Can I Claim My Masters Degree On Tax You can claim tuition fees paid with the help FEE HELP as a deduction though You must be enrolled with a full fee paying university or institution You can

Thus qualifying graduate expenses may be claimed as itemized deductions for state tax purposes even when not deductible for federal purposes However determining what expenses qualify as job Where do I put the amount of my education tax credit on my tax return A15 To claim the American opportunity credit complete Form 8863 and submitting it with your Form 1040

Can I Claim My Masters Degree On Tax

Can I Claim My Masters Degree On Tax

https://phdessay.com/phd-uploads/masters-degree-application-essays.webp

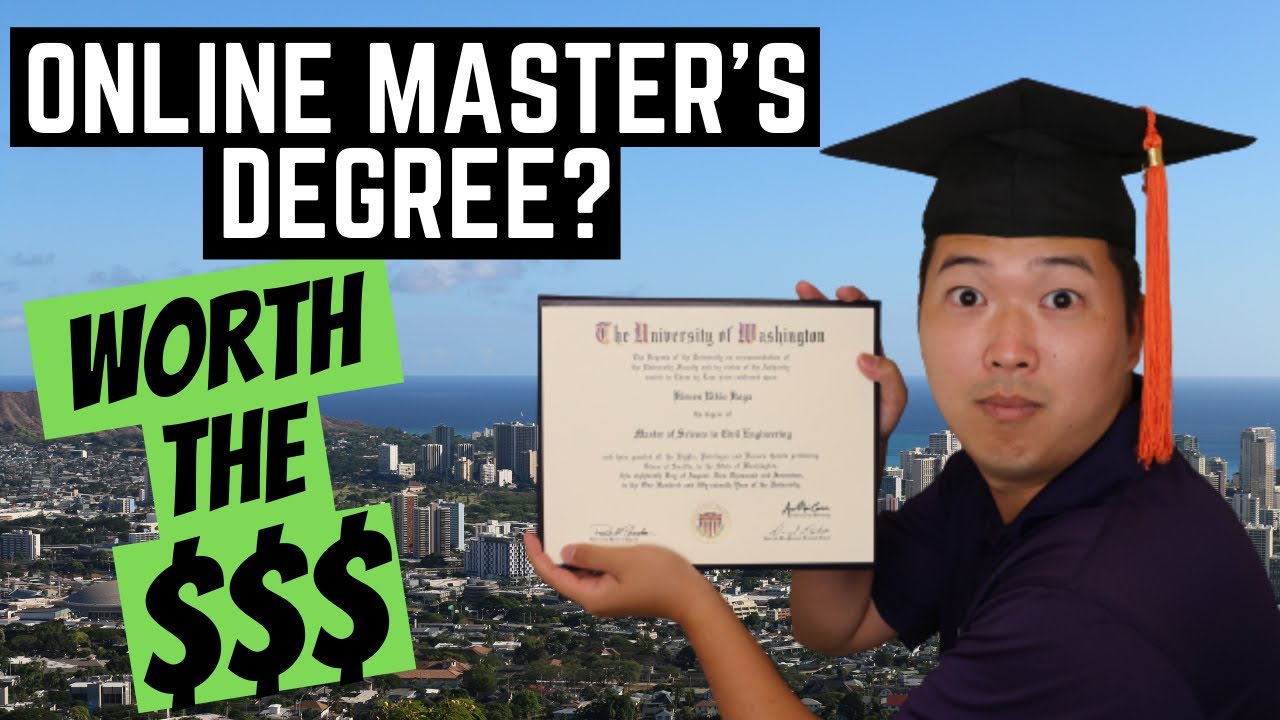

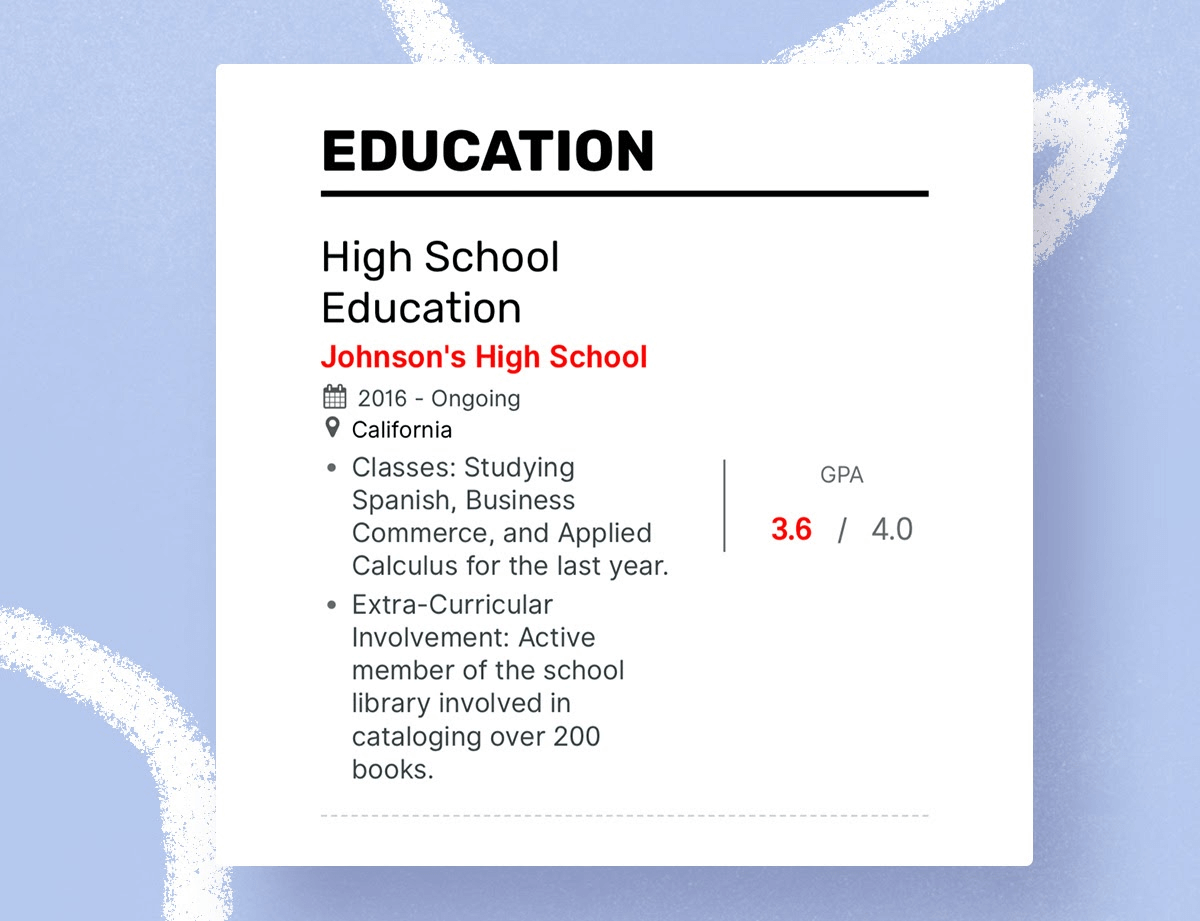

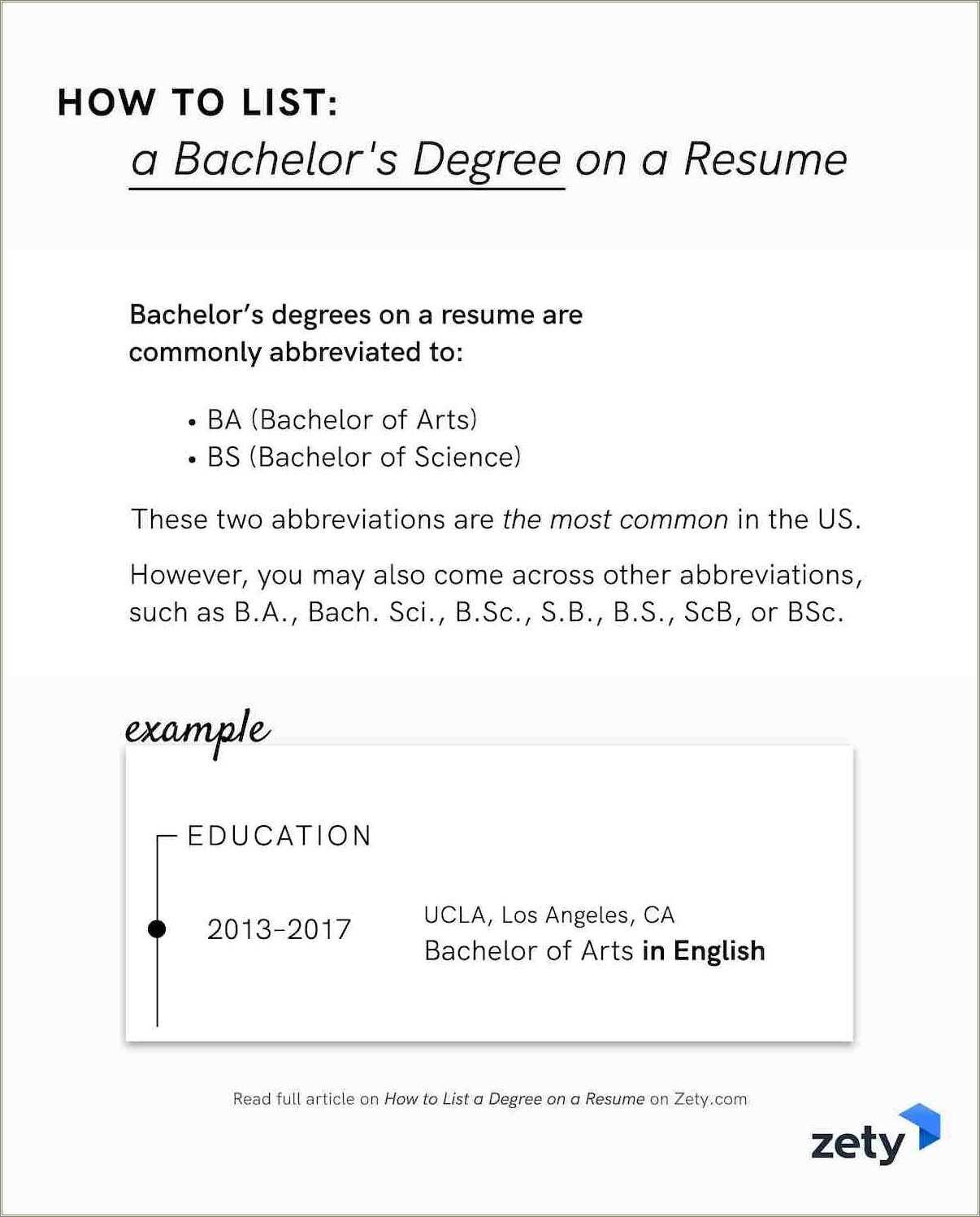

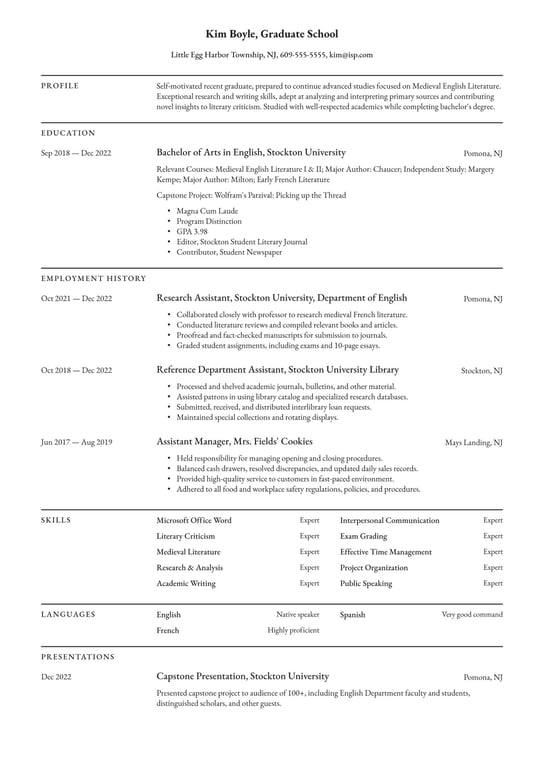

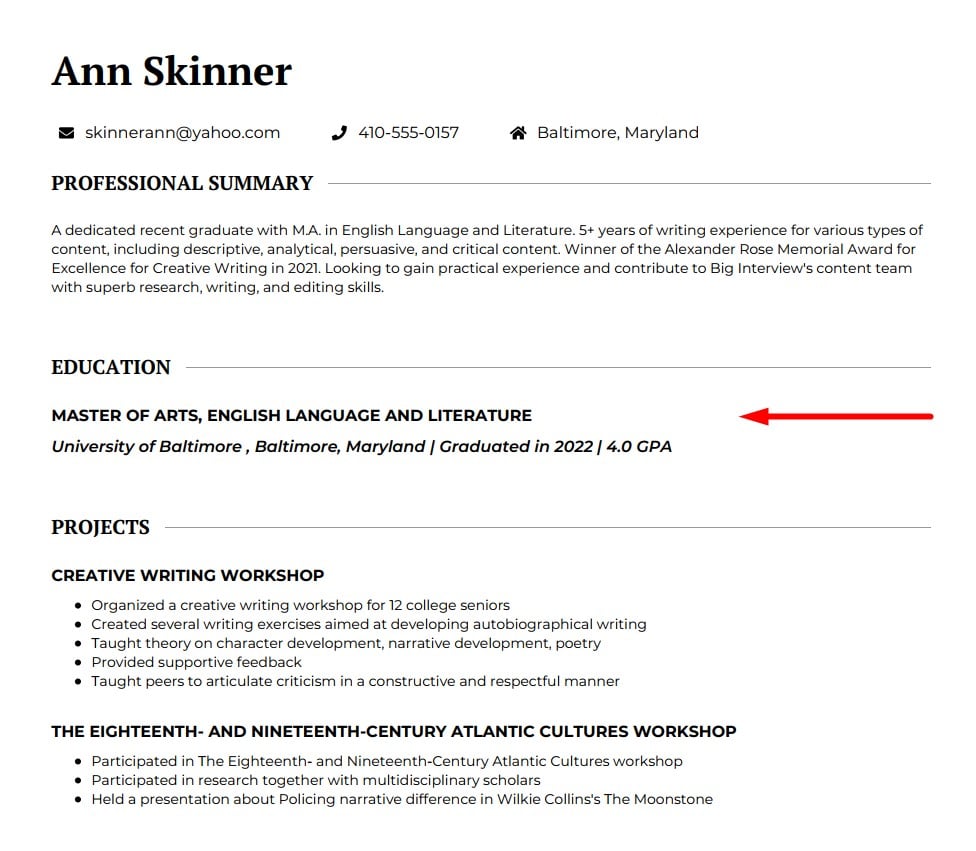

Should I Put In An Incomplete Degree On A Resume

https://enhancv.com/blog/content/images/2021/03/word-image.png

Filing Exempt On Taxes For 6 Months How To Do This

https://mgtblog.com/wp-content/uploads/2021/05/download-2-801x1024.png

Students pursuing a masters degree enrolled in an eligible graduate school may be able to receive a tax credit of up to 2 000 for qualified educational expenses You can claim a deduction for self education expenses if you do the course to satisfy study requirements to maintain your right to a taxable bonded

