Can I Claim Tax Relief On Legal Fees You can claim tax relief on professional membership fees if you must pay the fees to be able to do your job annual subscriptions you pay to approved professional bodies or

You can claim tax relief on professional membership fees if you must pay the fees to be able to do your job annual subscriptions you pay to approved You can claim tax relief on most legal expenses as long as they are wholly and exclusively for the business and directly relate to it If an expense is for both business and private use you can only claim

Can I Claim Tax Relief On Legal Fees

Can I Claim Tax Relief On Legal Fees

https://tbat.co.uk/wp-content/uploads/2021/10/[email protected]

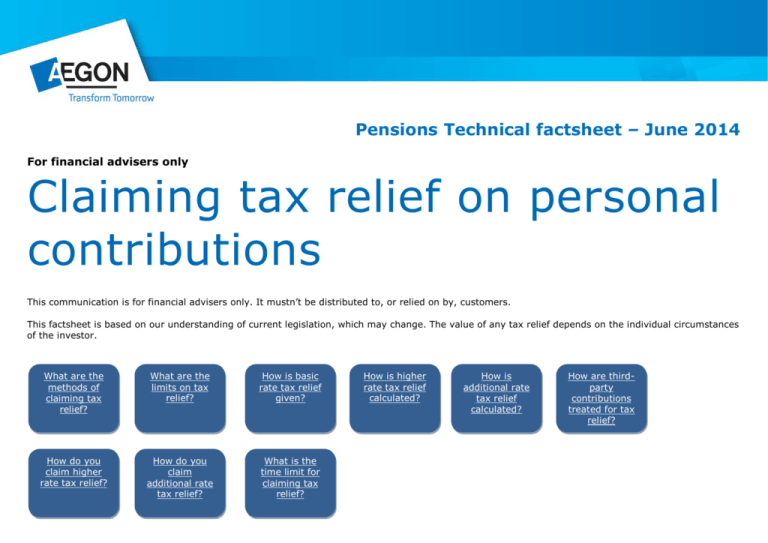

Claiming Tax Relief On Personal Contributions

https://s3.studylib.net/store/data/008863819_1-2f6094913014d745c3da18091a1e8c10-768x994.png

