Can Small Businesses Claim Vat Back Verkko 11 huhtik 2020 nbsp 0183 32 Only businesses that are VAT Registered are able to charge and reclaim VAT VAT registration becomes mandatory after

Verkko The good news for small businesses registering for VAT is you can use your first VAT Return to claim back VAT costs your business previously incurred You get only a Verkko 31 lokak 2023 nbsp 0183 32 How to claim back VAT as a small business 3min read by Nick Green Last updated 31 October 2023 VAT value added tax is a surcharge on most

Can Small Businesses Claim Vat Back

Can Small Businesses Claim Vat Back

https://gg.myggsa.co.za/can-you-claim-vat-on-fuel-south-africa-.jpg

Can You Claim VAT On Fuel In South Africa Greater Good SA

https://gg.myggsa.co.za/1661758698990.jpg

Vietnam Reduces VAT Rate Businesses Allowed To Claim CIT Deductions

https://www.vietnam-briefing.com/news/wp-content/uploads/2022/02/VAT.jpg

Verkko 17 tammik 2023 nbsp 0183 32 You can only claim back VAT if you are a VAT registered business Your business must be registered for VAT if your VAT taxable turnover has exceeded 163 85 000 over the past 12 months Verkko VAT is refunded within the EU under the EU VAT refund directive which enables EU companies to reclaim from any member state the 13th Directive allowing

Verkko Can I claim VAT back and do I need first to register then sell the business The good news is that yes you can claim for VAT incurred on purchases of goods up to four Verkko VAT relief on bad debts If you raise an invoice and pay VAT on the expected income but your customer doesn t pay you then you have a bad debt You can claim back the

Download Can Small Businesses Claim Vat Back

More picture related to Can Small Businesses Claim Vat Back

Who Can Claim Vat In South Africa Greater Good SA

https://gg.myggsa.co.za/who-can-claim-vat-in-south-africa-.jpg

How Far Back Can You Claim Vat In South Africa Greater Good SA

https://gg.myggsa.co.za/how-far-back-can-you-claim-vat-in-south-africa-.jpg

Why Businesses Are Allowed To Claim VAT Back Online Accounting Guide

https://i1.wp.com/onlineaccountingguide.com/wp-content/uploads/2020/05/stellrweb-djb1whucfBY-unsplash-scaled.jpg?fit=2560%2C1705&ssl=1

Verkko 6 marrask 2023 nbsp 0183 32 Who can reclaim VAT In the UK only businesses that are VAT registered can claim back VAT You must register for VAT if your business meets Verkko 31 lokak 2022 nbsp 0183 32 If you re running a big or small sized business you are able to claim back VAT on expenses for business if you re registered for VAT Accounting for VAT and then claiming the VAT back can be

Verkko Yes you can make a claim for VAT on all the goods and services you purchased for your business as soon as your business is VAT registered subject to the normal VAT Verkko What can you claim back VAT on As a business you can usually claim back the VAT you have paid on goods and services bought for business use for which you have a

How To Claim Back VAT VAT Guide Xero UK

https://www.xero.com/content/dam/xero/pilot-images/guides/guide-to-gst-bas-vat/354050_Hero_Guide to VAT_claimingx2.1646877578209.png

Can You Claim Back VAT Without Receipt Accountant s Answer

https://smallbusinessowneradvice.co.uk/wp-content/uploads/2022/10/Can-you-claim-back-VAT-without-a-receipt.jpg

https://onlineaccountingguide.com/why-busin…

Verkko 11 huhtik 2020 nbsp 0183 32 Only businesses that are VAT Registered are able to charge and reclaim VAT VAT registration becomes mandatory after

https://www.startuploans.co.uk/business-guidance/claiming-vat-back...

Verkko The good news for small businesses registering for VAT is you can use your first VAT Return to claim back VAT costs your business previously incurred You get only a

Can Businesses Claim Back Vat 2023 Updated

How To Claim Back VAT VAT Guide Xero UK

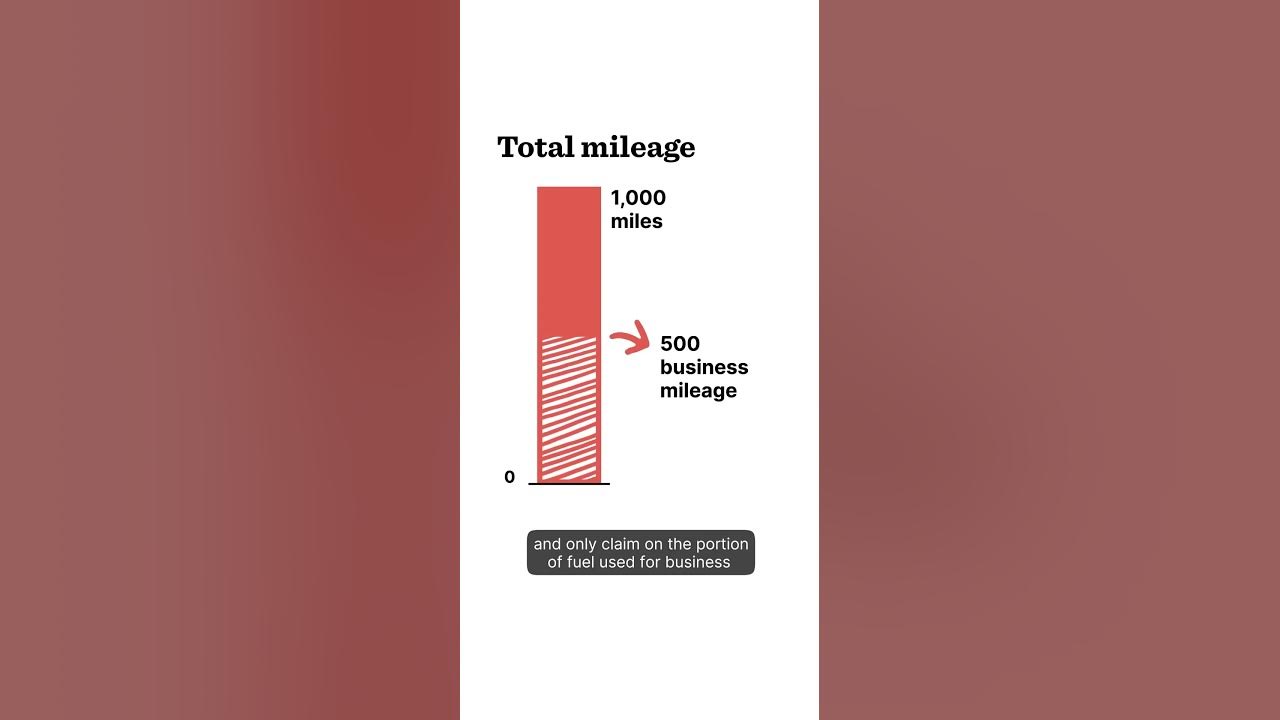

Can You Claim VAT Back On Fuel YouTube

How To Claim VAT Back On Expenses Goselfemployed co

How To Claim VAT Back On Expenses Finance Blog Bookkeeping Software

Learn How

Learn How

The Right To Claim Back VAT

Hecht Group How To Reclaim Value Added Tax VAT As A Commercial

FBA Storage Fees General Selling On Amazon Questions Amazon Seller

Can Small Businesses Claim Vat Back - Verkko 12 lokak 2022 nbsp 0183 32 Business tax Guidance Tax reliefs and allowances for businesses employers and the self employed English Cymraeg Find out about tax reliefs and