Just like an undergraduate student a graduate student is usually eligible for grad student tax deductions including File with H R Block to get your max refund File online File You can use the IRS s Interactive Tax Assistant tool to help determine if you re eligible for educational credits or deductions including the American Opportunity Tax Credit

Download Can I Claim My Masters Degree On Tax

More picture related to Can I Claim My Masters Degree On Tax

Online Masters Degree WORTH IT In 2021 Should You Get A Master s

https://i.ytimg.com/vi/PMIqd_N84iU/maxresdefault.jpg

Y ksek Lisans Derecesi Almak Ne Kadar S rer Online Y ksek Lisans Derecesi

https://kiiky.com/wp-content/uploads/2020/01/how-long-does-it-take-to-get-a-masters-degree-2.jpg

Listing Incomplete Degree On Your Resume Guide By Enhancv s Career

https://cdn.enhancv.com/images/1920/i/aHR0cHM6Ly9jZG4uZW5oYW5jdi5jb20vaW5jb21wbGV0ZV9kZWdyZWVfb25fcmVzdW1lX2UyYjIzODNmODMucG5n..png

For the tax year you may be able to claim a lifetime learning credit of up to 2 000 for qualified education expenses paid for all eligible students There is no limit on the number of years the lifetime learning credit can be I now have to do my first self assessment ever and wonder if I can claim the cost of the Masters from Oct 2022 April 2023 as an allowable expense eg if the

