Can I Claim Rent Paid On My Taxes Claim rent on taxes in Manitoba with Property Tax Credit Claim rent on taxes in Quebec with Solidarity Tax Credit How to claim rent as a home office expense If you rent your home your rent payment is most likely the biggest bill you pay every month

Updated February 28 2024 Is rent tax deductible Not for most people If you re self employed though rent can actually be a huge source of tax savings You just need to treat it as a business expense Rent as a tax deduction is frequently misunderstood There are three provinces that offer tax benefits or credits that you can claim your rent within Ontario Manitoba and Quebec Second self employed individuals may be able to claim rent paid on their taxes if they meet certain criteria

Can I Claim Rent Paid On My Taxes

Can I Claim Rent Paid On My Taxes

https://static.wixstatic.com/media/97aaeb_bbe5fb8c95dc40dca088c2e4a26d0843~mv2.jpeg/v1/fit/w_1000%2Ch_750%2Cal_c%2Cq_80/file.jpeg

How To Claim Rent On Taxes In 2023 APOLLO Insurance

https://ec2-3-98-51-152.ca-central-1.compute.amazonaws.com/wp-content/uploads/2023/02/can-i-claim-rent-on-my-taxes-canada.jpg

How To Fill Form 10BA A Y 23 24 How To Claim Rent Paid Sec 80gg 2023

https://i.ytimg.com/vi/W7qSbZEftIs/maxresdefault.jpg

1 min read Share No there are no circumstances where you can deduct rent payments on your tax return Rent is the amount of money you pay for the use of property that is not your own Deducting rent on taxes is not permitted by the IRS Unfortunately rent is not tax deductible And you can t claim all of your rent on your taxes either However you may be able to claim part of your rent if you work from home Even then there are specific requirements you need to qualify for

Do renters qualify for a tax deduction Yes but there are some qualifications you must meet to be eligible for certain tax deductions Some basic requirements include Residential Status You must be a resident of the state in which you are renting property Tax Filing Status You cannot be claimed as a dependent on someone else s tax return Rental income is taxed as ordinary income using progressive tax brackets which range from 10 to 37 depending on your filing status and taxable income Taxing rental income also requires special tax forms which we ll outline next Important rental income tax

Download Can I Claim Rent Paid On My Taxes

More picture related to Can I Claim Rent Paid On My Taxes

Can I Claim Rent A Room Relief YouTube

https://i.ytimg.com/vi/XBHD0Pa7qTU/maxresdefault.jpg

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/irishtimes/53NF4WU4QTEJ4Q6BKVERVM26H4.jpg)

Can I Claim Rent a room Relief On Son s College Flat The Irish Times

https://www.irishtimes.com/resizer/F11OHsBir1MwIR95E11H3FrYGWY=/1200x630/filters:format(jpg):quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/irishtimes/53NF4WU4QTEJ4Q6BKVERVM26H4.jpg

Free Download Pain In Full Clp Art Down Payment Invoice Debt Receipt

https://e7.pngegg.com/pngimages/551/998/png-clipart-pain-in-full-clp-art-down-payment-invoice-debt-receipt-rubber-stamp-miscellaneous-text.png

Can I claim rent as a deduction on taxes According to Adams you cannot claim rent as a deduction if the rent is for a place serving as your primary residence If you re wondering whether you can deduct your rent on your taxes the short answer is yes You can deduct rent if you live in a state that allows it However only 22 states offer this type of

Cash or the fair market value of property or services you receive for the use of real estate or personal property is taxable to you as rental income In general you can deduct expenses of renting property from your rental income Real estate rentals All rental income must be reported on your tax return and in general the associated expenses can be deducted from your rental income If you are a cash basis taxpayer you report rental income on your return for the year you receive it regardless of when it was earned