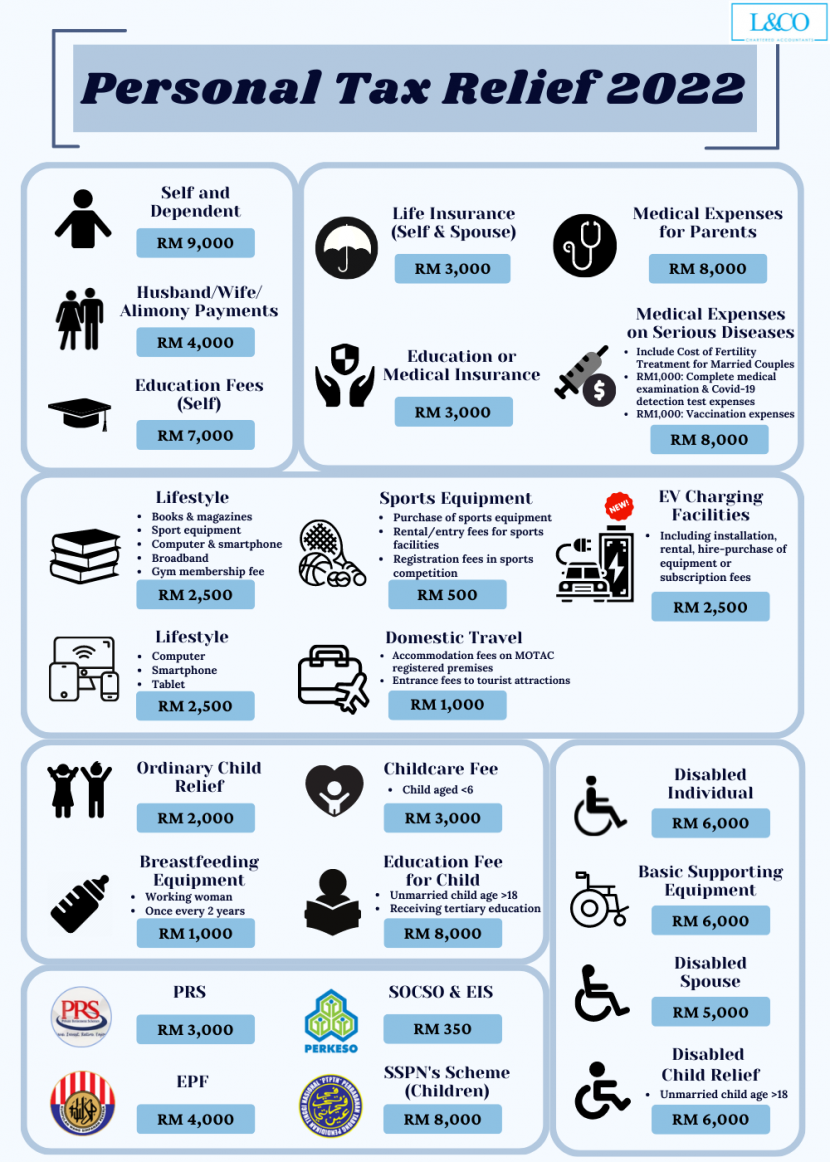

Personal Tax Relief 2022 L Co Accountants

https://landco.my/wp-content/uploads/2022/11/3-3-1024x1024.png

Legal management and accountancy fees You cannot claim any legal fees in connection with the purchase of the property or any fees for the initial lease if it is The tax code was amended back in 2004 to allow legal fee deductions above the line in some cases but the deduction has been quirky to claim ever since because previous

On certain job related expenses known as a tax deductible expense you can claim tax relief for the amounts you ve paid out This applies both where you have paid the expenses yourself without any If you get advice from an accountant lawyer or other professional as part of your business you can claim tax back on their fees You can also claim allowable expenses for hiring surveyors and

Download Can I Claim Tax Relief On Legal Fees

More picture related to Can I Claim Tax Relief On Legal Fees

Are You Missing Out On Pension Tax Breaks St Edmundsbury Wealth

https://stedswm.co.uk/wp-content/uploads/2022/05/image001.png

Personal Tax Relief 2022 L Co Accountants

https://landco.my/wp-content/uploads/2022/11/Personal-Tax-Relief-2022-1-830x1162.png

Can I Claim Tax Relief On Pension Contributions Chapman Robinson

https://crmoxford.co.uk/wp-content/uploads/2022/06/Can-I-claim.jpeg

WASHINGTON AP The Federal Emergency Management Agency can meet immediate needs but does not have enough funding to make it through the With recent changes to the tax laws and adjustments to what counts as being deductible or not you might be wondering if you re able to deduct any of your legal fees Follow our guide to determine

The Federal Emergency Management Agency FEMA has responded to false claims that money being spent on illegal migrants should be spent on disaster relief You cannot claim any legal fees in connection with the purchase of the property or any fees for the initial lease if it is for more than one year Any legal fees in connection with

Can I Claim Legal Fees Chasing Payments As A Tax Deduction

https://media-exp1.licdn.com/dms/image/C5612AQHVaIufXZ-vXA/article-cover_image-shrink_600_2000/0/1573402595488?e=2147483647&v=beta&t=aTrqd02Ks0BrNyHPUPBrGAtoD0P1I4w4_CunFF0lUUg

