Can I Claim Tax Relief On Employer Pension Contributions Web You can get tax relief on private pension contributions worth up to 100 of your annual earnings You ll either get the tax relief automatically or you ll have to claim it yourself

Web Vor 3 Tagen nbsp 0183 32 If you re paying into a workplace pension scheme organised by your employer and are earning under 163 50 270 for the 2023 24 tax year you won t need to declare your pension contributions on your tax Web Tax relief on employer pension contributions When are contributions to a registered pension scheme by an employer allowable as a deduction in computing trade profits

Can I Claim Tax Relief On Employer Pension Contributions

Can I Claim Tax Relief On Employer Pension Contributions

https://truemanbrown.co.uk/wp-content/uploads/2021/08/pension-fund.jpg

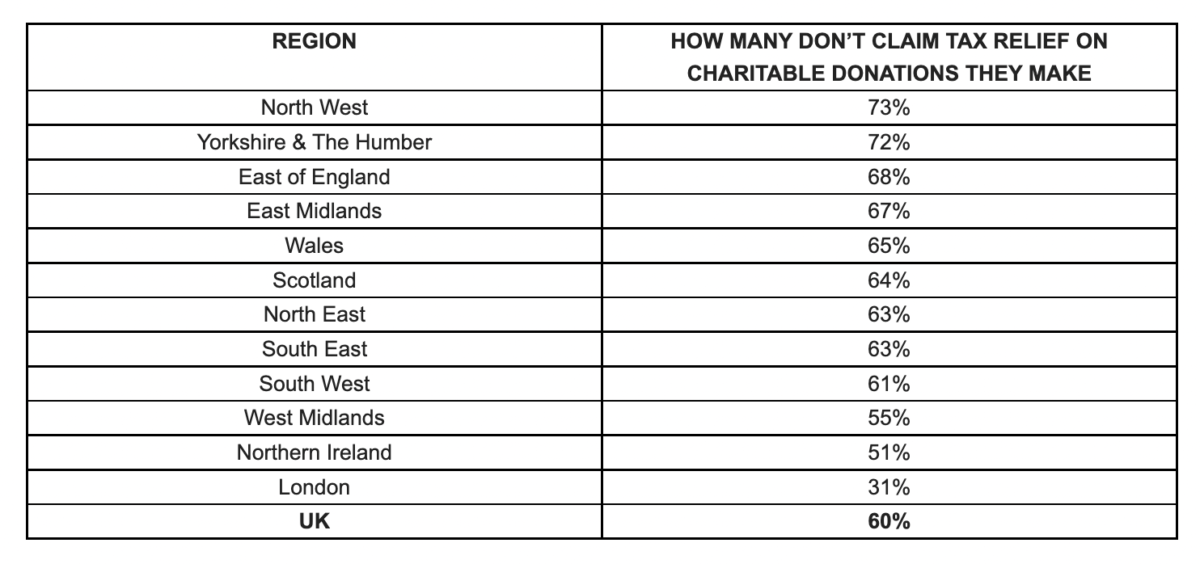

Low Take Up Of Tax Relief On Donations Means Charities Could Be Missing

https://fundraising.co.uk/wp-content/uploads/2022/04/Screenshot-2022-04-06-at-07.18.04.png