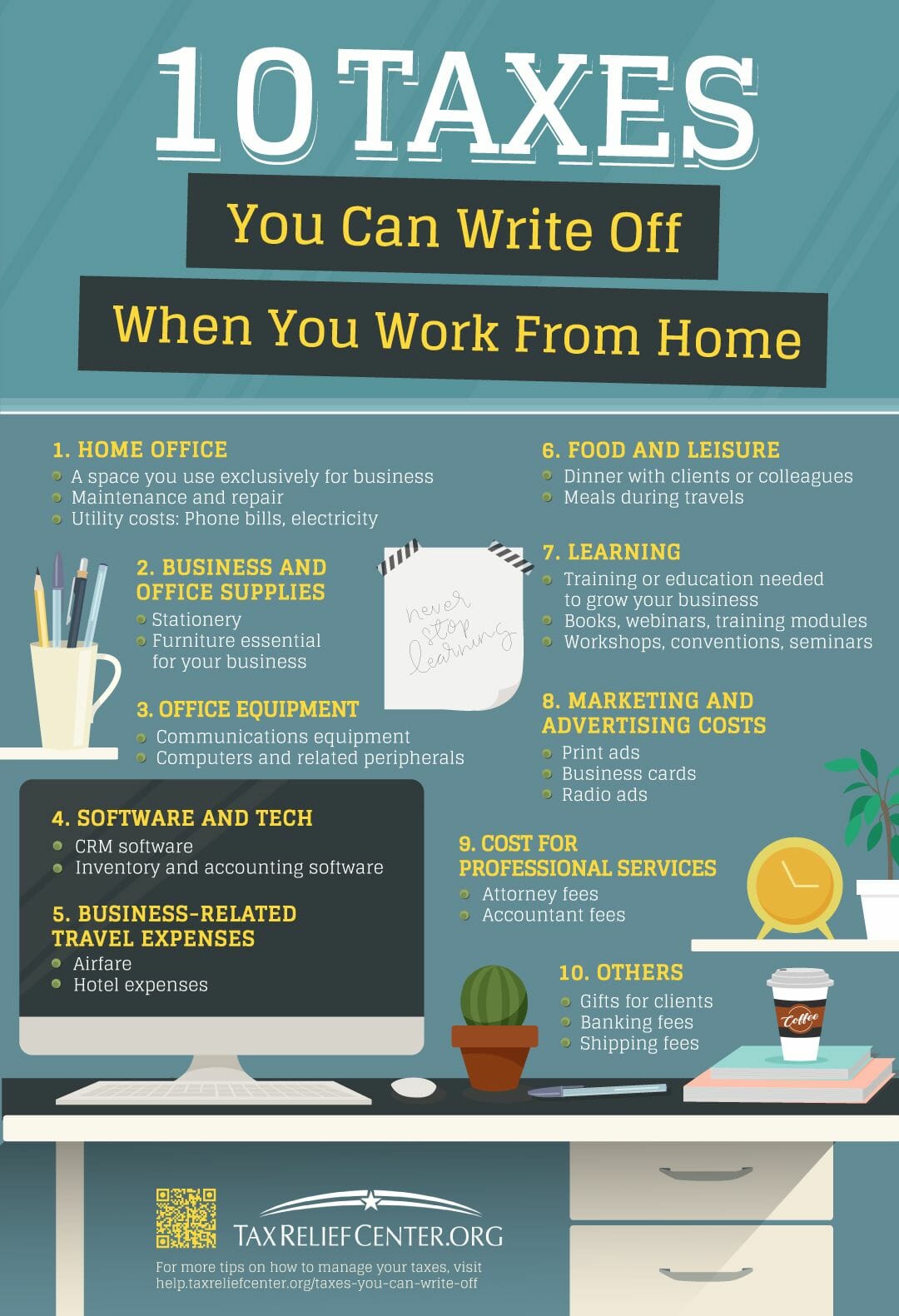

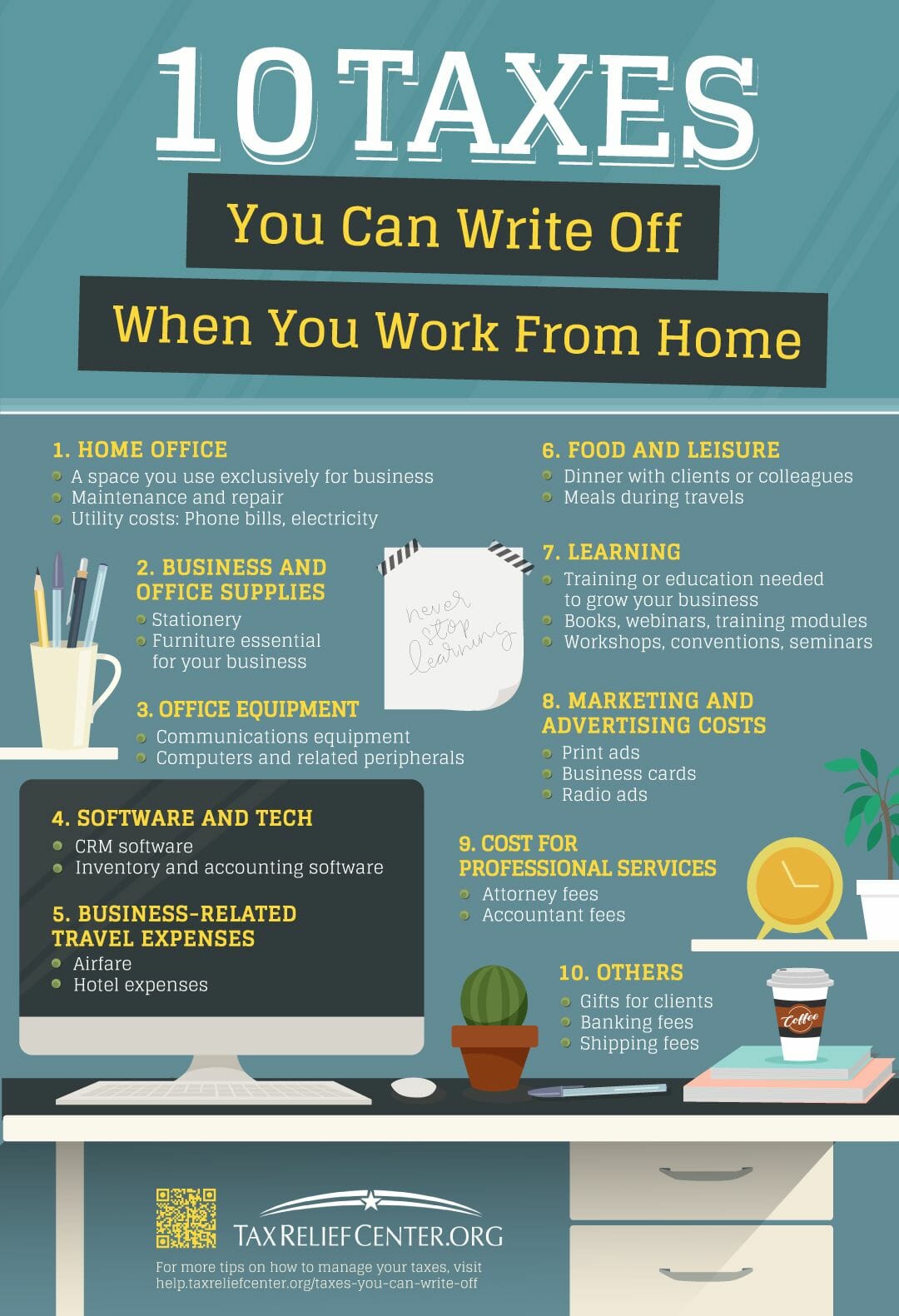

The Deductions You Can Claim Hra Tax Vrogue

https://help.taxreliefcenter.org/wp-content/uploads/2018/08/Tax-Relief-Center-10-Taxes-You-Can-Write-Off-When-You-Work-From-Home-20180725.jpg

Can I Claim Rent Reduction Due To Excessive Building Noise And Landlord

https://community.openrent.co.uk/uploads/short-url/AjwuGAvN4krWLbqQxc3PDVOcasf.jpeg?dl=1

https://turbotax.intuit.ca/tips/can-i-claim-a-tax-deduction-for-my-rent-3980

Claim rent on taxes in Manitoba with Property Tax Credit Claim rent on taxes in Quebec with Solidarity Tax Credit How to claim rent as a home office expense If you rent your home your rent payment is most likely the biggest bill you pay every month

https://www.keepertax.com/posts/rent-as-a-tax-deduction

Updated February 28 2024 Is rent tax deductible Not for most people If you re self employed though rent can actually be a huge source of tax savings You just need to treat it as a business expense Rent as a tax deduction is frequently misunderstood