It allows you to deduct up to 4 000 from your income for qualifying tuition expenses paid for you your spouse or your dependents TABLE OF CONTENTS You cannot claim a credit for education expenses paid with tax free funds You must reduce the amount of expenses paid with tax free grants scholarships and fellowships

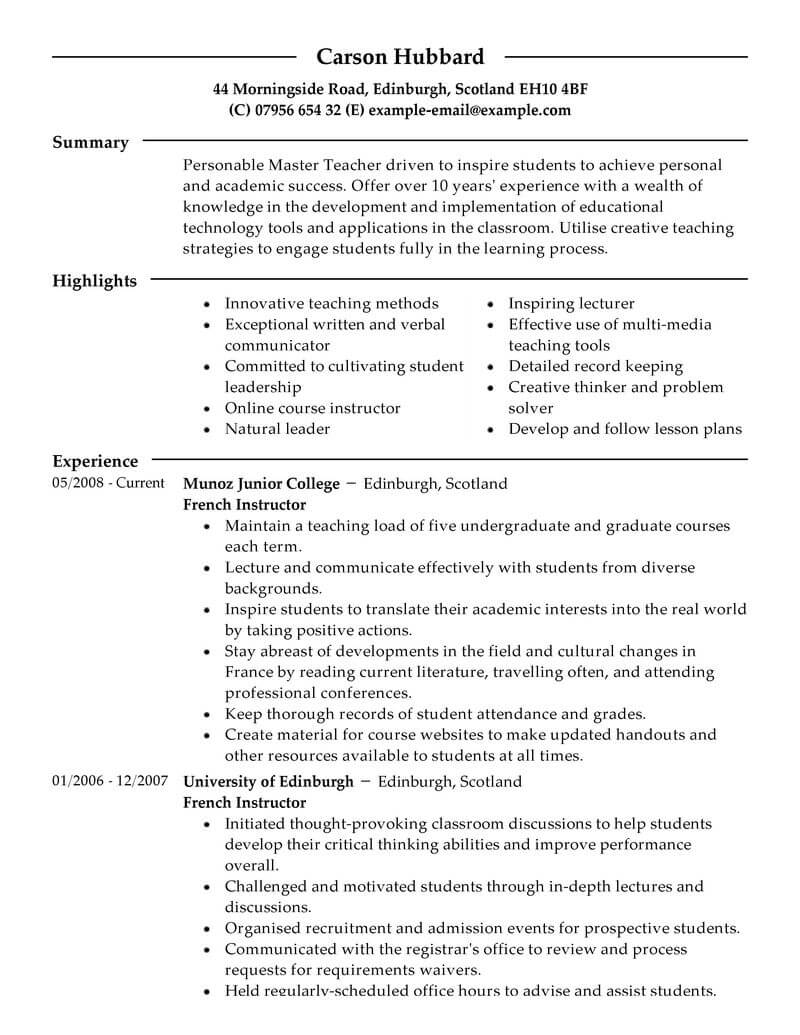

Student CV Template 2023 10 CV Examples Get Hired Quick

https://standout-cv.com/wp-content/uploads/2021/01/Masters-Student-CV-1.png

Who Is Eligible For The Child Tax Credit In 2022 Leia Aqui Can You

https://www.taxslayer.com/blog/wp-content/uploads/2022/07/Child-1-1.png

https://community.ato.gov.au/s/question/a0J9s000000TKsl

You can claim tuition fees paid with the help FEE HELP as a deduction though You must be enrolled with a full fee paying university or institution You can

https://www.taxaudit.com/tax-audit-blog/ca…

Thus qualifying graduate expenses may be claimed as itemized deductions for state tax purposes even when not deductible for federal purposes However determining what expenses qualify as job