A Consultation On Pensions Tax Relief Provisio Wealth

https://www.provisio.co.uk/wp-content/uploads/2015/07/pensionsimage.jpg

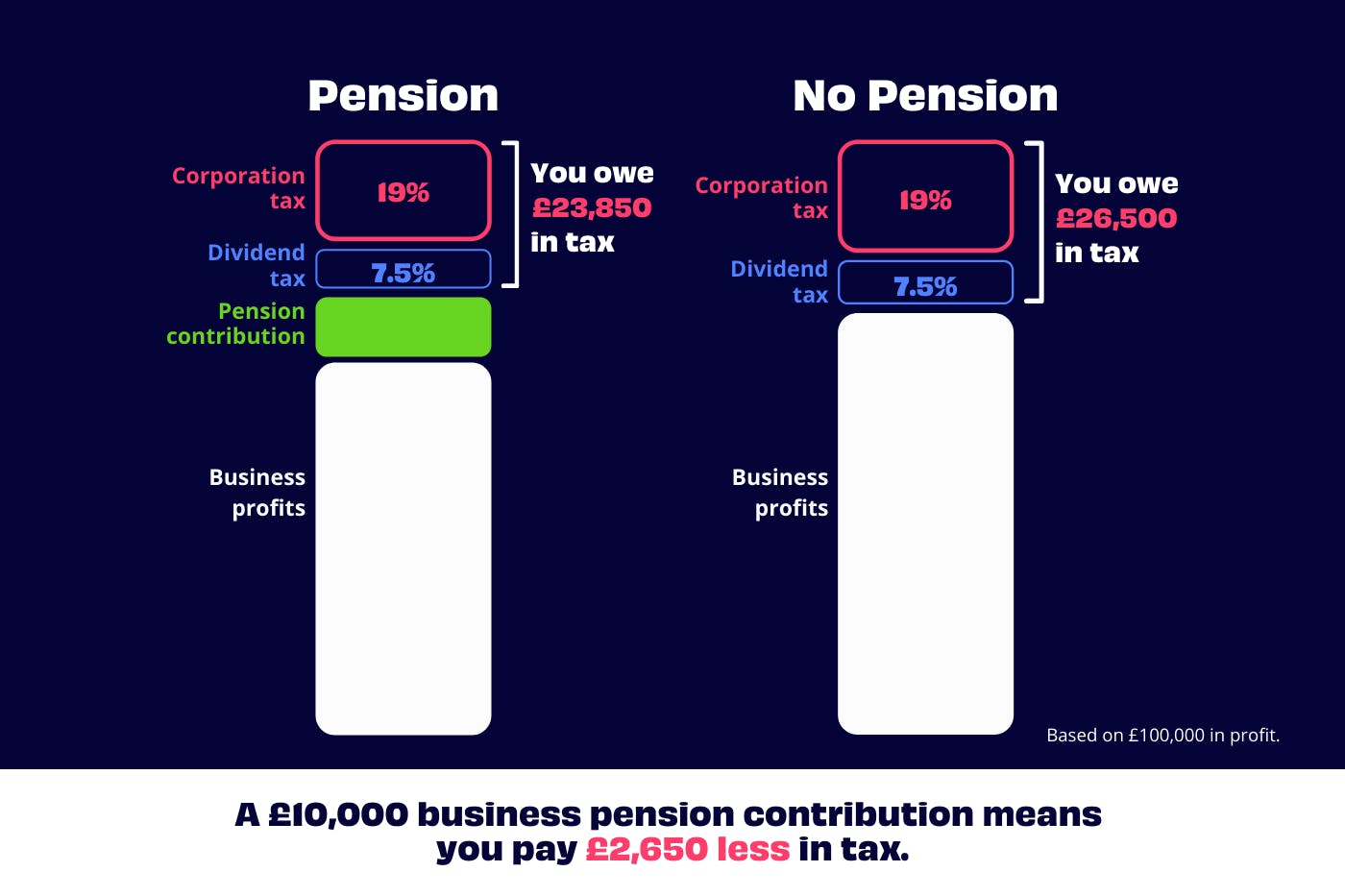

Web 3 Apr 2023 nbsp 0183 32 If you re paying into a pension through your employer your employer will take 80 of your pension contribution from your salary technically known as net of Web 6 Apr 2023 nbsp 0183 32 Tax relief on employer contributions is given by allowing pension contributions to be deducted as a legitimate business expense Deductions are only

Web Vor 3 Tagen nbsp 0183 32 You can claim an extra 20 tax relief on 163 30 000 the amount you paid higher rate tax on through your return or by writing to the tax office There is no extra Web 13 Mai 2022 nbsp 0183 32 As an employer you re required to pay pension contributions for eligible employees under auto enrolment 1 One of the benefits of making contributions is that

Download Can I Claim Tax Relief On Employer Pension Contributions

More picture related to Can I Claim Tax Relief On Employer Pension Contributions

Mac Financial Making Pension Contributions Before The End Of The Tax

http://macfinancial.uk.com/wp-content/uploads/2016/02/pension1.jpg

Self Employed Pension Tax Relief Explained Penfold Pension

https://images.prismic.io/penfold/d68abe56-2255-43f5-8412-5d0e13153a09_yearly-self-employed-pension-tax-relief.png?auto=compress

What Is Pension Tax Relief Moneybox Save And Invest

https://www.moneyboxapp.com/wp-content/uploads/2020/01/Copy-of-How-do-_pensions-work_-02-1024x516.png

Web Pension contributions are normally split between employers and employees For most people the minimum total contribution value that must be made under automatic Web 5 Dez 2016 nbsp 0183 32 You can get UK tax relief on contributions you make into certain types of overseas pension schemes You can get relief on your contributions up to the value of

Web you get 163 10 tax relief A total of 163 80 goes into your pension Use MoneyHelper s contributions calculator to work out how much you and your employer will put in Web 12 Mai 2016 nbsp 0183 32 You can get tax relief on most contributions you make to registered pension schemes some overseas pension schemes You can t claim relief for

Budget 2020 Pension Relief For Dentists SmallBiz Accounts

https://smallbizaccounts.co.uk/wp-content/uploads/2020/03/shutterstock_1387425773-scaled.jpg

Pension Tax Relief In The United Kingdom UK Pension Help

http://ukpensionhelp.com/wp-content/uploads/2021/03/5.png

https://www.gov.uk/tax-on-your-private-pension/pension-tax-relief

Web You can get tax relief on private pension contributions worth up to 100 of your annual earnings You ll either get the tax relief automatically or you ll have to claim it yourself

https://getpenfold.com/news/self-assessment …

Web Vor 3 Tagen nbsp 0183 32 If you re paying into a workplace pension scheme organised by your employer and are earning under 163 50 270 for the 2023 24 tax year you won t need to declare your pension contributions on your tax

Can I Get Tax Relief On Pension Contributions Financial Advisers

Budget 2020 Pension Relief For Dentists SmallBiz Accounts

Pension Tax Relief On Pension Contributions Freetrade

Self Employed Pension Tax Relief Explained Penfold Pension

How To Claim Pension Higher Rate Tax Relief

Tax Relief On Pension Contributions FKGB Accounting

Tax Relief On Pension Contributions FKGB Accounting

How To Write A Letter Requesting Pension Benefits

OS Payroll Your P60 Document Explained

How To Claim Pension Tax Relief 2023 Updated

Can I Claim Tax Relief On Employer Pension Contributions - Web 6 Apr 2023 nbsp 0183 32 Tax relief on employer contributions is given by allowing pension contributions to be deducted as a legitimate business expense Deductions are only