How Do I Pay My Rent Online Avail

The Deductions You Can Claim Hra Tax Vrogue

Can I Claim Rent Arrears From My Tenant YouTube

Can I Claim Rent As A Tax Deduction PRORFETY

Explore Our Image Of Notice Of Late Rent Payment Template

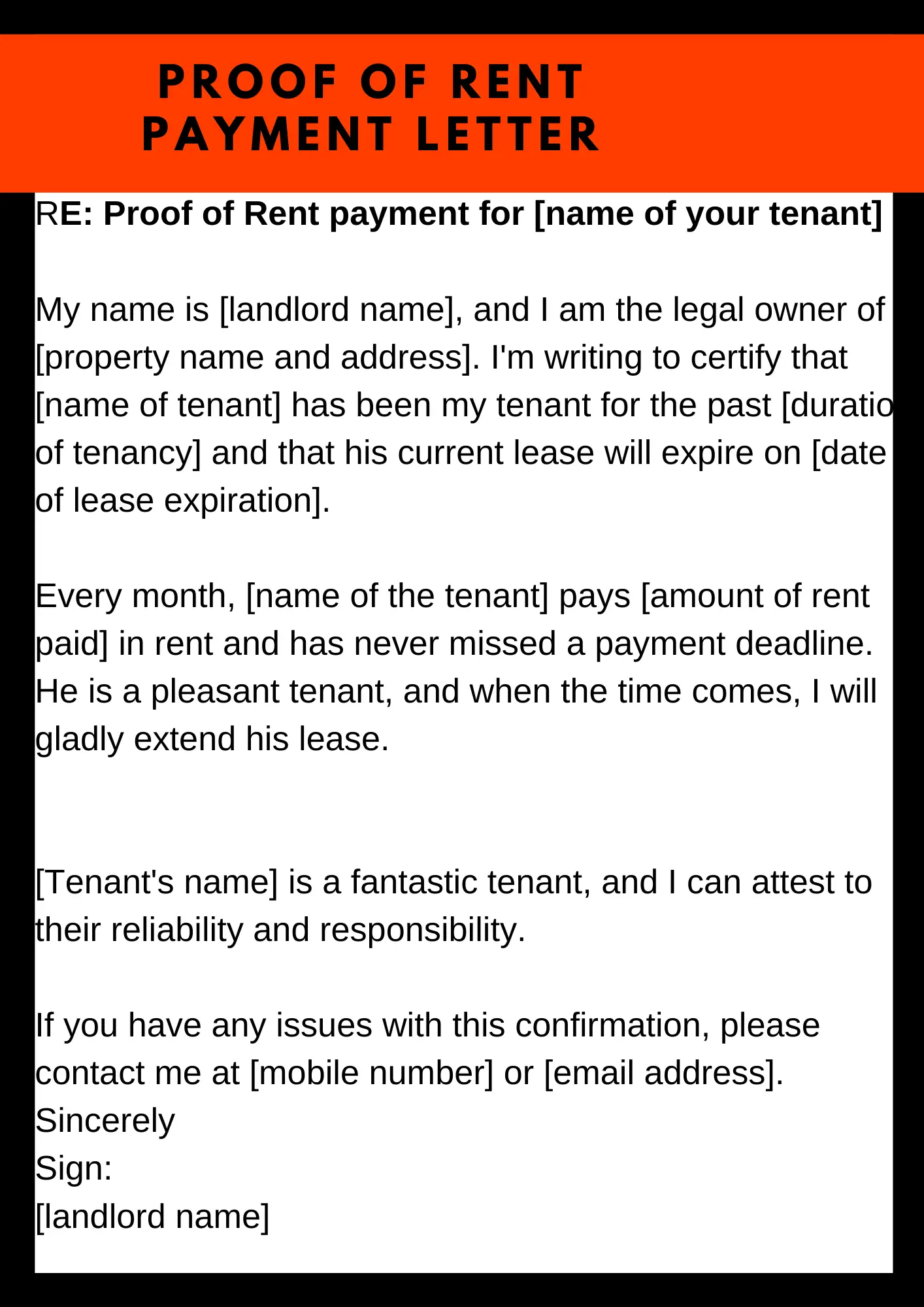

Proof Of Rent Payment Letter 2023 guide 4 Samples Sheria Na Jamii

Proof Of Rent Payment Letter 2023 guide 4 Samples Sheria Na Jamii

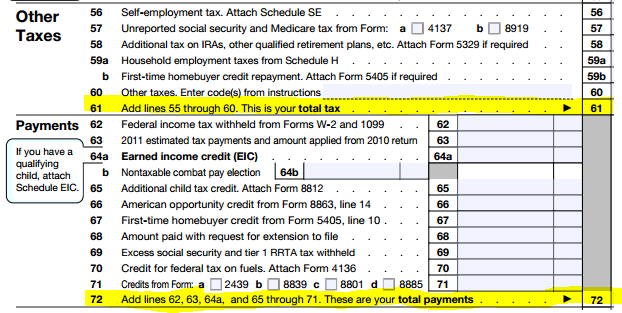

How To Request Your Federal Income Tax Refund Tax Rates

Rent Payment Letter Template Format Sample Examples

34 Printable Late Rent Notice Templates TemplateLab

Can I Claim Rent Paid On My Taxes - Do renters qualify for a tax deduction Yes but there are some qualifications you must meet to be eligible for certain tax deductions Some basic requirements include Residential Status You must be a resident of the state in which you are renting property Tax Filing Status You cannot be claimed as a dependent on someone else s tax return