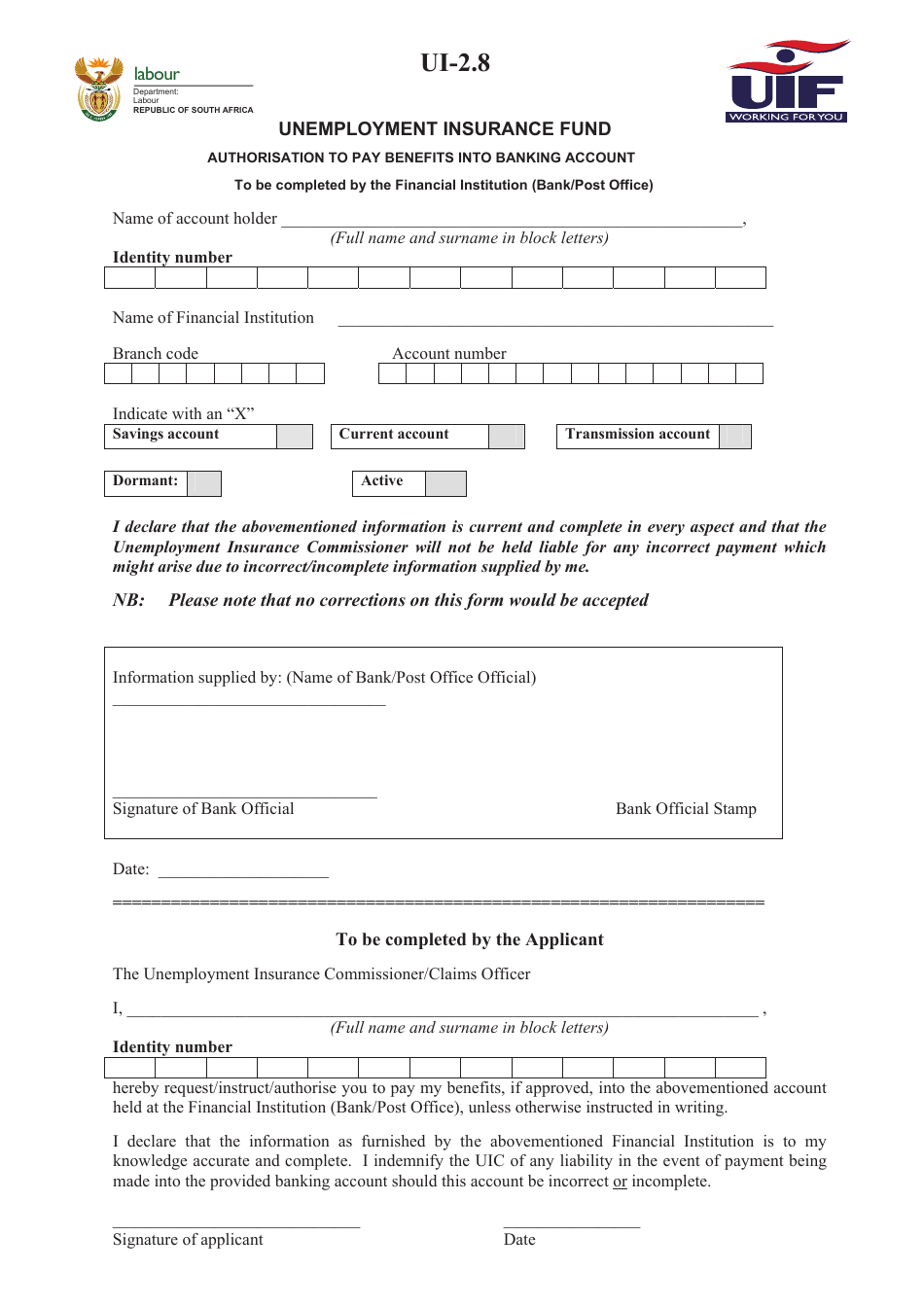

Printable Ui Clam Forms Printable Forms Free Online

Student CV Template 2023 10 CV Examples Get Hired Quick

Currently Pursuing Degree On Resume Sample Resume Example Gallery

Professional Master Teacher Resume Examples

When Do Student Loans Resume Vital Updates Tips Info Daily

Masters Degree Or Master s Degree Avoid Looking Foolish 7ESL

Masters Degree Or Master s Degree Avoid Looking Foolish 7ESL

Master s Degree Graduation Congratulations Elegant Art Deco Black Card

Who Can I Claim As Dependents On My Taxes Tax Tax Return Dependable

How To List Education On A Resume Sections Format

Can I Claim My Masters Degree On Tax - Tax filers can deduct up to 4 000 of tuition and fees paid for higher education in the tax year It is an above the line deduction meaning filers can claim it