Can I Claim Married Tax Allowance For Previous Years Verkko Yes Widows and widowers are able to claim backdated marriage tax allowance though only as far back as 2019 So if you and your

Verkko 19 lokak 2023 nbsp 0183 32 Remember you can only claim marriage allowance for previous years if you met the eligibility criteria in that year So you will not be eligible to backdate the relief if you have Verkko You can backdate your claim to include any tax year since 5 April 2019 that you were eligible for Marriage Allowance If your partner has since died you can still claim

Can I Claim Married Tax Allowance For Previous Years

Can I Claim Married Tax Allowance For Previous Years

https://carajput.com/art_imgs/how-to-claim-hra-allowance-while-filing-income-tax-return.jpg

Married Tax Brackets 2021 Westassets

https://i2.wp.com/wpdev.abercpa.com/wp-content/uploads/2018/06/married-filing-jointly-tax-brackets.png

Can I Claim Compensation In A Motorbike Accident Chester

https://www.aclaim.co.uk/wp-content/uploads/2022/09/dog-goggles.png

Verkko 6 huhtik 2023 nbsp 0183 32 If you cannot claim online you can telephone HMRC on 0300 200 3300 or write to them to make the claim For prior years you will receive a refund cheque from HMRC For the current tax year and Verkko Explore the topic Income Tax Married Couple s Allowance could reduce your tax bill each year you re married or in a civil partnership if one of you was born before before

Verkko 19 marrask 2023 nbsp 0183 32 If your partner has died since 5 April 2018 it is possible to backdate your marriage allowance claim to include any tax year since 5 April 2018 that you were eligible to receive it To receive Verkko 11 helmik 2022 nbsp 0183 32 Couples can apply any time backdate their claims for any of the 4 previous tax years and receive a payment of up to 163 1 220 at a time when they need it

Download Can I Claim Married Tax Allowance For Previous Years

More picture related to Can I Claim Married Tax Allowance For Previous Years

EFK elasticsearch Fluentd Kibana ATCtoK8s 51CTO

https://s2.51cto.com/images/202201/c7fd47182d5488cdeab518f2b3321a8b9c0604.png?x-oss-process=image/watermark,size_14,text_QDUxQ1RP5Y2a5a6i,color_FFFFFF,t_30,g_se,x_10,y_10,shadow_20,type_ZmFuZ3poZW5naGVpdGk=/resize,m_fixed,w_1184

Can I Claim For Surrogacy Costs After Medical Negligence Enable Law

https://www.enablelaw.com/wp-content/uploads/2020/10/Parents-and-baby.jpg

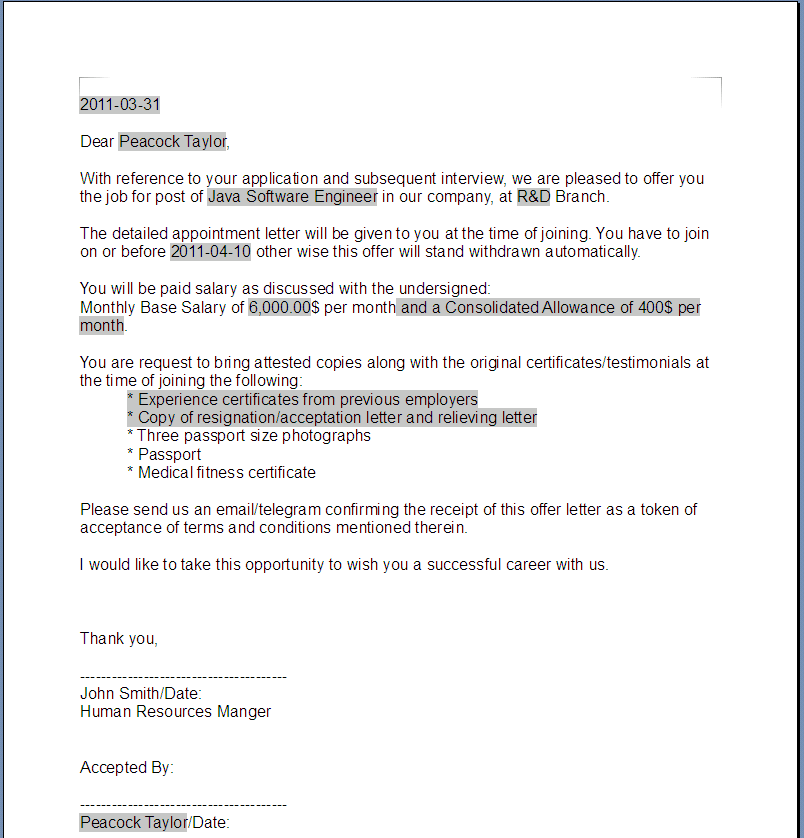

Special Allowance Letter Format Madalynngwf

https://odftoolkit.org/simple/demo/image/generated-offer-letter.png

Verkko 30 maalisk 2023 nbsp 0183 32 The Marriage Tax Allowance means if you re married or in a civil partnership you could be claiming on a tax break worth 163 252 a year If you re claiming Marriage Tax Allowance for Verkko 14 helmik 2023 nbsp 0183 32 Better still you can claim back for the previous 4 tax years As a result the total tax rebate can be as high as 163 1 241 This total is explained later We will explain who qualifies and the steps you

Verkko 20 tammik 2023 nbsp 0183 32 Any claimants in this current tax year are therefore able to backdate their claim to include any tax year since 5 April 2018 if they were eligible for the Verkko Married Couple s Allowance could reduce your tax bill each year you re married or in a civil partnership if one of you was born before before 6 April 1935

Thank You Foot Ankle Pain Report Rosanna Physio

https://rosannaphysio.com.au/wp-content/uploads/2021/08/download-25285911629860637.png

How Can You Claim For Married Tax Allowance In The UK

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEgzIGBPRodQCEVRX9xDX9iO_D8IapLZdzAbV-pymYIxLSmqBLKqjAveAa71BIpNu9S-R0IUkGzNEocP2PMCR8IZu4XJlFyk95TZblbB0OMbKD_OGssdD1ixAXo4_Amc2NHvbzmI6ZrldEM-Ur08abRK2TF9GMx9XuZooHP-ciTSw3O9WDIMX_oMwNNTpA/w1200-h630-p-k-no-nu/marriage tax allowance claim UK.jpg

https://www.moneysavingexpert.com/family/m…

Verkko Yes Widows and widowers are able to claim backdated marriage tax allowance though only as far back as 2019 So if you and your

https://www.thetimes.co.uk/money-mentor/arti…

Verkko 19 lokak 2023 nbsp 0183 32 Remember you can only claim marriage allowance for previous years if you met the eligibility criteria in that year So you will not be eligible to backdate the relief if you have

2022 Tax Tables Married Filing Jointly Printable Form Templates And

Thank You Foot Ankle Pain Report Rosanna Physio

Which Organizations Are BBS Approved CE Providers TrackYourCEs

How Can You Claim For Married Tax Allowance In The UK By

EIC Fraud Robergtaxsolutions

Married Couples Tax Allowance Claim Form Blank Template Imgflip

Married Couples Tax Allowance Claim Form Blank Template Imgflip

How Can You Claim For Married Tax Allowance In The UK By

Il W 4 2020 2022 W4 Form

Illinois Withholding Allowance Worksheet Example Abbreviation Tripmart

Can I Claim Married Tax Allowance For Previous Years - Verkko 19 marrask 2023 nbsp 0183 32 If your partner has died since 5 April 2018 it is possible to backdate your marriage allowance claim to include any tax year since 5 April 2018 that you were eligible to receive it To receive