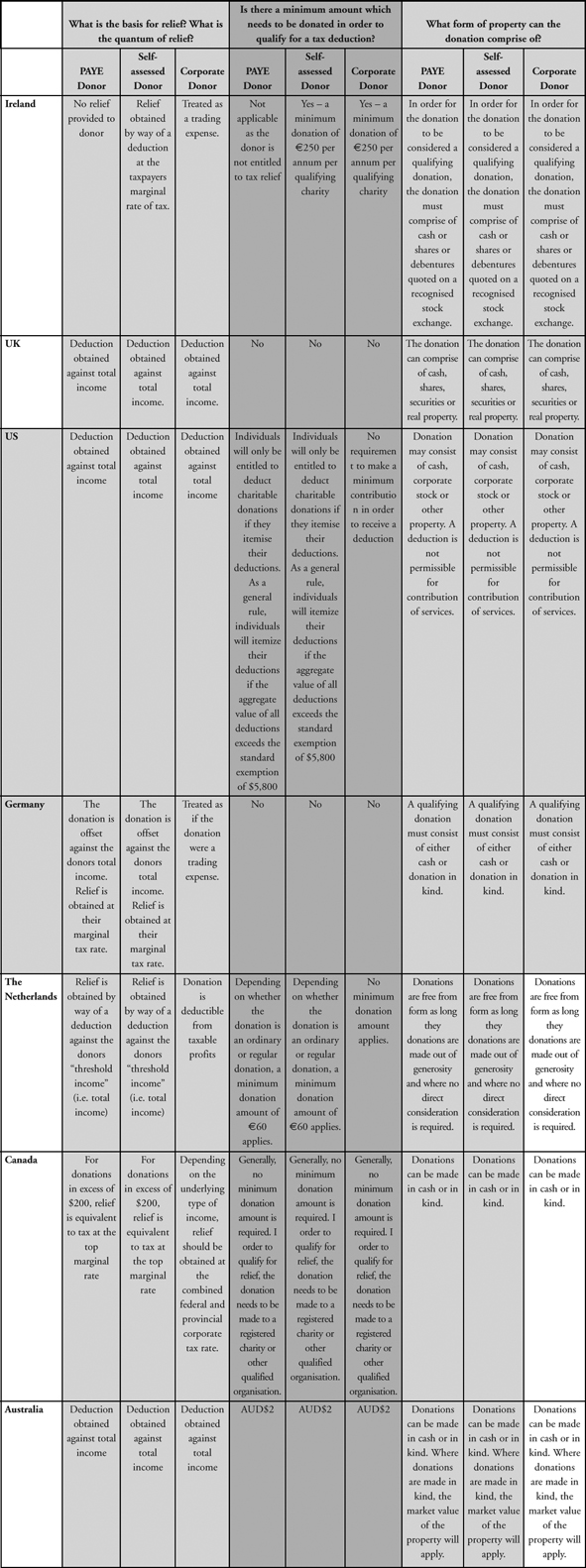

Tax Relief On Charitable Donations

https://www.charteredaccountants.ie/taxsourcetotal/taxpoint/images/images_TAXP042012_F0001.jpg

https://www.gov.uk/tax-relief-for-employees/...

You can claim tax relief on professional membership fees if you must pay the fees to be able to do your job annual subscriptions you pay to approved professional bodies or

https://www.gov.uk/government/publications/...

You can claim tax relief on professional membership fees if you must pay the fees to be able to do your job annual subscriptions you pay to approved

How To Claim Pension Higher Rate Tax Relief

Can I Claim Legal Fees Chasing Payments As A Tax Deduction

How To Claim Higher Rate Tax Relief On Pension Contributions

Can I Claim Tax Relief On Professional Subscriptions YouTube

The Ultimate And Comprehensive Guide To Freelance Tax

Businesses Receiving A Compulsory Purchase Order What Can I Claim For

Businesses Receiving A Compulsory Purchase Order What Can I Claim For

JUST HOW DO The Tax Breaks Work Dug Tech

Who Can I Claim As A Dependent

Oklahoma Fillable Title Forms Printable Forms Free Online

Can I Claim Tax Relief On Legal Fees - Legal fees for lets of a year or less or for renewing a lease of less than 50 years accountant s fees rents ground rents and service charges You can t claim tax relief