minimal impact Explain how if Capital losses can offset your capital gains as well as a portion of your regular income Any amount left over after what you are allowed to claim for one year can be carried over to

In stock investing investors can offset capital gains with capital losses in a process called tax loss harvesting They can also take advantage of lower tax rates for Capital losses can offset capital gains and you can deduct up to a net 3 000 in losses each year helping keep your adjusted gross income in a good place

How To Avoid Capital Gains Tax On Cryptocurrency Mind The Tax

https://mindthetax.com/wp-content/uploads/2022/06/how-to-avoid-capital-gains-tax-on-cryptocurrency-scaled.jpg

AC 407 Ch 9 Assignments For ACC Taxation Explain The Standard

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/8c501a005eb4e9319639cc4b570ff94c/thumb_1200_1553.png

https://www.investopedia.com/articles/investing/...

Learn how to report and deduct capital losses on your tax return and how they can offset capital gains or other income Find out the rules categories and

https://www.investopedia.com/articles/i…

Taxpayers can offset capital gains with capital losses in order to lower their capital gains taxes with tax loss harvesting strategies aimed at maximizing this effect Losses on

Can Passive Loss Tax Deductions Offset Capital Gains

How To Avoid Capital Gains Tax On Cryptocurrency Mind The Tax

Tax Deductions Armstrong Economics

10 Tax Deduction Worksheet Worksheeto

Surprise The Mortgage Interest Deduction Is Now Even More Of A Handout

.png)

How To Calculate Short Term Capital Gains Tax On Sale Of Shares Jordensky

.png)

How To Calculate Short Term Capital Gains Tax On Sale Of Shares Jordensky

Capital Gains Tax Notes GAINS DERIVED FROM DEALINGS IN PROPERTY

How To Set Off Capital Losses In Case Of Equities Yadnya Investment

Depreciation Deductions Can Boost Your Tax Return

Can Deductions Offset Capital Gains - If capital losses exceed capital gains you may be able to use the loss to offset up to 3 000 of other income If you have more than 3 000 in capital losses this excess amount can be carried forward to