Can We Claim Home Loan Interest In Old Tax Regime If the loan is taken jointly each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment under Section 80C up to Rs

Taxpayer must choose Old Tax Regime by selecting Yes in ITR 1 ITR 2 or Yes within due date option in ITR 3 ITR 4 ITR 5 in the field provided for opting out option in the If you have a home loan it makes sense to opt for the old tax regime If a couple jointly takes a home loan they can maximise the tax benefits

Can We Claim Home Loan Interest In Old Tax Regime

Can We Claim Home Loan Interest In Old Tax Regime

https://www.taxhelpdesk.in/wp-content/uploads/2021/11/Tax-Saving-Benefits-of-having-property-through-Home-Loan-1.png

Home Loan Lowest Interest Rate

https://marathikayda.com/wp-content/uploads/2022/12/home-loan-low-interest-rate-compressed.jpg

Claim Home Loan Tax Benefits HRA Together For ITR Filing Telangana Today

https://cdn.telanganatoday.com/wp-content/uploads/2022/07/Claim-Home-Loan-Tax-Benefits-HRA-together-for-ITR-filing.jpg

If you have a home loan you can claim both maximum principal and interest rate deductions you can save more taxes under the old tax regime Consider consolidated Interest on home loan If you have taken a loan for the acquisition construction or repair of the property you can claim the interest paid on the loan up to certain limits specified as

If you have bought a house with the help of a home loan you become eligible to get income tax deduction on interest payment up to Rs 2 lakh annually provided the You can still claim deduction on home loan interest The tax rules still allows deduction on interest paid towards loan on a rented property under section 24 b

Download Can We Claim Home Loan Interest In Old Tax Regime

More picture related to Can We Claim Home Loan Interest In Old Tax Regime

Mortgage Rates Payments By Decade INFOGRAPHIC Blog WestMark

https://www.westmarkrealtors.com/blog/wp-content/uploads/sites/152/2020/08/Mortgage-Rates-Payments-by-Decade-INFOGRAPHIC.jpg

What Is A Home Loan Loyalty Tax And Am I Paying It Nano Digital Home

https://nano.com.au/wp-content/uploads/2022/06/what-is-a-home-loan-loyalty-tax-scaled.jpg

Do You Know When Old And New Tax Regimes Give The Same Tax Liability

https://akm-img-a-in.tosshub.com/businesstoday/styles/medium_crop_simple/public/images/story/202302/break-even-point-for-old-and-new-tax-regime-.jpg?itok=h3-wLBy8

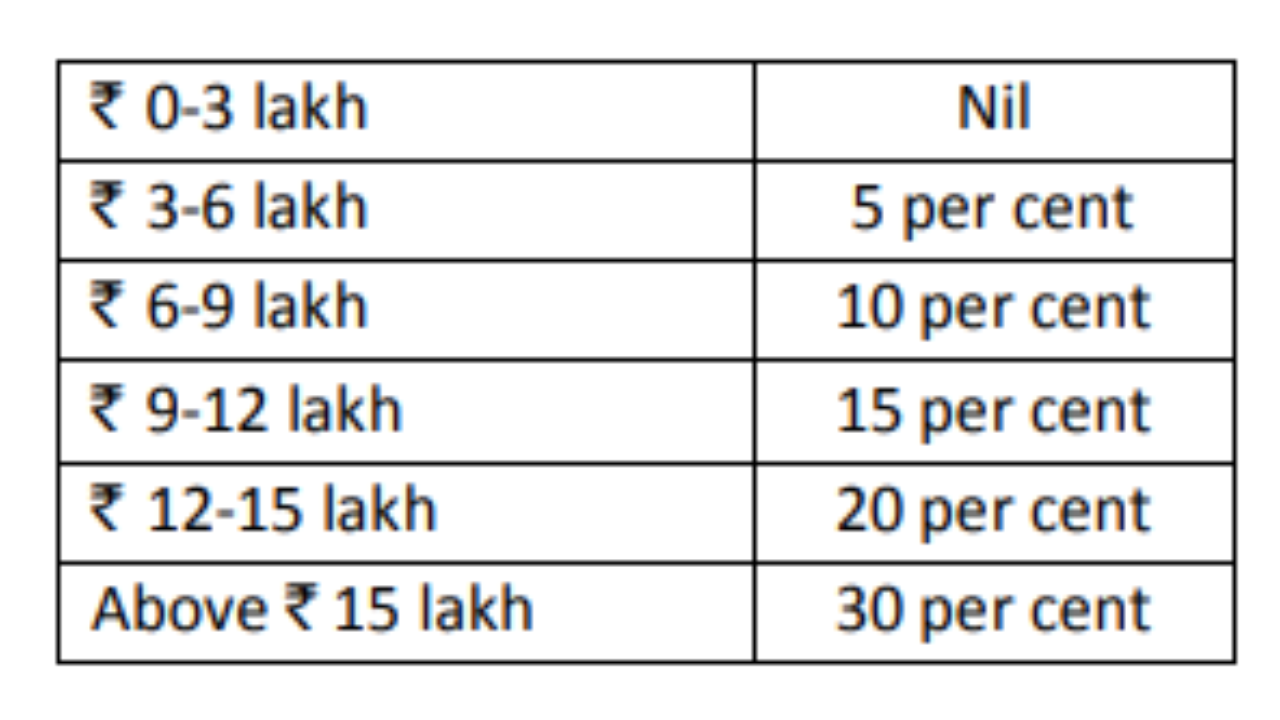

You can claim deduction for home loan interest but only on a rented property and not as much as under the old regime Gratuity is tax exempt up to Rs 20 You have two options continue with the old regime and keep taking tax deductions or opt for the new one lower taxes but don t avail of deductions The new

The following are some of the major deductions and exemptions you cannot claim under the new tax regime The deduction under Section 80TTA 80TTB Interest Tax benefits on home loan interest payment include deductions under Section 24 for self occupied and let out properties and an additional benefit of up to Rs

Union Budget 2023 24 Why Old Tax Regime Is Still Better Than New Tax

https://akm-img-a-in.tosshub.com/businesstoday/styles/medium_crop_simple/public/images/story/202302/tax-graphic-1.jpg?itok=AFs3rjIf

Best Home Loan Rates

https://images.livemint.com/img/2021/12/26/original/loan_1640547127620.png

https://cleartax.in/s/home-loan-tax-benefit

If the loan is taken jointly each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment under Section 80C up to Rs

https://www.incometax.gov.in/iec/foportal/sites...

Taxpayer must choose Old Tax Regime by selecting Yes in ITR 1 ITR 2 or Yes within due date option in ITR 3 ITR 4 ITR 5 in the field provided for opting out option in the

How To Calculate Home Loan EMI FREE CALCULATOR FinCalC Blog

Union Budget 2023 24 Why Old Tax Regime Is Still Better Than New Tax

Calculate Your Projected Income Tax For FY 2020 21 In New Tax Regime

Budget 2023 Old Vs New Tax Regimes Who Should Make The Switch

Home Loan Interest Rates At All time Low

Old Tax Regime And New Tax Regime Explained In 3 Scenarios Forum

Old Tax Regime And New Tax Regime Explained In 3 Scenarios Forum

New Income Tax Regime Changes In Tax Slabs And Rebate Limits See

How First time Home Buyers Can Get Up To 5 Lakh Tax Rebate Mint

Old Vs New Tax Regime Choose YouTube

Can We Claim Home Loan Interest In Old Tax Regime - You can still claim deduction on home loan interest The tax rules still allows deduction on interest paid towards loan on a rented property under section 24 b