Is Home Loan Interest Tax Deductible In India On purchase of property with home loans borrowers enjoy a variety of deductions on their income tax liability These deductions against the tax could be claimed under four sections of the income tax act namely

You can avail deduction on the interest paid on your home loan under section 24 b of the Income Tax Act For a self occupied house the maximum tax deduction of Rs 2 lakh can be claimed from your gross income annually Both the interest paid on a home loan and the principal paid back on the loan are deductible by an individual filing taxes Section 24 permits a deduction of interest paid on a home loan for self occupied property up to a

Is Home Loan Interest Tax Deductible In India

Is Home Loan Interest Tax Deductible In India

https://s.yimg.com/uu/api/res/1.2/evO7M0dUmFwjNGktKceIXQ--~B/aD0xNDYzO3c9MjA0OTtzbT0xO2FwcGlkPXl0YWNoeW9u/http://media.zenfs.com/en-US/homerun/motleyfool.com/cbdf5e307d50f0dbe4cdc22816aa633e

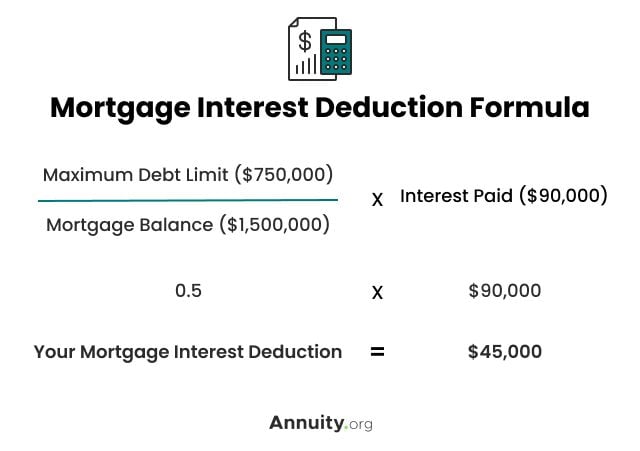

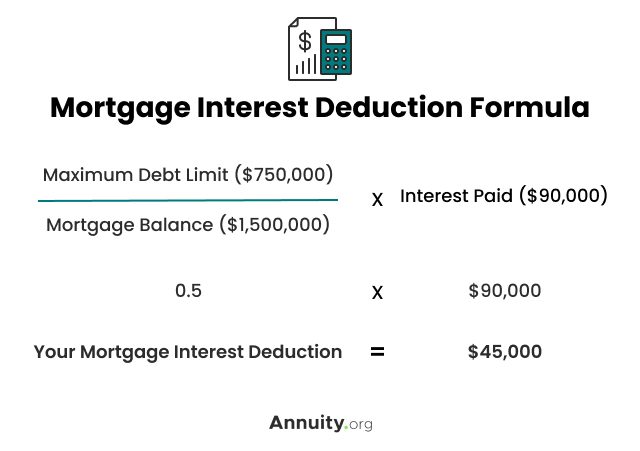

Mortgage Interest Tax Relief Calculator DermotHilary

https://www.annuity.org/wp-content/uploads/mortgage-interest-deduction-formula-640x0-c-default.jpg

Home Loan Lowest Interest Rate

https://marathikayda.com/wp-content/uploads/2022/12/home-loan-low-interest-rate-compressed.jpg

Tax deduction under Section 80EE of the Income Tax Act 1961 can be claimed by first time home buyers for the amount they pay as interest on a home loan and the loan must be sanctioned between 01 04 2016 to 31 03 2022 No housing loan interest is not entirely tax exempt in India However the Indian tax code offers deductions for a portion of the interest you pay on your home loan These

A home loan can help avail an 80C deduction of up to 1 5 lakh 80EE deduction of 50 000 and 24 b deduction of 2 lakh Hence a total taxable value deduction of up to 4 lakh for low cost In India taxpayers can claim tax deductions on home loan interest under Section 24 b of the Income Tax Act This deduction is available for self occupied properties that are completed within five years and for which the loan was

Download Is Home Loan Interest Tax Deductible In India

More picture related to Is Home Loan Interest Tax Deductible In India

What Is A Home Loan Loyalty Tax And Am I Paying It Nano Digital Home

https://nano.com.au/wp-content/uploads/2022/06/what-is-a-home-loan-loyalty-tax-scaled.jpg

Pin On Property Finance

https://i.pinimg.com/originals/5b/9c/f2/5b9cf2873744df5288180e2fd7e7be02.jpg

Is Home Equity Loan Interest Tax Deductible For Rental Property

https://freebill.cushion.ai/wp-content/uploads/2022/03/is-home-equity-loan-interest-tax-deductible-for-rental-property.jpg

Home Loan Income Tax Benefits For interest paid on home loans for affordable housing an additional Rs 1 5 lakh tax deduction under Section 80EE can be availed till 31 March 2022 This is applicable for loans that were received till Yes the home loan comes with many tax saving deductions such as a deduction under section 24 for interest payments a deduction under 80C for repayment of the principal

Under Section 24 the interest paid on the home loan Equated Monthly Instalments EMIs during the year can be deducted from your total income with a maximum cap of Rs2 Accordingly a new Section 80EEA has been inserted to allow for an interest deduction from AY 2020 21 FY 2019 20 The older provision of Section 80EE allowed a

Best Home Loan Rates

https://images.livemint.com/img/2021/12/26/original/loan_1640547127620.png

Home Loan Interest Rates In Mumbai India Housing Loan

https://www.loancounsellor.com/wp-content/uploads/2016/05/FINALLCLOGO_transparent.png

https://housing.com › news › home-loan…

On purchase of property with home loans borrowers enjoy a variety of deductions on their income tax liability These deductions against the tax could be claimed under four sections of the income tax act namely

https://www.hdfc.com › ... › home-loan-t…

You can avail deduction on the interest paid on your home loan under section 24 b of the Income Tax Act For a self occupied house the maximum tax deduction of Rs 2 lakh can be claimed from your gross income annually

Is Car Loan Interest Tax Deductible In Canada

Best Home Loan Rates

Personal Loan Tax Deduction Tax Benefit On Personal Loan EarlySalary

How Can I Deduct TDS On Home Loan In India Kanakkupillai

Sbi Home Loan Rates From July 2019 Home Sweet Home Insurance

Mortgage Interest Tax Deductible 2023

Mortgage Interest Tax Deductible 2023

Solved Please Note That This Is Based On Philippine Tax System Please

Home Loan Interest Rates Comparison Between SBI HDFC Bank Of Baroda

What Are Home Loans Know Your Home Interest Rates And Home Mortgage

Is Home Loan Interest Tax Deductible In India - Tax deduction under Section 80EE of the Income Tax Act 1961 can be claimed by first time home buyers for the amount they pay as interest on a home loan and the loan must be sanctioned between 01 04 2016 to 31 03 2022