Tax Rebate Depreciation Web Tax depreciation is the depreciation expense claimed by a taxpayer on a tax return to compensate for the loss in the value of the tangible assets used in income generating activities Similar to accounting

Web 4 d 233 c 2019 nbsp 0183 32 Tax depreciation is the depreciation expense listed by a taxpayer on a tax return for a tax period Tax depreciation is a type of tax deduction that tax rules in a Web How to claim Overview Capital allowances are a type of tax relief for businesses They let you deduct some or all of the value of an item from your profits before you pay tax You

Tax Rebate Depreciation

Tax Rebate Depreciation

https://i.ytimg.com/vi/m_rRcfWeCp4/maxresdefault_live.jpg

Depreciation Other Rebates Income Tax B Com Part 3 MDSU

https://i.ytimg.com/vi/Hd9u4mhuLMQ/maxresdefault.jpg

2007 Tax Rebate Tax Deduction Rebates

https://i.pinimg.com/originals/ba/b1/ac/bab1aca6df77531e309ff2affe669be8.jpg

Web 30 janv 2021 nbsp 0183 32 Depreciation is a method used to allocate a portion of an asset s cost to periods in which the tangible assets helped generate revenue A company s Web 1 avr 2015 nbsp 0183 32 The IRS would tax you on 75 000 of income instead of 100 000 because of the deduction At a corporate tax rate of 35 you d save 8 750 on taxes How to figure depreciation Here comes the

Web 28 oct 2020 nbsp 0183 32 Accelerated depreciation is any depreciation method that allows for the recognition of higher depreciation expenses during the earlier years The key accelerated depreciation methods Web DRE is a tax deduction on repairs replacements treated as revenue for tax purposes but capital for accounting purposes We find that DRE is often under claimed across all sectors We have experience in agreeing DRE

Download Tax Rebate Depreciation

More picture related to Tax Rebate Depreciation

Calculator For Auto Loan

http://www.bcscpa.com/bcs-blog/wp-content/uploads/2013/09/Example.jpg

P55 Tax Rebate Form By State Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/09/P55-Tax-Rebate-Form-768x735.png

Illinois Tax Rebate Tracker Rebate2022

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2023/05/illinois-tax-rebate-2022-cray-kaiser-1.png

Web 19 mars 2023 nbsp 0183 32 The term depreciation refers to an accounting method used to allocate the cost of a tangible or physical asset over its useful life Depreciation represents how Web 21 sept 2020 nbsp 0183 32 WASHINGTON The Treasury Department and the Internal Revenue Service today released the last set of final regulations implementing the 100 additional

Web 20 juil 2023 nbsp 0183 32 Depreciation recapture is a tax provision that allows the IRS to collect taxes on any profitable sale of an asset that the taxpayer had used to previously offset taxable Web 30 juin 2022 nbsp 0183 32 Definition Tax depreciation is the depreciation expense that allows you to regain some of your loss by deducting that loss from your business taxes

What Is A Depreciation Rate BMT Insider

https://s3-ap-southeast-2.amazonaws.com/bmt-insider/wp-content/uploads/2021/01/13122530/2020_TA267.jpg

500 New Mexico Tax Rebate Checks Why Some May Not Get It

https://www.valuewalk.com/wp-content/uploads/2023/04/Tax-Rebates-from-Minnesota.jpeg

https://corporatefinanceinstitute.com/.../accou…

Web Tax depreciation is the depreciation expense claimed by a taxpayer on a tax return to compensate for the loss in the value of the tangible assets used in income generating activities Similar to accounting

https://corporatefinanceinstitute.com/resources/accounting/accounting...

Web 4 d 233 c 2019 nbsp 0183 32 Tax depreciation is the depreciation expense listed by a taxpayer on a tax return for a tax period Tax depreciation is a type of tax deduction that tax rules in a

Amending 2022 Tax Return For Recovery Rebate Credit Recovery Rebate

What Is A Depreciation Rate BMT Insider

Pin On Tigri

Standard Deduction U s 16 ia For Ay 2021 22 Standard Deduction 2021

B Com Part 3 Income Tax Depreciation And Other Rebates Practical By

B Com Part 3 Depreciation And Other Rebates Income Tax Practical By

B Com Part 3 Depreciation And Other Rebates Income Tax Practical By

Depreciation And Other Rebates 54th Class Additional Depreciation

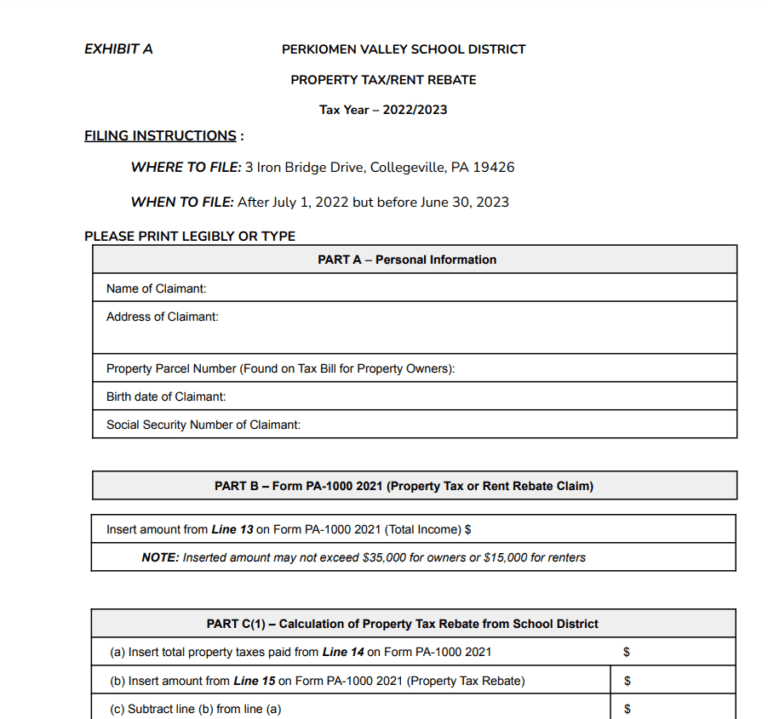

PA Property Tax Rebate Forms Printable Rebate Form

Property Tax Rebate Application Printable Pdf Download

Tax Rebate Depreciation - Web 30 janv 2021 nbsp 0183 32 Depreciation is a method used to allocate a portion of an asset s cost to periods in which the tangible assets helped generate revenue A company s